Top 15 Wealth-Creating Stocks of the Past Decade

These stocks have excelled at creating shareholder value in dollar terms.

If you invest in individual stocks, you’re probably used to seeing headlines about the top-performing stocks over shorter periods, such as for the year to date or even weekly or daily returns. There are two drawbacks to this approach. First, it’s difficult to create long-term wealth by focusing on short-term performance. In addition, even a strong-performing stock has less impact if few shareholders are around to benefit from it.

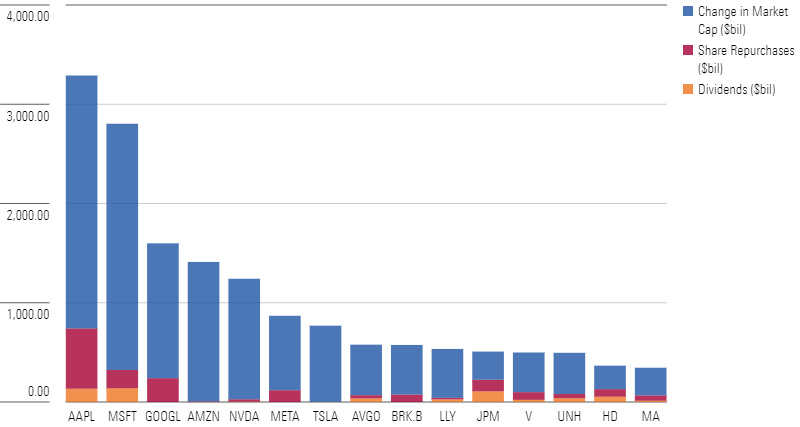

To find investments that have created the most value in dollar terms, wealth creation is a better measure. A few months ago, I sifted through Morningstar’s fund database to highlight funds that created the most wealth based on market appreciation in dollars. This time, I conducted a similar exercise on the equity side, focusing on stocks that created the most wealth based on the change in their market capitalization (which reflects the current stock price multiplied by total shares outstanding) over the 10-year period from 2014 through 2023. To get a more complete picture of wealth creation, I added in the total value of dividends paid and share repurchases over the same period.

The Results

The graph below shows the 15 stocks that have created the most value for shareholders based on these metrics.

Top 15 Wealth-Creating Stocks Over the Past Decade

The stocks on my list created an estimated $15.9 trillion in shareholder wealth over the past 10 years. That’s more than 4 times my estimate of about $3.5 trillion for the top 15 funds. Owning shares in an individual stock is a lot riskier than owning a broadly diversified fund, and the odds of experiencing a loss are much higher. However, if you manage to invest in a profitable stock, the upside can be much greater.

That’s especially true given that companies with outstanding financial results and share-price performance can continue to outshine their competitors over many years. Most of the companies on my list were already mega-cap stocks 10 years ago. Tesla TSLA is one exception. The company has been around since July 2013, but it didn’t reach mega-cap status until a couple of years ago.

More broadly, all of the members of the “Magnificent Seven” group of large-cap tech stocks have also generated significant shareholder wealth over the past decade. As a group, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, Alphabet GOOGL, Nvidia NVDA, Meta Platforms META, and Tesla, created about $12.0 trillion in shareholder value over the 10-year period, making up about three fourths of the total for the top 15.

From a sector perspective, technology-related stocks dominate the list. That shouldn’t come as a surprise, given that tech stocks have generated excess returns of more than 8 percentage points versus the broader market over the past 10 years.

Other sectors, including consumer cyclicals, financial services, and healthcare, also show up in the top 15. Notably absent are old-economy sectors, such as utilities, basic materials, industrials, and real estate.

