Another Losing Quarter for Many Bond Funds

Bond markets continued to reward investors who took credit risks.

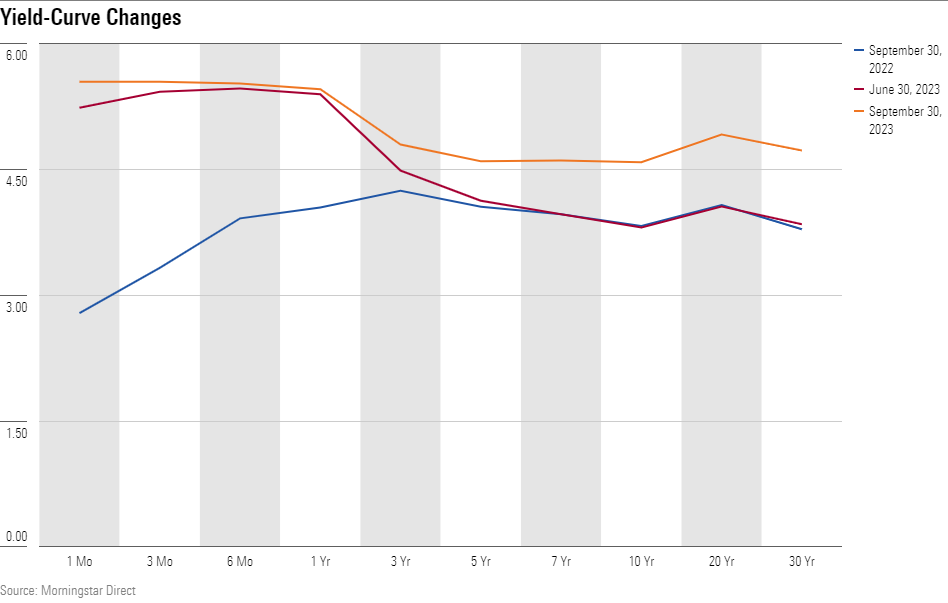

The third quarter brought more volatility for bond-fund investors, who continued to navigate market choppiness. Interest-rate-sensitive strategies lagged credit-sensitive funds as long-term Treasury yields rose, and credit spreads remained steady.

For the quarter, long government funds, the worst-performing fixed-income Morningstar Category, plummeted 10.5% on average, while the typical intermediate core bond manager lost 2.7%. These funds, which generally invest sizable stakes in Treasuries and other longer-duration high-quality securities, posted negative returns as yields rose and bond prices fell.

A resilient economy pushed yields higher over the quarter, surprising many bond-fund managers and strategists who believed an economic slowdown would drag interest rates lower by the year’s end. The benchmark 10-year Treasury note eclipsed 4.5%, over 70 basis points higher than the beginning of the quarter. Now, with an economy that’s picked up some steam, investors are bracing for rates to remain “higher for longer.”

It wasn’t gloomy for the entire fixed-income market, though. Bond investors who welcomed credit risk in their portfolios generally reaped the benefits. Bank loans, an asset class rooted in lower credit quality, continued their year-to-date momentum thanks to relatively healthy corporate fundamentals and higher short-term interest rates, which have buoyed bank loans’ floating-rate coupons. The Morningstar LSTA US Leveraged Loan Index gained 3.4% during the quarter and soared—in equitylike fashion—to 10.1% for the year to date through September.

Below, we take a closer look at how some of the more prominent bond-fund managers performed in their respective Morningstar Categories over the quarter and year-to-date periods.

Yield Curve Changes Q3 2023

Bank Loans Shine

The more credit risk that bank-loan managers accepted, the better they generally fared over the quarter and year-to-date periods. To be sure, Eaton Vance Floating-Rate Advantage Fund EIFAX, which has a Morningstar Medalist Rating of Bronze and is a higher-octane offering that systemically employs about 20% pro rata leverage to the portfolio’s holdings, rose 3.7% during the quarter. These results brought year-to-date returns to a staggering 10.8%, which outpaced 90% of its bank-loan Morningstar Category peers.

