Communication Services Stocks: Advertising Continues to Rule

Our top picks in the communications services sector are Warner Bros. Discovery, Crown Castle, and Comcast.

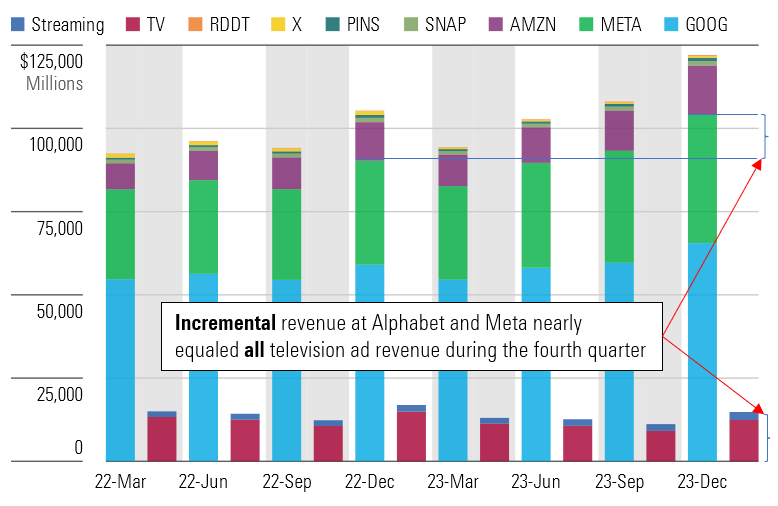

Advertising drives the communication services sector, with Alphabet GOOGL/GOOG and Meta Platforms META dominating the market. According to our estimates, online digital advertising revenue increased roughly 16% year over year during the fourth quarter of 2023, while traditional television ad revenue plunged 17%. The television ad business should improve as election season heats up, but we don’t expect a huge shift in the overall trend during 2024 as audiences steadily migrate to streaming and other services. According to Nielsen data, cable and broadcast television accounted for less than 52% of total screen time in the United States during the first two months of 2024, down from 55% last year.

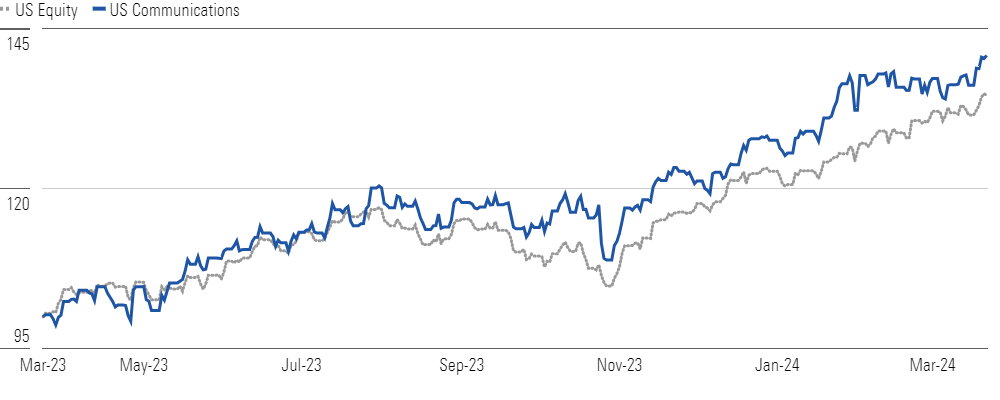

Meta Continues to Power Communication Services Gains as Alphabet Trails Off

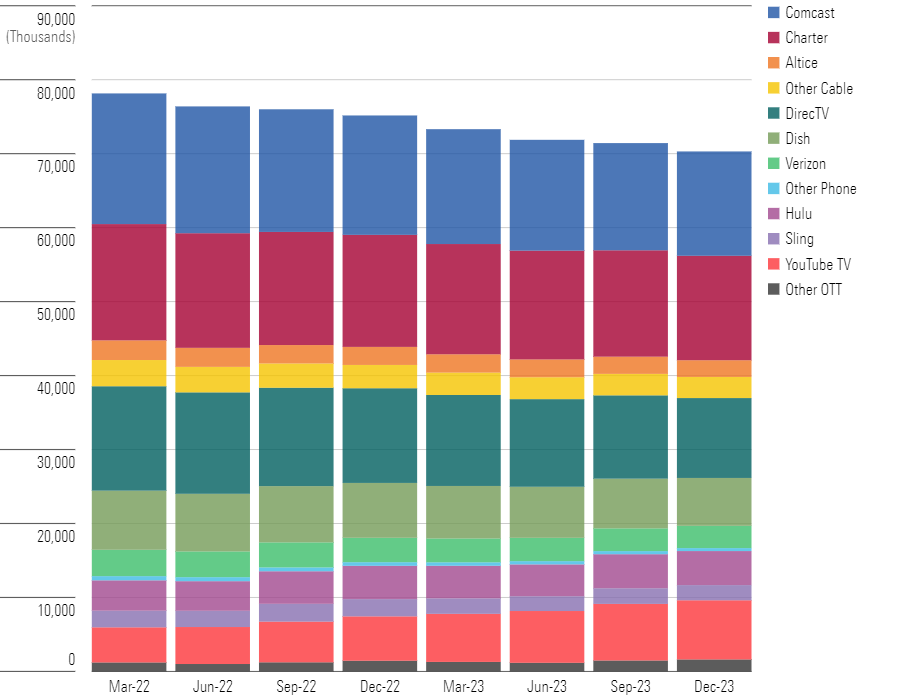

Ironically, Alphabet has provided one of the few bright spots for the traditional television business. The firm announced in early February that YouTube TV has surpassed 8 million customers, up from 5 million when it last provided an update in mid-2022. While not nearly enough to offset the loss of customers at traditional TV distributors like DirecTV or cable companies, YouTube TV has shown that combining a solid service and a somewhat lower price can attract viewers.

