Is a Reversal of Fortune on the Horizon for Small Caps?

Maintaining exposure to high-quality stocks is harder than it might seem.

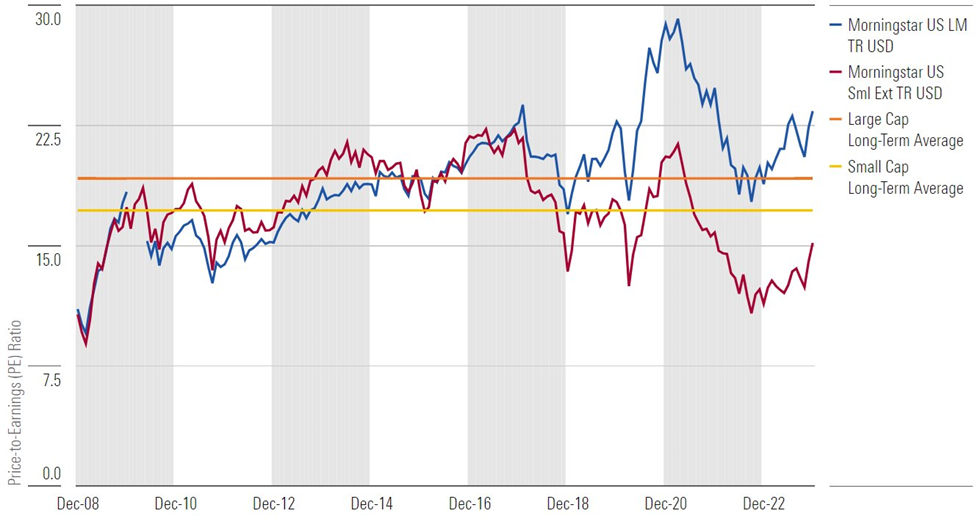

Now could be a good time to consider US small caps. Contrary to a broad academic consensus that small-cap stocks tend to outperform large caps, small caps have trailed large caps for an extended period, which suggests they could rebound. Valuations are compelling, too. In terms of price/earnings, small-cap valuations are low relative to their own history and large caps. Morningstar equity analysts’ stock-by-stock reviews of small caps’ price/fair value estimates also suggest they’re cheaper than large caps. Finally, small caps are a fruitful hunting ground for active managers, who should benefit by avoiding a rising number of low-quality companies in the small-cap universe.

Exhibit 1 Price/Earnings Ratio: Small Caps Have Traded at a Big Discount in Recent Years

Exhibit 1 Price/Earnings Ratio: Small Caps Have Traded at a Big Discount in Recent Years

Source: Morningstar Direct. Data as of December 2023.

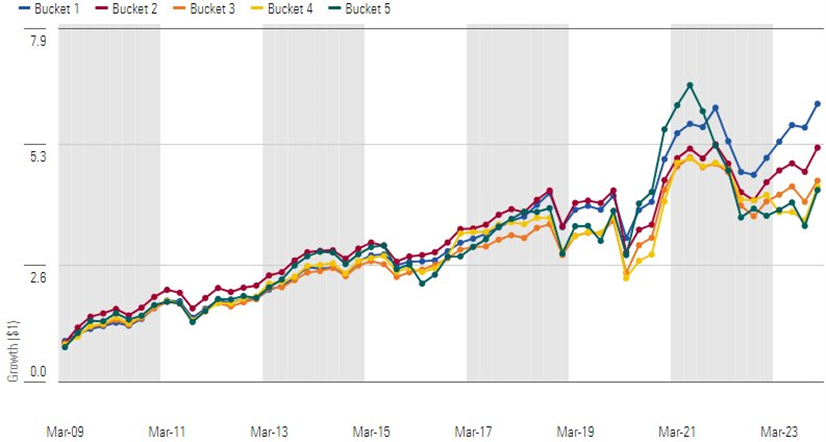

To test the effect of quality on performance, we bucketed active funds’ holdings and stocks in the Russell 2000 Index into quintiles based on quality, which we defined as an equally weighted mix of trailing 12-month return on equity and debt/capital ratios. We found that index performance closely followed quality. In the 15 years through 2023, the highest-quality quintile beat the lower-quality ones. Although there were brief periods when low quality outperformed, like most recently in the 2020-21 rally after covid, we learned that it pays to avoid low-quality businesses over the long term.

