How to Find Gun Stocks in Your Fund Portfolios

Some steps that you can take to analyze your exposure to gun manufacturers.

Editor's Note

The first version of this article ran on March 1, 2018. It was updated on Aug. 8, 2019, and again on March 31, 2021, each time in the aftermath of mass shootings.

It is unfortunate that we keep having to update this article. But here we are.

Following the most recent mass murders by gunmen targeting Black people doing their grocery shopping in Buffalo, New York, and little children finishing up their school year in Uvalde, Texas, many investors may want to know whether they are exposed to guns—either manufacturers or companies that sell guns—in their mutual fund holdings.

Chances are, you do have some exposure to guns in your fund portfolios. For most investors, however, that exposure is almost sure to be minimal.

If you are one of those concerned about your exposure to stocks tied to guns in your portfolio, here are some steps you can take to analyze your exposure and to take action to mitigate it or eliminate it altogether.

Large Retailers Have Reduced Their Sales of Guns and Ammunition

In large-cap funds, you may hold a company that sells guns, namely Walmart WMT, the nation's largest retailer. The stock is a top 30 holding in the S&P 500 at a weighting of about 0.6%.

However, since a mass shooting at a Walmart store in El Paso, Texas, in 2019, the company now only sells firearms and ammunition used for hunting. It has stopped selling handguns and has not sold assault rifles since 2015. Walmart also raised the age limit to purchase a firearm or ammunition to 21 and requires more-aggressive background checks than required by law.

If you own a mid-cap fund, you may own another gun retailer, Dick's Sporting Goods DKS. Its stock is held in the S&P MidCap 400 Index at a weighting of about 0.22%. Like Walmart, Dick's has been making changes. After the mass shooting at Marjory Stoneman Douglas High School in Parkland, Florida, in 2018, the company stopped selling assault weapons and has been gradually eliminating the sale of all firearms at most of its stores.

For both Walmart and Dick’s Sporting Goods, gun sales make up less than 5% of their total revenue, according to Morningstar Sustainalytics.

Which Public Companies in the U.S. Manufacture Guns?

There are two publicly traded gunmakers in the United States: Sturm Ruger RGR and Smith & Wesson Brands SWBI. With market capitalizations of $1.2 billion and $679 million, respectively, the two are considered to be small-cap stocks. Not long ago there was a third, Vista Outdoor VSTO. Vista sold off its Savage Arms gun manufacturing division to private buyers in 2018, although it remains in the ammunition manufacturing business.

Sturm Ruger is held in the Russell 2000 Index at a weighting of 0.05%. The smaller Smith & Wesson merits a 0.03% weighting in the Russell 2000 Index.

Do You Own Either Gunmaker in Your Fund Portfolios?

If you own a small-cap index fund, an extended market index fund (which focuses on small- and mid-cap stocks), or a total market index fund, you likely have exposure to Sturm Ruger and Smith & Wesson. By my estimate, nearly $800 billion in assets reside in these types of index funds.

Additionally, if you own a target-date fund consisting of underlying index funds in your 401(k) plan, chances are you have exposure to these gun stocks. Quantitatively driven dividend-focused funds may also hold Sturm Ruger and Smith & Wesson.

On the other hand, if you own an actively managed small-cap fund, you probably have no exposure to guns. Few of these 450 or so funds, representing approximately $347 billion in assets, own either gunmaker.

To quickly find out any fund's gun exposure, you can consult a website called Gun Free Funds, maintained by As You Sow, a nonprofit shareholder advocacy group, and partially powered by Morningstar. Simply input a fund name and get the fund's exposure to gun manufacturers and major gun retailers, along with replacement recommendations for those funds with exposure to guns.

If You Do Have Exposure to Either Gunmaker, Is It Material to Your Investment Returns?

Not likely. If you hold a small-cap index fund, Sturm Ruger and Smith & Wesson take up only about 0.1% of assets, hardly enough to materially affect performance one way or another.

To illustrate, let's take a look at how these two stocks would have affected the returns of iShares Russell 2000 ETF IWM over the past three years. Through March 2022, the fund posted a 11.6% three-year annualized gain. Both Sturm Ruger and Smith & Wesson outperformed the overall fund, gaining 15.1% and 27.3% annualized, respectively. By my estimate, those gains increased the index fund's returns by about 0.02% on an annualized basis during the past three years.

Given the de minimis impact on investment returns, most small-cap index investors can rest easy knowing they are not invested in guns to a degree that affects their investment return.

With So Little Exposure to Guns in My Portfolio, Is It Worth It to Take Steps to Exclude Guns Altogether?

That’s a question for each investor to answer. It may be enough to know that an exceedingly small portion of your investment return comes from your indirect investment in gunmakers via funds.

