Charts for Client Conversations: Earnings Season, the Taylor Swift Economy, Inflation Update, and More

The charts and themes that tell the current story in markets and investing.

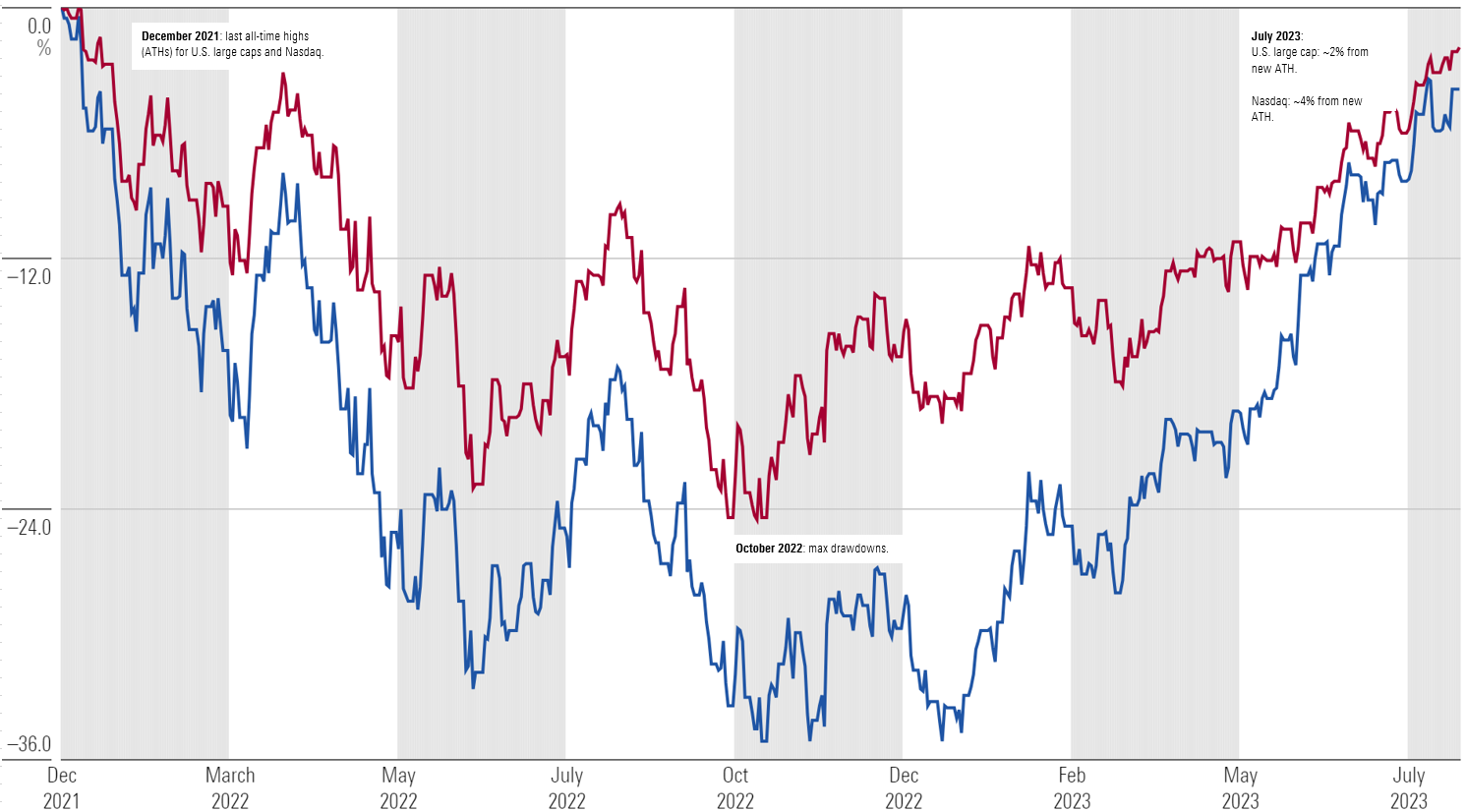

All-Time Highs Within Reach

One of the funny aspects of investing is: When it’s the best time to buy, you rarely want to.

Markets found a bottom last October. At that time, the Fed was in the middle of one of its most aggressive rate-hiking cycles ever, inflation was at a 40-year high, and sentiment readings looked like they stepped into a ring with Mike Tyson.

After making all-time highs in December 2021, U.S. large caps and the Nasdaq fell into painful bear markets—drawing down 24% and 35%, respectively, at their troughs last October.

Fast-forward to present, and those indexes are within whispering distance of all-time highs.

% Off All-Time Highs

How is this possible?

For one, the outlook for earnings has been improving. And we know earnings are one of the most important drivers of stock prices.

