Markets Brief: The February CPI Report Holds the Key to the Fed’s Next Move

What to look for as forecasts call for another hot reading on inflation.

Check out our weekly markets recap at the bottom of this article.

After another strong jobs report left the Federal Reserve on track for more interest-rate increases, attention turns to the Consumer Price Index report for February, which is set to release Tuesday, for the clues on just how big the next hike will be.

Economists’ CPI forecasts are calling for another hot reading on inflation. Whether that comes to pass could set the tone for stock and bond markets, which have been volatile in recent weeks as expectations for the Fed keeping rates higher for longer have been solidified.

“Tuesday’s inflation data will be the make-or-break on whether the Fed will raise rates by a quarter-point or a half-point at their next meeting on March 22,” says Kevin Cummins, chief U.S. economist at NatWest. The current federal-funds rate target range is 4.50% to 4.75%.

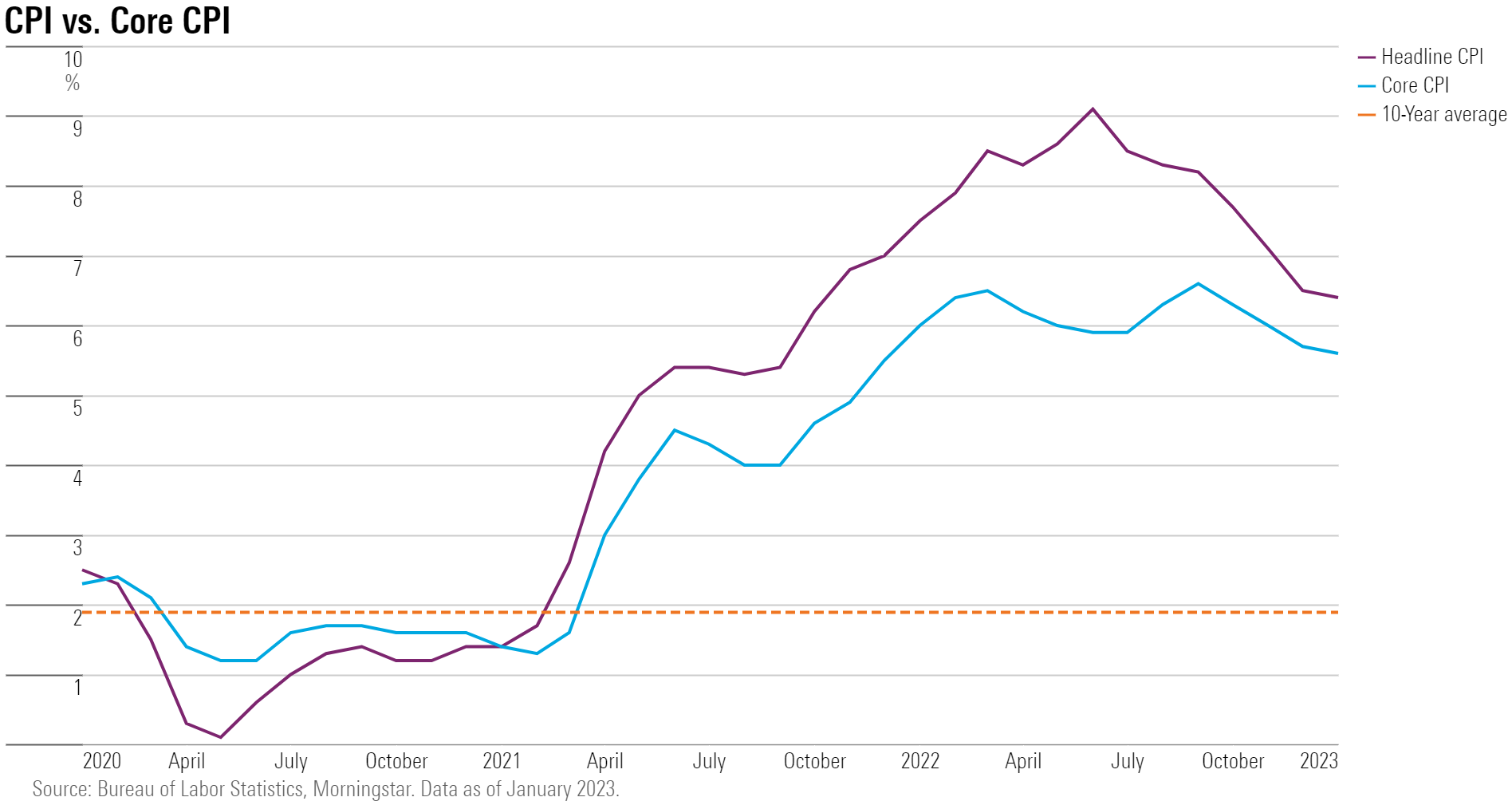

Lately, the inflation picture has shown prices rising faster than the Fed would like, according to Cummins. The belief at the end of last year was that price pressures were finally starting to cool. But a scorching January CPI reading—and upward revisions to 2022′s inflation data—showed that sticky inflation is back. “If anything, inflation is going in the wrong direction,” Cummins says.

However, a potential half-point increase in the federal-funds rate later this month isn’t guaranteed. “It really depends on the data between now and the next Fed meeting,” Cummins says.

