15 Stocks That Have Destroyed the Most Wealth Over the Past Decade

These stocks have eroded shareholder value in dollar terms.

Last week, I highlighted 15 stocks that have created the most wealth over the 10-year period from 2014 through 2023, focusing on market appreciation in dollars. This time, I conducted a similar exercise from the opposite point of view to identify stocks that eroded shareholder value instead of creating it. To find them, I started by sorting through Morningstar’s US equity database to find companies with the largest drops in market capitalization, which reflects the current stock price multiplied by total shares outstanding, over the same period. To get a more accurate picture of wealth destruction, I added back the total value of dividends paid and stock spinoffs, which partially offset the market-cap declines.

The Results

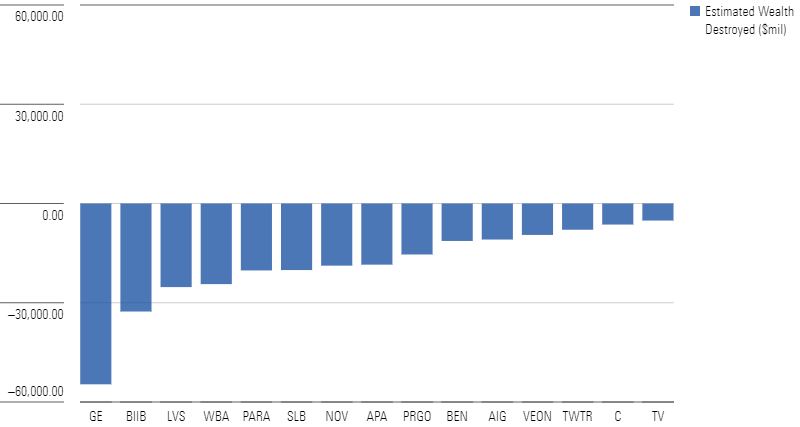

The graph below shows the 15 stocks that have destroyed the most value for shareholders based on these metrics.

Top 15 Wealth-Destroying Stocks Over the Past 10 Years

As a group, the wealth destroyers wiped out an estimated $281.2 billion in shareholder wealth over the past 10 years. That’s a big number, but far less than the estimated $15.9 trillion in wealth created by the top 15 stocks on the positive side. This reflects a few different factors. First, companies with outstanding financial results and share-price performance can continue to outshine their competitors over many years. While it’s impossible to lose more than 100% of your initial investment in a stock (unless you’re wading into risky territory like derivatives and leverage), winning stocks can have upside potential well in excess of their initial value. Second, the odds of experiencing a loss in any individual stock are relatively high, but value destruction can be somewhat limited if a stock never reached a large market cap to begin with.

Many of these companies are large-cap stocks that once dominated their industries. GE Aerospace GE, for example, is the legal successor to General Electric, which was once one of the largest companies in the United States based on revenue and profitability. Over the 10-year period ended in 2023, General Electric destroyed an estimated $55 billion in shareholder value, compared with about $33 billion for Biogen BIIB, the second company on the list.

