How to Make Your Voice Heard on Climate Issues

Every day can be Earth Day from an investment perspective.

Each year, Earth Day invites us to consider what we can do as individuals to help solve environmental problems. It offers a backdrop to gauge progress on issues ranging from plastics pollution (the theme of this year’s Earth Day) to biodiversity, land use, a just transition, and climate change. It provides a context to evaluate whether we have advanced or regressed. On many environmental topics, we witness both progress and backsliding. But one thing is certain: Solving complex environmental challenges requires participation from a broad range of stakeholders—including civil society, government, academics, nonprofits, and investors.

Individuals can play a role by supporting public policies aimed at addressing these issues. They can back actions intended to foster the transition to a low carbon economy, limit single-use plastics, or reduce species depletion or loss. They can also endorse initiatives like the SEC climate disclosure rules designed to give investors greater transparency on material climate risk at companies.

There is a broad consensus among investors that climate risk is investment risk. So, what can investors do in addition to advocating for greater transparency and disclosure about climate-related risk? Economist Albert O. Hirschman famously described the options people have when they are dissatisfied with outcomes they experience: They can exit the relationship or voice their desire for change. This framework has been applied to a broad range of institutional and organizational relationships. For investors, it implies the choice to advocate for change (“voice”) at a company or sell the stock (“exit”).

Climate Investing

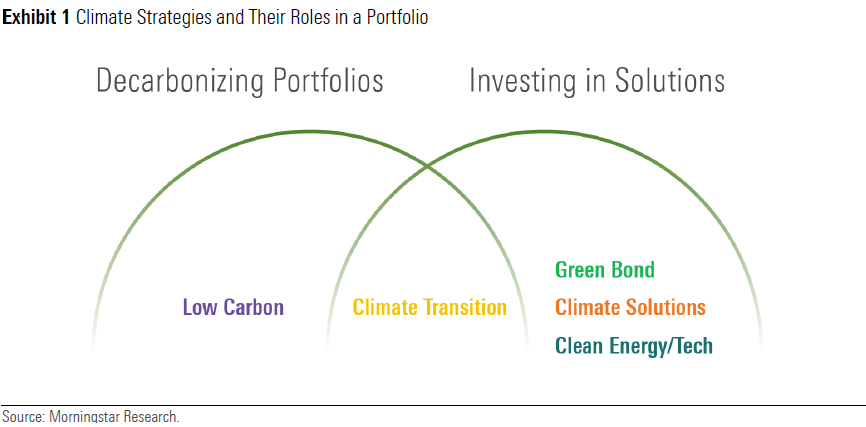

Climate investing encompasses several strategies. Let’s talk about risk. Low carbon and ex-fossil-fuel funds are constructed to reduce the carbon footprint of the portfolio either by lowering the weight of, or excluding altogether (that is, exiting), carbon-intensive assets like oil and gas companies. The investment thesis is to reduce exposure to carbon-intensive assets to lower investment risk.

The Role of Climate Strategies

Meanwhile, climate transition strategies include what are known as Paris-aligned benchmarks and net zero funds. These strategies share a focus on achieving net zero emissions by 2050, although PABs exclude oil and gas companies. Increasingly, climate transition funds focus on holding companies accountable to make progress on reducing their emissions. The investment thesis is to reduce transition risk by selecting companies that are prepared as the economy decarbonizes.

Then there’s opportunity. In climate investing, this is represented by thematic funds that focus on clean energy and clean technologies—like electric vehicles or energy efficiency—that are conducive to the low carbon transition. Climate solutions also include green bonds used to finance environmentally beneficial projects. The investment thesis is to capture growth from the secular decarbonization of the economy.

Low carbon and climate transition funds can serve as core holdings in a portfolio’s asset allocation because they are typically broad and diversified, whereas climate-themed funds tend to be satellite holdings in a portfolio because they are narrower and riskier.

