How to Find Stocks Primed to Beat the Market

Wide moats and low valuations have been a winning combination for investors.

Companies with durable competitive advantages, or economic moats, have performed well over the past year. Key to these returns are attractive starting valuations. The combination of a moat with an undervalued stock has had a long track record of outperformance. Morningstar analysts believe that for the best long-term results, investors are best served by considering companies’ moats alongside their valuations.

This can be seen with the Morningstar Wide Moat Focus Index, a collection of the lowest-priced companies with analyst-assessed competitive advantages that are expected to last more than 20 years. The index has returned twice as much as the Morningstar US Market Index over the past 20 years. Over the past decade, it’s outperformed the broader market by 40 percentage points. “To find stocks that are most likely to outperform, the key is to combine high quality with attractive price,” says Morningstar equity strategist Allen Good. “An economic moat in itself won’t result in outperformance.”

The ‘Magnificent Seven’ and Moat Stocks

This dynamic can even be seen in the stock market rally of the past year. Much of the attention has been on the stocks known as the Magnificent Seven: Nvidia NVDA, Meta Platforms META, Apple AAPL, Amazon.com AMZN, Microsoft MSFT, Alphabet GOOGL/GOOG, and Tesla TSLA. Six of these stocks have wide moats—the exception is narrow-moat Tesla. At the start of 2023, five of the six wide-moat Magnificent Seven stocks were in the Wide Moat Focus Index, with a total weight of 11%. As they rallied, Nvidia and Meta were booted from the index, while Amazon and Microsoft saw a decrease in weight. But these stocks continued to soar, causing the index to lag.

