Amid Outflows, Fidelity and Vanguard a Bright Spot for US Sustainable Funds in Q1

Two iShares ETFs account for half the withdrawals.

Investors pulled a record $8.7 billion from US sustainable funds in 2024′s first quarter, making it the sixth-consecutive quarter of outflows.

Although the motivations behind outflows cannot be perfectly quantified, many factors are in play. These include high interest rates, middling returns in 2023, greenwashing concerns, and the continued politicization of environmental, social, and governance-focused investing.

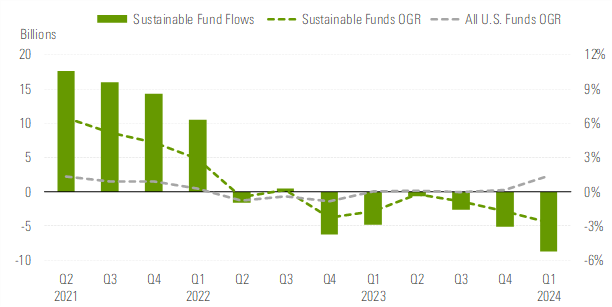

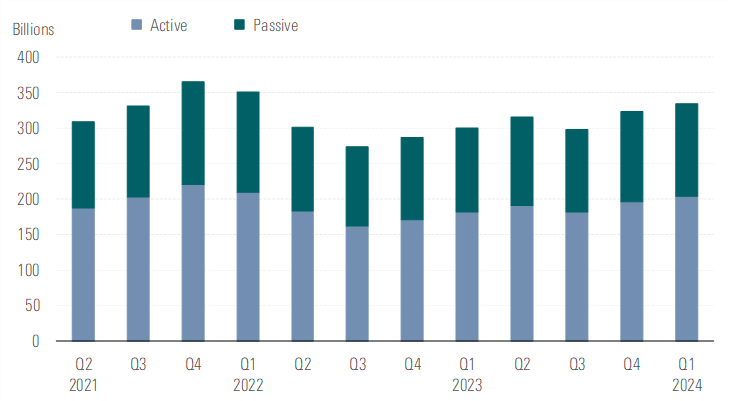

US Fund Flows: Sustainable vs. All US Funds (USD Billion)

The weaker demand for sustainable funds in the last three months did not mark a notable departure from the total universe of US open-end and exchange-traded funds, which saw $188 billion in net inflows during the same period. This marked the sixth-consecutive quarter where investor appetite for US sustainable funds was weaker than for their conventional counterparts.

The organic growth rate of sustainable funds, which is calculated as net flows as a percentage of total assets at the start of a period, puts the magnitude of net flows and redemptions into perspective. During the first quarter, sustainable funds contracted by 3%. By comparison, overall US funds grew by 1.4% during the period. The relative decline in demand was more significant for sustainable funds, compared with conventional peers.

Two iShares ETFs Account for Half of Outflows

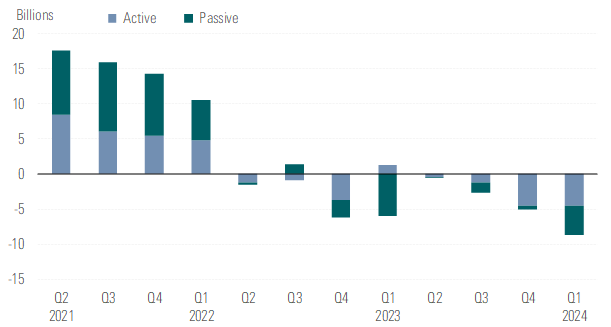

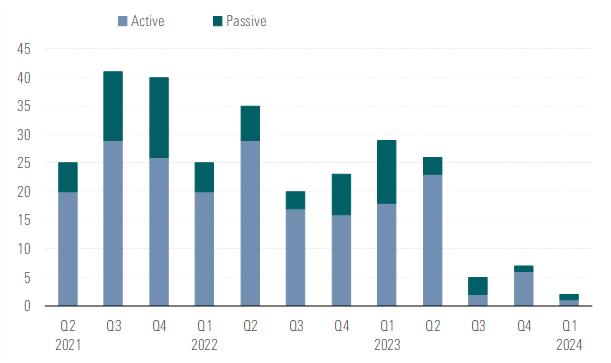

Actively managed sustainable funds shed $4.6 billion during the first quarter, which accounted for roughly 50% of net withdrawals from sustainable funds.

Outflows were split almost evenly between actively managed funds and index-tracking counterparts. Both groups shed more than $4 billion apiece during the period. Two iShares passive funds accounted for a substantial portion of these outflows. Investors pulled close to $4 billion from iShares MSCI USA ESG Select ETF SUSA and iShares ESG Aware MSCI USA ETF ESGU during the quarter. In 2023, iShares ESG Aware USA ETF experienced outflows of more than $9 billion. Without this fund, sustainable passive funds would have netted just a bit more than $1 billion over the year of 2023.

Parnassus came second, with two funds—Parnassus Core Equity PRBLX and Parnassus Mid Cap PARMX—ranking among the worst for first-quarter withdrawals. The duo lost $2.3 billion together over the first quarter of 2024. Long known as the largest US sustainable fund, Parnassus Core Equity has been one of the 10 biggest losers in terms of outflows for two years straight, shedding more than $4.3 billion over that period. Parnassus attributes a portion of the fund’s outflows to the launch of a less expensive collective investment trust and the subsequent conversion of investors from one vehicle to the other. Our data includes only open-end and exchange-traded funds.

