What the Next Bitcoin Halving Means for ETF Investors

The fourth halving in bitcoin history is expected as soon as today. Here’s why this time could be different.

Cryptocurrency investors are eyeing the next bitcoin halving, which is expected to happen either today, April 19, or tomorrow, April 20.

This process, which cuts the amount of bitcoin that can be created by 50%, comes in the wake of the currency’s price hitting a record high in 2024.

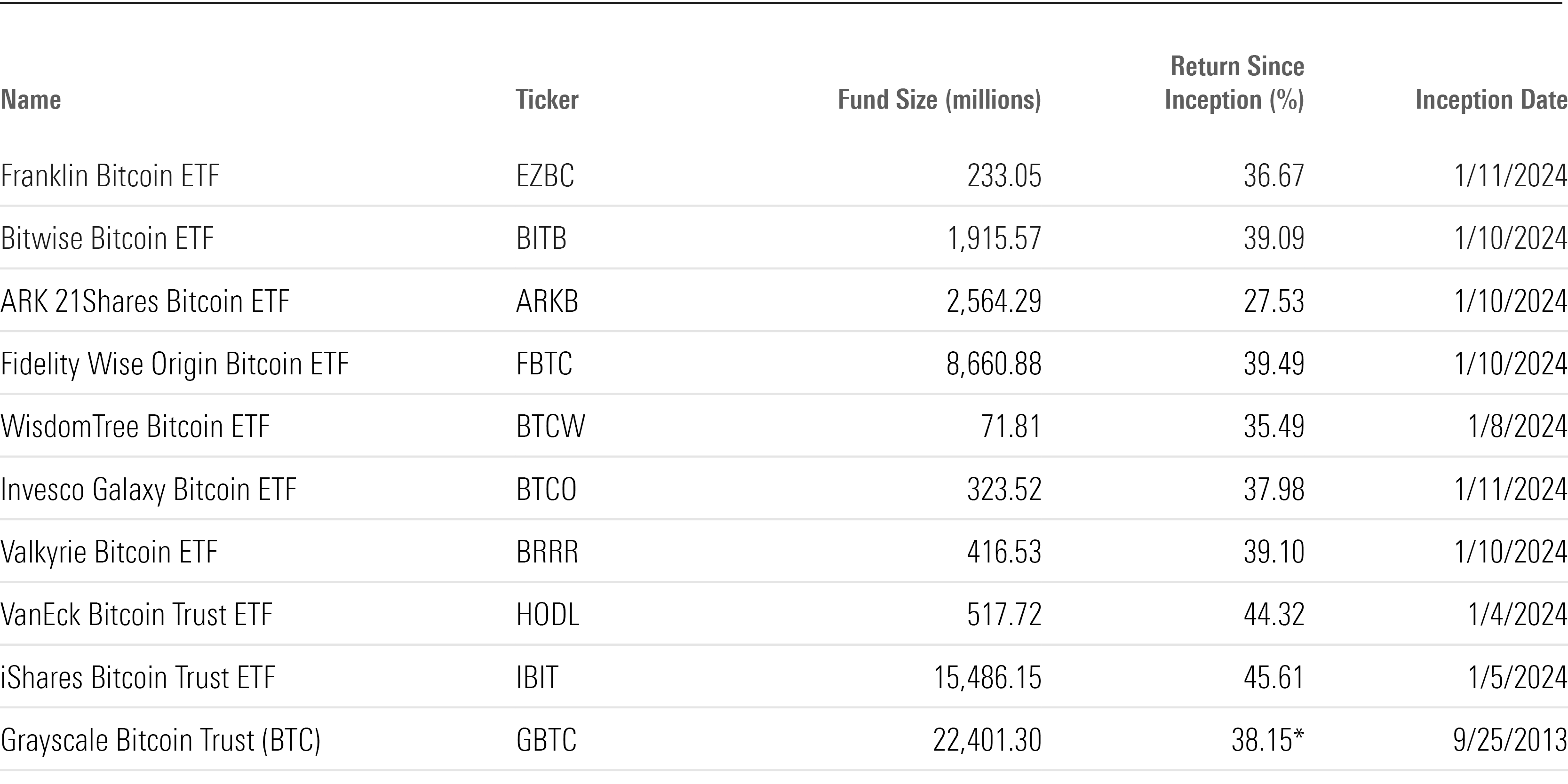

Bitcoin has already seen a huge rally this year, gaining 47%. This was fueled first by the Securities and Exchange Commission approving exchange-traded funds that invest directly in bitcoin (rather than bitcoin futures) in early January. More recently, gains have been magnified as traders looked ahead to the halving, which will reduce the future supply of bitcoin in the market.