Exhibit 2 Higher-Quality Stocks Did Better Than Lower Quality

Exhibit 2 Higher-Quality Stocks Did Better than Lower Quality

Source: Morningstar Direct. Data based on stock-level data of the iShares Russell 2000 ETF.

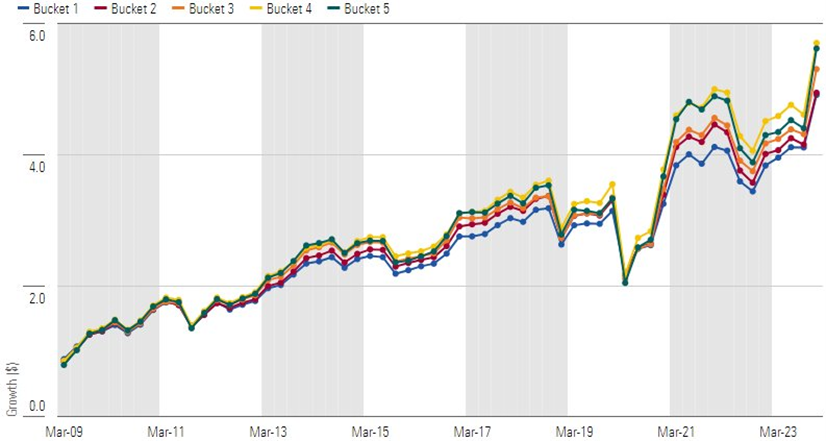

However, when we ran the same analysis for active small-cap funds’ holdings, we got different results. Dividing the aggregate holdings of active small-cap funds into quality quintiles showed performance did not correlate as neatly with quality levels as it did with the Russell 2000 Index. For instance, bucket 4 (the second lowest in quality) posted the best results over the same 15-year period, while bucket 1 (the highest quality) finished last. Additionally, the spread between first and fifth quintiles’ returns was more compressed than that of the index. This was likely due to active managers’ limited exposure to the index’s highest quality—and highest-returning—bucket-1 stocks. Overall, active small-cap funds did not stand out as being much higher quality than the index.

Exhibit 3 Lower-Quality Funds Did Better Than Higher Quality

Exhibit 3 Lower-Quality Funds Did Better Than Higher Quality

Source: Morningstar Direct. Data based on fund-level data of U.S. small-blend, small-value, and small-growth Morningstar categories.