US Sustainable Fund Flows (USD Billion)

Fidelity, Vanguard Defend Inflows

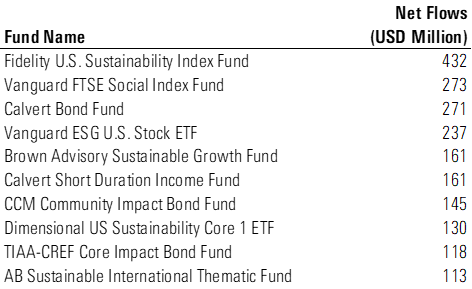

The first quarter’s biggest winner, Fidelity US Sustainability Index FITLX, collected more than $432 million during the period. Vanguard FTSE Social Index VFTNX came in second place, with inflows of $272 million.

The roster of top 10 flow recipients also includes another Vanguard offering, Vanguard ESG US Stock ETF ESGV, which brought in $237 million over the period. All three funds earn a Morningstar Medalist Rating of Silver. The Medalist Rating uses both qualitative insights and quantitative measures to indicate a strategy’s likelihood of outperforming its respective Morningstar Category index and/or peers. The funds have a near-zero exposure to the energy sector and sizable overweighting in the technology sector relative to the Morningstar US Large Mid Cap benchmark. These weightings were the strongest drivers of the funds’ outperformance in 2023 and in the first quarter of 2024 relative to the benchmark.

Top 10 US Sustainable Fund Flows

The Largest Sustainable Funds Extend Their Outflows

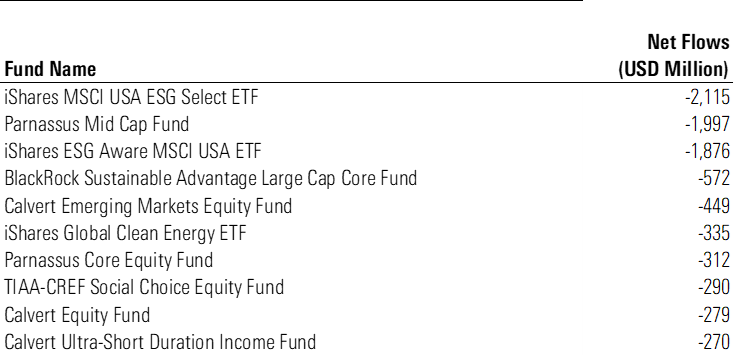

IShares MSCI USA ESG Select ETF topped the table as the worst-selling sustainable fund, with net withdrawals of nearly $2 billion during the quarter. That was a different turn from the fourth quarter of 2023, when the fund collected $942 million, boosting the fund’s annual net inflows to $1.3 billion, which secured its place among the top 10 flow recipients for the year 2023.

IShares ESG Aware MSCI USA ETF had nearly $1.8 billion in outflows, making the sixth-consecutive quarter of net redemptions for the fund. With $12.7 billion in assets, it remains one of the largest funds in the US sustainable funds landscape. The fund favors stocks with high ESG ratings and avoids stocks involved in controversial activities such as civilian firearms and thermal coal.

Bottom 10 US Sustainable Fund Flows

On a quarterly basis, Parnassus Mid Cap took second place in terms of the worst net withdrawals, shedding almost $572 million during the period. Another offering from Parnassus has sustained outflows over multiple quarters: Parnassus Core Equity lost $312 million quarterly, marking its 11th-consecutive quarter of outflows.

Asset in Sustainable Funds Continue to Grow

Despite outflows, and although sustainable equity funds tended to lag their conventional peers in terms of 2023 returns, market appreciation carried sustainable fund assets higher to close out the year.

US Sustainable Fund Assets (USD Billion)

Assets in sustainable funds climbed to $334 billion at the end of the first quarter. This represents a nearly 8% decline from the all-time high record at the end of 2021 but a 22% increase from the recent low in 2022′s third quarter. By comparison, assets in the broader US funds landscape witnessed a 1% increase compared with the peak in assets in 2021.

New Sustainable Fund Launches at Their Lowest Level

In the US, sustainability-focused product development stayed muted in 2024′s first quarter. Fewer sustainable funds (including both new launches and repurposed funds) came to market than at any other point in the past three years. Just two new sustainable funds launched during the period, down from six in the fourth quarter of 2023.

US Sustainable Fund Launches

Of the two new offerings, one focuses on climate-related themes and the other is a general ESG fund. The climate-focused investment, iShares Paris-Aligned Climate MSCI World ex USA ETF PABD, invests in an index that has objectives compatible to the Paris Agreement. The iShares offering garnered $47 million in its first month since launching. Nuveen Sustainable Core ETF NSCR, however, invests in companies aligned with energy transition, innovation, inclusive growth, and strong governance.

Sustainable Fund Closures Continue

For the second-consecutive quarter in recent history, sustainable fund departures outpaced arrivals. In the first quarter of 2024, only two new sustainable funds launched. During the same period, 10 sustainable funds liquidated.

Out of the 10 sustainable funds liquidated and merged during the first quarter, the majority were equity funds. CCM Core Equity Impact fund QUAGX had amassed nearly $72 million by the end of January 2024 before its closure.

The new offerings and repurposed funds brought the total number of sustainable open-end and exchange-traded funds in the United States to 630 at the end of the year.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PVJSLSCNFRF7DGSEJSCWXZHDFQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)