For Most Investors, Single-Stock ETFs Are Best Left Alone

The newest shiny object in the ETF marketplace is one to avoid.

As more investors shop in the exchange-traded funds marketplace, its aisles grow denser with investments that are more shine than substance. Promising gaudy returns or sky-high yield, new ETFs know how to get attention.

Single-stock ETFs are the latest in this gilded genre. They are new to the market but proliferating in both count and size. The two kingdoms of the single-stock domain—leveraged/inverse and covered-call products—have unique traits. But both are flawed and inappropriate for almost all investors who see them beckoning from the shelf.

How Single-Stock ETFs Work

Single-stock ETFs are built around one company. One way or another, the performance of that reference stock dictates the trajectory of the ETF. These strategies distinguish themselves by using derivatives to lever, short, or squeeze more income from the stocks in question.

We can crudely put single-stock ETFs in two broad buckets: leveraged/inverse and covered call. The categories have very different objectives and performance patterns from one another.

- Leveraged single-stock ETFs borrow money to dial up their exposure to the reference stock. Most leveraged ETFs amplify the stock’s daily performance by 1.25 times, 1.5 times, or 2 times. Likewise, inverse strategies may also be leveraged, in which case they use the same multipliers with a negative sign in front of them. When Nvidia NVDA soared 16.4% on Feb. 22, 2024, GraniteShares 2x Long NVDA Daily ETF NVDL gained 32.4% and GraniteShares 2x Short NVDA Daily ETF NVD lost 33.6%. These products are designed to magnify returns—for better or worse. Inverse single-stock ETFs without leverage allow investors to short a company: If the stock goes down 1%, the ETF should go up roughly 1%.

- Covered-call strategies follow two steps: 1) go long the reference stock, and 2) sell a call option against it, normally with a one-month expiration. Selling the call option generates income for investors. It also transforms the fund’s profile. The option strike price becomes a cap on upside return, while the proceeds from selling buffer the downside. That explains how YieldMax NVDA Option Income Strategy ETF NVDY gained 54.4% in 2024′s first quarter—nothing to sneeze at, but nearly 30 percentage points behind Nvidia itself. But true to form, NVDY fared better in the two months that Nvidia lost value since its May 2023 inception.

New on the Scene

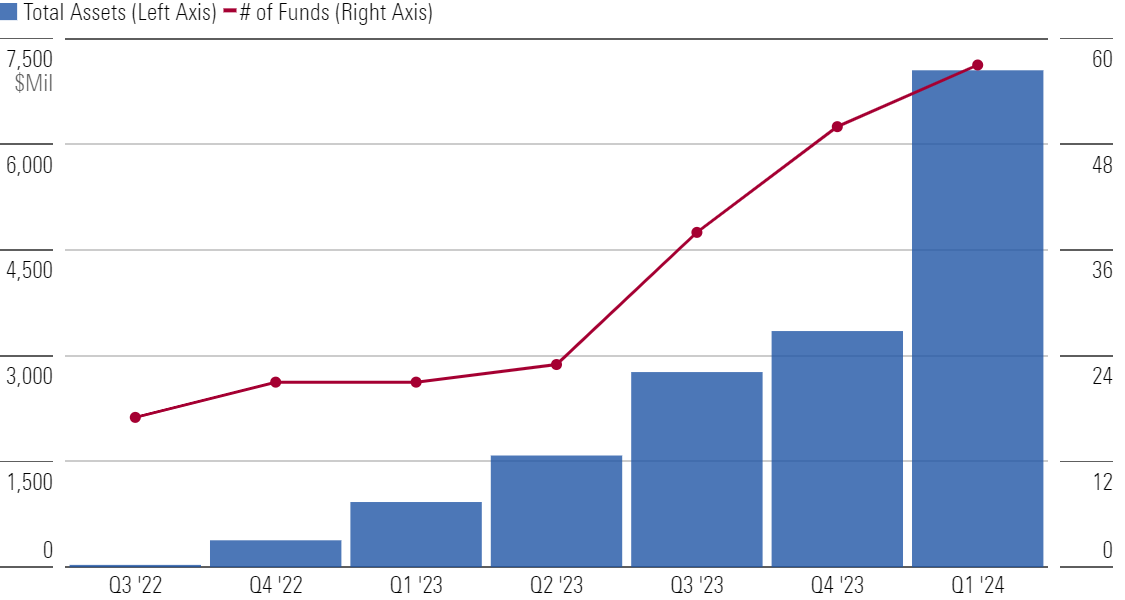

Both genres have gotten investors’ attention. The menu of nearly 60 US single-stock ETFs collectively covered about $7 billion in assets as of March 2024—double their size at just three months earlier. The leveraged cohort led covered call by both number of funds and total assets, a reflection of their older age. Most covered-call single-stock ETFs flooded the market in late 2023, chasing the commercial success of covered-call funds like JPMorgan Equity Premium Income ETF JEPI, which center around stock portfolios instead of individual companies.