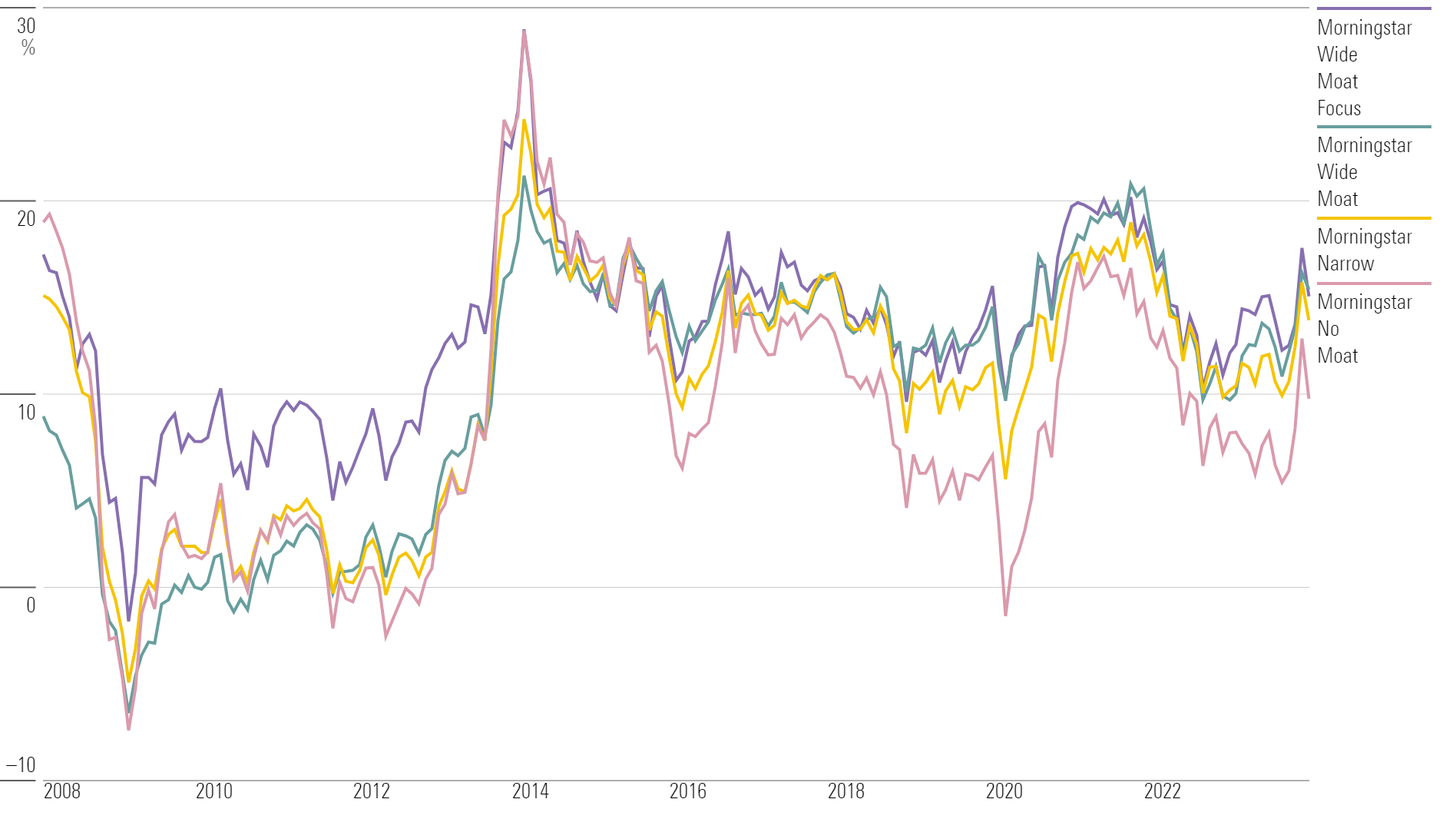

Over the past year, wide-moat stocks have performed very well. The Morningstar Wide Moat Composite Index—which tracks all the stocks in the U.S. market with wide moats, regardless of their valuations—gained 30.3%. This outpaced the US Market Index, which gained 19.9%. The Wide Moat Focus Index did not see quite the same success, gaining only 16.4%. Still, it’s outperformed narrow-moat and no-moat stocks over this time. Narrow-moat stocks were up 12.9%, and stocks without moats were up 1.9%.

1-Year Performance by Moat Index

Long-Term Outperformance for Undervalued Wide Moat Stocks

Despite underperforming the market over the past year, “If you go back to when the Wide Moat Focus Index launched [in 2007], it has hugely outperformed,” says Andrew Lane, director of equity research for index strategies at Morningstar. Over the past 20 years, the index has risen 1,070.81%, gaining twice as much as the US Market Index, which rose 547.50%. Undervalued wide-moat stocks also outpaced the overall group of wide-moat stocks during this period; the Wide Moat Composite Index has risen 562%.

“Investing at the intersection of quality and value has worked really well,” says Ioannis Pontikis, senior equity analyst at Morningstar.

Performance by Moat Index

To understand why undervalued stocks with moats have done so well, it’s worth looking at both the moat rating itself and how Morningstar analysts determine valuations.

What Are Moat Stocks?

Long-lasting competitive advantages—represented by economic moats—play a big role in how companies generate excess returns on capital. A moat reflects the degree to which a company has durable competitive advantages. A company with a moat can fend off competition and earn high returns on capital for years to come. To determine whether a company has a moat, Morningstar analysts look at its network effect, switching costs, intangible assets, cost advantage, and efficient scale.