Other economists’ CPI forecasts also call for another month of fast-rising prices. “Tuesday’s CPI report will likely show that prices are resistant and sticky,” says Jose Torres, senior economist at Interactive Brokers. “The Fed still has a lot of work to do, not only in their rate hikes but also their tone to signal to the market that they won’t let up.”

Forecasts for the February CPI report show no signs of a slowdown in prices, according to FactSet. The CPI is forecast to rise 0.4% for the month after a rise of 0.5% in January. So-called core CPI, which excludes volatile food and energy costs, is expected to rise 0.4% for the third month in a row, according to FactSet’s consensus forecasts.

February CPI Report Forecasts

- The CPI is forecast to rise 0.4% for the month versus 0.5% in January, according to FactSet.

- Core CPI (which excludes food and energy) is forecast to rise 0.4% for the month after rising 0.4% in January.

- The CPI, year over year, is forecast to rise 6.0% versus 6.4% in January.

- Core CPI, year over year, is forecast to rise 5.5% versus 5.6% in January.

Torres maintains a February CPI forecast slightly above consensus: He’s projecting headline CPI to rise 0.6% month over month and 6.3% from year-ago levels. For core CPI, Torres expects a February rise of 0.5% from month-ago levels and 5.6% from year-ago levels.

The forecasts of NatWest’s Cummins fall more in line with consensus. He expects headline CPI to rise of 0.4% month over month and 6.1% year-over-year for February. In terms of core CPI, his expectations are for a 0.4% increase month over month and a 5.5% increase from year-ago levels.

“I wouldn’t pound the table that the Fed is definitely going to go 50 points at the meeting,” Cummins says. “The details of the report matter.”

Here’s where to look within the February CPI Report:

