Tax-Deferred Retirement-Saver Portfolios for Mutual Fund Investors

These portfolios are geared toward the tax-deferred accounts of people who are still working and saving.

When it comes to saving and investing for retirement, less is more. The keys to success are setting a decent savings rate and investing the funds in a straightforward, low-cost portfolio.

We can’t help you with the first objective—saving—but we can help with the second. This series of model portfolios is geared toward still-working people who are building up their retirement nest eggs within the confines of tax-sheltered accounts—for example, an IRA or 401(k). In other words, the portfolios don’t aim to limit income or capital gains distributions because investors in those types of accounts aren’t subject to taxes unless they take funds out of their accounts.

About the Portfolios

I’ve used the Morningstar Lifetime Allocation Indexes to inform the portfolios’ asset allocations and the exposures to subasset classes. To populate the portfolios, I employed no-load, open mutual funds that have Morningstar Medalist Ratings of Gold, Silver, or Bronze. Most of the funds earn Medalist Ratings of Gold, though I’ve used Silver- and Bronze-rated funds in cases when suitable Gold-rated, no-load options that are accepting new investments are unavailable. I also assumed that an investor isn’t wedded to a single brokerage or fund-company platform. In reality, that’s rarely the case, so investors interested in crafting a portfolio along the lines of this one will want to aim for funds that give them similar exposures. I’ve also created fund-family-specific portfolios for Vanguard, Fidelity, T. Rowe Price, and Schwab supermarket investors.

How to Use Them

My key goal with these portfolios is to depict sound asset-allocation and portfolio-management principles rather than to shoot out the lights with performance. That means that investors can use them to help size up their own portfolios’ asset allocations and suballocations. Alternatively, investors can use the portfolios as a source of ideas in building out their own portfolios. As with the Bucket portfolios, I’ll employ a strategic (that is, long-term and hands-off) approach to asset allocation; I’ll make changes to the holdings only when individual holdings encounter fundamental problems or changes, or if they are no longer highly rated.