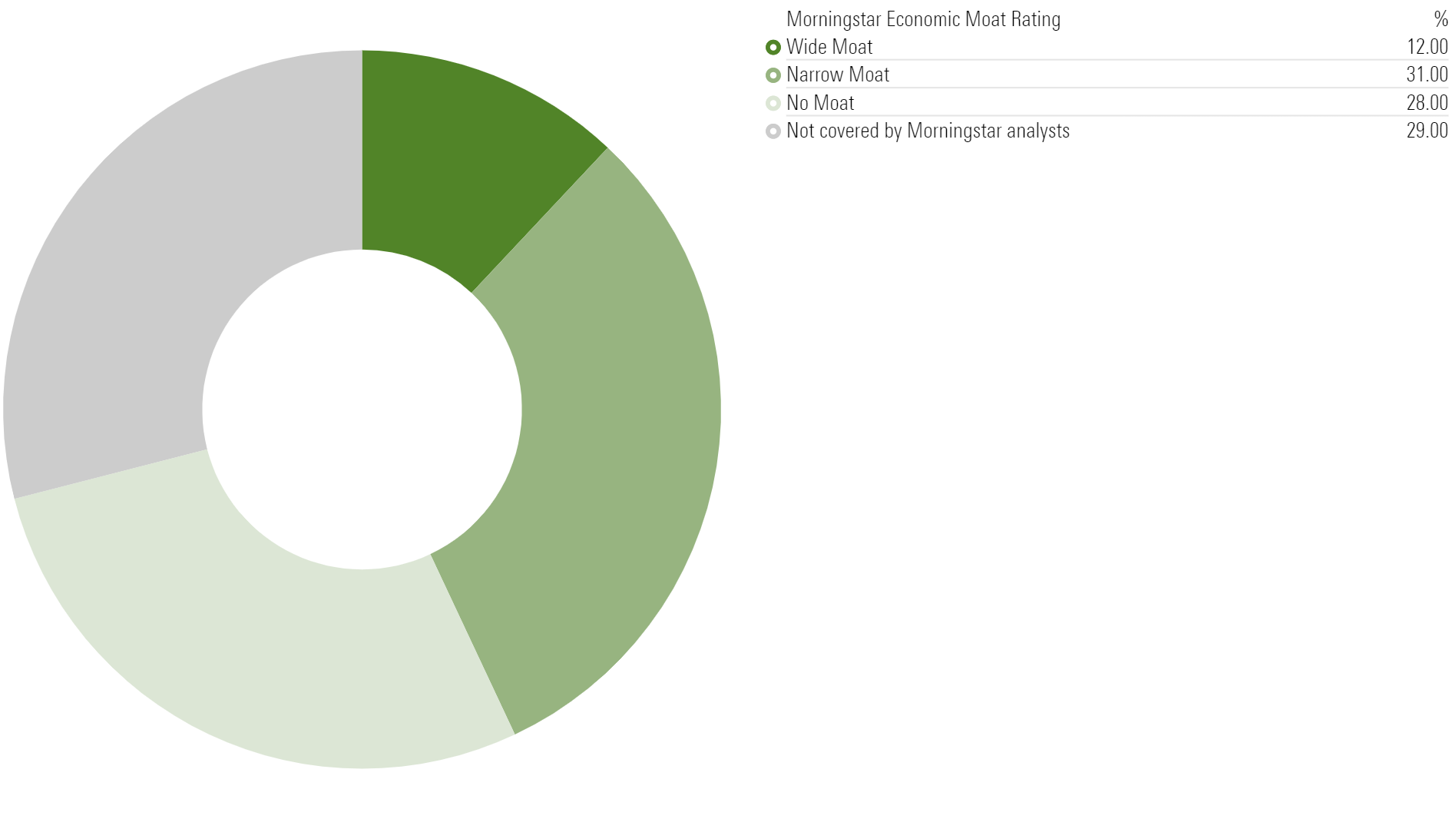

Companies with wide moats are expected to maintain their competitive advantages for more than 20 years. Just 156 of the 1,321 companies in the US Market Index (12%) have a wide moat rating. Meanwhile, 31% have narrow moat ratings, meaning they should be able to fend off rivals for 10-20 years. The remaining 57% of these firms have no moat; our analysts either don’t cover them or think they have no durable competitive advantage.

Moat Ratings of Stocks In the Morningstar US Market Index

The Benefits of Economic Moats and Attractive Stock Prices

Though a company may be generating meaningful returns on invested capital, those fundamental returns may not raise its stock. For a stock’s price to appreciate meaningfully, it generally has to start from an attractive valuation. “If you buy at the top, it’ll be almost impossible to earn returns on your investment, no matter how high-quality the company,” Good says.

But a moat has historically meant that when prices are moving higher, a stock has a better chance of outperforming over a long period. “An economic moat adds an element of quality to a company. Cash flow is expected to compound at a higher rate for a longer time, risk of bankruptcy is lower, and R&D investment is more productive,” says Good. “But it’s the combination of quality and valuation which ultimately impacts the long-term stock price.”

