A Closer Look at Our New Tools to Assess Carbon Risk in a Portfolio

We explore how Morningstar's new metrics go beyond carbon footprinting.

The new Morningstar Portfolio Carbon Risk Score gives investors the means to evaluate the carbon risk embedded in a fund's portfolio. Sometimes referred to as transition risk, carbon risk addresses how vulnerable a company is financially to the transition away from a fossil-fuel-based economy to a lower-carbon economy. Such a transition is required to keep the global temperature rise this century well below 2 degrees Celsius above preindustrial levels. It's a transition that is already under way, as companies respond to pressure to lower their carbon emissions from regulators, customers, other stakeholders, and investors. As for the latter, more and more investors globally are interested in understanding carbon risk and its implications for the risk and return of their portfolios.

Let's take a closer look at how the Carbon Risk Score works, how to use it, and what the initial scores indicate about funds.

What Is the Morningstar Portfolio Carbon Risk Score? The Morningstar Portfolio Carbon Risk Score is based on company-level evaluations of carbon risk conducted by Sustainalytics, our environmental, social, and governance research partner. The Carbon Risk Score is the asset-weighted Sustainalytics carbon-risk rating of companies held in a portfolio.

How Does It Differ From Carbon Footprinting? A portfolio's carbon footprint is calculated by estimating the carbon emissions that are attributable to each underlying holding. Carbon footprinting is helpful in understanding carbon risk but is not a direct measure of carbon risk. It does not take into account the financial materiality of a company's carbon-risk exposure or its actions and strategy to manage such risk. The Morningstar Portfolio Carbon Risk Score is based on Sustainalytics' new carbon-risk rating for companies, which provides deeper insights than carbon footprinting alone can provide.

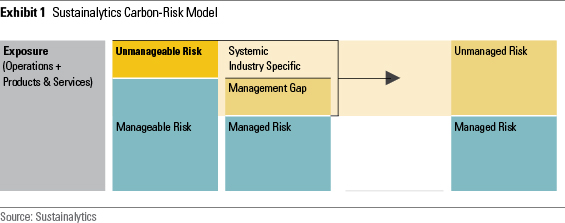

How Does Sustainalytics Assess the Carbon Risk of a Company? The company carbon-risk rating evaluates the degree to which a company's economic value is at risk in the transition to a low-carbon economy. The first step is an assessment of a company's exposure to carbon risk, which comes mainly from carbon emissions in its own operations and from the use of its products. The second step is an assessment of a company's management of that exposure--its actions and its strategy, if there is one, to lower emissions and develop products and services that are less carbon intensive. This process yields a score for a company that reflects its remaining unmanaged carbon risk.

Some industries, such as those in the technology and healthcare sectors, have little carbon exposure to begin with, so companies in those industries all have low levels of carbon risk. Other industries, such as integrated oil and gas, electric utilities, and autos, have significant carbon exposure. And for some industries, a significant portion of that risk is unmanageable (see Exhibit 1). Airlines, for example, can only manage a portion of their carbon exposure because there are no current alternatives to fossil-fuel-based jet fuel. But some of their carbon risk can be managed lower through improved routing efficiency or engineering planes for better fuel economy.

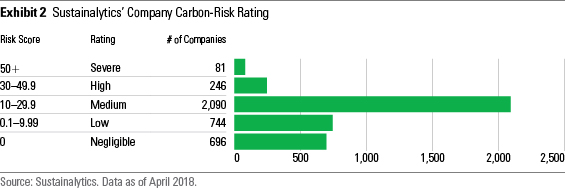

Considerable variation in the level of carbon risk exists among companies in many industries. Among airlines, all companies have carbon risk in the Medium risk range (see Exhibit 2), but

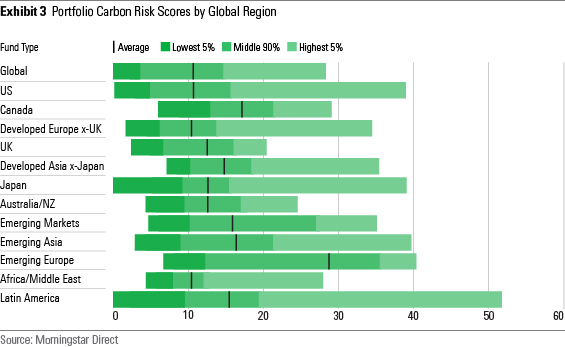

What Do the Initial Scores Tell Us About Funds? Exhibit 3 shows the average Carbon Risk Scores and the range of scores across various regional fund types. Diversification helps keep the average fund's Carbon Risk Score in the Medium risk range, with many developed-markets equity funds landing near the low end of it. Developed-markets funds focused on Europe ex-U.K. have the lowest average score, while those invested in Asia ex-Japan and Canada have the highest. U.S. funds land in between those two groups. Emerging-markets funds have average scores that still fall within the Medium risk range but are about 50% higher than those of developed-markets funds. As is the case for companies within many industries, considerable variation in Carbon Risk Scores exists within most Morningstar Categories.

