How Strong Are Target-Date Series' Potential Building Blocks?

We examine target-date providers' menus of available underlying offerings.

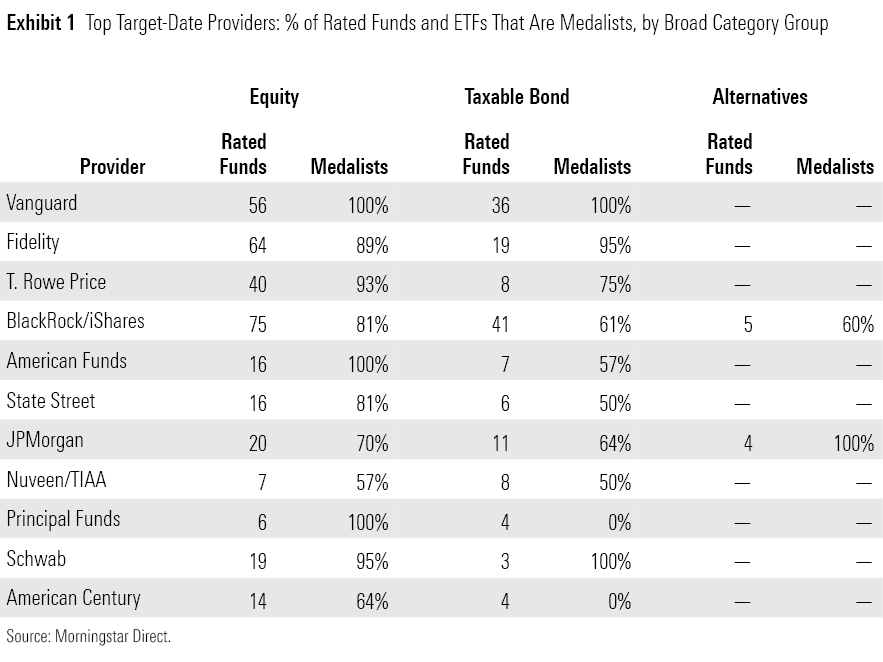

Most target-date series invest in an array of their providers' proprietary strategies, so it's critical to consider each firm's range of expertise. One way to do that is to examine the broad categories in which firms' assets are most focused. Another is to measure the percentage of a firm's funds and exchange-traded funds in each category that are rated by Morningstar analysts where the cheapest share classes earn Morningstar Analyst Ratings of Bronze or better. The table below shows those percentages for the top target-date providers in the three types of strategies most likely to show up in target-date portfolios: diversified equity, taxable fixed income, and alternatives. Allocation funds are rarely included in target-date series; firms prefer using single-asset class strategies to more precisely target exposures.

These comparisons are relevant for the largest target-date providers because each one, with the exception of Schwab, maintains closed architecture target-date series, for the most part. Most of these firms have plenty of decorated equity strategies; fund families typically don't offer target-date strategies until they've established themselves as solid asset managers, and equities remain the dominant asset class in target-date portfolios. Strong fixed-income strategies are less common within this group; firms that specialize in fixed income don't make this list, and those that don't focus on bonds may simply hold core fixed income and high-yield strategies. And most of these top providers don't offer any alternatives strategies.

Vanguard's low fees are a substantial long-term advantage, resulting in a lot of Morningstar Medalists among both passive and active strategies. Fidelity's percentage of medalists is a bit lower; the firm offers many strategies, some of which are less attractive. That said, only three firms among the top providers don't garner medals for at least 80% of their rated equity strategies: American Century, J.P. Morgan, and Nuveen/TIAA. American Century has few bright spots in its lineup. Outside of a handful of well-regarded U.S. value and growth-equity funds, all its rated funds in equity and fixed income earn Neutral ratings. J.P. Morgan's structured equity team runs several Neutral-rated funds. And three of Nuveen/TIAA's seven rated equity funds earn Neutrals. In contrast, the strength of American Funds' vast equity team is reflected in its 16 rated equity strategies, which all earn medals. And 93% of T. Rowe Price's 40 rated equity strategies earn medals.

Vanguard and Fidelity's taxable-bond lineups are strong. Vanguard's taxable-bond funds earn plenty of medals because of their combination of low fees and limited credit risk, while Fidelity boasts a highly proven fixed-income team. Most other firms on this list have far fewer rated taxable-bond strategies, except for BlackRock's extensive lineup of iShares fixed-income ETFs, most of them cheaply priced. T. Rowe Price scores well, despite the fact that its core fixed-income strategies have seen manager turnover and mixed results.

Pickings are slim among alternatives options. Just two of these firms offer medalists that invest in alternatives: BlackRock and J.P. Morgan. Three others have unrated alts funds, while the other six don't offer any.

The differences across broad categories can be telling. At American Funds, for example, all the firm's rated equity strategies earn medals, while 57% of its rated taxable-bond offerings do. The latter figure was lower before the firm's fixed-income team hired a few bond-investing veterans and added more structure to its approach, leading to several ratings upgrades.

Ultimately, most of the largest target-date providers have a substantial number of proven equity strategies to fill out their series, and a decent number of fixed-income choices. How they utilize those lineups, their resources and the approach they employ at the series level, and, of course, fees determine those series' attractiveness.

/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YI7RBXKMXVAZDBWEJYQREEJJL4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NZE33UZQNJC6FGMLKRPNGFAAYA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/e9419b77-5e99-4d39-8b08-8c553bef37bd.jpg)