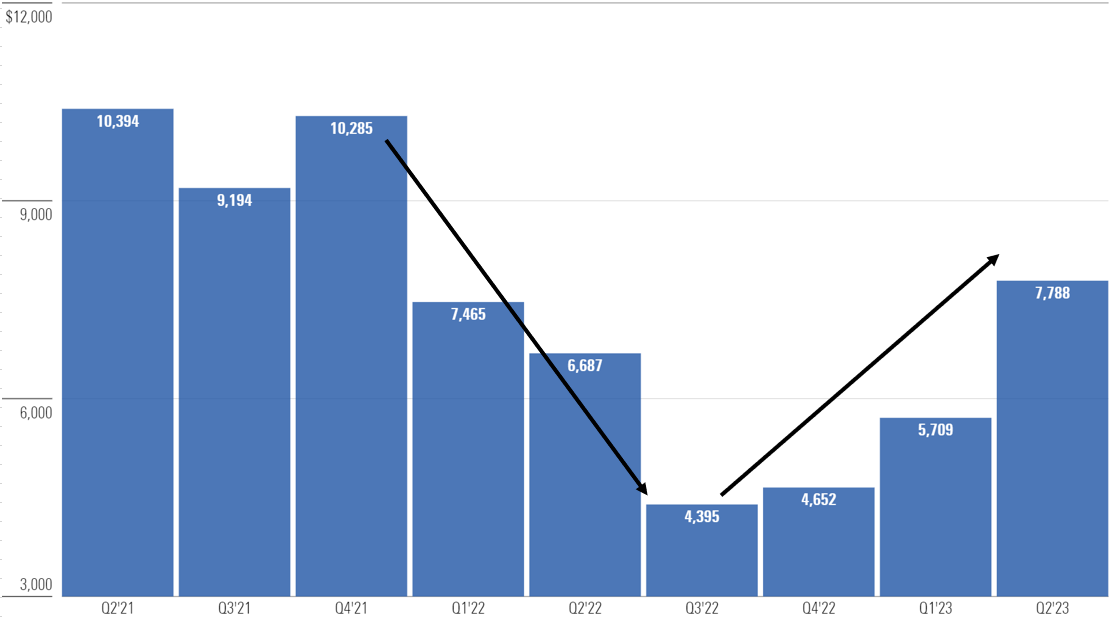

Take one example: Meta META, formerly Facebook.

Meta’s net income declined in three consecutive quarters last year, hitting its trough in the third quarter, coinciding with the previously mentioned October bottom. Since, earnings have grown in every quarter.

Meta Net Income (USD millions)