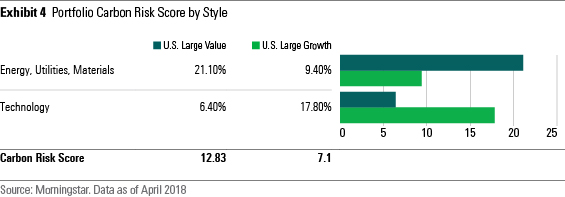

U.S. large-value funds have considerably higher average scores than do U.S. large-growth funds. As shown in Exhibit 4, large-value funds devote more than 20% of their assets to the three sectors with the highest levels of carbon risk (energy, utilities, and materials), while large-growth funds have less than 10% invested in those sectors. Large-value funds have only a 6.4% weighting in technology, which has one of the lowest carbon-risk profiles, compared with 17.8% for large-growth funds.

How Can Investors Use Carbon Risk Scores? For asset managers, Morningstar Portfolio Carbon Risk Scores can be used to set a baseline for ongoing monitoring of their funds' carbon-risk exposures. Those that have or are considering carbon-reduction targets can use the portfolio scores over time to evaluate their progress. The portfolio scores give asset managers an ongoing comparison with their peers and benchmarks. Asset managers can also use the portfolio scores to communicate with interested stakeholders about carbon risk and any efforts they are making to reduce it.

Fund investors can use the portfolio scores in several ways. The initial scores can be used to set a baseline for ongoing monitoring of the carbon-risk exposure of an investor's portfolio holdings. Portfolio scores can be compared with category averages and benchmarks to determine whether funds are above or below the category average or benchmark exposure. Because there is a range of portfolio scores within most categories, the scores can be used to identify and evaluate lower carbon-risk alternatives, allowing fund investors to lower the carbon risk in their portfolios.

What Is the Morningstar Low Carbon Designation? Portfolios that exhibit low overall carbon risk and have lower-than-average exposure to companies with fossil-fuel involvement will receive the Morningstar Low Carbon Designation, shown in Exhibit 5. This designation, represented by a green leaf icon, is meant to help investors quickly and easily identify low-carbon funds and, in general, to educate key stakeholders and the public about the availability of low-carbon investment choices. The designation is an indicator that a portfolio's holdings are in general alignment with the transition to a low-carbon economy.

For a fund to receive the Low Carbon designation, it must have a Morningstar Portfolio Carbon Risk Score below 10 for the trailing 12 months and exposure to companies with fossil-fuel involvement below 7% over the same trailing 12 months. Sustainalytics sorts companies with risk scores below 10 into the Low risk category, so we are requiring the same for portfolios. The portfolio exposure threshold for fossil-fuel-involved companies was set at 7% because it represents about a one-third lower level of exposure to these companies than that of major global indexes.

What's the Relationship Between the Morningstar Portfolio Carbon Risk Score, the Morningstar Low Carbon Designation, and the Morningstar Sustainability Rating? The Morningstar Sustainability Rating is based on Sustainalytics' company-level ESG scores, which also include assessments of companies' carbon exposure and management, but as part of a broader evaluation of their exposure to, and management of, overall ESG risks and opportunities. Company-level ESG scores are calculated within industries and reflect "best-in-class" comparisons. The fund-level Sustainability Rating is assigned relative to a fund's category.

The Morningstar Portfolio Carbon Risk Score, by contrast, is focused solely on carbon risk. Although intragroup comparisons can be made, carbon risk at the company level is an absolute risk measure. A company with the the lowest carbon-risk score in a high carbon-risk industry will typically have a higher risk score than a company with the highest risk score in a low carbon-risk industry. While the Carbon Risk Score can be compared with peers, it is not a rating. Those funds that get the Low Carbon designation have to meet the same absolute criteria regardless of the category they inhabit.

Is More-Detailed Information Available? A deeper dive into the Morningstar Portfolio Carbon Risk Score can be found on the Morningstar corporate site.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar's investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/NNGJ3G4COBBN5NSKSKMWOVYSMA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6BCTH5O2DVGYHBA4UDPCFNXA7M.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)