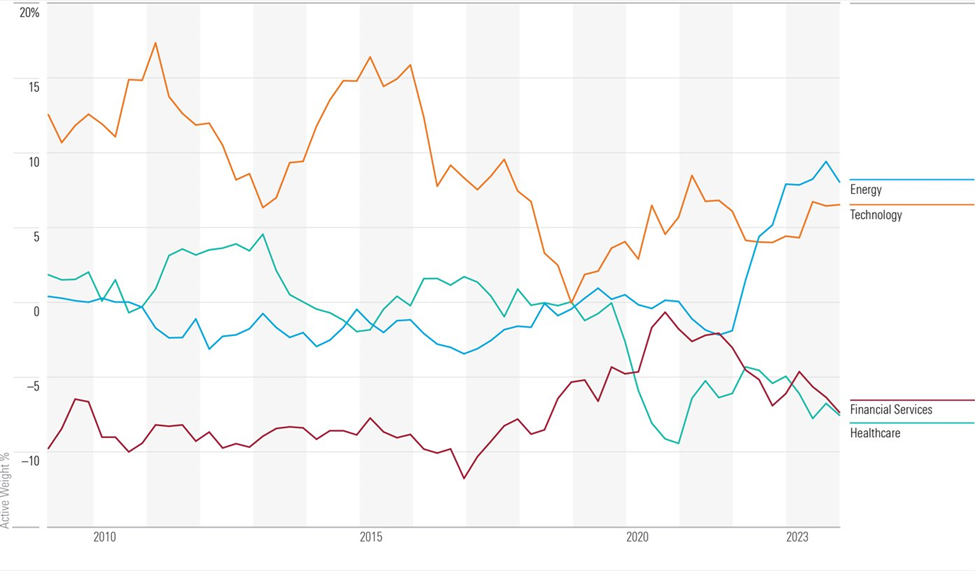

So why didn’t active managers simply load up on high-quality stocks? Quality, it turns out, is a moving target, making it difficult for active managers to consistently invest in a portfolio of the highest-quality stocks. In fact, managers seeking to do this needed to be adept in their portfolio positioning and make big, potentially career-risking sector bets. The following chart shows the largest active underweights or overweights—and rapid shifts between them—required to maintain exposure to the highest-quality stocks.

Exhibit 4 Quality Is a Moving Target

Exhibit 4 Quality Is a Moving Target

Source: Morningstar Direct. Data relative to the iShares Russell 2000 ETF.

Another reason managers struggle to own quality is that index composition could also push them into lower-quality areas of the market. One such example is biotech, which in the small-cap universe, are often nascent businesses with little-to-no earnings. They can often be highly indebted and reliant on the commercial success of a single drug, so they struggle with our definition of quality. That said, the industry is hard to ignore—particularly for growth managers—given its prominence in the Morningstar US Small Growth Index, where it peaked near 12% in mid-2021 before falling to roughly 9% by year-end 2023. The median growth manager owned a lot, though remained slightly underweight versus the index. Despite having its moments, biotech was a net drag on the Morningstar US Small Healthcare Index in the 15-year period through 2023. Without biotech stocks, the index would have gained roughly 25% more than it did.

On the other side of the Morningstar Style Box, value managers faced a similar dilemma with regional banks. The banking business model is inherently leveraged, and regional banks have more geographically concentrated deposit bases and less diversified businesses compared with larger banks. Value managers tended to embrace regional banks as their weight in the Morningstar US Small Value Index increased to roughly 20% by late 2022. They should have avoided them. From 2009 to 2023, the Morningstar Financial Services Index would have nearly doubled its cumulative gain without regional banks. Two huge drawdowns also exacerbated already-desultory performance: First during the coronavirus shutdowns of 2020, then in early 2023 when the collapse of regional banks Silicon Valley Bank and First Republic Bank triggered a panic among depositors.

Takeaways

Despite these issues, active managers had a better chance of outperforming in small caps than they did higher up the market-cap spectrum. Active funds in the small-blend Morningstar Category beat the Russell 2000 Index in roughly 69% of the rolling three-year periods from 2009 through year-end 2023. In contrast, active large-growth category funds outperformed the Russell 1000 Growth Index just 33% of the time during the same period.

Quality plays a big role in small-cap stock performance, yet active fund portfolios’ aggregate quality exposure hasn’t been drastically different from their benchmarks’. So, investors should press self-professed high-quality managers for their definition of quality and how they differentiate themselves from their peers and indexes.

Similarly, index construction means low-quality areas like biotechnology and regional banks can be hard for managers to ignore, so expertise in these areas is paramount, as they can have a big influence—for better or worse—on performance. Managers who make big bets for or against such low-quality areas should be able to differentiate themselves with analytical or resource edges. Finally, although it can be hard for managers to maintain continual exposure to the highest-quality stocks, sector weights can offer insight into how well they’ve been able to identify these higher-quality stocks before the market rewards them.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/c68a6746-dc31-465f-b144-7ec565088c67.jpg)

/s3.amazonaws.com/arc-authors/morningstar/c7cf419e-c9b2-4fb9-a62f-e31efa4728eb.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FGC25JIKZ5EATCXF265D56SZTE.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_d30270f760794625a1e74b94c0d352af_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/DOXM5RLEKJHX5B6OIEWSUMX6X4.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c68a6746-dc31-465f-b144-7ec565088c67.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c7cf419e-c9b2-4fb9-a62f-e31efa4728eb.jpg)