Grayscale’s Victory Over the SEC Doesn’t Mean a Spot Bitcoin ETF—for Now

D.C. Circuit Court of Appeals rules SEC must reconsider Grayscale’s spot Bitcoin ETF filing.

The SEC has long resisted approving a spot bitcoin ETF. Their resolve faces its toughest challenge yet: Tuesday, a federal circuit court ruled that the SEC’s rejection of Grayscale Investments’ proposed bitcoin exchange-traded fund was unlawful.[1]

What the SEC Ruling Means (and Doesn’t Mean)

This ruling doesn’t force the SEC to approve Grayscale’s filing for a spot bitcoin ETF. This isn’t “mission accomplished” for a spot bitcoin ETF, but it certainly raises the likelihood of approval in the future. Calls for a spot bitcoin ETF have grown louder and more powerful figures—like BlackRock’s CEO Larry Fink—have joined the charge, making resistance increasingly difficult for the SEC.

But the SEC isn’t out of options. They could appeal the decision, reject the filing again while addressing concerns raised by the court or by changing their reasoning, or even give bitcoin futures ETFs the boot. But the path of least resistance for the SEC is clearly to approve spot bitcoin ETFs. It remains to be seen how big of a chip this lawsuit took out of SEC chair Gary Gensler’s stony resolve.

A Timeline of Events Preceding Grayscale’s Lawsuit

SEC

The first attempt at a spot bitcoin ETF was made by Tyler and Cameron Winklevoss in 2013. The SEC rejected their proposal in 2017. The SEC rejected all bitcoin-related ETFs over the ensuing years until finally approving a bitcoin futures ETF in 2021. In its approval, the SEC claimed that the CME-listed bitcoin futures market was sufficiently large and regulated to prevent manipulation.

The first spot bitcoin ETF has yet to be approved.

Grayscale

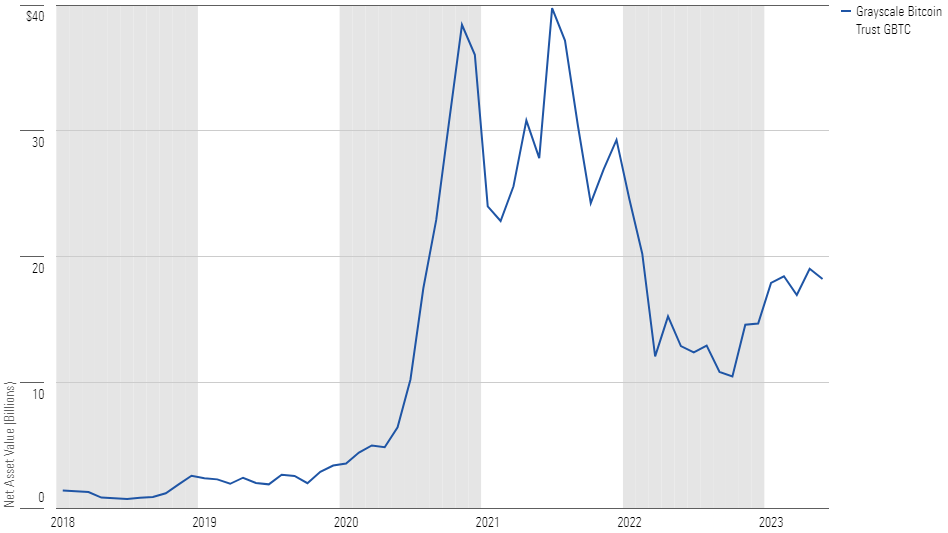

Grayscale Bitcoin Trust GBTC launched in 2013, long before bitcoin exploded in popularity. In 2021, it peaked at $40 billion in assets under management. GBTC offered one of the few ways investors could get exposure to bitcoin without opening an account to trade on cryptocurrency exchanges. No open-end mutual fund or ETF provided this exposure until the first bitcoin futures ETF, ProShares Bitcoin Strategy ETF BITO, launched in October 2021.

