Markets Brief: Will the New Inflation Story Hurt Stocks?

Insights into key market performance and economic trends from Dan Kemp, Morningstar’s global chief research and investment officer.

The latest inflation data captured investor attention last week. Core consumer prices (which exclude the volatile costs of food and energy) rose 3.5% over the previous 12 months, compared with 3.2% last month and the expected 3.4%. The threat of inflation persisting challenges the narrative of lower inflation leading to lower interest rates. The concern this has raised among investors likely contributed to the Morningstar US Market Index falling 1.63% over the week.

Investors Now Expect Fewer Rate Cuts

The probability of at least three interest rate cuts this year has fallen to 28% from 68% a month ago. Pessimism around inflation can also be seen in the bond market, with the 10-year US Treasury yielding 4.52%. While lower than its peak in the fourth quarter of 2023, it is significantly higher than the year-end yield of 3.87%.

Big Banks Causing a Stir

Financial companies were in the spotlight as they reported their latest results, and the reaction to JPMorgan Chase JPM was notable. Against a background of weakening sentiment, investors appeared to ignore the strength of its business over the first quarter and expressed their displeasure with the bank’s neutral outlook. Despite its stock price falling 6.47% on Friday, Morningstar banking analyst Suryansh Sharma believes JPMorgan is still overvalued.

Citigroup C and Wells Fargo WFC also shared their quarterly scorecards last week. Neither suffered the declines JPMorgan did, reminding us that disappointment is often most felt where expectations are highest. Consequently, periods of negative sentiment create opportunities for long-term investors to buy high-quality businesses at attractive prices.

Sticky Inflation, Weaker Stocks?

While there are few significant economic releases this week, market commentators will likely seek confirmation of the new narrative that inflation is “stickier” than previously thought and that interest rates will thus be higher for longer. It is a short logical leap from there to the belief that the economy will slow and profits will be harder to come by. While the data will ultimately reveal the perspicacity of this narrative, it may be tempting enough to cause further price falls.

Robust estimates of the fair values of the investments that interest you are essential if you want to respond well in these situations. Without the research required to anchor your decision-making, it’s better to stay invested and focus on the benefits of participation in the long-term growth of equities.

Highlights of This Week’s Market and Investing Events

- Monday, April 15: March Retail Sales (month to month): 0.35% vs. 0.60% in Feb.

- Tuesday, April 16: Earnings from Bank of America BAC, Johnson & Johnson JNJ

- Thursday, April 18: Earnings from Netflix NFLX

- Friday, April 19: Earnings from Procter & Gamble PG

Check out our full weekly calendar of economic reports and corporate earnings.

Stats for the Trading Week Ended April 12

- The Morningstar US Market Index fell 1.65%.

- The best-performing sectors were technology, down 0.48%, and communication services, down 1.17%.

- The worst-performing sector was financial services, down 3.59%.

- Yields on 10-year US Treasury notes rose to 4.50% from 4.39%.

- West Texas Intermediate crude prices fell 2.52% to $85.48 per barrel.

- Of the 704 US-listed companies covered by Morningstar, 82, or 12%, were up, two were unchanged, and 620, or 88%, were down.