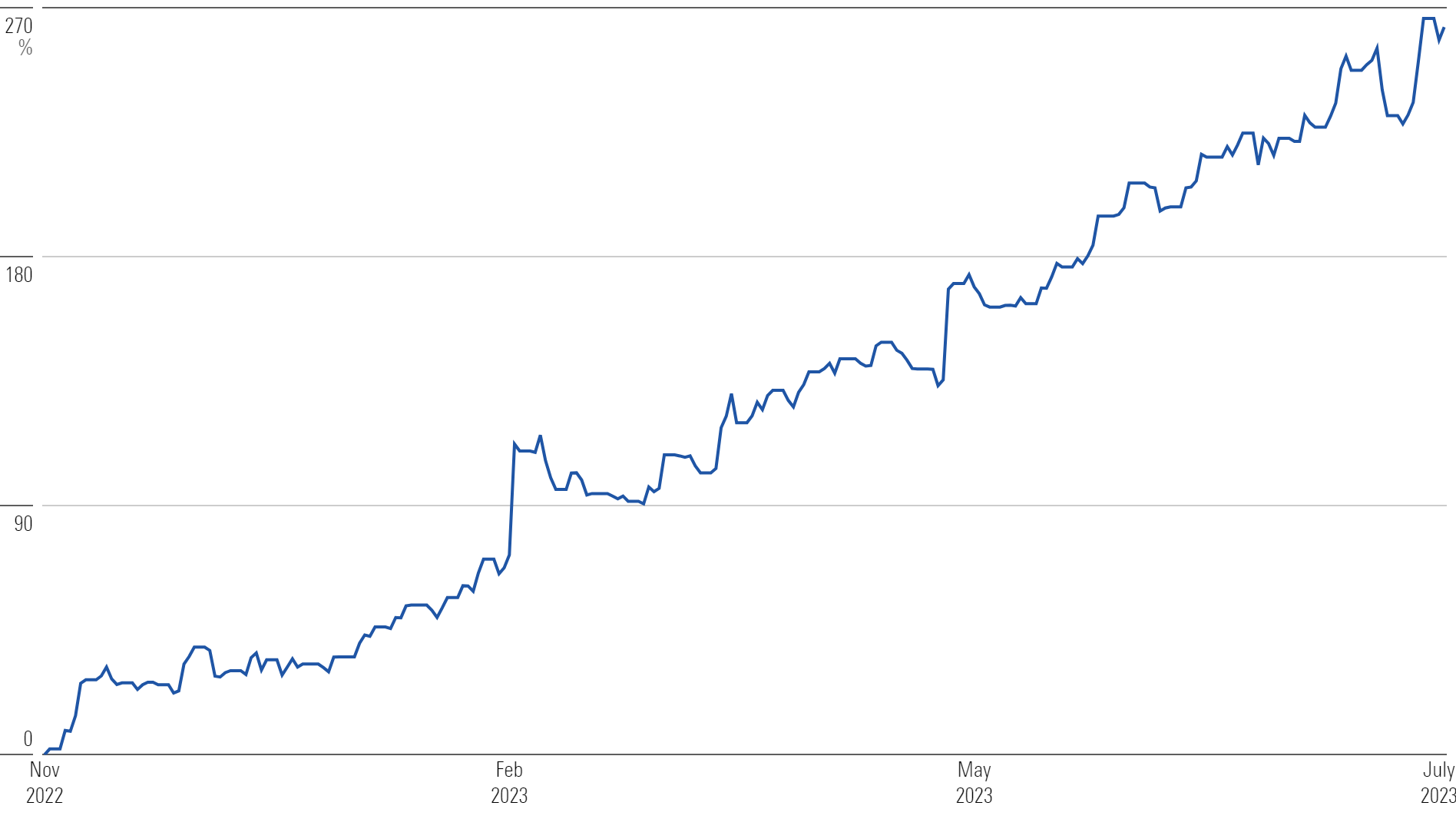

Meta’s stock price has followed the path of its earnings. Since its lowest point late last year, the stock is up more than 250%.

Meta Stock Return Since October Low

Meta is only a single example, but the market broadly reflects a similar trend regarding earnings.

Earnings Season

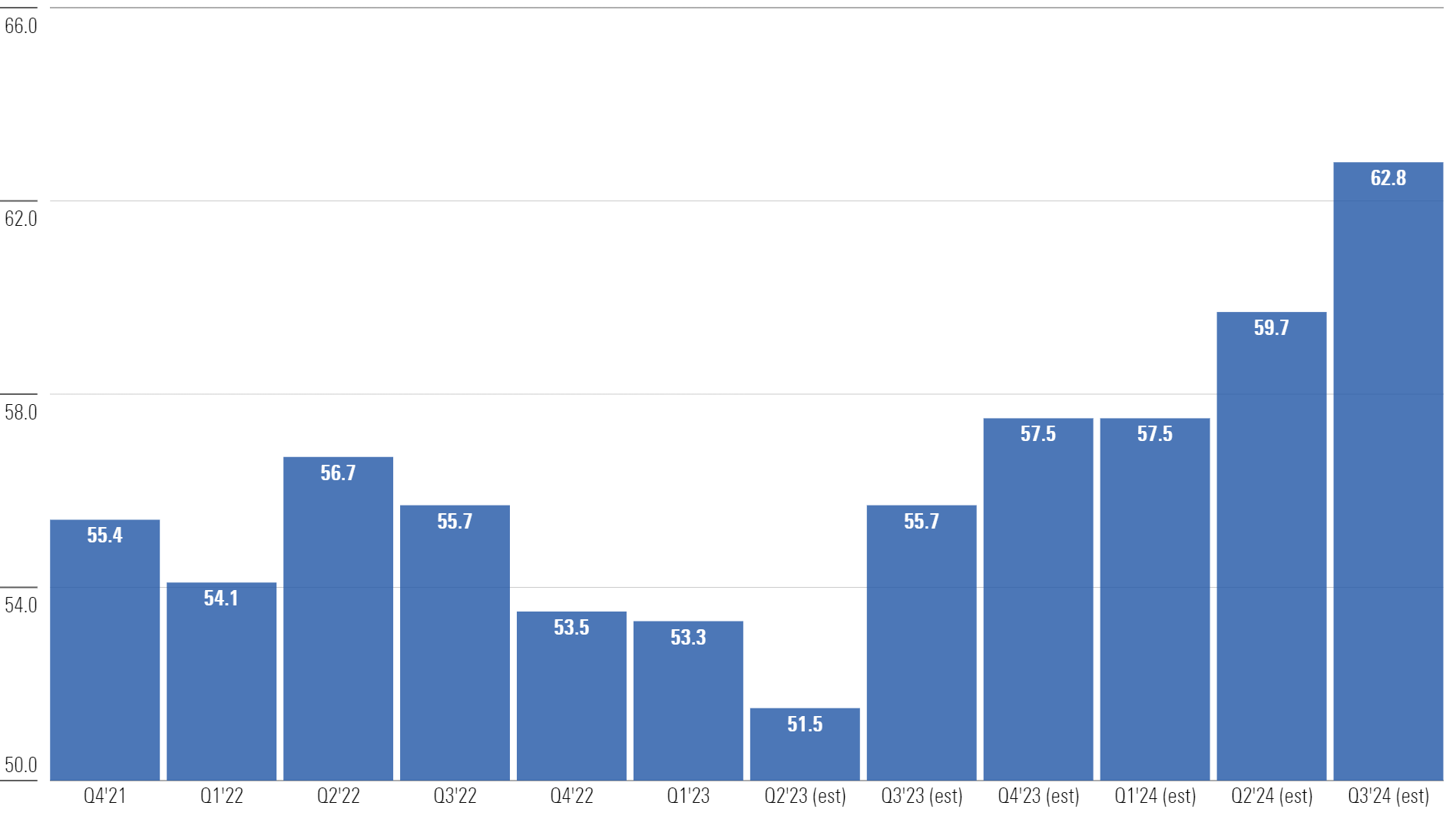

Corporate earnings have been extremely weak over the past year. Earnings peaked in the second quarter of 2022 and have declined in three consecutive quarters; with the expectation they will decline for a fourth consecutive time in the current quarter.