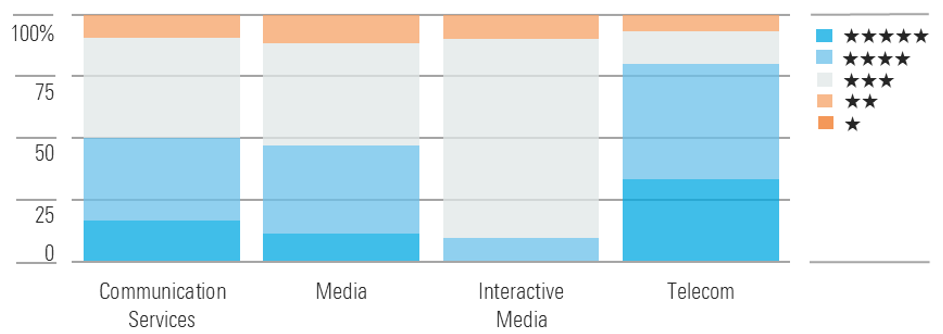

Telecom Still Offers the Most Opportunity; Traditional Media Is Also Cheap

Traditional media firms are growing ad revenue on their streaming platforms, but this business remains less than a fifth of the size of legacy television ads. As advertisers shift their spending to streaming services on connected televisions, they will likely demand the same targeting and measurement capabilities that Alphabet and Meta provide. As Alphabet gets deeper into the television business with YouTube TV, we wouldn’t be surprised to see a traditional media firm partner directly with the internet giant to increase revenue per ad sold.

Total Advertising Revenue: Alphabet and Meta Dominate the Market

We expect Alphabet and Meta will continue to attract a growing share of advertising budgets, leveraging their unparalleled audience reach and data access. There are technological and regulatory risks for both firms as AI capabilities expand and governments seek to protect consumers. Given this, we believe Meta shares have gotten well ahead of themselves, while Alphabet provides some upside. On the other hand, we think traditional media companies have been overly punished.

Traditional US TV Customers: YouTube TV Is the Lone Significant Bright Spot

Top Communication Services Sector Picks

Warner Bros. Discovery

- Fair Value Estimate: $20.00

- Morningstar Rating: 5 stars

- Morningstar Economic Moat Rating: None

- Morningstar Uncertainty Rating: Very High

We think Warner Bros. Discovery WBD has too many sources of value for the business to perpetually deteriorate, but the investment carries significant uncertainty. The firm faces a high debt load, and its traditional TV business remains in steep decline. On the flip side, we expect the firm will easily continue to generate enough free cash flow to exceed debt maturities over the next five years. The direct-to-consumer business, which revolves around the Max streaming service, should add subscribers and grow revenue as it enters new markets and adds live programming. Warner also has a premier studio business that continues to generate profits and holds valuable content.

Crown Castle

- Fair Value Estimate: $130.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Narrow

- Morningstar Uncertainty Rating: Medium

We believe the US tower business has been overlooked, and Crown Castle CCI is our current favorite. We have previously shied from the firm because of its fiber and small-cell business, but it has cut capital investment in fiber and is increasingly co-locating new tenants on existing fiber, so we don’t think fiber will destroy value prospectively. Because of this, we think the extent of Crown’s valuation discount to its peers is now unwarranted. High interest rates and malaise for many REITs have depressed tower stock prices, but we expect the businesses to remain strong in the long term. With its US-only presence, Crown should benefit from further wireless network investment by US carriers in their 5G networks.

Comcast

- Fair Value Estimate: $60.00

- Morningstar Rating: 4 stars

- Morningstar Economic Moat Rating: Wide

- Morningstar Uncertainty Rating: Medium

We expect very modest broadband customer growth in the coming years, with fiber and wireless networks gaining share, but we also believe price competition will remain rational, allowing broadband prices to rise. Comcast CMCSA will need to increase network spending in the coming years to keep pace with the capabilities of the phone companies’ fiber networks. The net result is that we expect cable cash flow to grow modestly over the coming years. We don’t think the NBCUniversal business is as strong, but it remains an important media asset. The company’s theme parks also remain a strong and growing contributor.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/CWMPLAZER5HFBGFDFB45VCOUHI.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VCYGUEZEV5DA3PVEIJNCMYA7AU.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/K36BSDXY2RAXNMH6G5XT7YIXMU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/12c6871b-2322-44d8-bd98-0437fa1a0a07.jpg)