Where Are the Benchmark-Beating Bond Funds?

A new Morningstar study examines active managers' odds of outperformance across fixed-income categories.

Longtime readers of Morningstar’s research have heard us relentlessly beat the drum for funds that charge low fees. For all our manager research analysts’ combing through historical portfolios, scrutinizing performance data, and grilling portfolio managers to formulate views on a fund’s People and Process Pillars, there’s no surer indicator that a fund has an advantage over its peers than a cheap price tag. That’s just simple math.

Expenses are especially crucial to consider for fixed-income funds, because returns between bond funds tend to be more compressed. And with yields near historic lows across bond sectors in recent years, fees have eaten up an even larger share of the returns that investors pocket. It’s no wonder, then, that investors have increasingly turned to the expanding menu of low-cost passive exchange-traded funds for their bond exposure.

A new study authored by my European-based manager research colleagues, Mara Dobrescu and Matias Möttölä, starts with the headline conclusion that the typical fixed-income fund is “priced to fail,” meaning it can’t keep up with its benchmark after fees. But is a passive approach that minimizes costs the right approach for every type of bond fund? If not, where might an active manager stand a better chance of beating the benchmark or a similar passive option?

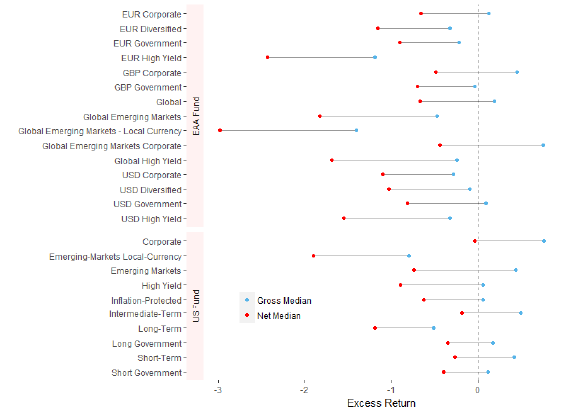

The duo sought to answer these questions using history as a guide for forming expectations about a fund’s potential to outperform. They examined the historical excess return distributions in 25 Morningstar Categories across Europe, Asia, and Africa (EAA) as well as the United States. Focusing on share classes available to retail investors, they looked at excess returns on a gross and net of fees basis, both compared with the funds’ assigned category index and the closest passive option.

Annualized Gross and Net Excess Returns for Category Medians, Rolling 3-Year Periods 2002-17 Against Morningstar Category Indexes

Source: Morningstar

They developed a useful grouping of bond fund categories to help investors make an informed choice between active and passive options, described below.

1. In benchmark-driven categories, costs have a greater impact on net returns than manager skill, making the case for low-cost investments (active or passive).

This group includes mainly government bond and investment-grade corporate bond categories where the “gravity” of the benchmark has been strong. The median gross return for each category was close to zero and didn’t move much over time (the study used rolling three-year periods going back to 2002). The dispersion of returns within categories also tended to be narrow.

For funds in the U.S. inflation-protected bond category, for instance, the median gross excess return versus the category benchmark, the Bloomberg Barclays U.S. TIPS Index, was just 5 basis points, the slimmest of margins that put the typical fund at a 63-basis-point disadvantage versus the benchmark net of fees. Funds in the category only managed to beat the index gross of fees by a percentage-point margin 10% of the time, and there were some three-year periods in which none of the funds in the category could beat that modest hurdle. In a playing field this competitive, a passive option such as

2. In more-diverse peer groups, a low-cost passive option is often superior to the typical active fund, but there is still room for manager skill to add value, provided that fees are reasonable.

Categories that fall into this subset exhibited a reasonably close fit to their index over time (as illustrated by high R-squared) but still had a high dispersion of excess returns around the median, as well as periods in which the median itself deviated significantly from the index.

On the surface, the results appear identical to the previous group: The typical active fund underperforms the index or outperforms it very narrowly, even before fees. Thus, a low-cost passive fund seems like a reasonable option. But because there’s more dispersion between the best and worst active funds in these categories, they appear to provide a more lucrative field for active managers.

For example, the typical fund in the U.S. intermediate-term bond category underperformed its category benchmark, the Bloomberg Barclays U.S. Aggregate Bond Index, by 20 basis points net of fees. However, funds that landed in the best quintile of the peer group managed to outperform the bogy net of fees by close to half a percentage point on average (some did even better), suggesting there's some value to investing with skilled managers in this cohort. We've identified a subset of intermediate-bond funds with Morningstar Analyst Ratings of Gold and Silver (which can be found using this premium screen) that are equipped to do just that.

There is a caveat: Many funds in the intermediate-bond category have gained an edge over the Aggregate Index by taking more credit risk, whether via larger-than-index allocations to investment-grade corporates or through modest out-of-benchmark exposures to securitized credit, high-yield corporates, or emerging-markets debt. As a result, many active funds in the category have struggled during periods of credit stress while the benchmark has thrived. So, when choosing an active manager in this peer group, it’s important to weigh the risks of its approach against the potential long-term rewards.

The U.S. high-yield bond category also falls in this camp, but the story is a bit different. The median of gross excess returns in this peer group just barely beat the benchmark, the ICE BofAML U.S. High Yield Index (formerly the BofAML U.S. High Yield Master II Index), putting most funds at a disadvantage versus the benchmark after fees. However, comparable passive ETFs, such as

3. In categories where volatility and transaction costs are high, both active and passive funds struggle to achieve the performance of the category benchmark over the long term.

In the U.S., the emerging-markets bond and emerging-markets local currency categories fall into this third group, alongside their EAA counterparts. The medians of gross excess returns in these categories over the period studied deviated dramatically from their respective benchmark indexes. For instance, the median of three-year excess returns for emerging-markets bond funds lagged its category index, the JPMorgan EMBI Global Index, by 74 basis points annualized, but that median waggled in a range of more than 5 percentage points depending on which three-year period you looked at. In this case, the category’s performance versus the closest representative ETF appeared similarly poor.

The case for passive management over active isn’t necessarily clear-cut in emerging-markets bonds, however. For one, the category is not as homogenous as it may appear. It includes funds that invest most of their portfolios in hard currency debt (bonds issued by emerging-markets issuers in U.S. dollars or euros) aligned with the category’s hard currency benchmark. But as the local currency and corporate bond markets have grown over the years, more of these hard currency funds have held stakes in local currency and corporate debt. The category also includes funds that take a diversified approach, investing more evenly across all three emerging-markets debt sectors. So far, there’s no accepted standard benchmark for a diversified approach to emerging-markets debt.

Given how volatile emerging-markets currencies have been historically, even small currency exposures can have a sizable impact on returns. In 2016, for instance, the local currency JPMorgan GBI-EM Global Diversified Index gained 8.7%, but underlying returns among individual countries were vastly different in some cases, mainly owing to currency fluctuations. The index’s two largest issuers, Brazil and Mexico, moved in drastically opposite directions that year: Brazil gained 58%, while Mexico lost 17%.

Investors looking for straightforward emerging-markets debt exposure have good reason to choose a comparatively cheap ETF (the fees charged by both active and passive funds in these categories tend to be higher than those charged elsewhere) and be done. But a wide dispersion of returns among the sector’s constituents also presents opportunities for skilled active managers to outperform through country and currency selection, not to mention plenty of patience.

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)