U.S. Large-Cap Earnings Per Share (Actuals & Estimates)

The weak earnings outlook is why numerous market forecasters warned of a pullback in the first half of this year—one that never came to fruition.

A likely reason the market didn’t fall further? Stocks are discounting mechanisms, which is a fancy way of saying they attempt to price in future expectations in today’s prices.

The market likely looked beyond the period of declining earnings we’re experiencing now and began to price in earnings growth that is expected to start next quarter.

One example? In the last week of July—a significant week for corporate earnings—analysts raised their next 12-month earnings per share estimates every day of the week. The “E” in the P/E ratio is finally starting to move higher after trending sideways for months.

While oversimplifying, it’s probably not a stretch to argue that last year’s stock market troubles came in anticipation of the downturn in earnings. And it’s likely fair to argue that the bull market we’re currently experiencing has been in anticipation of reaccelerating earnings growth.

One of the main reasons for optimism around earnings growth? A strong and resilient consumer.

The Consumer

Consumption is a key factor in U.S. economic growth. Over 70% of the U.S. economy, as measured by gross domestic product, is based on personal consumption.

So, in theory, “as the consumer goes, so goes the economy.” And right now, the consumer is holding up better than many expected.

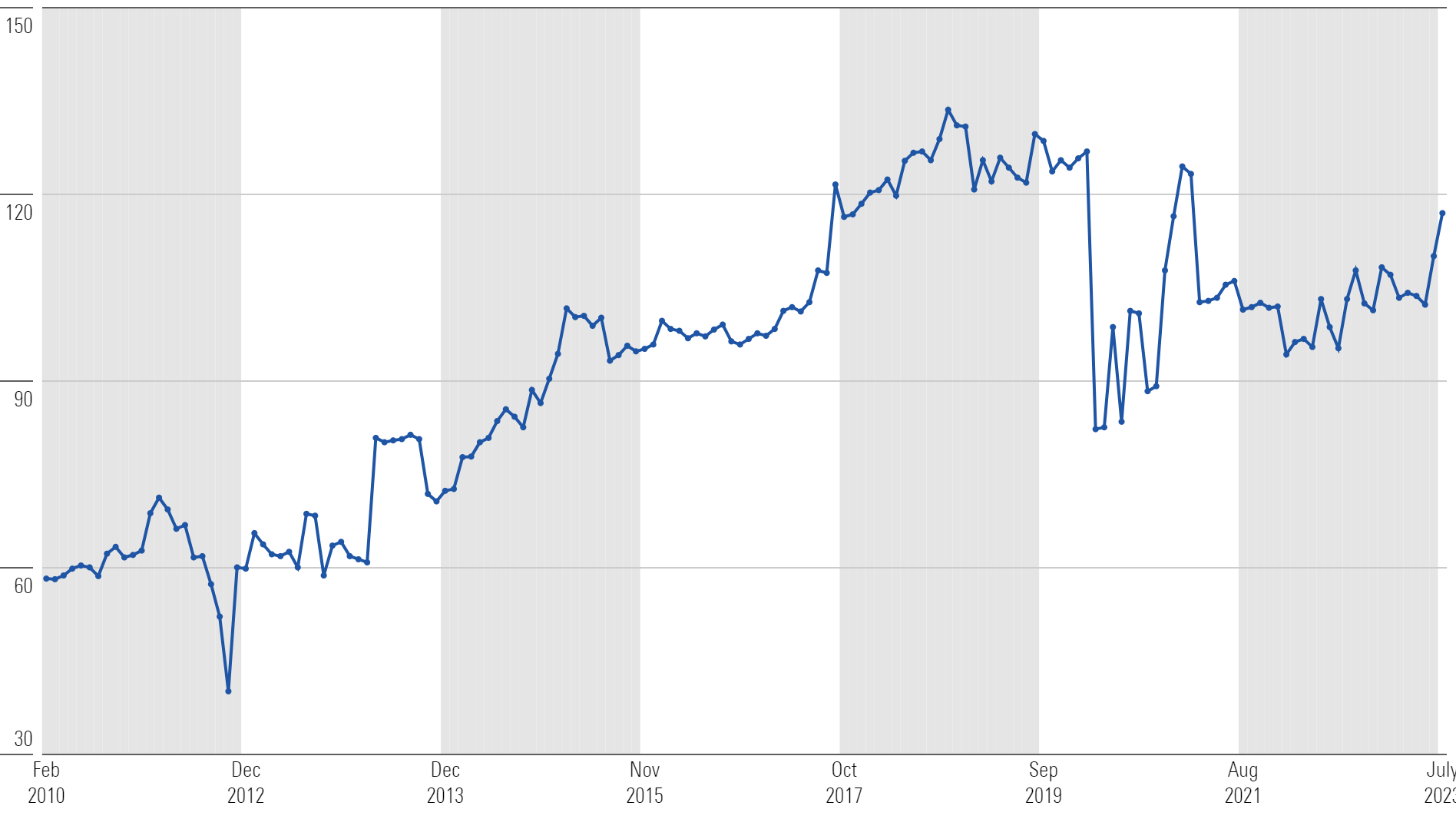

Consumer confidence is at its highest levels in more than two years, using data from The Conference Board, which is a monthly report summarizing consumer attitudes, buying intentions, vacation plans, and expectations for inflation, stock prices, and interest rates.

