What's Next for Crypto Assets?

As cryptographic tokens proliferate and institutional investors find new ways to access them, the frenzy should only continue in 2018.

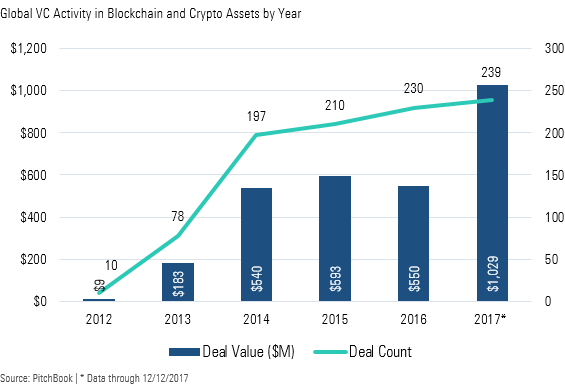

- We see further implementation of various decentralized business models that have taken advantage of the relative ease of raising capital via non-dilutive token sales (ICOs), which attracted over $4 billion in 2017. These token sales have displaced venture capital as the primary funding source of early-stage blockchain projects, which in comparison raised a little less than $1 billion year to date through mid-December.

- In November and December, widespread coverage in the financial press caused a significant runup in prices for those tokens listed on the more retail-friendly U.S. Exchanges such as Coinbase. However, given continued positive price action, coupled with the emergence of over 1,000 unique crypto, we anticipate many new market participants to recycle gains into more esoteric tokens. Increased media coverage--as well as access to Bitcoin (BTC) and Ethereum via traditional brokerage providers, futures markets, and other access ramps such as proposed ETFs--will also drive further public consciousness of the technology in 2018.

- We anticipate Institutional-grade investment funds to proliferate further in the first quarter of 2018 and take various forms, including ICO funds, blockchain-focused VC funds, and crypto hedge funds. This represents a unique evolution of crypto assets; unlike other types of investments, interest from retail investors preceded the entrance of institutional players.

The exponential growth of interest in the blockchain and crypto asset space has not fully translated into venture capital investment into blockchain companies. As of Dec. 13, venture capital investments in the space had barely surpassed $1 billion year to date.

This pales in comparison to the rise of token sales, often referred to as initial coin offerings (ICOs). According to fintech consultancy Autonomous Next, the fundraising method provided new projects with $4.27 billion year to date through Dec. 10.

Token sales are when a blockchain project sells an initial batch of cryptographic tokens to the public, accompanied by a whitepaper with details on plans for the technology that will be developed, team biographies, and a list of (often prominent) advisors/investors. Virtually all of these projects are pre-product at the time of the token sale, as funds are slated to go toward development.

Currently, we observe a number of adverse incentives to this method of putting liquidity before development. First, the founding team has minimal accountability not to cash out right away. Second, various advisors often receive significant discounts for writing large checks and providing credibility, but are not typically subject to lockup periods. Over time, we expect greater thought will be put into aligning incentives between founding teams and investors of all sizes.

Much of the media-fueled euphoria in recent weeks has focused on the largest tokens by market cap, Bitcoin and Ethereum. While these two coins have the most proven respective use cases as a store of value and decentralized computing platform for smart contracts, there are over 1,000 other unique crypto assets.

We anticipate the runup in prices across the most major cryptocurrencies will drive a contagion effect that will result in many investors recycling gains into up-and-coming platforms called "alt coins." Risks can be prevalent here as many retail investors lack a long-term fundamental approach to trading and investing in crypto assets; however, more sophisticated frameworks for investment in the space have recently been proffered by individuals such as Chris Burniske and former KKR partner John Pfeffer.

The increased interest in the space has attracted a wave of institutional capital into the asset class. This may seem like a normal development for those casually watching the space, but it is a seminal moment for those who have been following Bitcoin since its genesis in 2009. Although it is difficult to deploy large quantities of capital into the space without extremely concentrated positions in Bitcoin and Ethereum, managers have pointed to their ability to arbitrage across multiple exchanges and currency pairs, to deploy sophisticated quantitative strategies, and to run a 24-hour trading desk (as these markets never close). Notable former global macro fund managers John Burbank and Mike Novogratz have switched completely over to crypto trading after closing their funds at Passport and Fortress, respectively.

Many readers are likely already fatigued by the incessant media coverage over recent weeks and ready for a reprieve; however, as cryptographic tokens proliferate and institutional investors find new ways to access them, the frenzy should only continue in 2018.

Quarter-End Insights

Stock Market Outlook: A Dearth of Opportunity Amid the Rally Credit Market Insights: Flattening Yield Curve Impacts Performance Basic Materials: The Most Overvalued Sector We Cover Energy: A False Sense of Security for Oil Markets Communication Services: A Deal Eludes Sprint and T-Mobile Consumer Cyclical: E-Commerce a Key Threat for Some, But Not All Consumer Defensive: Hungering for Top-Line Gains Financial Services: Asset Managers Are Forced to Adapt Healthcare: Pick Carefully as Valuations Head Higher Industrials: Pockets of Uncertainty Present a Few Opportunities Real Estate: Slow but Steady Climb Continues Technology: Most Bellwethers Are Overvalued Utilities: A Weak December Could Foreshadow a Tough 2018 Venture Capital Outlook: Dry Powder for Late-Stage Deals Private Equity Outlook: Eyewatering Acquisition Multiples

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HTLB322SBJCLTLWYSDCTESUQZI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/TAIQTNFTKRDL7JUP4N4CX7SDKI.png)