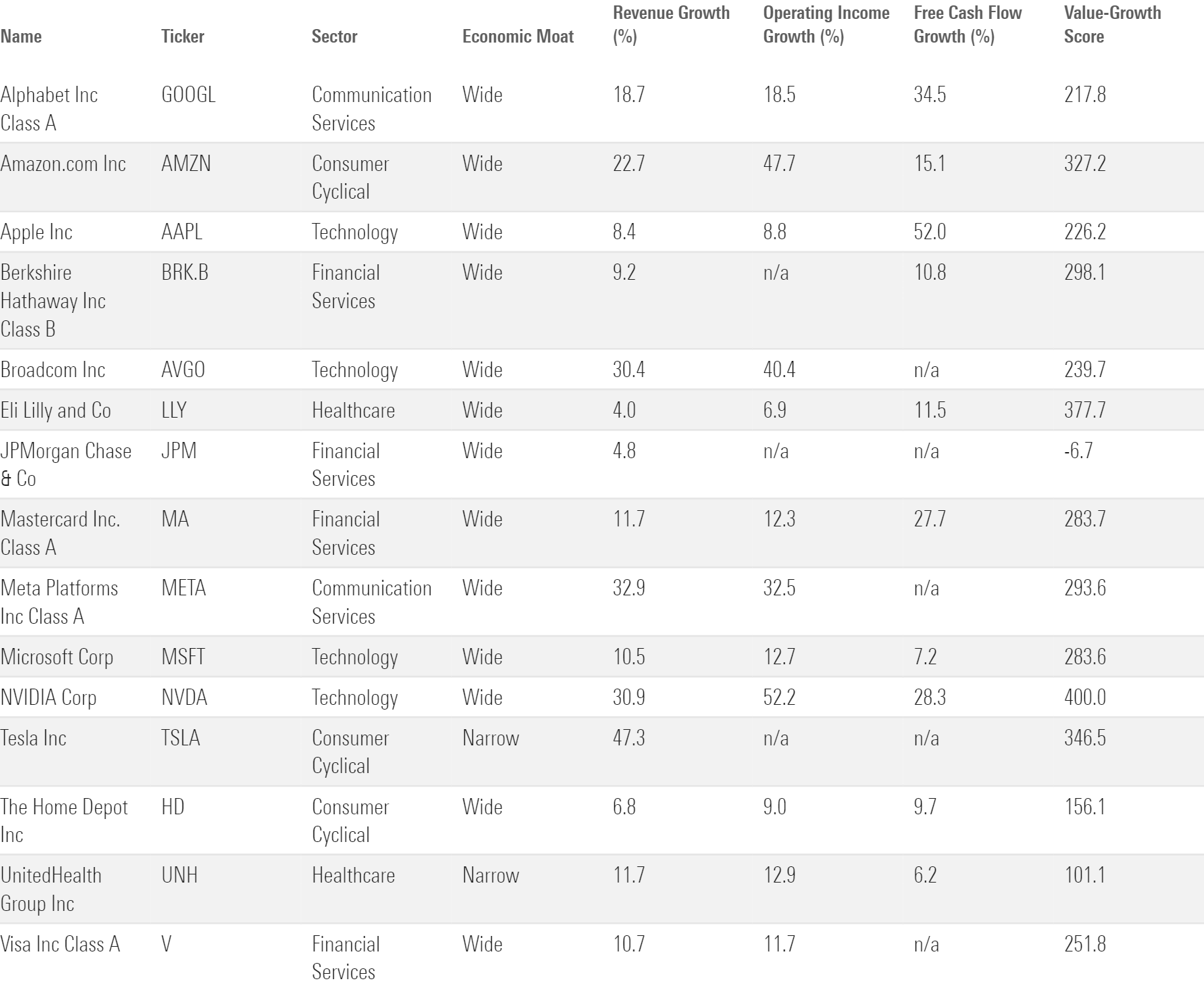

Another common thread that ties together the top 15 wealth creators: an economic moat, or sustainable competitive advantage. An economic moat is a structural feature that allows a firm to sustain excess profits over a long period of time. Morningstar’s equity analysts define economic profits as returns on invested capital over and above our estimate of a firm’s cost of capital, or weighted average cost of capital. Only 15% of the companies we cover have a wide Morningstar Economic Moat Rating, while 30% have a narrow moat, and the remaining 55% have no moat. However, 13 of the top 15 wealth-creating stocks have wide economic moat ratings based on our analysts’ assessments, while the remaining two have narrow moats. In other words, economic moats have been key to shareholder value creation.

Economic Moat and Growth Statistics

Growth has also been an important trait. Growth stocks have had a massive performance advantage over the 10-year period in the study, outperforming value issues by more than 4 percentage points per year, on average. So, it probably should come as no surprise that most of the stocks on the list are growth-oriented rather than value-oriented. As shown in the table above, the value-creation winners generated significantly better growth in revenue, operating income, and free cash flow than the market over the past 10 years.

On average, they also sport a value-growth score, which reflects the aggregate expectations of market participants for future growth and required rates of return, nearly double that of the overall market. The only exception is JPMorgan Chase JPM, which has been slower-growing but has parlayed its dominant position in many types of banking into above-average profitability and financial health.