Consumer Confidence Index

If there is a recession around the corner, the remedy might be to put Taylor Swift back on tour.

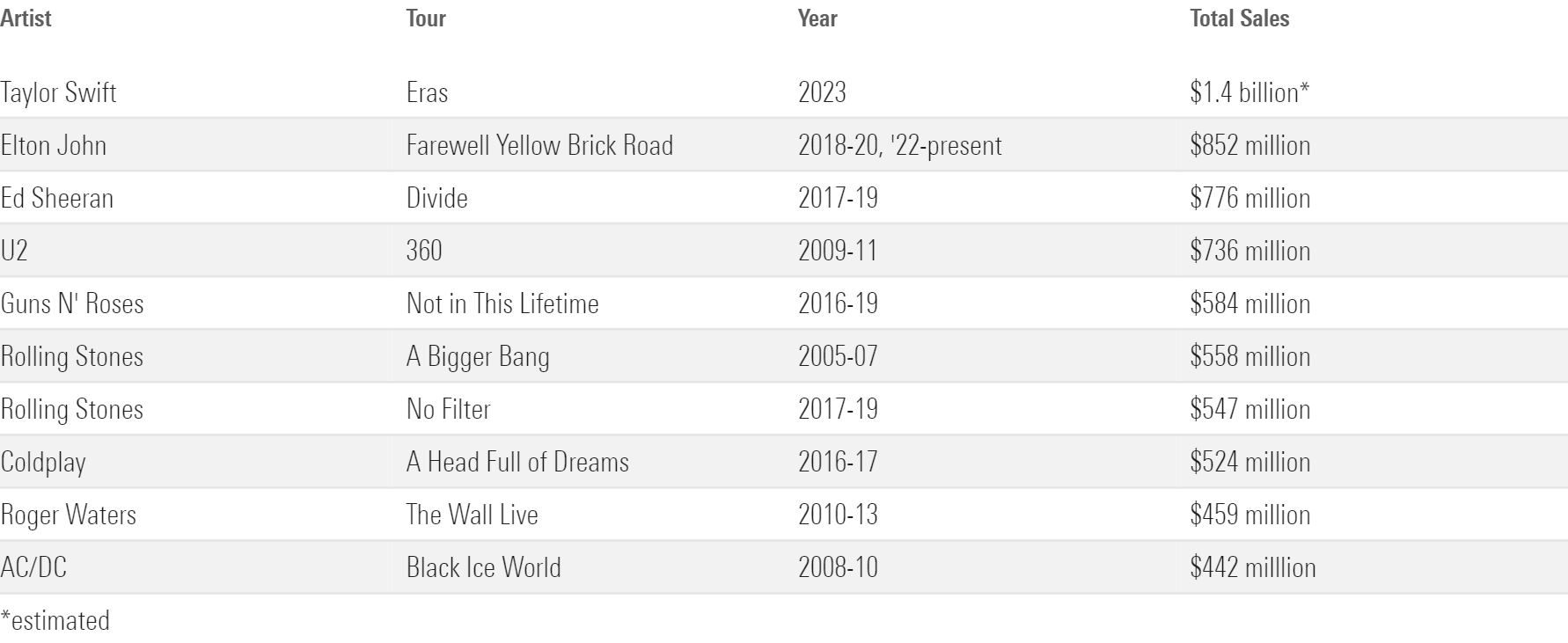

Swift’s current Eras Tour will likely go down as the highest-grossing concert tour of all time, earning more than $1 billion in total sales.

Top 10 Highest-Grossing Concert Tours Ever

Market research firm QuestionPro estimated last month that her tour could help add $5 billion to the worldwide economy, which is larger than the GDP of 50 countries.

The impact has been so significant that the Federal Reserve Bank of Philadelphia recently called attention to it:

“May was the strongest month for hotel revenue in Philadelphia since the onset of the pandemic, in large part due to an influx of guests for the Taylor Swift concerts in the city,” the reserve wrote in the Beige Book, which is published by the regional banks to share information about the state of the economy.