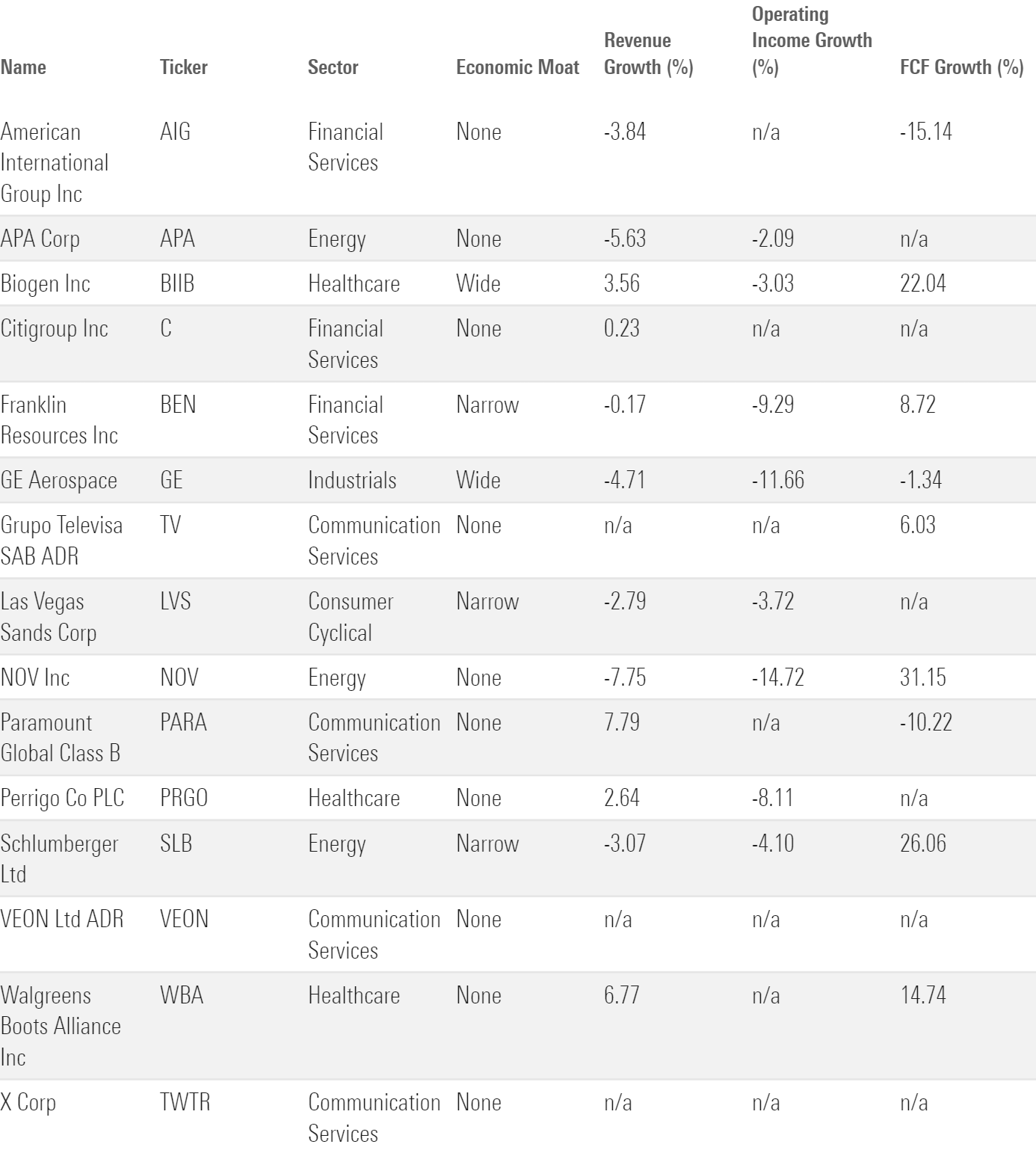

While the remaining companies span a motley assortment of industries, sectors, and underlying problems, many of them have a common thread: a lack of economic moat, or sustainable competitive advantage. Ten of the companies on the list have no economic moat, and another three have narrow economic moats. Only two companies on the list—Biogen and GE Aerospace—currently have a wide Morningstar Economic Moat Rating. Despite those companies’ previous problems, our analysts believe both have a competitive advantage going forward: for Biogen, a specialty-market-focused drug portfolio and novel, neurology-focused pipeline, and for GE Aerospace, a specialized skill-set in designing, building, and servicing complex products with long lead times and high switching costs. Moats were much more prevalent on my list of wealth creators, with 13 of the 15 garnering wide economic moat ratings based on our analysts’ assessments.

Economic Moat and Growth Statistics

Another common factor: deteriorating fundamentals. As shown in the table above, most of the value destroyers suffered declining revenue and operating income over the past 10 years. Three of them—American International Group AIG, Paramount Global PARA, and General Electric—have also reported declines in free cash flow. Investors responded to these worsening metrics by bidding down the stock prices.

What Went Wrong?

It’s tough to generalize about what led to these companies’ falloffs. Just as there are many different paths to greatness, there are many paths to value destruction. But in digging into these companies’ travails, a few issues surfaced more than once.

- Acquisitions that failed to create shareholder value. GE previously built up a sprawling portfolio of businesses in many different areas, but complexity and lack of focus eventually led to its downfall. Schlumberger SLB took a massive write-off of $13 billion in 2019 to account for the decline in its acquired operations in the American pressure pumping business. Franklin Resources BEN has made numerous acquisitions over the past few years but has struggled to win back market share as performance has lagged.

- Failure to keep up with changes in consumer preferences. Paramount Global, for example, has watched its net income shrink as viewers have abandoned traditional television in favor of streaming services. Walgreens Boots Alliance WBA has lagged as consumers have shifted toward online services for prescriptions and other products.

- Failures of risk management. Citigroup C was one of the hardest-hit banks in the 2008 financial crisis and has been struggling to get its business on a more profitable path ever since then. Similarly, American International Group AIG sold large amounts of credit-default swaps on subprime mortgage products, leading to a massive government bailout in 2008 and many years of poor financial performance since then.

- Challenging external factors. As a leading oilfield services company, Schlumberger is heavily dependent on energy prices. The oil price collapse between 2014 and 2016 took a heavy toll on its revenue and profitability. Las Vegas Sands’ LVS revenue took a big hit when covid-19 restrictions in Asia made it impossible for consumers to visit casinos in Macao and other locations.

- Lack of success in developing new products. Once a biotech darling, Biogen has suffered several setbacks in product development. It was counting on a new Alzheimer’s disease medication to replace falling revenue from multiple sclerosis drugs, but progress on the drug stalled out at various points. After numerous controversies and setbacks with Medicare coverage, Biogen recently announced that it will discontinue clinical trials.