One of our favorite picks among bank-loan funds, Gold-rated T. Rowe Price Floating Rate TFAIX, posted middling returns over the same periods. This team favors BB and B rated loans and selectiveness with CCC and below rated loans. As such, the portfolio’s positioning tends to produce medianlike performance during periods favorable to corporate credit markets, as it did in 2023. While relative performance didn’t stand out from peers, its respectable 8.9% gain for the year-to-date period through September fell in line with the typical fund’s 8.9% return.

Safety on the Short End of the Yield Curve

Short duration strategies helped protect as yields rose. These funds that focused on the short end of the yield curve generally provided investors with downside protection and even eked out gains for the quarter. The typical ultrashort bond and short-term bond fund generated 1.4% and 0.7%, respectively, during 2023′s third quarter.

Silver-rated Pimco Low Duration Fund PTLDX weathered the interest-rate volatility better than most of its short-term bond Morningstar Category peers. Its 1.3% gain outpaced 85% of rivals during the quarter, thanks to the portfolio’s 1.5-year duration, which stood shorter than the typical peer’s 2.0-year duration.

Not all strategies enjoyed positive results, though. For instance, Bronze-rated American Funds Intermediate Bond Fund of America IFBFX, which structurally carries higher interest-rate risk than many of its short-term bond rivals, trailed most of its peers. Its longer duration positioning—currently 4.0 years—typically damps its relative returns when yields soar. To no surprise, the strategy’s 0.6% loss lagged over 90% of its peers during the quarter.

Core Bond Performance Back in the Red

Intermediate core bond and intermediate core-plus bond Morningstar Category strategies, which invest in a mix of high-quality and longer-duration securities like Treasuries, agency mortgage-backed securities, and investment-grade corporates, took a hit during the third quarter. The Morningstar US Core Bond Index and the Morningstar US Core Plus Bond Index, proxies for these strategies, lost 3.2% and 3.0%, respectively. These results wiped out the year’s first-half gains and then some.

Gold-rated Baird Aggregate Bond BAGIX, one of the intermediate core bond category’s largest strategies, provided investors with relatively steady results amid the most recent bout of rate volatility, due in part to the team’s consistent approach to matching the fund’s duration to its Bloomberg U.S. Aggregate Bond Index benchmark. While it lost 0.7% for the year through September, it outperformed over 60% of its peers.

American Funds Bond Fund of America ABNFX, another Gold-rated strategy, has struggled lately. Its year-to-date 1.7% drop through September landed in the worst quintile of the intermediate core bond peer group.

Muni Bonds Approach Uncharted Territory

Municipal bonds followed taxable strategies lower. Bloomberg Municipal Bond Index hasn’t posted consecutive calendar-year negative returns since 1980 and 1981. After plummeting 8.5% in 2022, munis rallied in 2023’s first half, as it typically does after a market selloff, gaining 2.7%. However, tax-exempt yields rose alongside Treasuries and the median national Morningstar Category fund lost 2.9% during the quarter, driving down year-to-date returns to negative territory, losing 0.8%.

Despite the volatility, some muni-bond managers generated positive returns for the year. Silver-rated BlackRock National Municipal’s MANLX 0.3% gain outperformed over 95% of its peers. On the other hand, Gold-rated Vanguard Intermediate-Term Tax-Exempt VWIUX, the category’s largest fund at about $70 billion in assets, lost 0.6% over the year through September, slightly better than the typical rival, though.

What Rising Bond Yields Mean for Investors

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/d10o6nnig0wrdw.cloudfront.net/05-14-2024/t_958dc30e28aa4c8593f13c19505966e3_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/OMVK3XQEVFDRHGPHSQPIBDENQE.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/WJS7WXEWB5GVXMAD4CEAM5FE4A.png)