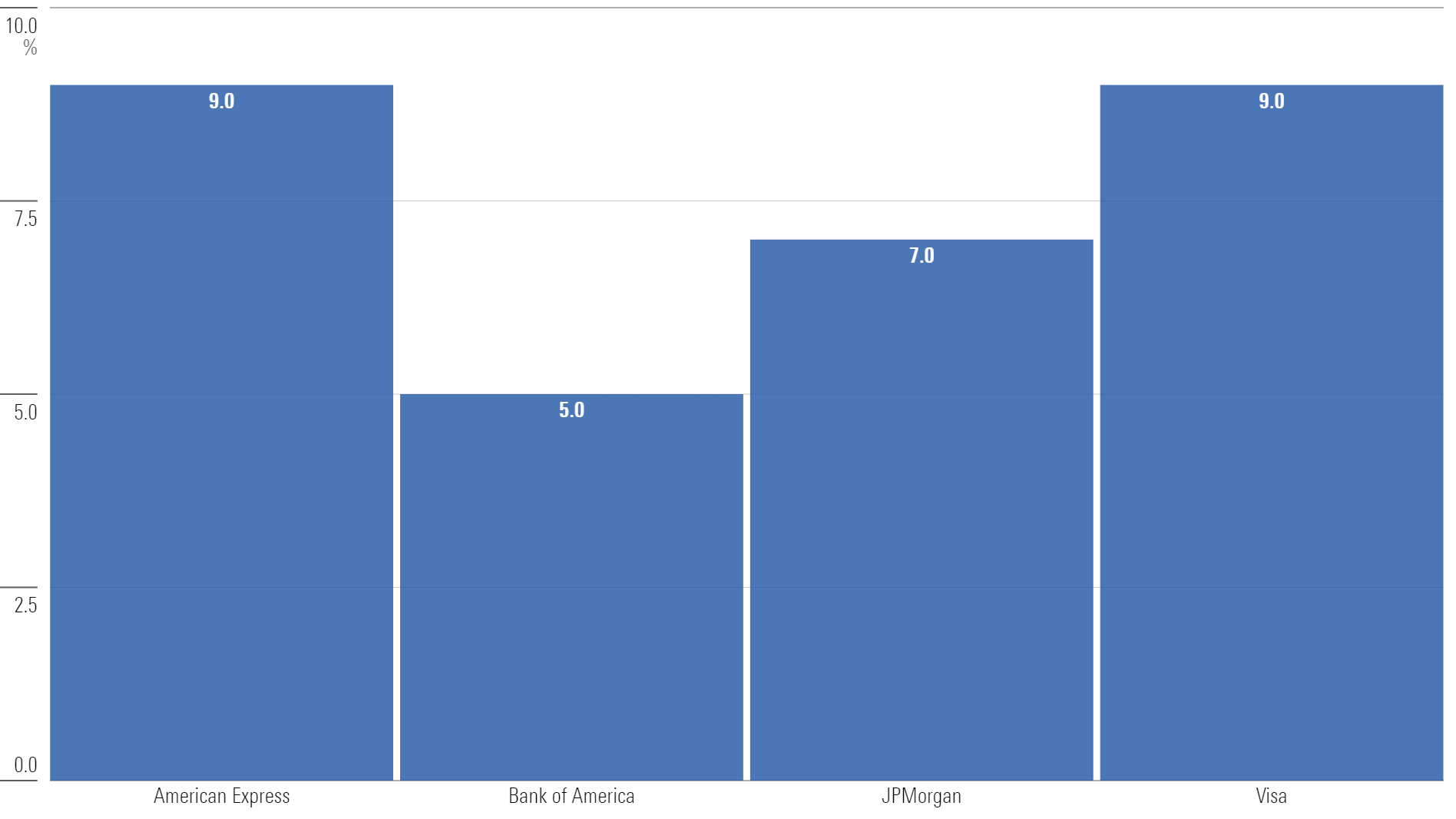

Sampling data from earnings reports, we see many other encouraging trends related to the consumer. American Express AXP, Bank of America BAC, JPMorgan Chase JPM, and Visa V all reported total payment spend across debit and credit card holders up mid- to high single digits versus last year.

Total Spending Volume (Year Over Year % Growth)

Bank of America gave a brief state of the union on the consumer on its earnings call:

“The consumer is still in a healthy place and remains resilient. We believe that remains the case, and we’re benefiting it.”

The airlines also had positive things to say.

American Airlines AAL reported its highest revenue quarter in company history. And United Airlines UAL flew a daily average of more than 2,400 flights, the most mainline flights during a single quarter in company history.

In short, despite much anxiety, the U.S. consumer remains healthy. And a major factor pushing consumer confidence has been the continued trend of falling inflation.

