Ratings Upgrades and Downgrades for U.S. Target-Date Series

An updated ratings methodology brings a few notable changes.

Target-date series have steadily become a popular retirement savings strategy for Americans during the last decade. At the end of 2015, assets in target-date mutual funds stood at $763 billion, up from $703 billion the year prior. Morningstar has rated these thriving strategies since 2009, and our most recent quarterly review of those Analyst Ratings produced a few notable changes.

Some of the ratings changes stem from an update we've made to how we rate target-date series. Details behind the methodology update and Morningstar's current target-date series methodology paper can be found in the Research Library on Morningstar's corporate website. To summarize: Previously, a series' Performance and Price Pillar ratings and half of its Process Pillar score were set by a quantitative formula. Now, analysts qualitatively determine all aspects of the ratings, which also include the People and Parent Pillars, as well as the overall Morningstar Analyst Rating. Of course, quantitative considerations continue to remain important inputs to many aspects of the pillar and overall ratings.

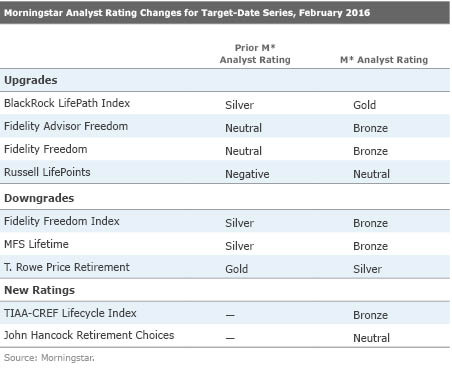

The table below summarizes the seven target-date series that saw changes in their Analyst Ratings, as well as the two series new to coverage.

(One nuance to point out: The Analyst Rating for target-date

series

is separate from the Analyst Rating for individual funds. The latter applies to all mutual funds and has always been qualitatively set by analysts; the methodology change for the target-date series rating brings it in line with the fund rating because both are now qualitative. A target-date series, such as BlackRock LifePath Index, includes individual vintage-year funds, such as

Familiarity Breeds Confidence Three of the upgrades reflect Morningstar's growing confidence in newer or altered strategies. We upgraded the BlackRock LifePath Index series to Gold from Silver after years of meetings with management and analysis of the portfolio details. BlackRock only launched the series in 2011, but the firm's long history in target-date management dates back more than two decades. It has remained at the forefront of target-date research since then, with a well-documented research agenda that continually re-examines the asset mix and considers potential new asset classes to include in the series' investments. The series already had a Positive Process Pillar rating, but a steady flow of evidence showing the team's forward thinking in the space gave analysts confidence to make the series one of their highest-conviction picks. The series has a meaningful cost advantage over peers as well. Its 0.18% asset-weighted expense ratio undercuts its typical competitor by almost 60 basis points.

Meanwhile at Fidelity, portfolio managers Andrew Dierdorf and Brett Sumsion are wielding their relatively newfound tactical management flexibility. The team has seen some success making short-term allocation moves since adding the feature to Fidelity Freedom and Fidelity Advisor Freedom in August 2014, though it's years from proving it can consistently do so. These moves are unlikely to derail the strategy or offset the strength of its underlying funds because the team stays true to operating within tight tracking-error bounds--within 150 basis points. This led us to upgrade the series' overall ratings to Bronze from Neutral.

In fact, the two series use some of the industry's most well-regarded managers, a foundation for the series' Positive People ratings and upgraded overall ratings. On the equity side for Fidelity Freedom, these managers include Steve Wymer, Joel Tillinghast, and Will Danoff, who account for nearly one fifth of

Sibling Harmony, Sibling Rivalry While some ratings changes reflect an increase in confidence, other changes bring consistent ratings to similar strategies. For example, Fidelity Freedom Index, the third Fidelity series under coverage, was downgraded to Bronze from Silver to bring all of the Fidelity target-date ratings in line. The index-based series, also managed by Dierdorf and Sumsion, still boasts some of the target-date market's lowest expense ratios. However, its success rests with the similar glide-path design that links it with Fidelity Freedom and Fidelity Freedom Advisor.

Similarly, we launched coverage for TIAA-CREF Lifecycle Index with a Bronze rating, the same as TIAA-CREF Lifecycle, which we've covered since 2009. While Lifecycle uses a slate of actively managed TIAA-CREF underlying funds and Lifecycle Index relies on index-based strategies, both benefit from a long-tenured team and share the same overall asset-allocation glide path. A February change to the glide-path design slightly increased the equity exposure for younger investors in both series. The stock stake for the 2050 funds--meant for 30-something investors--grew to 92% from 90%. The team used its ongoing research, including updated mortality figures and savings rates, to justify the glide-path adjustment.

