The Best and Worst New ETFs of 2023

A record year of new ETF launches brought with it the good, the bad, and the ugly—we weigh in on this year’s best and worst.

As of Dec. 13, this year’s nearly 500 exchange-traded fund launches have already broken the record set in 2021 (461). The ETF universe is more expansive than ever: Investors can choose from 3,487 ETFs. There have been 5,067 ETFs brought to market since SPDR S&P 500 ETF SPY launched in 1993. This means 31% of them have since closed.

Asset managers are close to breaking a record for ETF closures this year, as well. As of Dec. 13, they are 12 ETFs away from surpassing 2020′s record of 196. Seven ETFs both launched and closed already this year (sorry for rubbing salt in the wounds of Long Jim Cramer ETF fans).

Longtime favorite ETFs continue to control most of investors’ assets, despite the increasing number of options available. Half of ETFs’ $7.8 billion in assets is parked in the top 40 ETFs. The youngest of the top 40 ETFs was launched in 2013, and all are index funds. Actively managed ETFs are a major growth trend, but the ETF market’s broad index-tracking roots remain intact. New ETFs have little chance of competing with these strategies directly. Instead, they try to differentiate themselves by targeting new markets or by tweaking the classics.

With all this in mind, our ETF research team has analyzed the class of 2023 and voted on the best and worst new ETFs launched this year.

Best New ETFs of 2023

New ETFs must capture investors’ attention—a tough task given the breadth of options available. Some achieve this by tapping into investors’ biases and emotions, which we will talk about later. Others offer a new twist on an already successful strategy. Both of this year’s winners stand on the shoulders of giants, ultimately improving ETF investors’ options without creating something original. One cut costs for investors by sparking a fee war in the high-yield bond Morningstar Category. The other cut costs for investors by offering a mutual fund strategy in an ETF wrapper, adding tax efficiency, transparency, lower operational costs, and intraday trading, to boot. Investors should take notice of these new ETFs.

Best new ETFs of 2023

- BlackRock Flexible Income ETF BINC

- Schwab High Yield Bond ETF SCYB

Bond ETFs saw a resurgence in 2023, as higher yields gave investors good reason to replenish their portfolios with bonds. Taxable-bond ETFs brought in $168 billion of estimated net flows through November, not far off from U.S. equity ETFs’ $210 billion, despite a significantly smaller asset base.

The fact that BINC and SCYB hold bonds is the extent of their similarities. They target different markets. One is actively managed, while the other tracks an index. BlackRock’s ETF marks the next stage in the evolution of ETFs, while Schwab’s ETF proves there’s still room for improvement of traditional ETFs.

What ties these two ETFs together is that investors benefit from both.

Why We Like BINC: The New Frontier of Actively Managed Funds

I wrote earlier this year about the accelerating adoption of actively managed ETFs. A growing willingness by portfolio managers to reveal their daily holdings and the added flexibility of custom creations and redemptions have been crucial to pulling star mutual fund managers into ETFs. Perhaps no star is bigger than Rick Rieder, BlackRock investment officer of fixed income and winner of Morningstar’s 2023 Outstanding Portfolio Manager award.

Investors have flocked to Rieder’s funds, which, as of July 2023, totaled $144 billion in assets. Rieder’s teams are known for their broad and deep analytical resources combined with a well-honed process, resulting in a High rating for the People and Process Pillars for Rieder’s top strategies: BlackRock Total Return MAHQX and BlackRock Strategic Income Opportunities BSIIX.

This ETF focuses on harder-to-reach fixed-income sectors. Out of the gates, the portfolio has targeted a short duration and a solid yield. Duration can be expected to change with conditions in the bond market. The ETF has focused its holdings in global credit, securitized debt, and emerging-markets sovereign debt. A 40-basis-point fee offers investors a welcomed reprieve from the higher fees for investor share classes of Rieder’s mutual funds.