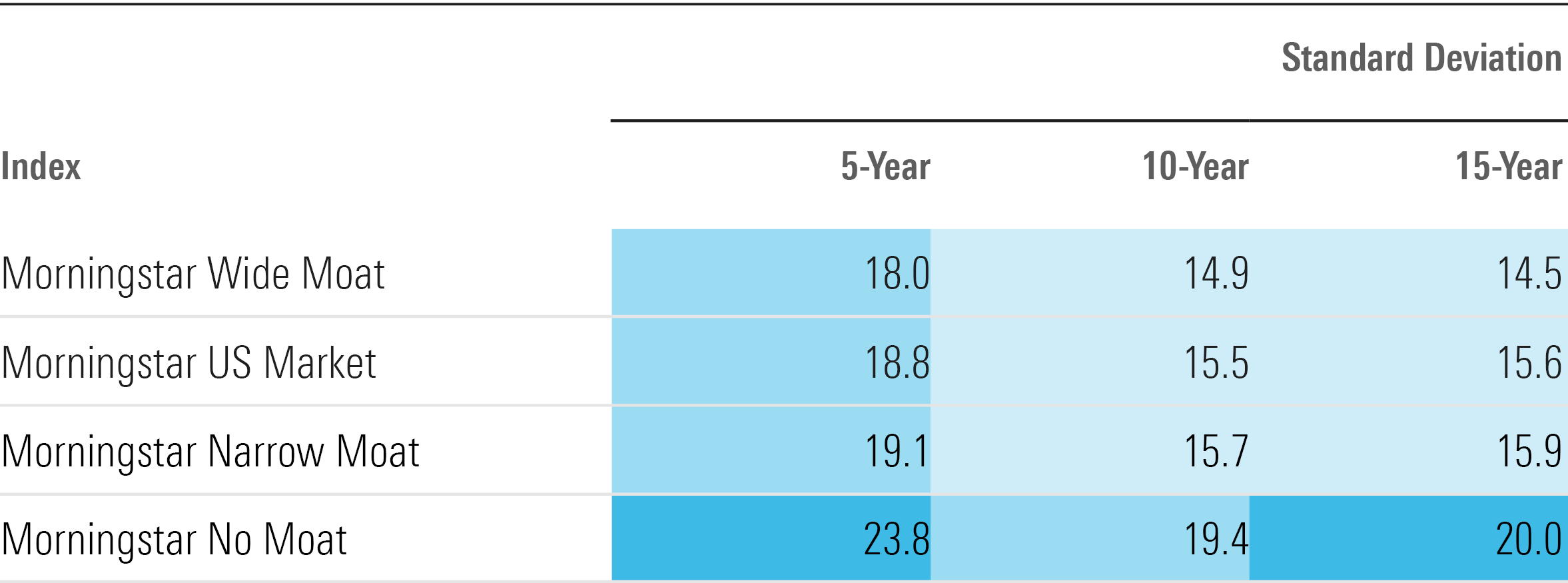

High-Quality, Stable Stock Prices

Stocks with moats have also tended to see smaller price swings than no-moat stocks. As measured by standard deviation—a common barometer for volatility—over the past five-, 10-, and 15-year periods, wide-moat stocks have had lower volatility than narrow-moat stocks and the broader equity market. No-moat stocks have shown the highest volatility.

That lower volatility could be seen during the recent bear market. But it also means investors may get somewhat smaller returns in bull markets. “Stocks of companies with economic moats have tended to outperform in downcycles and underperform in the upcycle,” Good says. However, “their strong showing during downcycles ultimately results in long-term outperformance.”

Historical Volatility

Which Stocks Have Led the Wide Moat Focus Index?