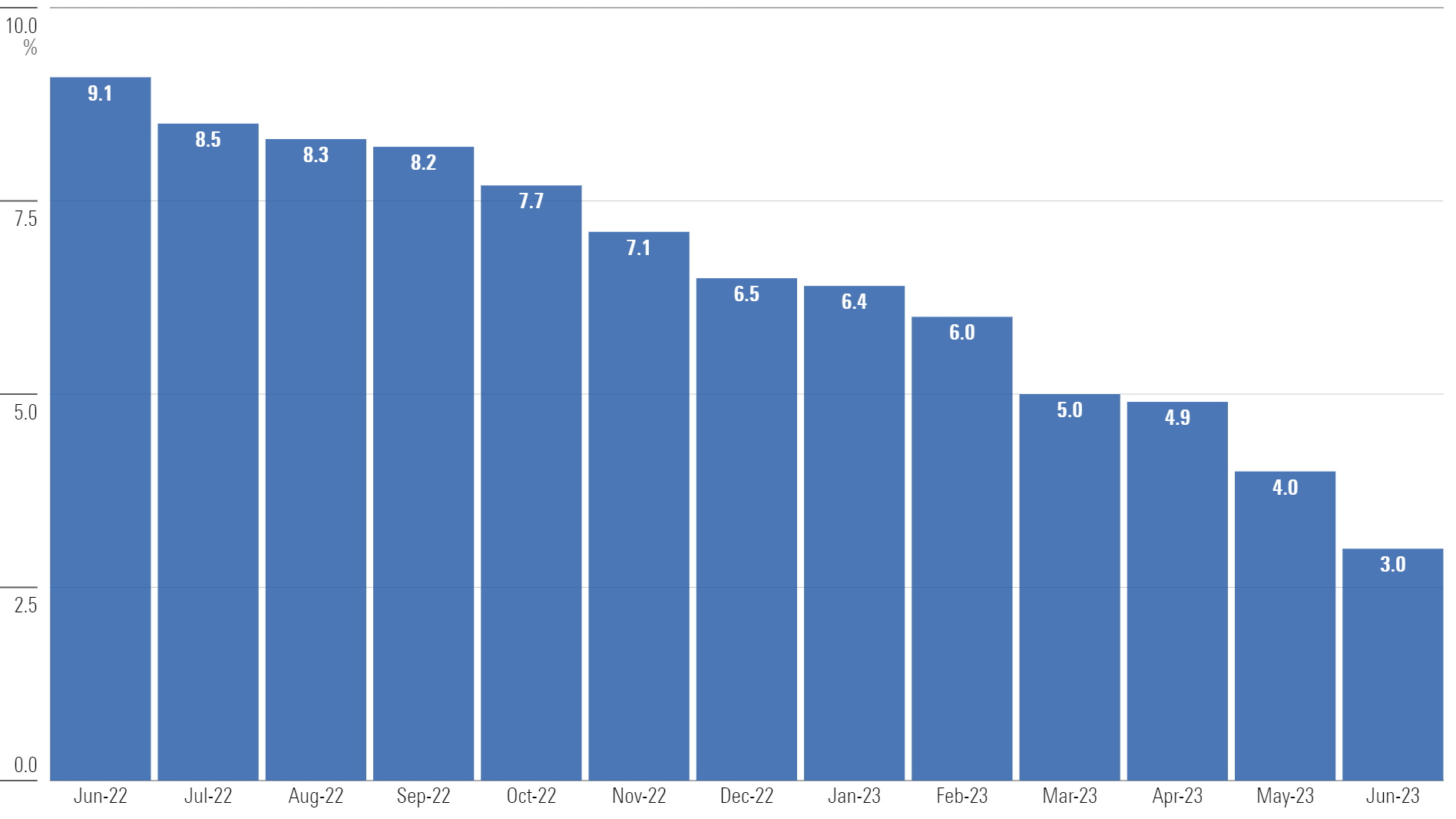

Inflation

Only a year ago—June 2022—we had the highest inflation reading in more than 40 years at 9.1%.

Since then, the rate of growth in inflation has declined in 12 consecutive months.

U.S. Inflation

Overall, the U.S. Consumer Price Index is now at 3.0%, its lowest level since March 2021.

The Misery Index—which combines inflation and the unemployment rate—has also drifted down to its lowest levels since 2020.

The Misery Index

When inflation peaked a year ago, it seemed obvious that the only way to tame inflation would require a significant uptick in unemployment. In effect, the labor market had to be sacrificed to stop inflation.

But to our good fortune, that outcome has not manifested.