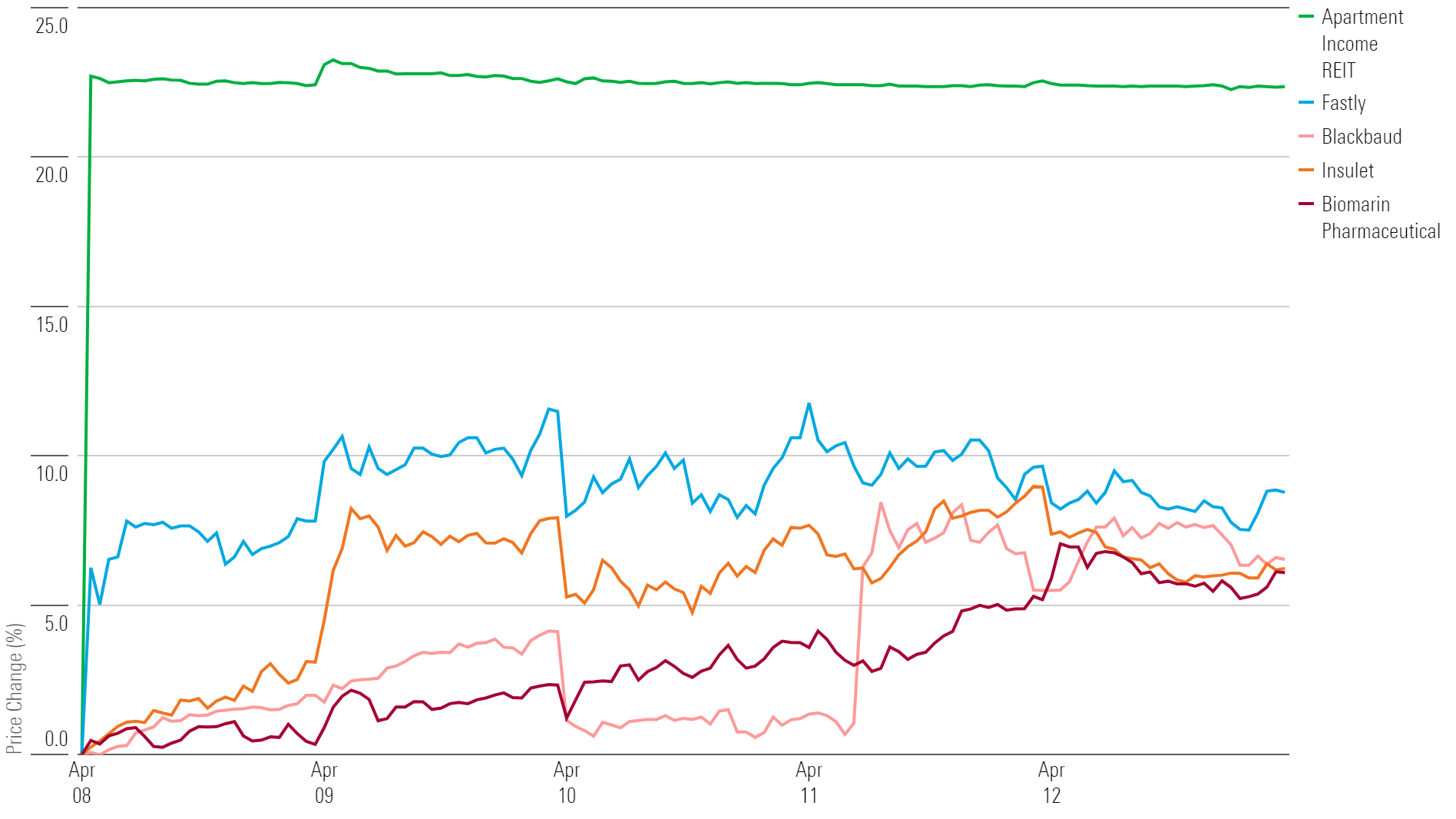

What Stocks Are Up?

Apartment Income AIRC, Fastly FSLY, Blackbaud BLKB, Insulet PODD, and BioMarin Pharmaceutical BMRN.