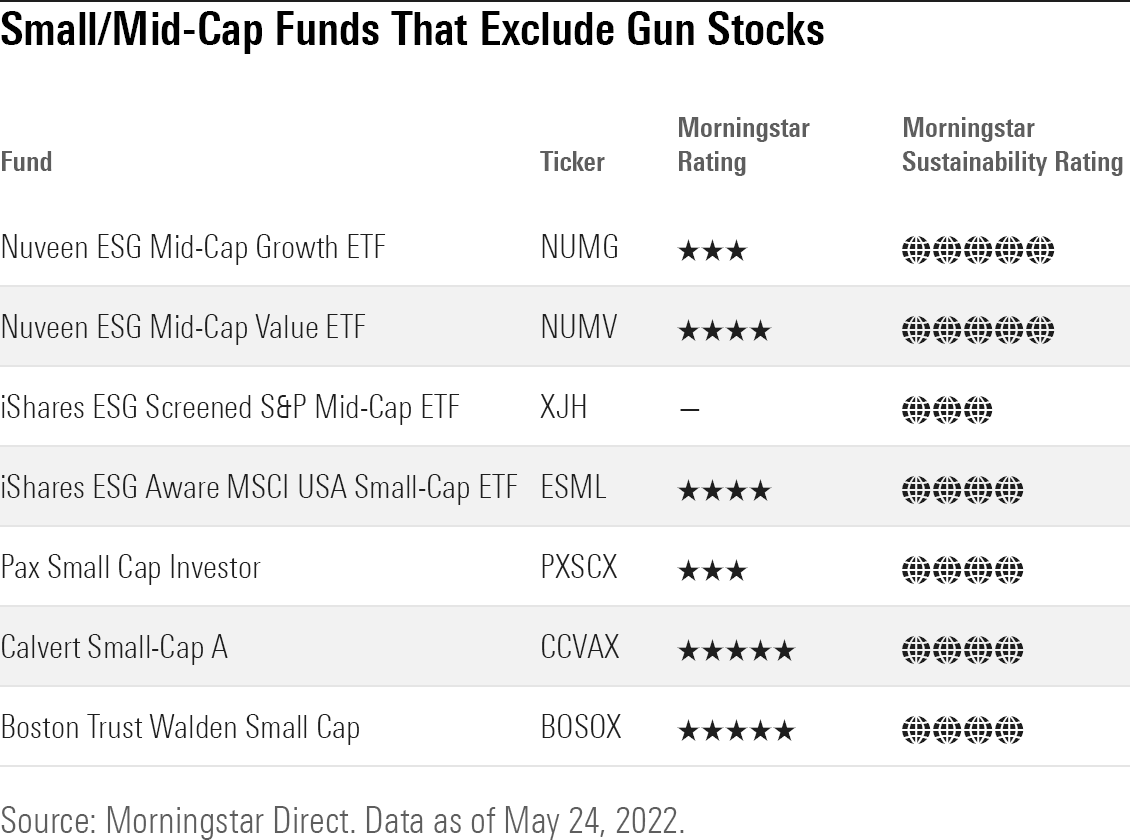

If you want to avoid guns completely, on principle, it’s not hard to invest that way. You can do this by investing in a fund that avoids guns as a matter of investment policy. Around 300 funds exclude guns. (Morningstar Direct users can screen for these funds.) I’ve listed several of these in the following table:

These are some of the funds that exclude producers and retailers of civilian firearms. They also have a broader focus on investing in companies that manage their environmental, social, and governance risks well.

For example, investors might consider iShares ESG Aware MSCI USA Small-Cap ETF ESML. Launched in the aftermath of the 2018 Parkland mass shooting, this passive fund avoids guns, controversial weapons, and tobacco and optimizes the rest of the portfolio to maximize exposure to companies with higher ESG ratings, while broadly maintaining the risk and return characteristics of a conventional small-cap index. It has a competitive expense ratio of 0.17%.

Through March, the fund gained 14.3% annualized over the trailing three years. By comparison, IWM, as discussed above, gained 11.6% annualized during the same period.

Bottom line: It is easier than ever to align your portfolio with your values. When a lot of investors do so, it sends a broader message to asset managers and public companies. It also ties you more closely to your investments, making it more likely that you will stay the course during bad markets and focus on the long term.