The Short, Lucrative History of Single-Stock ETFs

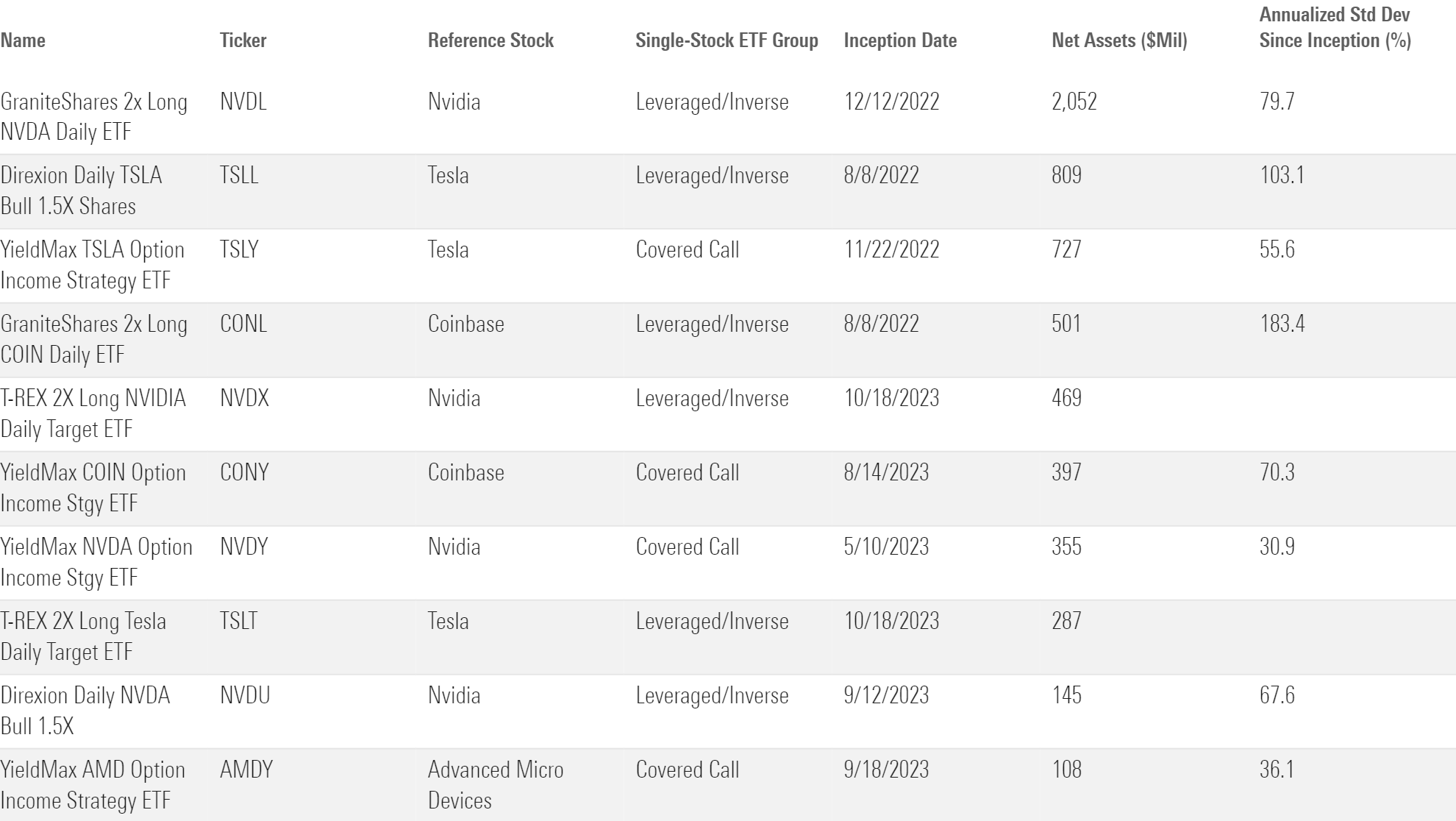

Any stock can anchor a single-stock ETF, but the current offerings orbit around the most volatile ones. Some products built around sturdier firms already closed shop because of a lack of investor interest. Tesla TSLA and Nvidia were two of the 10 most volatile stocks in the S&P 500 over the three years through March 2024. Coinbase COIN, whose stock price tends to ebb and flow with bitcoin, was bumpier than both since its April 2021 IPO. Ironically, volatility can make these franchises bad candidates to headline single-stock ETFs, as the next section will explain.