Best-Performing Stocks of the Week

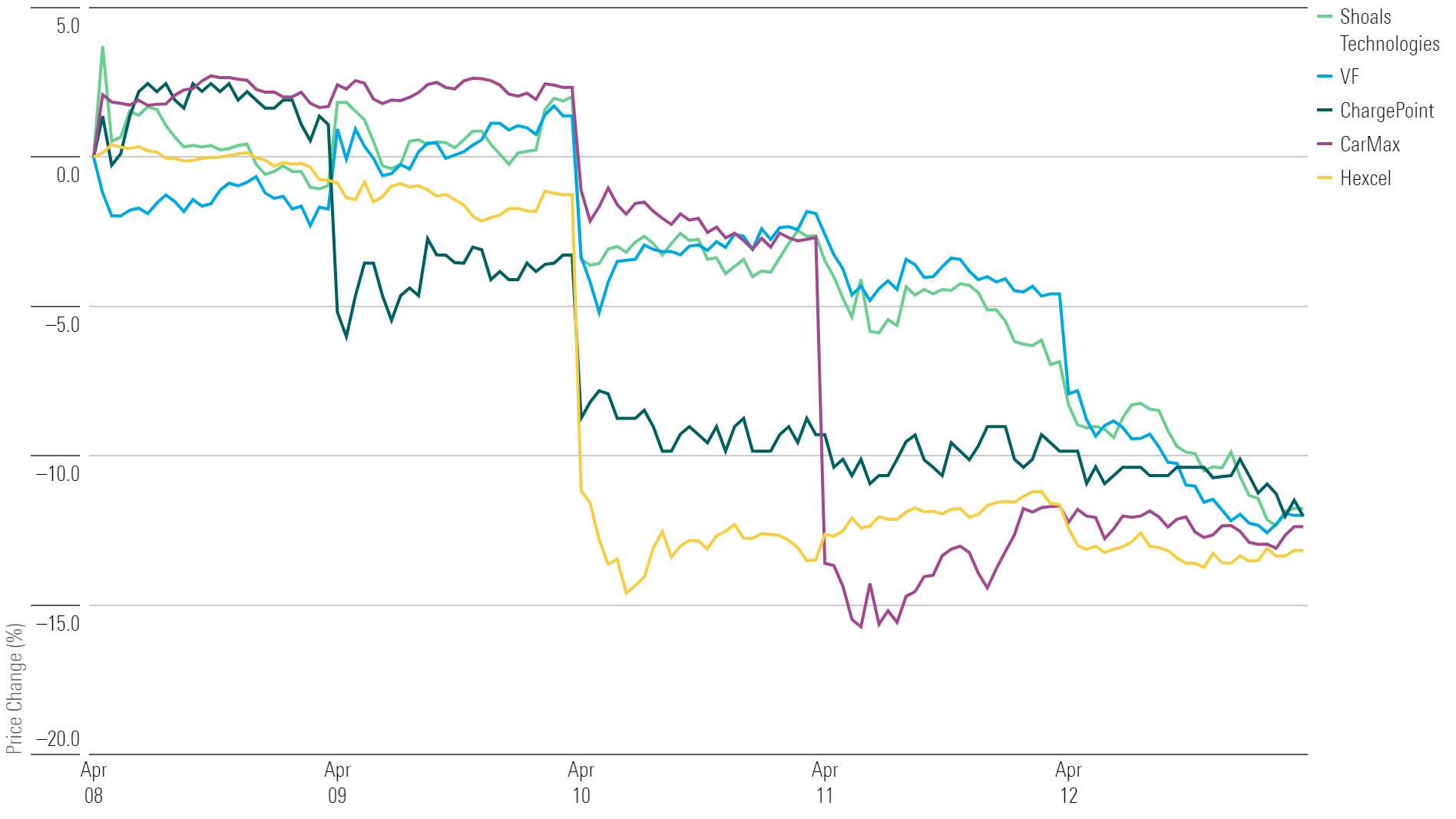

What Stocks Are Down?

Hexcel HXL, CarMax KMX, ChargePoint CHPT, VF VFC, and Shoals Technologies SHLS.

Worst-Performing Stocks of the Week

Bella Albrecht contributed to this article.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-29-2024/t_eae1cd6b656f43d5bf31399c8d7310a7_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GJMQNPFPOFHUHHT3UABTAMBTZM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/687c42c2-15b8-4c8d-a9f6-6fadac96dd73.jpg)