Series from the same firm don't always warrant the same rating, however. The same portfolio management team may link John Hancock Retirement Choices with John Hancock Retirement Living, but the two share few other traits. We've covered the Bronze-rated Retirement Living since 2009. Its focus on mitigating longevity risk--the possibility of retirees outliving their savings--leads to one of the most equity-heavy glide paths among its target-date peers. At retirement, for example, its investors have a 52% stock allocation, while the industry average stands at 43%.

Retirement Choices, new to Morningstar coverage with a Neutral rating, takes the opposite tack: It prioritizes capital preservation, which leads to a notably bond-heavy glide path. At retirement, its investors have a scant 8% equity allocation. Even if investors leave the series at retirement, as management assumes they will do, that allocation is remarkably low. Only a handful of target-risk series, for instance, have stock allocations that small, and many of those series reflect the model portfolio allocations that advisors use to invest assets for retirees. Unless investors have substantial allocations to equity elsewhere (such as through company stock), they could court meaningful market risk if they move into a higher-equity-allocation-portfolio upon retiring.

More importantly, the index-based Retirement Choices does not benefit from the well-regarded third-party managers that are sprinkled throughout Retirement Living. And while Retirement Choices' 0.49% weighted average expense ratio is lower than most competitors', it's pricey for an index-based offering. Retirement Choices' tactical management component makes it more active than most other index-based target-date funds, but the team's short-term moves may not overcome the added cost. Those considerations led to John Hancock Retirement Choices' Neutral rating.

A High Standard for Actively Managed Underlying Funds Morningstar analysts consider it a best practice for target-date managers to continually assess the stand-alone merit of each underlying fund used within a target-date series. There's a higher burden of proof for actively managed underlying funds versus passively managed ones: Whereas the former succeeds by outpacing an index, the latter does so merely by matching it. Target-date managers who choose to use actively managed underlying funds should have the processes in place to employ funds that carry out those objectives and make changes when necessary.

Diving deeper into managers' processes for choosing and evaluating underlying funds revealed that some series don't meet that standard. That was the case with T. Rowe Price Retirement, as we have reservations about management's tendency to stick with the status quo when underlying manager concerns arise. While investors still enjoy a strong lineup of underlying strategies, Morningstar analysts downgraded two of the series' underlying funds in 2014 because of manager changes. The target-date team could take a more proactive role in advocating for the ongoing quality of the underlying funds, rather than leave that oversight to each underlying fund's respective steering committee. This contributed to our downgrading the series rating to Silver from Gold.

We downgraded MFS Lifetime to Bronze from Silver for similar reasons. True, the series has a strong performance record, and many of its funds can stand on their own investment merits. But it has become more apparent over time that management takes a relatively hands-off approach to examining the ongoing robustness of the series' glide path and fund mix. We don't believe that target-date series need to constantly change to be strong, but their management teams should continually test the validity of their asset-class and underlying fund assumptions.

Series that use third-party subadvisors, such as Russell LifePoints, theoretically have an advantage over those that stick to in-house funds when it comes to choosing and changing underlying strategies. It's not clear that LifePoints investors have seen that benefit, though. Russell often chooses well-regarded subadvisors, but it doesn't stick with them for very long, as the firm has an average subadvisor relationship of four years. The Russell portfolio managers in charge of hiring subadvisors regularly changed, which appeared to encourage subadvisor change. Russell has deliberately tried to decrease manager turnover, which could result in longer subadvisor relationships.

Russell's recent sale to TA Associates, expected to close in the first half of 2016, also alleviates some uncertainty. After a year in limbo, in October 2015, private equity firm TA Associates agreed to acquire Russell's asset management business from the London Stock Exchange, which itself had just completed its acquisition of Russell in December 2014. Though the series doesn't offer any apparent advantages over peers, it also no longer has notable deficiencies, which results in an upgrade of its Morningstar Analyst Rating to Neutral from Negative.

Premium Members can find one-page summary reports for all 25 target-date series under coverage here. Full five-page reports with detailed analysis of the five pillars--People, Process, Performance, Parent, and Price--supporting each series' Morningstar Analyst Rating are available to subscribers of Morningstar's software for advisors and institutions: Morningstar Advisor Workstation(SM), Morningstar Office(SM), and Morningstar Direct(SM).

The members of Morningstar's multiasset manager research team--Jeff Holt, Leo Acheson, Gretchen Rupp, and Susan Wasserman--contributed to this report.

/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5WSHPTEQ6BADZPVPXVVDYIKL5M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BNHBFLSEHBBGBEEQAWGAG6FHLQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/44f33af1-4d5c-42fb-934a-ba764f670bc6.jpg)