What exactly is bitcoin halving? What does it mean for bitcoin ETF investors? Here’s what you need to know.

What Is Bitcoin Halving?

Bitcoin halving occurs roughly every four years. April’s halving will be the fourth in the history of the currency. It means that the miners’ reward will fall by half following the approval of new blocks added to the blockchain. This will reduce the frequency of new bitcoin injected into the system as the total amount of mined bitcoin edges closer to the maximum threshold of 21 million circulating units.

Bitcoin creator Satoshi Nakamoto set that limit to ensure the arbitrary issuance of new tokens wouldn’t devalue the currency. Halving can be seen as a tool to control inflation. When all 21 million bitcoins are mined (which is estimated to happen in the year 2140), the miners will no longer receive bitcoins as rewards for solving complex transactions. They will instead be compensated for their work through transaction fees.

The bitcoin protocol periodically cuts the number of new coins that miners earn through the process in half. This control of the supply is one of the reasons the world’s most popular cryptocurrency is currently seen as a store of value more powerful than gold or traditional fiat currencies. Indeed, one of the most important features of bitcoin is its limited supply and issuance mechanism. In this, bitcoin is similar to scarce commodities like precious metals.

By reducing the reward for creating new blocks on the blockchain—an expensive process requiring energy-hungry computers—the incentive to produce new bitcoins is theoretically reduced. Miners may also be pushed toward better mining machines that can consume less power but have higher computing ability.

What Happened After Past Bitcoin Halvings?

The first halving occurred on Nov. 28, 2012, after 210,000 blocks had been drawn, reducing the reward to 25 coins per new block. After a further 210,000 blocks, the reward fell to 12.5 bitcoins on July 9, 2016, and then to 6.25 on May 12, 2020. After the upcoming halving, it will be 3.125 BTC. This process is set to continue until all 21 million tokens are in circulation.

Generally, these events have historically triggered supply shocks that have generated greater interest and speculation within the crypto community. According to research by crypto tax consultancy CoinLedger, in the six months following the last two halvings, the value of BTC increased by 51% and 83%, respectively. Of course, the value of bitcoin then was far from what it is today; at the time of the 2016 halving, one BTC was worth $650, and in 2020 it was $8,572.

Bitcoin's Rally

Why This Bitcoin Halving Could Be Different

The current market dynamics are unique in the history of cryptocurrency, prompting a reassessment of the potential impacts of the halving, according to a study published last week by the research team of 21Shares, the first issuer of ETPs on crypto in Europe. The researchers said the halving effect has gradually diminished over time, with each leading to a decrease in growth rates in the value of bitcoin.

For example, BTC surged about 5,500% in the four years following the first halving, by about 1,250% after the second, and by roughly 700% in the current cycle. This suggests an increasing maturity of the market. Also, bitcoin is soaring close to its all-time high, whereas during past halvings it has traded 40%-50% below prior highs.

What Halving Means for Bitcoin ETFs

One wild card in the current cycle has been the launch of cryptocurrency exchange-traded products. “BTC spot ETFs demonstrated staggering trading volumes, signaling significant interest from traditional investors by reaching a new all-time high of over $1 billion of inflows in a single day on March 13, 2024,” 21Shares said.

Finally, the study’s authors claim that the entry of institutional players is changing the overall habits of bitcoin investors, with long-term holders becoming increasingly important and the amount of bitcoin held on exchanges at a five-year low. “If this trend were to persist, bitcoin’s supply would become increasingly illiquid, setting the stage for a supply squeeze and consequently a potential sharp rise in price,” they wrote.

21Shares is unsurprisingly striking an optimistic tone. What seems certain is that current supply and demand dynamics are very different from those of the past. Although halving will certainly have some effect on bitcoin’s value and publicly-traded miners’ stocks, it will not have any direct consequences for ETF holders.

Bitcoin ETFs

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)