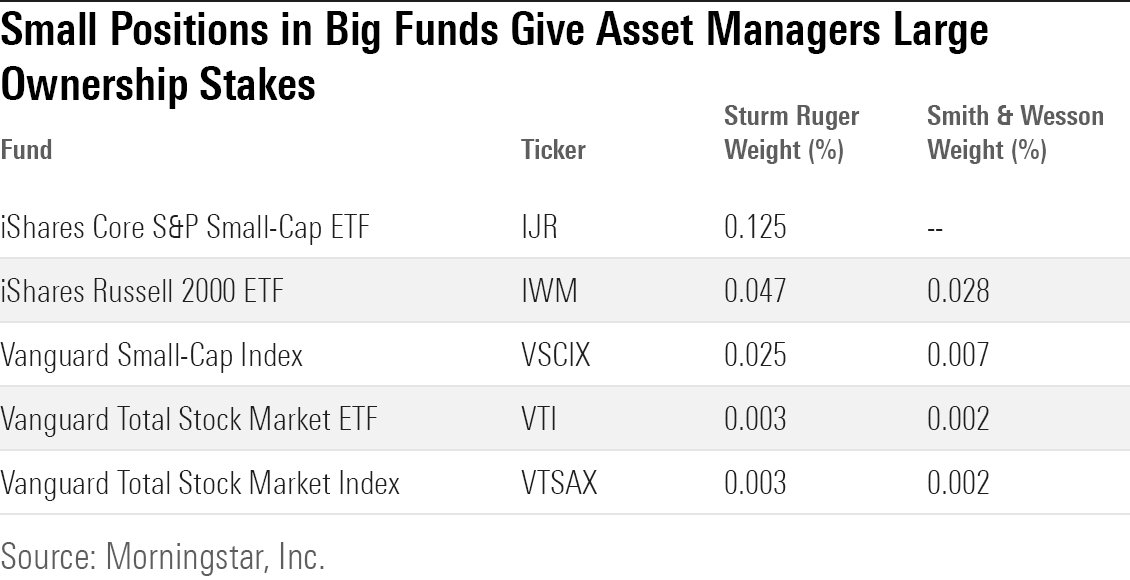

Small Positions in Large Funds Equals Major Ownership Stakes for Asset Managers

Because index funds have so many assets under management, even though they hold very small positions in these two stocks, their tiny positions equate to the fund company holding a lot of the firms' outstanding shares. The next table shows the index funds that hold the largest number of shares in Sturm Ruger and Smith & Wesson Brands. Even though Sturm Ruger is only a 0.125% position in iShares Core S&P Small-Cap ETF IJR, the fund holds 7% of Sturm Ruger's outstanding stock.

Is My Asset Manager Engaging With Gunmakers and Other Companies It Owns?

If you own a fund from Vanguard or BlackRock BLK (including iShares), or any large fund company, regardless of whether they limit investment in guns, you should expect them to be actively meeting with many of the companies they own to discuss issues that may affect long-term shareholder value. This is a process called engagement, which is aimed at helping companies understand the issues that are important to their investors.

The giant asset managers that manage index funds, like BlackRock and Vanguard, not only are among the largest shareholders of most public companies, but as long-term permanent investors, they also have a stake in maintaining and strengthening the broader social systems within which they invest.

Over the long run, their investors stand to benefit because healthy systems create the conditions for better investment returns. Thus, their engagement activities should include systemic issues that affect subject companies materially and that the companies can play a role in helping address more broadly. The misuse of guns has spillover costs on many other companies that asset managers hold in their portfolios, as well as on society at large.

Significant engagement with gunmakers, gun retailers, and banks and credit card companies that finance gun purchases at this point should be an obligation.

Shareholders will have their say in two proxy votes that are coming up related to guns. (Proxy voting simply means voting on a slate of proposals and on issues such as executive compensation at the company’s annual meeting. It’s important for shareholders to know what’s on the proxy ballot, so they can use their voice to effect the change they’d like to see.)

At Sturm Ruger’s June 1 annual meeting, shareholders will vote on a proposal by asset owner CommonSpirit Health, a Catholic-aligned nonprofit health system, asking the board to conduct a third-party assessment about the human rights impacts of its policies and products. The resolution is aimed at forcing the company to curb misuse of its firearms and to “take concrete steps to remediate adverse impacts.” CommonSpirit notes that companies “have a responsibility to respect human rights within their operations and throughout their value chains,” adding, “the inherent lethality of firearms exposes all gunmakers to elevated human rights risks. In selling its firearms to civilians, Ruger assumes they will be used safely, and while that is mainly the case, the grave threat for product misuse and resulting harm to society is not accounted for in Ruger’s governance structures or in policies or practices that would mitigate this threat.”

In 2019, in response to a shareholder proposal that achieved majority support, Sturm Ruger published a report on its measures to address gun safety, but the report, according to CommonSpirit Health, “failed to put forward meaningful solutions to address gun violence. Moreover, the report did not assess or address the company’s human rights risks.”

At its annual meeting set for June 21, Mastercard MA faces a resolution proposed by the Employees' Retirement System of Rhode Island that the company report on how it intends "to reduce the risk associated with the processing of payments involving its cards and/or its electronic payment system services" for sales of so-called "buy, build, shoot" guns made from kits, also known as "ghost guns." The resolution notes that from 2016 through 2020, nearly 24,000 suspected ghost guns were recovered by law enforcement from crime scenes, including 325 homicides or attempted homicides, including students killed during mass school shootings.

Sturm Ruger and Mastercard recommend voting against the proposals.

To find out the extent to which the asset-management firms that run your funds are engaging with companies on guns and other issues, take a look at their shareholder engagement reports. If you can’t find one, that’s an indicator they may not be doing much.

Jon Hale has been researching the fund industry since 1995. He is Morningstar’s director of ESG research for the Americas and a member of Morningstar’s investment research department. While Morningstar typically agrees with the views Jon expresses on ESG matters, they represent his own views.

/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EBTIDAIWWBBUZKXEEGCDYHQFDU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IJKB5DGDNJFLPP6SBNF27R3UEA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PJQ2TFVCOFACVODYK7FJ2Q3J2U.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/42c1ea94-d6c0-4bf1-a767-7f56026627df.jpg)