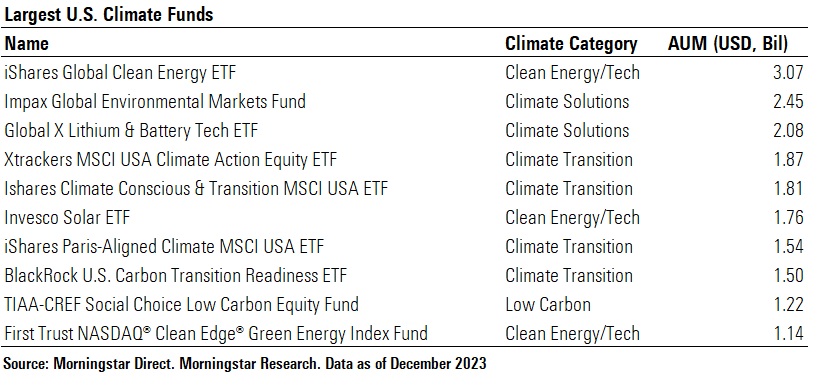

Largest US Climate Funds

Climate Engagement

Corporate engagement is an expression of shareholder voice. As shareowners, investors can vote on shareholder resolutions and have standing to propose resolutions (with a sufficient investment) for other shareholders to vote on. In addition, they can enter into dialogue with companies and sponsor or support shareholder resolutions on topics that are outside of the everyday domain of directors and management, known in SEC parlance as “ordinary business.” (You can read more about your rights as a shareholder here.)

A fund’s proxy-voting policy signals its objectives and priorities to investors. Some asset managers vote consistently with management, while others see their role as challenging management and the board to act more diligently and proactively to address issues like risks from climate change. Asset managers sometimes join collaborative engagements to amplify their voices on issues of urgency for them.

Reducing real-world carbon emissions—not simply carbon exposure in a portfolio—is critical to climate transition strategies because that is the goal, after all. Consequently, engagement with portfolio companies is an important tool for fund managers on behalf of their investors. Of course, climate funds engage with companies about net zero commitments. But it’s also essential for investors to understand whether management and boards are prepared to adapt their governance practices, business strategies, and capital expenditures to realize these goals—and to engage where they fall short.

While many asset managers engage directly with companies on climate matters, some of the most effective climate engagement is collaborative. Climate Action 100+, which is supported by more than 700 investors, boasts that 75% of the most carbon-intensive global companies have net zero commitments and 93% have committee oversight of climate risks and opportunities on their boards. The organization retains its climate engagement leadership despite some high-profile departures, including J.P. Morgan, Invesco, and State Street, in the past year.

Does this kind of climate engagement make a meaningful difference? In 2023, CA 100+ highlighted 20 key climate resolutions at 15 companies for its members (and nonmembers) to support. The topics of these resolutions covered a gamut of issues including climate transition risks and opportunities, methane emission disclosure, and climate-related lobbying.

A recent study by Morningstar’s Lindsay Stewart shows that support by CA 100+ asset manager signatories was significantly higher than support by nonsignatories. Not surprisingly, support among European asset managers was higher on average than that of US asset managers. The data affirms that asset managers who participate in this collaborative engagement are among those most committed to climate issues, leveraging their voice in a collective effort to improve climate-related practices at companies they invest in.

Earth Day, Every Day

Investors alone can’t reasonably be expected to convince companies to address climate risk on their own, but they can play a role by exercising their voice rather than exiting or doing nothing. Individual investors can invest in funds committed to engaging and voting on climate-related issues, such as carbon and methane emissions reductions, net zero pathways, adoption of green technologies, climate lobbying, and climate governance. As part of your due diligence, you can choose a fund manager committed to engagement on climate risks and opportunities by looking into their proxy-voting policy, voting record, resources dedicated to climate engagement, and whether they participate in climate-related collective engagements like CA 100+.

Every day can be Earth Day from an investment perspective if your portfolio is invested in funds constructed with climate considerations in mind, that have proxy voting and engagement on climate, and that are seeking companies that are credibly committed to decarbonization. It may not move the needle on its own, but it’s another signal to companies and policymakers that climate risk is investment risk—and that investors expect companies to lead the transition to a low carbon economy.

So, if you care about the risks and opportunities associated with climate change and you invest in the stock market, let your voice be heard.

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. A list of investable products that track or have tracked a Morningstar index is available on the resources tab at indexes.morningstar.com. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IJKB5DGDNJFLPP6SBNF27R3UEA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VSMLFOHJRVBK5L2JAJXUPP274Q.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZNKQPGMG5RFE5GPV47XGWXDLMI.png)