4 Utility Stocks to Play the AI Data Center Boom

Dividend-paying Entergy and Southern Co. are among the best-positioned for rising electricity demand.

The boom in artificial intelligence technology is expected to ripple beyond semiconductor and software stocks. The data centers that train and host AI programs require electricity, and lots of it.

Consequently, data center expansion means a new source of demand growth for utilities. Morningstar analysts don’t believe this element has been factored into the prices of utility stocks yet. This comes while electricity demand is also being lifted by growth in electric vehicles. “We expect electricity demand growth to top market expectations, requiring substantial energy infrastructure investment and boosting utilities’ earnings growth,” says Morningstar strategist Travis Miller.

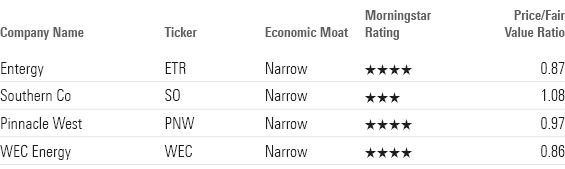

The utilities sector was 5% undervalued as of May 1, according to Morningstar analysts, with many companies predicted to profit from the increase in electricity demand. Miller and fellow Morningstar strategist Andrew Bischof see four stocks as best-positioned to benefit from data center growth:

Of the three, Entergy, Pinnacle, and WEC are considered undervalued by Morningstar, while Southern is deemed fairly valued.

Utility Stock Performance

Data Center Electricity Demand Seen Booming

Data centers are dedicated spaces for housing computer systems, including data processing hardware. To keep up with the boom, utilities will face the challenges of serving peak summer and winter demand while aiming to use clean energy, which requires considerable investments in energy storage and grid updates. “One large data center could require billions of dollars of utility investment,” Miller explains.

Looking at demand growth, the base case from Morningstar analysts—which considers that electricity demand will continue to lean more toward electric vehicles over data centers—is a 1.4% annualized increase through 2032, the fastest growth in two decades. That’s a cumulative 46% increase in data center demand by that year. Morningstar analysts offer a bull case wherein data center growth accelerates demand by 131% through 2032. In that case, data center demand will surpass EV demand.

Data Center Electricity Demand Forecast

“The outlook for data center electricity demand is trending toward our bull-case scenario,” Miller says. “If anticipated data center development materializes, we will consider raising our fair value estimates for some US electric distribution utilities.”

Which Utilities Stocks Are Best Poised to Benefit From Data Center Demand?

Location plays a key role in which data center companies have the best chance of succeeding. Lower power prices are key, given the electricity requirements of data centers. This gives companies that operate out of the Southeast and some of the Midwest a competitive advantage. Additionally, Bischof says investors should look for “utilities that operate in constructive regulatory jurisdictions with key stakeholder support in high economic development areas.”

Here’s a closer look at Morningstar’s picks for utility stocks expected to benefit from data center growth.

Best Positioned Utility Stocks for Data Center Boom

Entergy

- Fair Value Estimate: $123.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Low

- Forward Dividend Yield: 4.22%

“Entergy’s growing, energy-hungry customer base and constructive rate regulation in the US Southeast give the company a long runway of earnings and dividend growth potential.

“We expect Entergy to invest nearly $7 billion annually on average for the next five years to upgrade its electric grid and expand its clean energy portfolio. Industrial customers, which represent about half of Entergy’s customer base, generally support these investments in reliability and power generation with lower carbon emissions.

“We forecast Entergy’s planned growth investments and customer growth will lead to annual earnings growth toward the top half of management’s 6%-8% target. Constructive regulatory outcomes could push management’s $20 billion capital investment plan in 2024-26 higher, boosting earnings growth to near 8% through the decade.”

Read more of Travis Miller’s analyst notes here.

Southern Co.

- Fair Value Estimate: $69.00

- Morningstar Rating: 3 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Low

- Forward Dividend Yield: 3.87%

“Southern is in the process of a dramatic clean energy transformation. Its $43 billion capital investment plan during the next five years will reduce greenhouse gas emissions, expand renewable energy, strengthen the gas system, and support the Southeast region’s fast-growing energy demand.

“In 2000, almost 80% of the electricity Southern sold was generated using coal. That share is now below 20% and falling. The company is aiming to retire all but eight coal plants by 2028 and reach net-zero carbon emissions from power generation by 2050. Nuclear, natural gas, and renewable energy are all increasing their share of generation.

“With a renewed focus on smaller projects, we think Southern can produce steady 6% earnings growth. Dividend growth has trailed earnings growth in recent years because of Southern’s large investments, but we expect dividend growth to accelerate and match earnings growth starting in 2024 when Vogtle is finished.”

Read more of Travis Miller’s analyst notes here.

Pinnacle West Capital

- Fair Value Estimate: $77.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Low

- Forward Dividend Yield: 4.70%

“Until 2021, Pinnacle West had been earning solid returns and rewarding shareholders with dividend increases as customer and energy usage growth in Arizona outpaced most other utilities. But regulatory setbacks have made it difficult for Pinnacle West to turn those favorable fundamentals into earnings and dividend growth.

“Arizona regulators’ decision to cut Pinnacle West’s allowed return on equity to 8.7% from 10% contributed to a $200 million rate cut in 2022. It appeared earnings wouldn’t reach 2021 levels again until 2025. But Pinnacle West reversed some of that rate cut with a successful appeal, and a new set of regulators approved a $253 million annualized rate increase in March 2024.”

Read more of Travis Miller’s analyst notes here.

WEC Energy Group

- Fair Value Estimate: $96.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Fair Value Uncertainty: Low

- Forward Dividend Yield: 4.03%

“WEC Energy Group is the largest Midwest utility, with approximately $29 billion of rate base, and it derives most of its earnings from regulated operations. Nearly 75% of earnings come from areas with constructive Wisconsin and Federal Energy Regulatory Commission regulations. Its commercial renewable energy business accounts for the remainder of its earnings.

“We expect the company to invest $23.7 billion of capital through 2028, which includes its investment in American Transmission. This investment plan supports our forecast that the company will achieve the high end of management’s narrow 6.5%-7% annual earnings growth target.”

Read more of Andrew Bischof’s analyst notes here.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/4JOND5R2SBFPZE63XWPYQDG56A.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BG4IFJHA25B6RKD3XNUYKROBBM.jpg)