Looking Ahead

Shareholders in these 15 companies have suffered greatly over the past 10 years. But as I pointed out in my previous article, what really matters for investors considering a new purchase is a company’s future prospects and whether the current stock price offers a margin of safety.

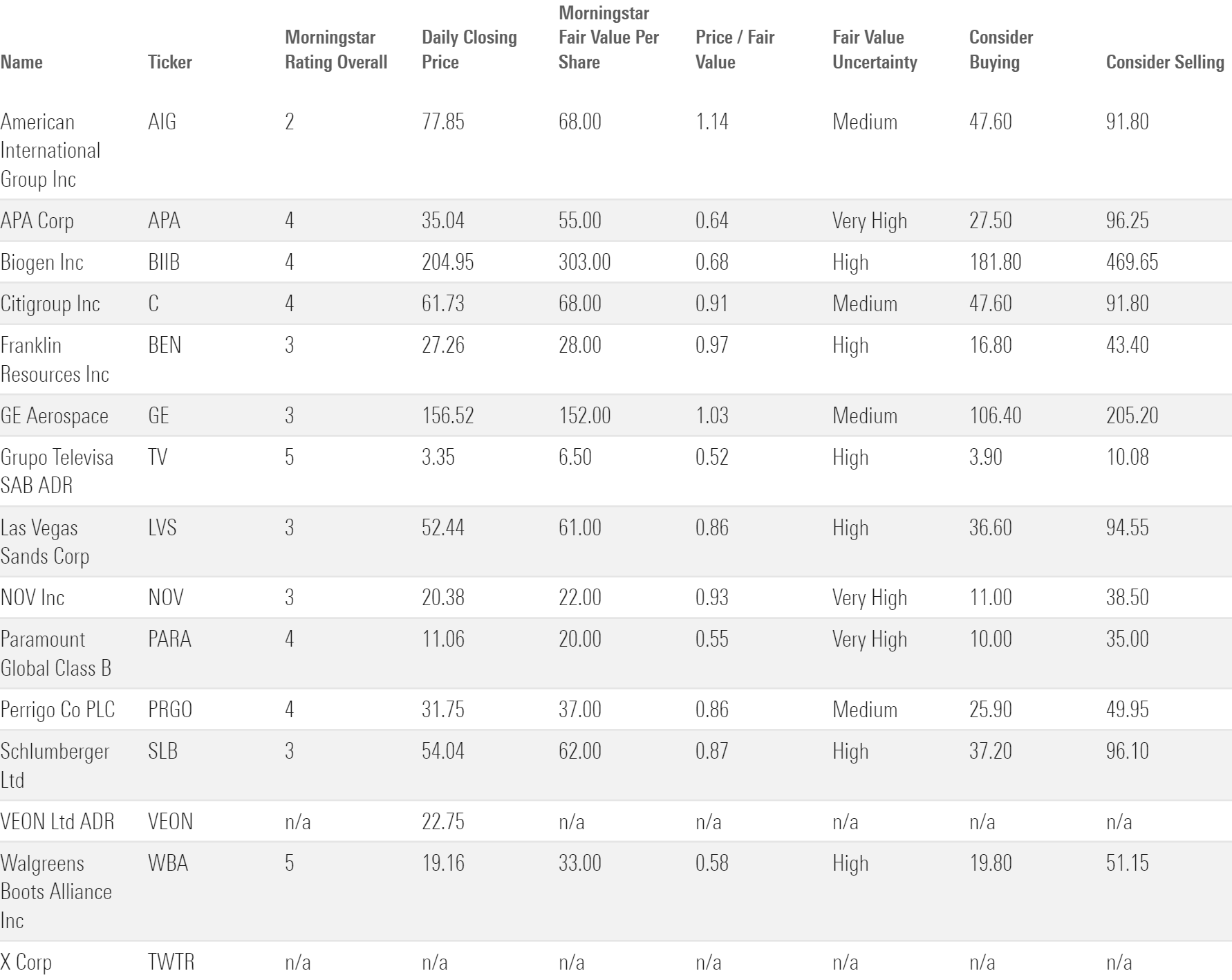

Morningstar Ratings and Valuations

On that front, the wealth destroyers are a mixed bag. Five of the 15 have Morningstar Ratings of 3 stars, indicating that they’re neither significantly undervalued nor overvalued based on our analysts’ assessments. Five others—APA APA, Biogen, Citigroup, Paramount, and Perrigo PRGO—are currently trading at modest discounts to our estimates of their value, earning them 4-star ratings. Two stocks, Grupo Televisa TV and Walgreens Boots Alliance, are trading at more significant discounts and were slightly below Morningstar’s “consider buying” cutoff as of this writing. American International Group remains well above analyst Brett Horn’s fair value estimate of $68 per share and currently earns a 2-star rating.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/YTLLJ3VT4NFZTCTDNZPCUR27D4.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/347BSP2KJNBCLKVD7DGXSFLDLU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/360a595b-3706-41f3-862d-b9d4d069160e.jpg)