Target-Date Funds: Good Behavior Leads to Better Results

Target-date funds' built-in discipline makes for an industry anomaly: positive investor return gaps.

Target-date funds have become a prevalent investment for American workers saving for retirement, and Morningstar's 2016 Target-Date Fund Landscape report covers the ins and outs of these strategies, including how to choose and evaluate them. The funds can differ from one another in a host of ways--from holding in-house versus outside funds to using index-based or active underlying strategies.

One of the key decisions for investors choosing between target-date series continues to be how much market risk--often characterized by equity exposure--to assume at different points along the asset-allocation glide path. The argument for taking less market risk sometimes centers on the concern that investors are prone to abandon their long-term investing plans in the face of market downturns. The theory posits that a lower equity exposure helps to mitigate losses in market dips, and investors in lower-volatility funds are less likely to be spooked enough to sell into a market trough, avoiding potentially locking in losses and missing a market rebound. A related concern is that retirees using target-date funds will have to sell shares in down markets to meet their income needs, and those withdrawals will also miss out on any market turnaround.

Investor returns, a dollar-weighted return that takes into account cash inflows and outflows to estimate the returns that investors actually experience, gives clues to how target-date investors have fared according to these concerns. The news is good. Whereas most other broad categories show the effects of poor timing--investors tend to buy high and sell low--target-date investors largely avoid that fate.

The return gap between a fund's investor return and published total return (see Exhibit 1) illustrates the point: Most broad categories have a negative return gap, but target-date funds overall have a positive gap for the 10 years through the end of 2015. Target-date investors have generally experienced results that are 74 basis points better than their fund's published total returns.

Breaking down the overall target-date category into vintage years shows that the positive gaps generally hold for younger and older investors. Target-date investors in the retirement-income and target-date 2000-10 categories are the exceptions. Those categories, which consist of funds intended for those already retired, have negative return gaps of 14 and 38 basis points, respectively, and also happen to be the only target-date categories that have seen negative net flows in the past decade. That period includes 2008's market crash and subsequent recovery; the negative return gaps correspond with the narrative of workers retiring, pulling out their savings, and missing some of the post-financial-crisis market recovery.

Those negative gaps are still smaller than those of most other broad categories, and they don't necessarily lend credence to the notion that target-date funds should have lower equity allocations at the retirement date. Even if target-date investors cash out of their target-date funds at retirement, those assets likely will be reinvested into another portfolio. Investors potentially court significant market-timing risk if the new portfolio's allocations differ markedly from those of the target-date fund.

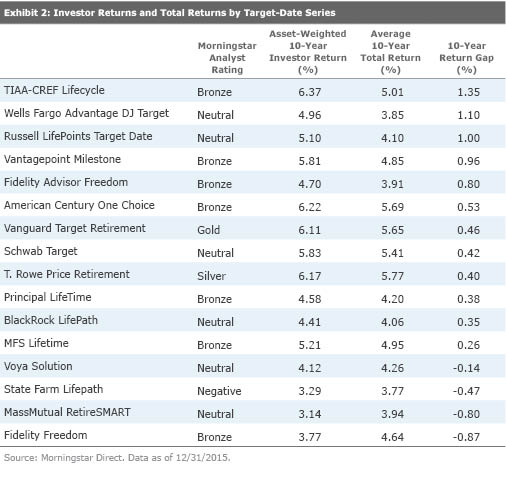

Exhibit 2 shows that the positive gaps aren't just concentrated in a few prominent series but are fairly widespread across the market. During the last decade, 12 of the 16 series with at least 10 years of investor returns have positive gaps. Series with negative gaps have generally seen steady outflows over that time. The Fidelity Freedom series, for instance, has been in net redemptions every year since 2010. As a result, investors missed much of the last five years of the series' returns, when a stream of changes--such as upgrades to underlying strategies and a boost in equity allocation--helped the series to come out ahead of most peers. In contrast, TIAA-CREF Lifecycle's consistent double-digit organic growth from 2010 through 2015--a period when the series often posted top-percentile annual returns--helped it record the target-date group's most positive return gap.

There's nothing particularly magical about target-date funds that drives their overall positive investor return gap. Instead, the key to their success stems from their broad use within employer-sponsored retirement savings plans, as well as their status as a qualified default investment alternative within 401(k) plans. The majority of target-date investors access these funds via employer-defined contribution plans, so the funds benefit from the consistent flows coming from regular paychecks.

Because they're designed as all-in-one default investments, target-date investors also tend to be more hands-off than most, and that behavior has worked to their advantage. The behavior engendered by retirement plans supports the case for higher-equity glide paths, given that the narrative of investors pulling out assets following market corrections has not been borne out by the data.

For a list of the open-end funds we cover, click here. For a list of the closed-end funds we cover, click here. For a list of the exchange-traded funds we cover, click here. For information on the Morningstar Analyst Ratings, click here.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)