The 10 Largest Single-Stock ETFs

Leveraged ETFs: A Double-Edged Sword

Leveraged single-stock ETFs supercharge the companies they follow, offering higher highs and lower lows. In other words, they’re more volatile. That is no problem for traders who glide in and out of them on daily basis, but it presents problems for investors who hold them for more than one day.

Consider a $10 stock that loses 10% one day (now $9) and gains 11.1% the next, finishing at $10 for a net return of 0%. Now double the action for the same $10 stock: lose 20% on day one ($8), gain 22.2% on day two, and finish at $9.78—a negative 2.2% return. This example is oversimplified but illustrates the challenge with leveraged single-stock ETFs’ inherent volatility. Over a longer period, the reference stock must rise consistently for returns to meet (or exceed) their stated leverage. Zigzagging up the mountain makes it hard for these products to reach the top.

These hidden costs feed on returns. When a leveraged strategy books a gain one day, it needs to borrow more to preserve its leverage ratio for the next. Conversely, it sheds leverage on the days it loses value. Borrowing and returning money on this timetable is a buy-high/sell-low proposition, a structural drawback that hurts the bottom line for fundholders.

What about the obvious costs? The average investor paid a 1.07% annual fee for single-stock ETFs at the end of March 2024. That’s nearly 3 times what they paid for the average fund across the overall US market.

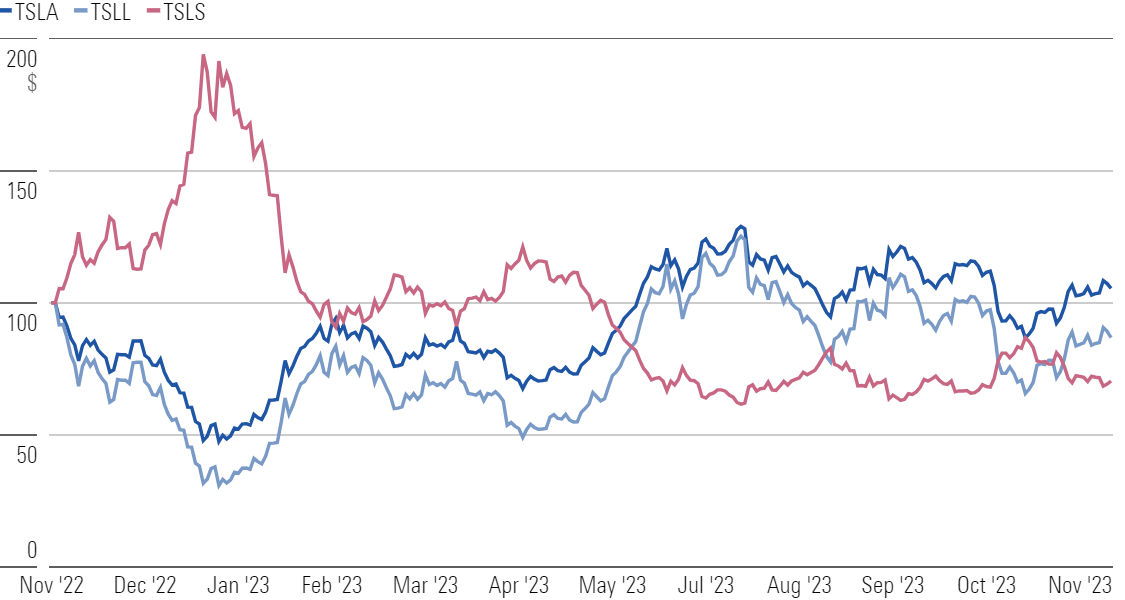

The litany of red flags has reared its head. Look to the Direxion Daily TSLA Bull 1.5X Shares TSLL, its inverse twin Direxion Daily TSLA Bear 1X Shares TSLS, and their electric engine, Tesla. From November 2022 through November 2023, Tesla gained 5.5%. TSLL and TSLS both lost value—13.0% and 29.6%, respectively. The reference stock advanced over the period, but the volatility along the way sank both single-stock ETFs. Leave your chips on the table for longer than a couple of days, and single-stock ETFs may not pay out a winning bet.