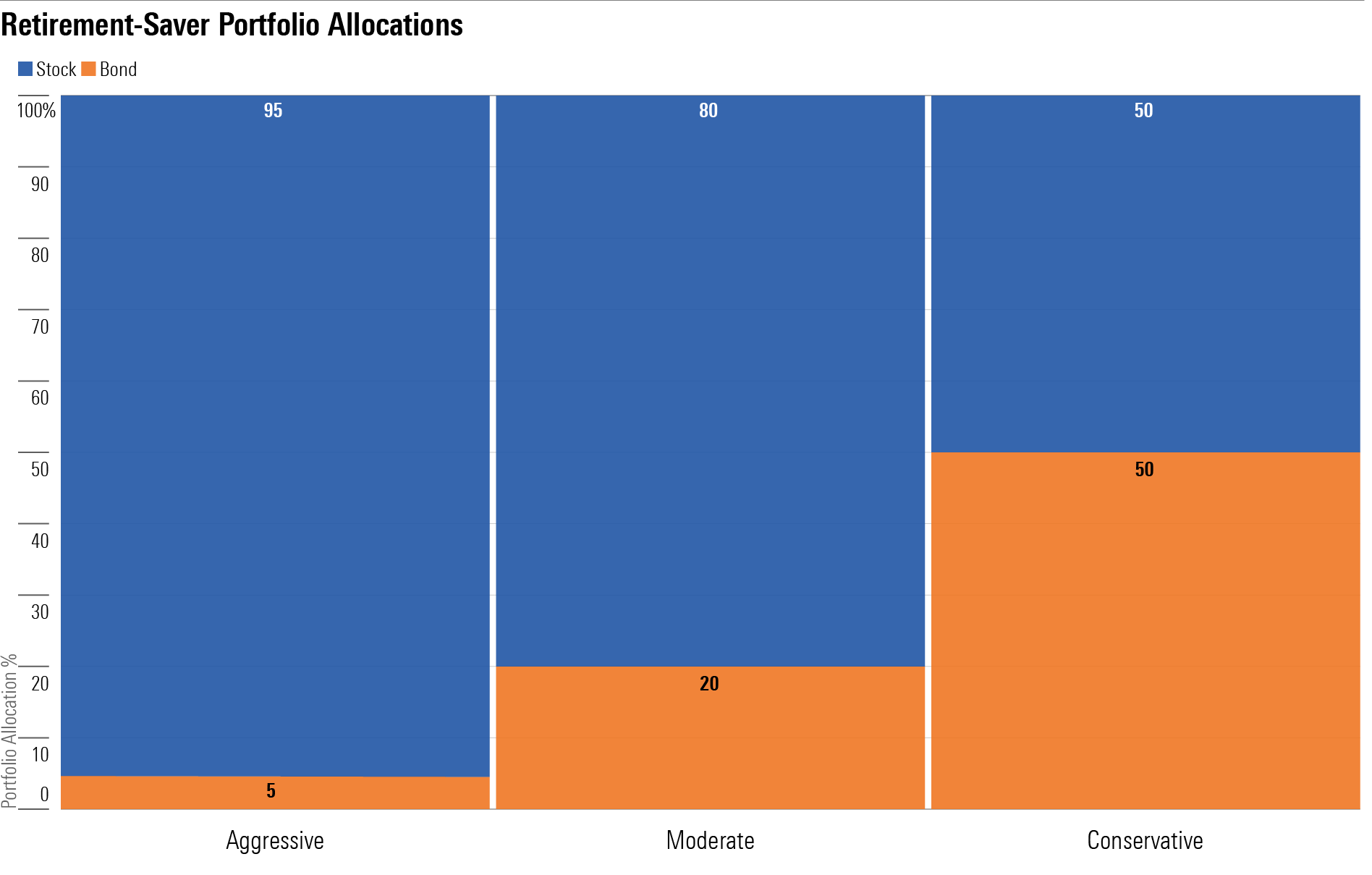

The portfolios vary in their amounts of stock exposure and in turn their risk levels. The Aggressive portfolio is geared toward someone with many years until retirement and a high tolerance/capacity for short-term volatility. The Conservative portfolio is geared toward people who are just a few years shy of retirement. The Moderate portfolio falls between the two in terms of its risk/return potential.

The portfolios are geared toward investors’ tax-sheltered accounts, so I didn’t consider the holdings’ tax efficiency when populating the portfolios.

Aggressive Tax-Deferred Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 35-40 years

Risk Tolerance/Capacity: High

Target Stock/Bond Mix: 95/5

- 20%: Primecap Odyssey Growth POGRX

- 20%: Oakmark OAKMX

- 15%: Vanguard Extended Market Index VEXAX

- 33%: Vanguard Total International Stock Index VTIAX

- 7%: Oakmark International Small Cap OAKEX

- 5%: Metropolitan West Total Return Bond MWTRX

Moderate Tax-Deferred Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 20-25 years

Risk Tolerance/Capacity: Moderate

Target Stock/Bond Mix: 80/20

- 12%: Primecap Odyssey Growth

- 13%: Vanguard Dividend Appreciation Index VDADX

- 13%: Oakmark

- 10%: Vanguard Extended Market Index

- 27%: Vanguard Total International Stock Index

- 5%: Oakmark International Small Cap

- 20%: Metropolitan West Total Return Bond

Conservative Tax-Deferred Retirement-Saver Portfolio for Mutual Fund Investors

Anticipated Time Horizon to Retirement: 2-5 years

Risk Tolerance/Capacity: Low

Target Stock/Bond Mix: 50/50

- 10%: Primecap Odyssey Growth

- 10%: Vanguard Dividend Appreciation Index

- 10%: Oakmark

- 5%: Vanguard Extended Market Index

- 10%: Vanguard Total International Stock Index

- 5%: Oakmark International Small Cap

- 30%: Metropolitan West Total Return Bond

- 10%: Fidelity Short-Term Bond FSHBX

- 10%: Vanguard Short-Term Inflation-Protected Securities Index VTAPX

A version of this article was published on March 3, 2023.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZOMUI7V4LVD37GYFMSENZFH3GM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HCVXKY35QNVZ4AHAWI2N4JWONA.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/EC7LK4HAG4BRKAYRRDWZ2NF3TY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/66112c3a-1edc-4f2a-ad8e-317f22d64dd3.jpg)