Services Inflation in the CPI Report

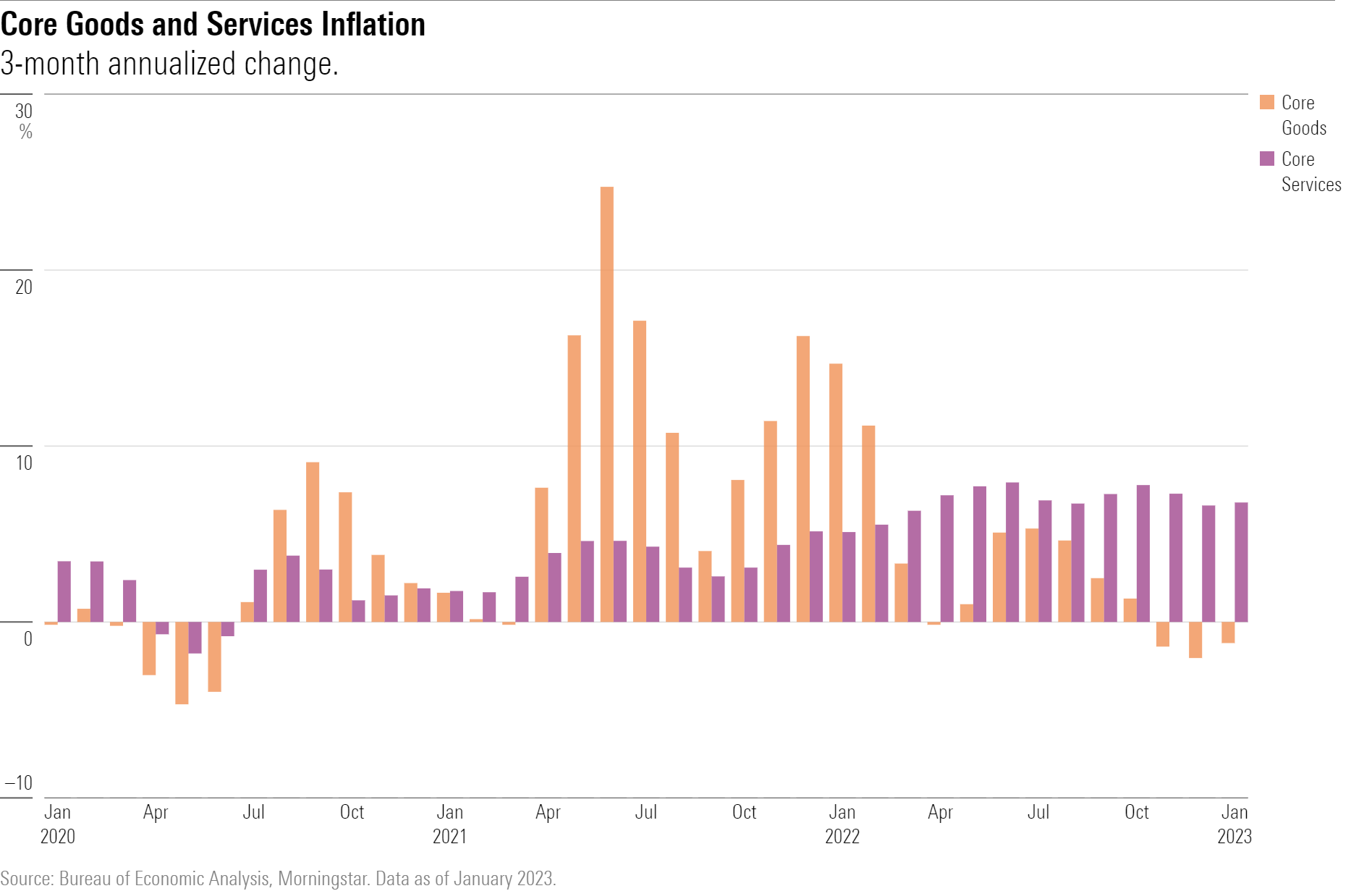

“The services components of inflation will give us the best view of the overall trends,” says Torres from Interactive Brokers.

According to Torres, core services prices—excluding housing—will remain sticky even after goods and commodities prices come down. “Services are going to be the problem for a while,” he says, as they are driven by the tight labor market and labor shortages. “Workers are starting to expect higher wages—they want to pay for things that now cost so much.”

Torres is keeping an eye on core nonhousing services, including recreation, restaurants, and healthcare.

Core Goods Inflation Could Be Bumpy

“For this month, my number-one focus is actually on goods prices,” says Torres. He is expecting core goods prices, especially new and used cars, to have risen over the month. “Slower interest-rate rises during the month of February will have allowed goods inflation to rear its head and come back.” Interest rates directly affect consumers’ purchasing power on big ticket items like cars and mortgages, according to Torres.

He also notes that food prices are still rising, and commodities are still a problem. “Goods are reaccelerating even while services prices remain a problem,” he says. “The Fed still has a lot of work to do, especially in the tone it uses with the markets. We can’t claim victory too soon.”

