The Death of Active Management Has Been Greatly Exaggerated

Active investing will never die, but it's being forced to evolve.

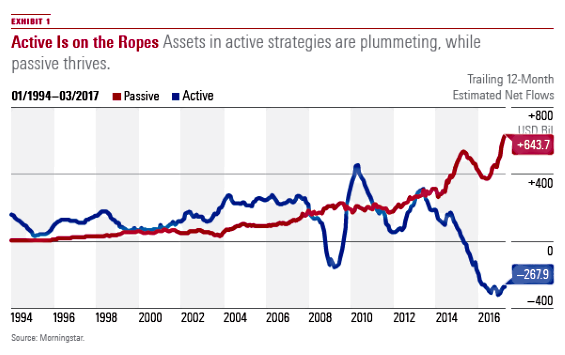

It is no secret that actively managed funds are struggling (EXHIBIT 1). Over the three-year period ending April 30, U.S.-domiciled actively managed mutual funds and exchange-traded funds witnessed collective outflows of nearly $514 billion. Passively managed mutual funds and ETFs collected nearly $1.57 trillion in net new money during that same span. What began as more discerning culling of positions in underperforming U.S. stock funds has become more widespread. For example, during the 12 months ending Jan. 31, investors pulled $99 billion from funds that beat their Morningstar Category indexes over that same period.1

Are we approaching the End of Days for active management? I don't believe so. In my opinion, active management will never die. There will always be investors who hope for something better than getting the market's return net of a small fee--it's human nature. But active management must continue to evolve. Here, I'll take a closer look at two ways in which active management has changed in recent years as evidenced by:

1 The growth in the active use of passive funds. 2 The expansion of a class of nominally passive funds that make active bets.

Both phenomena demonstrate that active management is alive and well and that the distinction between active and passive is as blurry as ever.

Investors Are Getting Active With Passive The objects of many active managers' decision-making process are changing. Instead of choosing between Coca-Cola KO and Apple AAPL, many active managers are deciding between U.S. large caps and U.S.-dollar-denominated emerging-markets debt. These active asset-allocation decisions are increasingly implemented using ETFs and index mutual funds. The managers making these decisions are doing so in a number of different settings and with varying degrees of activity. These range from broadly diversified strategic asset-allocation models that are managed at intermediary platforms' home offices to so-called robo-advisors and ETFs of ETFs. Among these actors, the preference for passive is strong. In trying to generate alpha by recombining various beta building blocks, many asset allocators want to take ownership of all active decisionmaking rather than outsource it to a traditional security selector.

The growth of these model-builders is most readily measured by the increase in assets under management of target-date funds, the assets under management or advisement in ETF managed portfolios, and the amount of money managed on digital advice platforms (aka robo-advisors).

Assets in U.S.-domiciled target-date funds stood at $880 billion as of the end of 2016.² Of that sum, 39%, or $343 billion, was invested in target-date series that use passive funds exclusively. These series’ share of the target-date market increased from 17% as of 10 years ago. ETF managed portfolios are investment strategies that typically have more than 50% of portfolio assets invested in ETFs. Primarily available as separate accounts in the United States, these portfolios represent one of the fastest-growing segments of the managed-accounts universe. As of Dec. 31, Morningstar was tracking 881 strategies from 162 firms with total assets of $84.8 billion in this space. This is just the tip of the iceberg, as there are tens of billions of dollars invested in similar strategies that are managed by teams at a number of different intermediary platforms, which are not captured in our database. Lastly, there are the robo-advisors. Firms like Vanguard and Charles Schwab SCHW have seen rapid growth in the adoption of their digital-advice platforms. Schwab Intelligent Portfolios were home to $16 billion in investors’ assets as of the end of March. Vanguard's Personal Advisor Services segment now oversees more than $50 billion.

As individuals and advisors show a growing preference for solutions over products and grow more comfortable with technology, it is likely that these active asset allocators will continue to attract new money from investors.

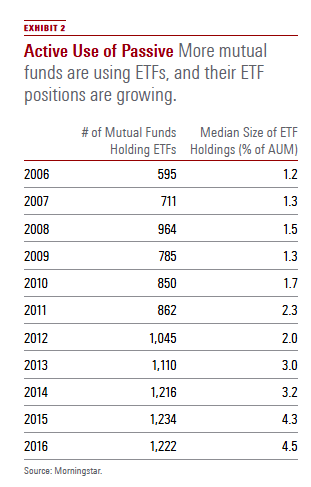

Actively managed mutual funds are also making greater use of passive funds, and ETFs in particular (EXHIBIT 2). Since 2006, the number of actively managed U.S.-domiciled mutual funds that hold at least one ETF has more than doubled. Meanwhile, the size of the median ETF positions held by these funds has nearly quadrupled. Security selectors are using ETFs to fill gaps in their portfolios. Some have substituted them for futures contracts to equitize cash. Others invest in them to take sector bets when they don’t have expertise to select the most attractively priced stocks in a corner of the market. The growing use of ETFs by active fund managers is a clear example of the increasingly fuzzy distinction between active and passive.