Investors Have Shown Significant Interest in Bitcoin

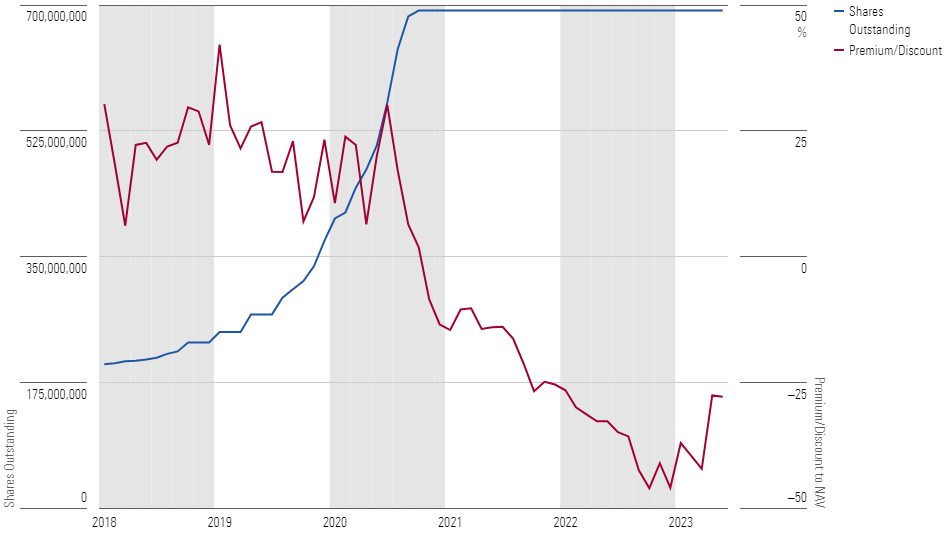

As a grantor trust, GBTC operates more like a closed-end fund. Adding new investment or allowing investors to redeem shares takes time and effort. Without the ability to easily regulate the size of the trust, it has struggled to manage supply and demand. As a result, GBTC experienced extreme deviations from its net asset value. GBTC holds bitcoin, which is what is reflected in its net asset value, but GBTC’s price is dictated by the market, meaning the price could diverge from the value of bitcoin held by the trust. GBTC traded at a premium when bitcoin was in high demand, then at a steep discount after bitcoin’s price dropped precipitously in 2022.

Grayscale Met Demand But Not Supply

Grayscale decided to meet the increasing demand by creating more shares at NAV through private placements. But it never opened redemptions for investors when the trust began trading at a steep discount. For the past couple of years, investors were forced to sell at the prevailing price, which was significantly lower than the value of the bitcoin held by the trust.

Grayscale’s substantial 2% fee applied to its NAV, meaning GBTC’s price discount didn’t affect Grayscale’s fee revenue. There was an economic incentive for it to maintain its asset base rather than help resolve its oversupply issue. When Grayscale caught heat for not initiating a redemption program, it came up with an alternative solution: It filed to convert GBTC to an ETF, which would make it the U.S.’s first spot bitcoin ETF.

The SEC rejected Grayscale’s filing, just as it had done for past spot bitcoin ETF proposals. But unlike other issuers, Grayscale: 1) focuses solely on digital assets, 2) built a substantial war chest from the $1 billion-plus in fees GBTC fetched in recent years, and 3) benefited economically from deferring action in addressing GBTC’s price discount. Grayscale opted to sue the SEC for rejecting its ETF filing.

Grounds for the Grayscale Lawsuit

Grayscale’s lawsuit claimed that its proposed bitcoin ETF is materially similar to the bitcoin futures ETFs previously approved by the SEC. Past spot bitcoin ETF proposals were denied by the SEC for failing the commission’s significant market test, whereas the futures-based ETFs passed. Grayscale’s argument effectively came down to the SEC’s inconsistency in applying this market test. Based on the court’s decision, Grayscale’s argument was valid.