Heads I Win, Tails You Lose: Growth of $100 in Tesla and Its Offshoots

The Demerits of Covered Calls

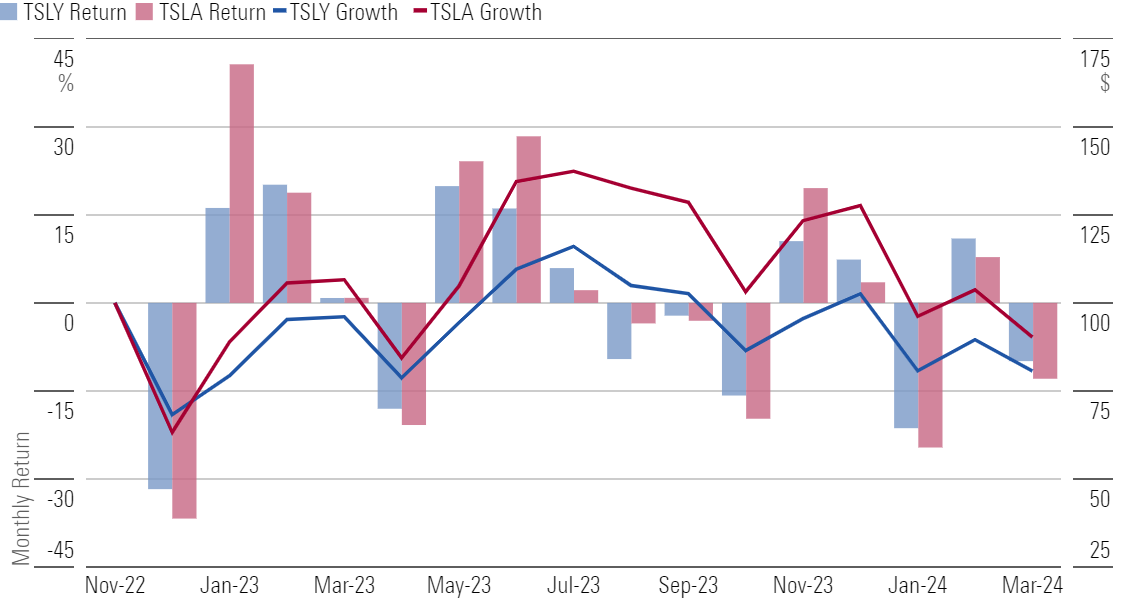

Covered-call single-stock ETFs have few redeeming qualities themselves. The main selling point is yield, as these products promise to wring income from even nondividend stocks. YieldMax TSLA Option Income Strategy ETF TSLY flaunted a 12-month yield of 87% as of February 2024; Tesla pays no dividend. Eye-popping yields conceal meaningful drawbacks, though. It’s easy to fixate on the “zero sugar” label and gloss over the chemicals listed in fine print.

These strategies generate income by selling call options on the reference stock and distributing the proceeds to investors. The proceeds also provide an incremental margin if the stock slumps. With the money in hand, a buffer—albeit a small one—is established.

Critically, that comes at the expense of upside return. Selling call options surrenders any gains above the settlement price to whomever buys them. This is an asymmetrical trade-off: Investors face a hard ceiling on their gains and a soft floor on their drawdowns.

This trade-off can make sense for covered-call strategies built around stock portfolios, but it’s head-scratching for individual stocks. The range of returns is narrower for baskets of stocks. Limiting upside is still a sacrifice, but the reference portfolio rarely booms or busts, rendering call-option seller’s remorse unlikely and making the proceeds a greater share of returns.

Contrast that with the current roster of covered-call single-stock ETFs, which target stocks with boom-or-bust DNA. TSLY sells one-month calls on Tesla with strike prices 15% above the current price. That means the fund’s maximum monthly return is 15% plus the call-option proceeds. The problem is that Tesla is liable to blow past that threshold and leave TSLY in the dust. And it has—15 of 48 months from 2020 through 2023, to be exact. In 2023, the fund’s first full calendar year on the market, Tesla stock doubled it up with a 101.7% gain.

Covered-Call ETFs: Both a Cushion and Drag

Tails drive everything in investing. Cutting off the positive tail for extra income is a hard trade-off to rationalize.

Single-Stock ETF Buyers Beware

Single-stock ETFs can meet the needs of a few. High-conviction traders with a single-day or shorter holding period may find them useful vehicles to express their views. After all, it’s hard for everyday investors to use leverage or construct their own covered calls.

But the fact is that these products are rarely sensible for everyday investors. They are flawed, costly, and liable to take more from investors than they give. When single-stock ETFs hit the market, the SEC issued its own “buyer beware”—a disclaimer investors should take to heart when considering these products.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/24UPFK5OBNANLM2B55TIWIK2S4.png)

/d10o6nnig0wrdw.cloudfront.net/04-25-2024/t_29c382728cbc4bf2aaef646d1589a188_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)