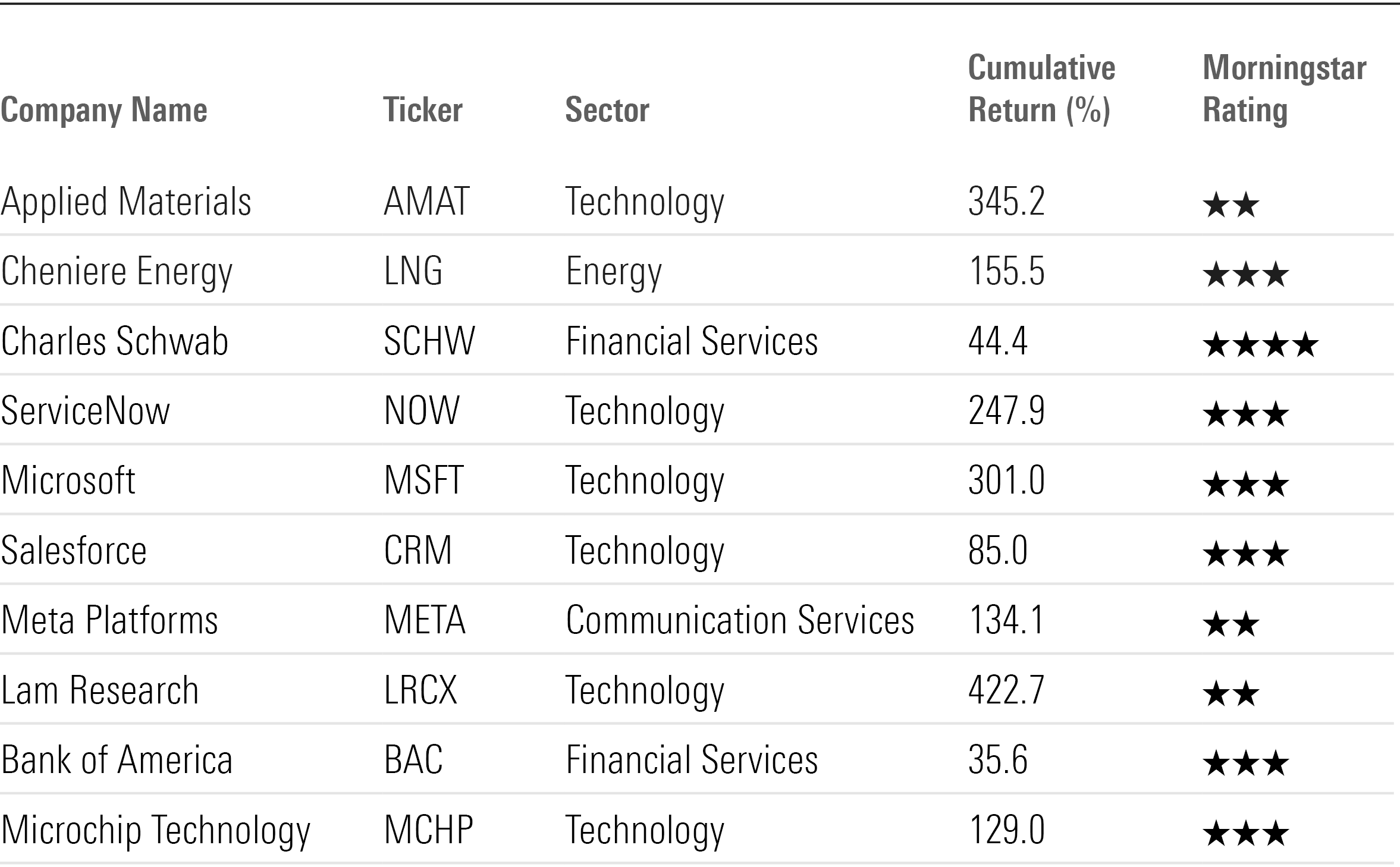

Top contributors to the Wide Moat Focus Index’s outperformance come from a variety of sectors, including technology, healthcare, financial services, industrials, and consumer defensives.

Over the past five years, the semiconductor equipment supplier Applied Materials AMAT, which rose 345.2%, and the liquified natural gas company Cheniere Energy LNG, which gained 155.5%, led returns for the index. Applied Materials is also the top contributor over the trailing 10-year period, gaining over 1,000%.

The list of leaders for undervalued wide-moat stocks is markedly different from that of the broader equity market. Over the past five years, leaders in the US Market Index have included Apple, Microsoft, Nvidia, Amazon, Meta, and Alphabet.

Undervalued Wide Moat Leaders

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a8c4d0a1-24c6-4c96-81d6-7bb13a177a1e.jpg)