Looking Ahead

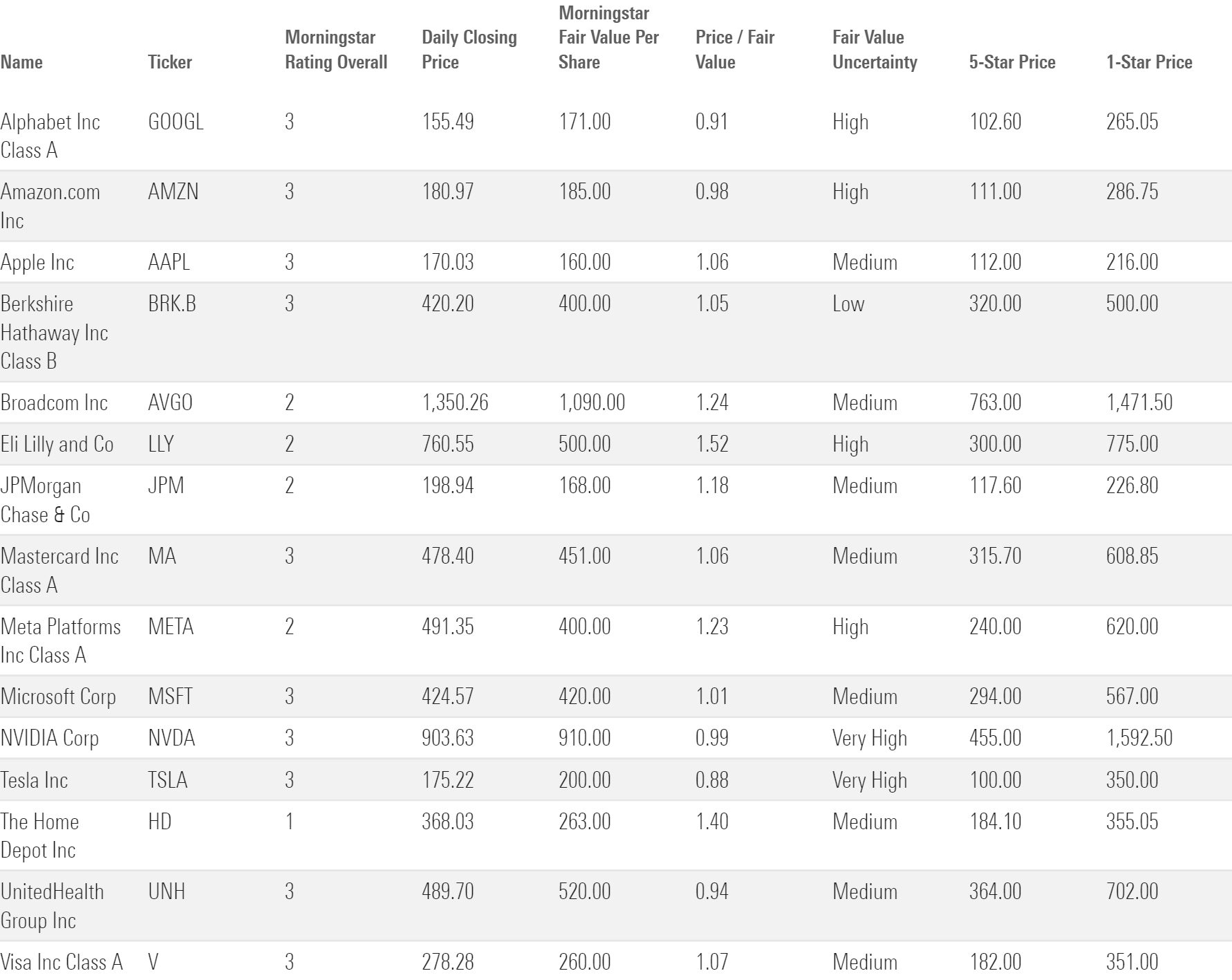

Shareholders in these 15 companies have been amply rewarded over the past decade. But when it comes to equity investing, the past may or may not be prologue. What really matters for investors considering a new purchase is a company’s future prospects and whether the current stock price offers a margin of safety.

Morningstar Ratings and Valuations

On that front, the wealth creators are a mixed bag. While the companies on the list might continue to dominate their peers, none of them is currently trading at a low enough price to garner a Morningstar Rating of 4 or 5 stars. Ten of the 15 have ratings of 3 stars, indicating that they’re neither significantly undervalued nor overvalued based on our analysts’ assessments. Four others—Broadcom AVGO, Eli Lilly LLY, JPMorgan, and Meta Platforms—are currently trading above our estimates of their fair value, earning them 2-star ratings. Finally, The Home Depot HD is trading at a significant premium to our fair value estimate. Depending on their tax circumstances and other factors, investors may want to consider selling.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_d0e8253d77de4af9ae68caf7e502e1bf_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)