The Court’s Findings

To be clear, the judges didn’t rule on whether the U.S. public deserves its first spot bitcoin ETF. Instead, the court ruled that the SEC failed to adequately explain its different treatment of similar products. The lawsuit vacates the SEC’s denial and forces the SEC to review Grayscale’s proposal again. Should the SEC reject Grayscale’s Bitcoin ETF a second time, it would need to find new reasons for rejection or address these shortcomings identified by the court:

1. Material Similarity of Bitcoin Exposure

Futures are derivatives whose prices are predicated on the price of their underlying security. This means bitcoin futures prices are highly sensitive to the spot price of bitcoin. Grayscale showed that the correlation between the two is 0.999, meaning a spot bitcoin ETF would have a materially similar exposure to bitcoin’s spot market as a futures-based ETF.

In short, if spot markets are susceptible to manipulation, then futures markets should be affected as well. The SEC needs to clearly explain the difference in exposure to manipulation between futures-based and spot bitcoin ETFs, if that’s the case. Currently, the SEC’s distinction between the two relies on the results of the significant market test.

2. Significant Market Test

The SEC’s rejection of Grayscale’s proposal cited the failure of its significant market test, which includes, “a market (or group of markets) as to which (a) there is a reasonable likelihood that a person attempting to manipulate the ETP would also have to trade on that market to successfully manipulate the ETP, so that a surveillance-sharing agreement would assist in detecting and deterring misconduct, and (b) it is unlikely that trading in the ETP would be the predominant influence on prices in that market.”

The SEC concluded that Grayscale failed on both counts, while the bitcoin futures ETFs satisfied both. The key difference for (a) being that futures-based ETFs hold securities traded on a regulated exchange makes, rendering such a test unnecessary. Grayscale’s listing exchange, NYSE Arca, already has a surveillance-sharing agreement with the CME, so it believes it should be afforded the same exemption.

The SEC’s rebuttal to this claim stated that there was a significant difference between holding assets traded on the surveilled exchange and otherwise. Simply, Grayscale can’t rely on futures surveillance since it doesn’t hold futures. The court made no ruling on the validity of this statement, instead taking aim at the lack of support provided by the SEC to substantiate its claims. The SEC would need to clearly back up its argument here, although it seems reasonable at face value.

For (b) above, the SEC concluded that the Grayscale ETF would become the predominant influence on price in the CME bitcoin futures market. Grayscale’s $17.4 billion in assets dwarfs the value of open futures contracts. But Grayscale would only be a portion of the spot market, not all of it. If futures prices rely on spot prices, then the entirety of the spot market should be considered. Per the court documents, Grayscale holds just 3.4% of outstanding bitcoin. This argument is less reasonable by the SEC. It’s something they will need to address or concede.

How Does the Ruling Affect Investors?

GBTC investors welcomed the outcome of the lawsuit because it gave a glimmer of hope that they would be able to sell shares closer to NAV, should they choose to sell. The discount of GBTC’s price to NAV has narrowed to 18% from over 40% in June 2023.

Bitcoin investors, and would-be investors, celebrated the ruling because it increased the likelihood of a spot bitcoin ETF down the road. Such a product would better track bitcoin prices than currently available products like futures-based ETFs or GBTC, and it would likely come with much cheaper trading costs than buying bitcoin on crypto exchanges. A spot ETF may also open doors for investors in accounts that can’t currently access crypto markets.

[1] Grayscale Investments, LLC vs. Securities and Exchange Commission, Case No. 22-1142 (D.C. Circuit Court of Appeals 2023), https://storage.courtlistener.com/recap/gov.uscourts.cadc.38827/gov.uscourts.cadc.38827.1208547574.0_1.pdf.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EGA35LGTJFBVTDK3OCMQCHW7XQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHTKX3QAYCHPXKWRA6SEOUGCK4.png)

/d10o6nnig0wrdw.cloudfront.net/05-13-2024/t_4a71dba80d824d828e4552252136df22_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)