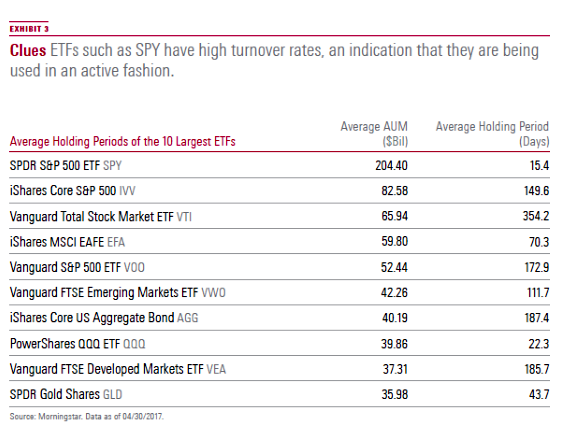

The starkest data demonstrating the active use of passive building blocks is the rate of turnover in many ETFs' shares. SPDR S&P 500 ETF SPY is the most actively traded security on the planet. According to NYSE, SPY's average daily turnover in March was $21.4 billion. Over the year ending April 30, the average holding period for SPY was 15.4 days.3 That hardly seems passive. ETFs are being used in countless ways by countless different market participants. For some, they are low-cost, tax-efficient, buy, hold, and rebalance building blocks. For others, they are a substitute for a derivative, a trading tool, or a hedge. Unlike mutual funds, there is no way to trace ETF users or to discern how they are being used. Trying to do so is like a playing a frustrating game of Clue. All we know for certain is that the candlestick was the murder weapon (SPY, in our case). We have no idea who committed the crime, why they did it, nor in what dark corner of the mansion the deed was done. What we can say for certain is that ETFs are being used actively (EXHIBIT 3).

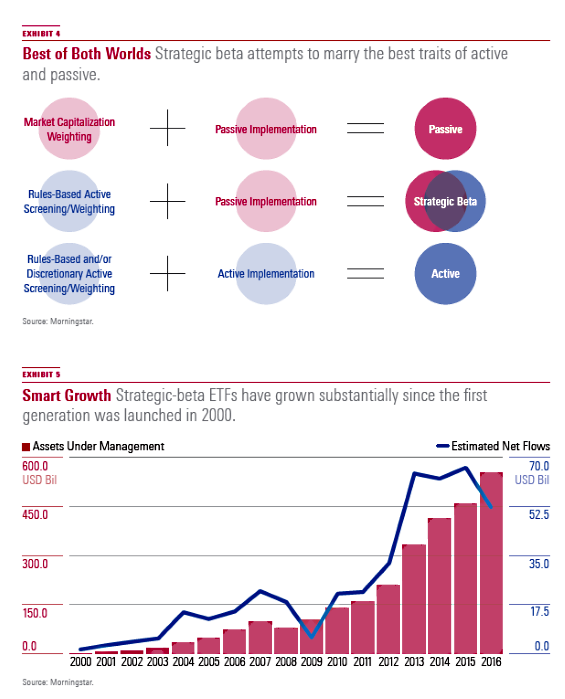

Passive Itself Is Getting More Active Not only are investors making active use of passive funds, but the complexion of passive funds is also changing. Asset managers are looking to marry the best traits of active and passive, pairing active bets with the strict discipline and lower costs of an index approach (EXHIBIT 4). This has given rise to a swelling number of strategic-beta (aka "smart" beta) ETFs and substantial growth in these funds' assets. From the launch of the first generation of these ETFs in 2000, their collective AUM had grown to $556 billion as of the end of 2016, having compounded at an annualized rate in excess of 40% during that period (EXHIBIT 5).

These funds make rules-based active bets against the market in a nominally passive manner. Unlike traditional actively managed funds, there is no ongoing research or day-to-day buy, sell, or hold decisions made in response to developments in the markets. As these are active bets, these funds give investors the opportunity for outperformance, less risk, or some combination of the two relative to owning the market at large via a broad-based market-cap-weighted index fund. It also takes an important risk off the table--manager risk. Omitting the uncertainty associated with the human element of active security selection is an important differentiating feature. Furthermore, because these strategies are delivered via an ETF, they can be more tax efficient than traditional active funds. Most important, however, is the fact that these funds tend to charge lower fees than most of their active peers.

Make no mistake, strategic-beta and other kindred factor-focused approaches to portfolio construction are a form of active management. So, not unlike traditional active funds, not all of them will succeed in generating better risk-adjusted returns relative to plain-vanilla market-cap-weighted index funds over the long haul. And like the best active managers, these funds will experience cycles of performance marked by droughts and market-beating returns. As such, investors' patience will be tested, and their behavior may be suboptimal. We have already seen examples of all-too-familiar performance-chasing behavior among investors in these funds. The active decisions that matter most are still those made by the end investor.

I'm Not Dead Active management will never die. It will continue to evolve--we hope for the better. Fees will face pressure, and fee arrangements themselves may also evolve. Performance fees and loyalty programs are among the ideas being mulled by fund sponsors. New share-class and product types are also coming to the market.

Active managers may also get more active. The exodus from actively managed funds has disproportionately affected funds that are high-priced benchmark huggers. Taking on more active risk is the only way that many managers can possibly justify their current fee levels. The movement to passive and the growth of strategic-beta and other factor-oriented funds will drive the evolution of active managers and further reinforce the fact that active and passive are becoming more indistinguishable by the day.

1 Ptak, J. 2017. "Loveless: Even Winning Funds Are Bleeding Assets" Morningstar. March 28, 2017. http://news.morningstar.com/articlenet/article.aspx?id=798866

2 Holt, J. 2017. Morningstar Target-Date Fund Landscape 2017. https://corporate1.morningstar.com/ResearchLibrary/article/803362/2017-target-date-fund-landscape/

3 I calculated ETFs’ average holding periods as follows: Average Holding Period = 365 / (Total Dollar Value of Trades Over Last 12 Months / Average Daily Assets Under Management).

This article originally appeared in the June/July 2017 issue of Morningstar magazine.

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)