The Fed May Raise Rates Higher for Longer

“[Fed Chair Jerome] Powell’s latest comments have opened the door to the possibility of a 50-point rate hike later this month,” NatWest’s Cummins says, “and now markets are starting to assume that that’s the base case.”

The market’s expectations for the federal-funds effective rate at the Fed’s upcoming March 22 meeting are roughly split between a quarter-point and half-point rise: 55% of the market sees the rate rising by 0.25 percentage points in March, while 45% expects the Fed to issue a stronger 0.50-percentage-point hike, according to the CME FedWatch Tool. Just a week ago, only 28% of market participants expected the Fed to issue a 0.50-percentage-point hike.

And for longer-term expectations, the majority of market participants see the federal-funds rate reaching an upper limit of 5.50% at the Federal Open Market Committee meeting in June and holding steady until falling back to an upper limit of 5.25% in November. About a month ago, most expected the rate to reach an upper limit of just 5.25% and drop to 5.00% in the fall.

Events Scheduled for the Coming Week

- Tuesday: February Consumer Price Index Report.

- Wednesday: Adobe ADBE and BMW BMWYY report earnings.

- Thursday: FedEx FDX, Dollar General DG, and Williams-Sonoma WSM report earnings.

- Friday: XPeng XPEV reports earnings.

For the Trading Week Ended March 10

The Morningstar US Market Index fell 5.0%.

All 11 stock sectors were down. The worst-performing sectors were financial services and basic materials with declines of about 8.2%.

Yields on 10-year U.S. Treasuries fell to 3.70% from 3.97%.

West Texas Intermediate crude prices fell 3.8% to $76.68 per barrel.

Of the 843 U.S.-listed companies covered by Morningstar, only 40, or about 5%, were up, and 803, or about 95%, declined.

What Stocks Are Up?