Why We Like SCYB: The Spark That Ignited a Three-Month Fee War

ETFs are steeped in index-tracking tradition. Their original use case was to provide broad exposure to markets at a cheap cost. Core markets have been commoditized after intense fee competition among asset managers: Today, some S&P 500 and total stock market ETFs are available at nearly no cost. Niche markets haven’t experienced the same level of competition, leaving investors with a higher bill for venturing away from the most liquid stocks and bonds.

Vanguard has long played the role of fee agitator. It would enter a new market by undercutting incumbents’ fees, forcing them to cut their expense ratios to compete. This became known as the “Vanguard Effect.”

Over the past two years, it hasn’t been Vanguard playing this role. Instead, bond ETF markets have been rattled by the “Schwab Effect.” Schwab added municipal-bond and high-yield bond ETFs that not only gave investors a new low-cost option but also led to fee cuts for investors holding competing ETFs.

Schwab’s approach to product development has long been to provide low-cost, broad access to different markets. It wasn’t until 2022 that it moved into more niche bonds, when Schwab added a muni-bond ETF with a 0.03% fee, undercutting the lowest fee ETF by 2 basis points. In 2023, it launched a high-yield bond ETF with a 0.10% expense ratio that matched the lowest-cost high-yield bond ETF on the market, SPDR Portfolio High Yield Bond ETF SPHY.

State Street didn’t appear to take kindly to the new competition. SCYB launched on July 11, and by Aug. 1, State Street had already cut SPHY’s fee to 0.05%. But Schwab didn’t back down. On Sept. 25, Schwab responded by cutting its two-month-old ETF’s fee to 0.03% from 0.10%. The response by asset managers didn’t stop there. On Nov. 28, iShares cut the fee for iShares Broad USD High Yield Corporate Bond ETF USHY to 0.08% from 0.15%. Two days later, Xtrackers dropped Xtrackers USD High-Yield Corporate Bond ETF’s HYLB fee 10 basis point to 0.05%.

Schwab sparked a fee war in high-yield bond ETFs that benefited not only new investors of SCYB but also those already holding SPHY, USHY, and HYLB. These fee cuts should save investors over $10 million next year alone.

By playing the role of agitator while offering rock-solid performance, Schwab has cemented itself as the Dennis Rodman of fixed-income ETFs. Here are the other ETFs we considered for best new ETF:

Honorable mentions for best new ETFs of 2023

- T. Rowe Price Capital Appreciation Equity ETF TCAF

- Dimensional World Equity ETF DFAW

- iShares J.P. Morgan Broad USD Emerging Markets Bond ETF BEMB

Worst New ETFs of 2023

Investing is a marathon, but investors can grow impatient and try to get rich quickly. Many of the competitors for worst new ETF try to help investors scratch that gambling itch. Some asset managers seek out volatility in the hopes of a big swing that captures investors’ attention. Others try to capture trends by offering unsound strategies marketed to less-savvy investors.

This year’s winners of worst new ETFs tap into derivatives, a sandbox best left to the pros to play in. The potential outcomes for derivatives are not always obvious. And concentrated risk, leverage, and high fees are all a recipe for disaster in the long run.

Worst new ETFs of 2023

- 2x Bitcoin Strategy ETF BITX

- YieldMax AI Option Income Strategy ETF AIYY

Why We’re Skeptical of BITX: Back to the Bitcoin Casino

One of last year’s winners for worst new ETF was ProShares Short Bitcoin Strategy ETF BITI. The reasoning was that ProShares was playing bookie, trying to force a referendum on bitcoin by enticing investors to go long or short. This year’s winner of worst new ETF, 2x Bitcoin Strategy ETF BITX, has the potential to be far more destructive.

Bitcoin is highly volatile even without leverage. BITX takes volatility to the extreme. Since launching in June 2023, BITX has already experienced a 40% drawdown and rallied to a 70% gain. Investors may see the large return and think they can play this ETF right, but timing markets is extremely difficult. And there’s more to leveraged ETFs than meets the eye.