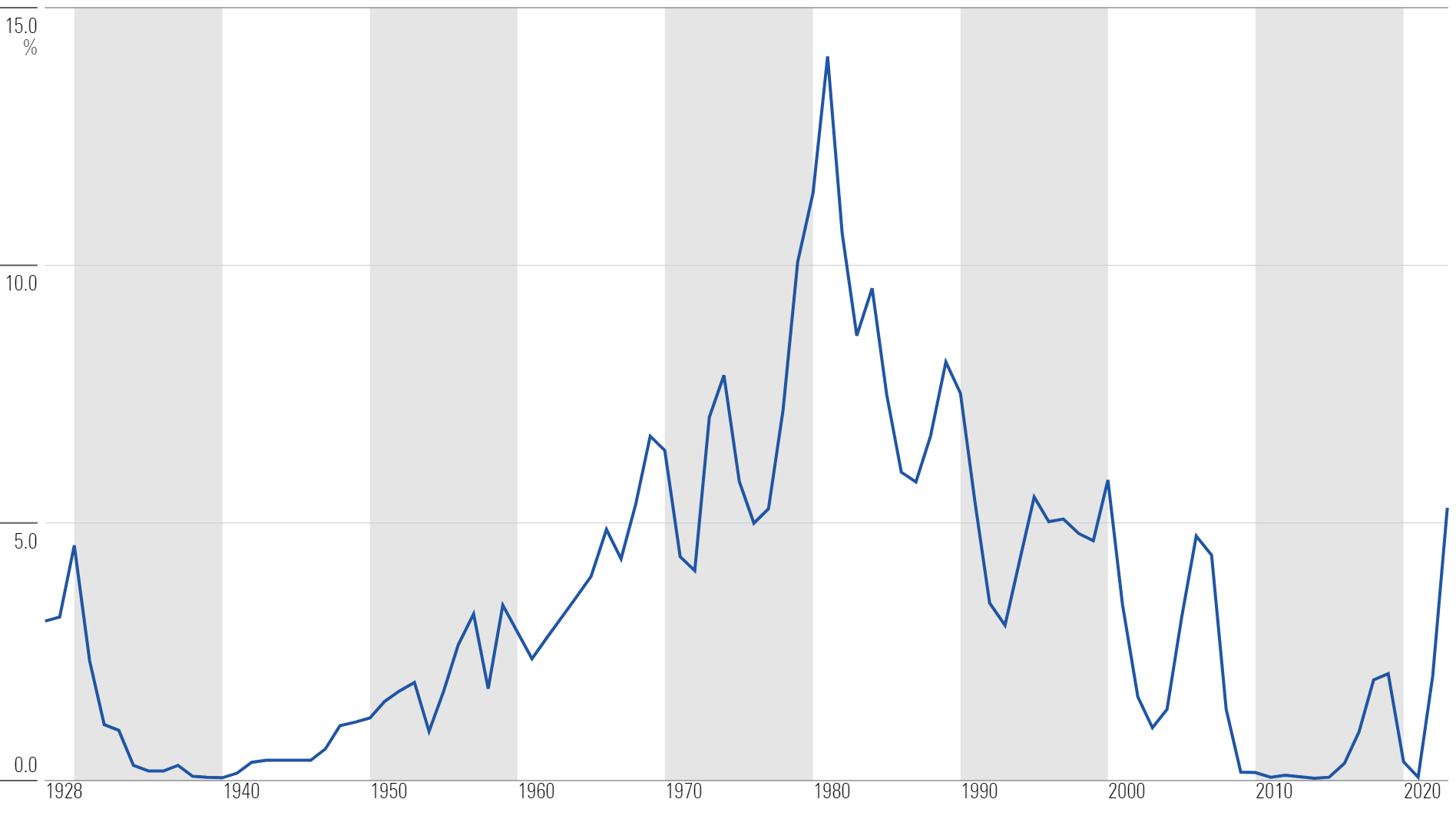

Return of the Bond Market?

It has been painful getting here, but the bond market appears to be reaching a cruising altitude.

Investors can now earn more than 5% on short-term Treasuries—the highest yield since 1995.

3-Month Treasury Bill Yield

BlackRock BLK recently discussed trends in the bond market, stating:

“Our clients shifted towards illiquid investments over the last decade to get returns (they used to get from bonds), but now they can get most of that yield and meet their liabilities through bonds. Yields are back. To give you some numbers, 80% of all fixed income is now yielding over 4%. This is a pretty remarkable shift. There is finally income to be earned in the fixed-income market and we are expecting a resurgence in demand.”

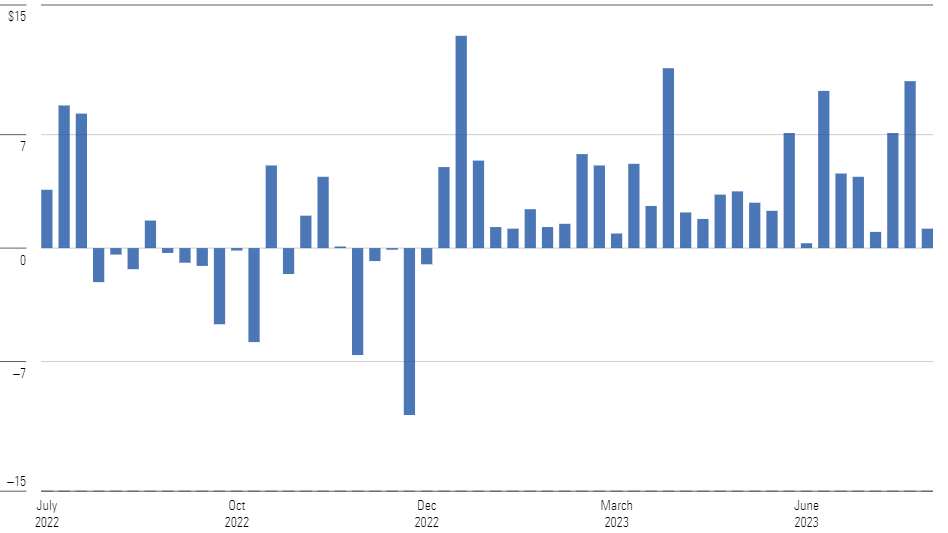

Investors seem to agree.

Using data from TD Ameritrade, weekly flows into U.S. bonds have been positive for 29 straight weeks—a stark contrast to last year.

Weekly U.S. Fixed-Income Flows (in USD Billions)

After a frustrating period when most bond yields sat below inflation, it’s nice to see optimism coming back into the bond market.

Turning a ‘Hard No’ Into Financial Freedom

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

Morningstar Investment Management LLC is a Registered Investment Advisor and subsidiary of Morningstar, Inc. The Morningstar name and logo are registered marks of Morningstar, Inc. Opinions expressed are as of the date indicated; such opinions are subject to change without notice. Morningstar Investment Management and its affiliates shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses or opinions or their use. This commentary is for informational purposes only. The information data, analyses, and opinions presented herein do not constitute investment advice, are provided solely for informational purposes and therefore are not an offer to buy or sell a security. Before making any investment decision, please consider consulting a financial or tax professional regarding your unique situation.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/L4B22R7UFVDBJN2ZYJWBSMCIJA.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/BL6WGG72URAJJJCPC4376SZKX4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZHBXSNJYDNAY7HDFQK47HGBDXY.png)