Separating Skill From Luck in Active Management

Buy stock-pickers, avoid sector rotators: large-cap growth edition

This article was published in the October 2015 issue of Morningstar FundInvestor. Download a complimentary copy of FundInvestor here.

A litle over a year ago, we introduced readers to the initial findings from Morningstar's research on using peer attribution to screen and select funds. Starting with the small-cap value universe, we took a look at whether strong sector-rotation or stock-selection skills in the past led to better performance in the future.

The results fell in line with expectations: Morningstar analysts have anecdotally observed that stock-selection skill tends to be more stable than sector-rotating dexterity, and peer-attribution data supported the hypothesis. While the latter can markedly affect returns in any given period, academic and industry research has shown that it's difficult to consistently make additive market-timing calls. Picking managers based on their past stock-picking attribution results led to higher returns and better success rates than picking them based on their sector-attribution rankings.

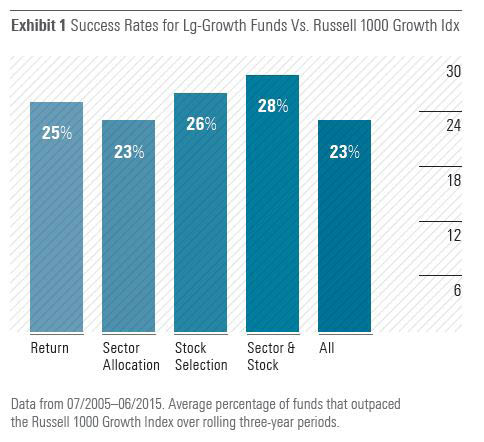

We've since expanded the research into the large-growth stock space, a Morningstar Category that's had a strong run in the past 10 years. Using the same methodology that was used for the small-value findings, we looked at all distinct large-growth funds that existed in the 10 years from July 1, 2005, to June 30, 2015. We then used three-year rolling results to answer this question: If we picked funds that ranked in the top half of the group based on the past three years of either returns, allocation effects, or stock-picking results, what is the chance that those funds would outperform the Russell 1000 Growth Index three years later? Exhibit 1 shows the average success rates of those rolling three-year results.

The numbers don't look impressive upon first glance, but they require some perspective. The Russell 1000 Growth Index has been one of the toughest indexes to beat of late. During the past 10 years, using three-year returns that roll forward every three months, the large-growth category average has never topped the index. On average, only 23% of all large-growth funds outpaced the index over those rolling three years.

In that context, the success rates in Exhibit 1 look somewhat less dire for active managers, which are by and large the majority of constituents within the large-growth group. Funds that ranked in the category's top half based on the past three years of returns, on average, had a 25% chance of outperforming the index three years later. That's slightly better than the 23% chance of picking a fund at random. Picking funds with the best past sector-allocation effects produced success rates similar to random chance, adding to the evidence of the difficulty of making good sector bets. While some funds that tend to favor certain sectors may see strong sector results at times, those gains often get wiped out in other periods, commensurate with how certain sectors come into and out of favor over time. Meanwhile, funds with strong stock-picking results had a better chance--at 26%--of coming out ahead of the index.

If sector rotation doesn't help but stock selection does, we tried to combine the two concepts by asking, what would have happened if we picked managers that ranked in the top half of their peers by stock-picking but in the bottom half by sector allocation? This scenario excludes funds receiving boosts from seemingly unsustainable strong sector decisions and instead homes in on those that have had to rely primarily on stock-picking. Under this scenario, the success rate increases to 28%.

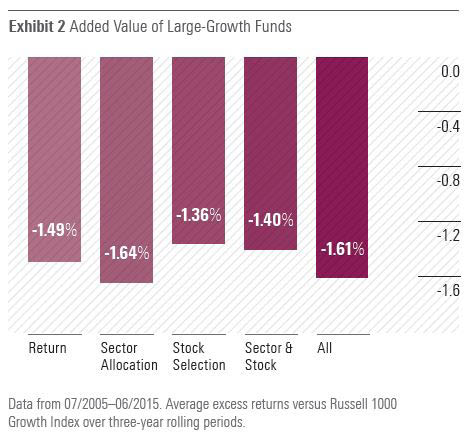

Exhibit 2 shows the results in a different way, via the average excess returns that each scenario produced in the subsequent three-year periods. Again, context matters a lot here. As a group, large-growth funds have trailed the Russell 1000 Growth Index by an average of 1.61 percentage points net of expense over those rolling periods. Funds with returns that beat their peers during the past three years subsequently trailed the index by 1.49 percentage points three years later--that's better than just picking at random. It's also better than picking funds with strong past sector-rotation results, which trail the index by an average of 1.64 percentage points three years later. Choosing funds by stock-picking or by the combination of low sector-allocation/high stock-selection yields better returns than any of the previous methods.

Screening the M500 These relatively subtle outcomes for large-growth funds are at least partly attributable to the more efficient markets seen in the larger-cap space. Adding a qualitative analysis consideration via the forward-looking Morningstar Analyst Ratings improves the numbers considerably. Exhibit 3 presents the large-growth Morningstar Medalist funds within the M500 that meet the top-half stock-selection/ bottom-half sector-allocation screen.

Many of the names on the list are longtime analyst picks and well-known to investors. Four have won Morningstar's Fund Manager of the Year award, including 2014's winner, the team at Primecap that manages

As a group, the M500 large-growth funds that pass the two-part screen also outpace the Russell 1000 Growth Index, on average. That outcome serves as a reminder of the usefulness of adding the human analytical touch to mechanical fund screening.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)