Are AI ETFs Worth the Hype?

AI is the newest theme on the ETF block, but the same old lessons of thematic investing apply.

The launches of OpenAI’s ChatGPT and Google’s Bard have sparked immense interest in artificial intelligence, making it a popular topic in both mainstream and financial circles. Anyone can now access powerful AI tools and models at little or no cost. Although it is hard to quantify its impact, AI is a technological innovation with the potential to change society, akin to the introduction of the internet.

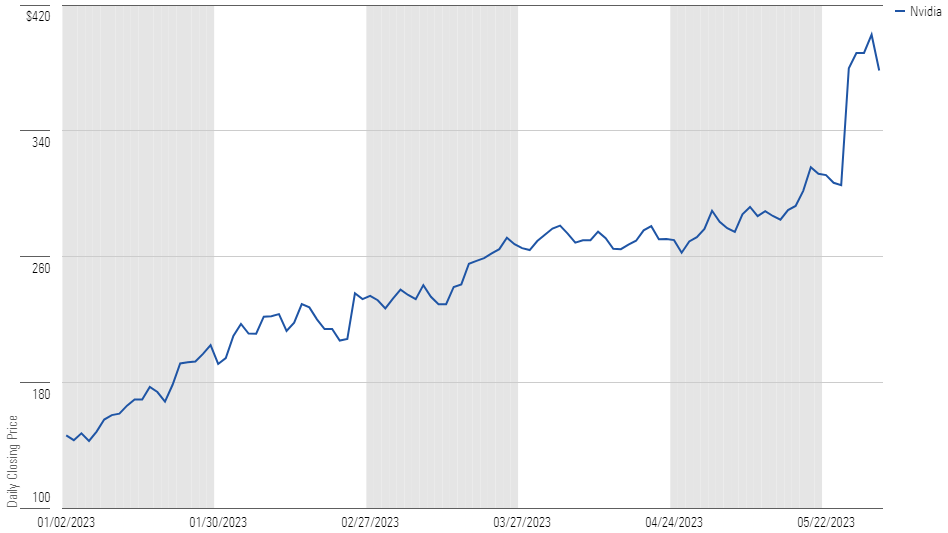

Investors rapidly took note of the growth potential for AI-related companies. In May 2023, Nvidia NVDA quickly became the poster child for AI investing when it beat earnings and revised forecasts higher, thanks to its focus on graphics processing units used for generative AI and large language models, such as ChatGPT. Investors extrapolated Nvidia’s success as a concrete signal of AI’s materiality and financial viability, even though the company does not develop AI applications but builds the tools used for computation. Consequently, Nvidia’s price shot up by 27% from May 22 to May 26, pushing its market cap past the illustrious $1 trillion threshold.

Nvidia's Daily Share Price

From May 22 through May 26, investors poured approximately $232 million into exchange-traded funds that specifically target companies like Nvidia that help build or benefit from AI applications. This could mark the beginning of a hot new theme in ETF investing, one that has only $3.28 billion in assets for U.S.-domiciled, AI-focused ETFs—a mere fraction of the total U.S. ETF market at the end of May 2023. The table below lists the largest of these ETFs.

| Name | Ticker | Fund Size (USD Mil) | Expense Ratio (%) | Return YTD (%) |

|---|---|---|---|---|

| Global X Robotics & Artificial Intelligence ETF | BOTZ | 2,116 | 0.69 | 32.43 |

| IShares Robotics and Artificial Intelligence Multisector ETF | IRBO | 338 | 0.47 | 20.16 |

| First Trust Nasdaq Artificial Intelligence and Robotics ETF | ROBT | 294 | 0.65 | 22.34 |

| Global X Artificial Intelligence & Technology ETF | AIQ | 219 | 0.68 | 29.32 |

| WisdomTree Artificial Intelligence and Innovation | WTAI | 47 | 0.45 | 29.25 |

| Robo Global Artificial Intelligence ETF | THNQ | 31 | 0.68 | 28.24 |

| TrueShares Technology, AI & Deep Learning ETF | LRNZ | 22 | 0.69 | 35.09 |

3 Bets Investors Are Making on AI ETFs

Investing in a vehicle that aims to harness a single theme can often result in a narrow bet. Thematic ETFs generally concentrate on one or two sectors of the market and hold a small number of companies. But the potential application of AI technology is vast, so the odds of missing out on companies that can benefit from AI are higher than for other themes. If AI proves revolutionary, it will reverberate throughout the business world, and much of the market will benefit, not only Nvidia.

While AI ETFs are enjoying their moment in the limelight, it is important to stay grounded in evaluating them like any other type of thematic ETF. Thematic investing generally entails making a three-pronged bet that:

- The theme is real and durable.

- The fund properly represents the theme and holds companies that stand to benefit from the theme.

- The growth potential of the theme is not already baked into its price.