These ETFs reset their leverage daily to provide 2 times returns for the next trading day. That means they must add leverage when bitcoin moves higher and remove leverage when its price falls. In choppy markets, that means lots of buying high and selling low. Over the long term, performance will look far worse than a continuous 2 times exposure to the price of bitcoin. And it comes with a prohibitive 1.85% fee. Investors don’t need to take a stand on bitcoin, but there are better options if they do.

Why We’re Skeptical of AIYY: Chasing Not One, but Two Terrible Trends

Leveraged and inverse single-stock ETFs are a terrible idea. Betting on single stocks stacks the odds against long-term success. Adding leverage or inverse exposure with a high fee is even worse. Still, investors looking for a lottery ticket have found their way into these types of ETFs.

Another trend that has captivated investors are covered-call strategies. These strategies start with a long position in something like the S&P 500, then sell a call option against it, setting an upside cap on performance while generating income.

YieldMax merged these two trends into a single-stock covered-call ETF—a strategy that few could ever need. In keeping with the trendiness of the ETF, YieldMax launched this strategy for many of the trendiest, most volatile stocks and funds on the market. Think Tesla TSLA, Nvidia NVDA, and Apple AAPL. Does it make sense to target some of the most popular stocks? For YieldMax, of course it does. Are those stocks the best suited for a covered-call strategy? Perhaps not. But at least they are among the biggest, most liquid stocks on the market, making the strategy easy to execute.

But, on its face, no ETF has targeted more trends in a single fund than YieldMax AI Option Income Strategy ETF. Everyone has wanted AI exposure this year. The only problem is that AI does not stand for artificial intelligence in this instance. AI is the ticker for C3.ai stock, which is a company working on artificial intelligence, so at least that’s aligned with expectations. But it’s a highly unprofitable small-cap stock with under $300 million in revenue and a $3 billion market cap. This is not a great candidate for a single-stock covered-call strategy, leaving YieldMax’s use of this stock for this strategy misleading, at best.

Honorable mentions for worst new ETFs of 2023

- Long/Inverse Jim Cramer ETFs LJIM/SJIM

- Roundhill Magnificent Seven ETF MAGS

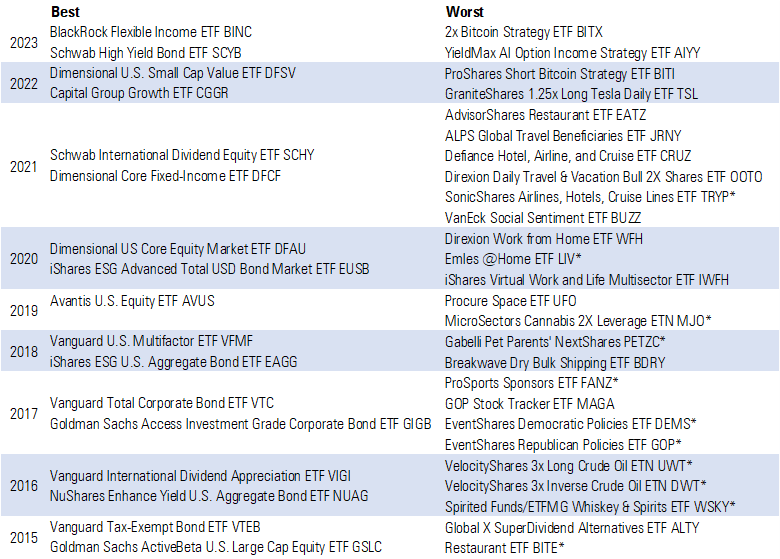

The Best and Worst New ETFs Since 2015

The author or authors own shares in one or more securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/d10o6nnig0wrdw.cloudfront.net/05-31-2024/t_68607a5db29e471d8bf1a155ea356f7c_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/3WXR46JX6VF2HMOMAWQGCO67DM.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)