Betting that a theme like AI is a winning one with a lasting impact seems obvious but could be more difficult to predict than it seems at first blush. Experience tells us that most themes are transitory and do not translate into sustained returns for shareholders. For example, Direxion Work From Home ETF WFH, which aims to invest in companies that facilitate the ability of people to work from home, had $174 million in assets under management in December 2020, when much of the world was still under strict lockdowns because of the coronavirus pandemic. By the end of May 2023, assets plummeted to $31 million, proving the theme’s fragility as lockdown restrictions were lifted and vaccines widely distributed. That said, AI seems more promising with plenty of possible use cases than most themes that make their way into the ETF market.

The Challenge of Finding Funds Exposed to AI

Selecting funds that are well-positioned to harness the AI theme can be challenging. Themes can be difficult to articulate in real-world terms, and leading companies may not offer pure exposure to a theme. For example, how should an investor view the growth potential of AI? Will it be through chatbots replacing search and customer service? Or AI’s ability to identify diseases and discover new drugs?

Thematic funds have the difficult task of determining which companies stand to benefit from this nascent technology. And the lack of consensus shows: the two largest AI ETFs, Global X Robotics & Artificial Intelligence ETF BOTZ and iShares Robotics and Artificial Intelligence Multisector ETF IRBO, focus more narrowly on robotics yet still only had 12 holdings in common as of May 2023.

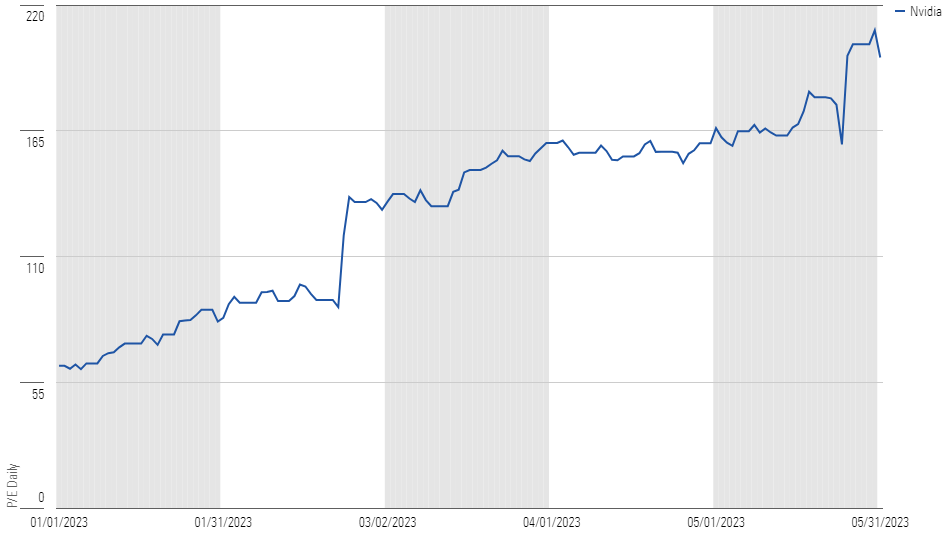

By the time a theme’s potential has become evident, the market would have already priced in its potential. Buying companies at elevated valuations suppresses expected returns. For example, Nvidia’s P/E ratio jumped from 179.17 on May 22, 2023, to 202.84 on May 26, 2023. The company’s management needs to increase earnings by another 13% to fulfill the new valuation on top of the already-lofty expectations embedded into the stock price. Buying at such rich valuations can be hard to rationalize.

Nvidia's Daily P/E Ratio

3 Great Total-Market ETFs for AI Exposure

Investors might question whether AI ETFs adequately expose them to current and future AI developments and the broader implications of the AI gold rush. Concentrated portfolios increase the likelihood of missing out on companies poised to benefit from AI developments. Attempting to actively position one’s portfolio to capture companies reaping the benefits of AI can be laborious and time-consuming. However, owning a larger slice of the market might improve investors’ odds of getting earlier exposure to winning stocks and themes.

Cheap total-market ETFs may be the best option for taking advantage of wide-reaching innovations across not just AI but all other themes. These ETFs encompass all stocks and weight them by their market caps, harnessing the market’s collective view on the relative value of each stock. Companies benefiting from AI developments would certainly be in the portfolio, and their allocation would grow alongside their relative performance.

Here are three of our favorite total-market ETFs to consider:

| Name | Ticker | Morningstar Medalist Rating | Process Pillar Rating | People Pillar Rating | Parent Pillar Rating | Expense Ratio (%) |

|---|---|---|---|---|---|---|

| IShares Core S&P Total U.S. Stock Market ETF | ITOT | Gold | High | Above Average | Above Average | 0.03 |

| Vanguard Total Stock Market ETF | VTI | Gold | High | Above Average | High | 0.03 |

| Schwab U.S. Broad Market ETF | SCHB | Gold | High | Above Average | Above Average | 0.03 |

The Future of Investing in AI ETFs

Timing a theme’s potential is akin to guessing the weather five years from today. Only those who can speak to a market oracle might have a shot. For the rest of us, the next closest thing is buying a cheap and well-diversified total-market index fund to ensure we don’t miss the potentially revolutionary innovations that AI can bring to markets.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ab0b7979-59e4-461f-be92-19c328d94d6f.jpg)