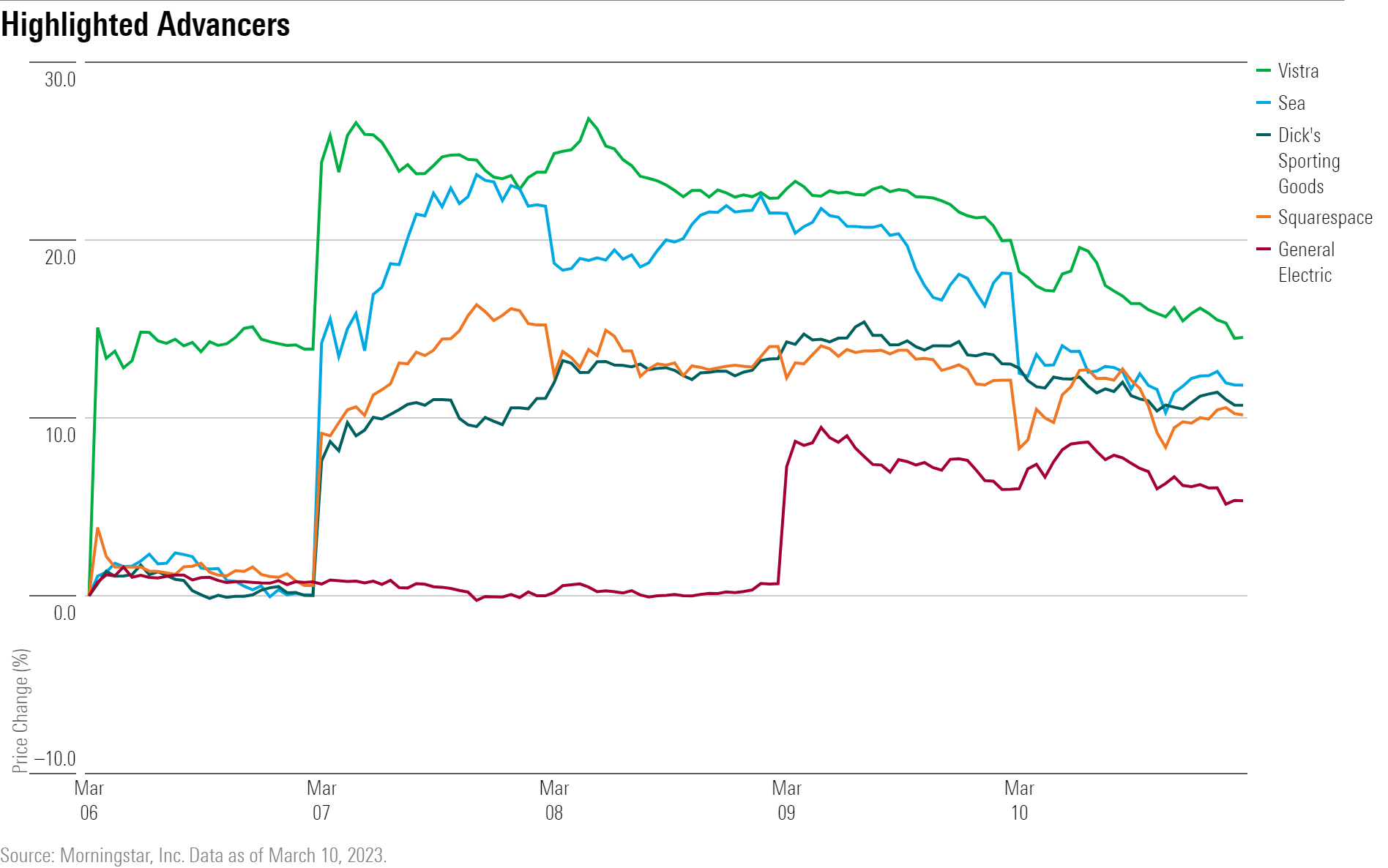

Utilities firm Vistra VST saw its stock rally after the company announced that it was acquiring privately held energy producer Energy Harbor in an estimated $5.7 billion deal.

“The transaction effectively ringfences Vistra’s nuclear energy, renewable energy, energy storage, and retail energy businesses from its legacy fossil fuel generation,” says Morningstar strategist Travis Miller. “This is the approach that some European utilities took during the past decade with good success.”

The company also announced a restructuring that would split it into two stand-alone businesses, which could set up the possibility that Vistra may sell its fossil fuel generation assets in the future, says Miller. Vistra’s fair value estimate was increased by $1 to $24 per share following the news.

The shares of Singapore-based e-commerce giant Sea SE jumped after the firm posted fourth-quarter earnings of $1.01 per share versus FactSet estimates of a $0.64 loss per share. Revenue also came in at $3.45 billion, exceeding expectations of $3.05 billion. However, Morningstar senior analyst Kai Wang maintained the company’s fair value estimate of $70 per share. “While we found its recent profitability encouraging, supported by its 22% share price surge on March 7, the day of earnings—and while the market may enjoy the strategic shift toward profitability—we believe the long-term revenue growth trajectory should now decelerate significantly, leading to a lower valuation despite higher margins,” he says.

Dick’s Sporting Goods DKS saw its stock rise after reporting strong fourth-quarter results. Same-store sales rose 5.3%, ahead of Morningstar senior analyst David Swartz’s forecast of 0.5% growth. The sporting retailer reported earnings per share of $2.93, beating FactSet estimates of $2.88. Revenue also came in higher at $3.60 billion versus estimates of $3.45 billion. Swartz expects to raise his fair value estimate of $82 per share by a high-single-digit percentage.

Website-building software firm Squarespace SQSP surged after it posted revenue growth of 11% year over year for its fourth quarter. Morningstar analyst Emma Williams raised Squarespace’s fair value estimate to $19.60 from $17.00 partially owing to “more resilience to macroeconomic challenges in the near term than previously anticipated.”

Shares of General Electric GE also rose after the company hosted an investor meeting where CEO Larry Culp announced that the aerospace business hit 20% operating margins.

What Stocks Are Down?

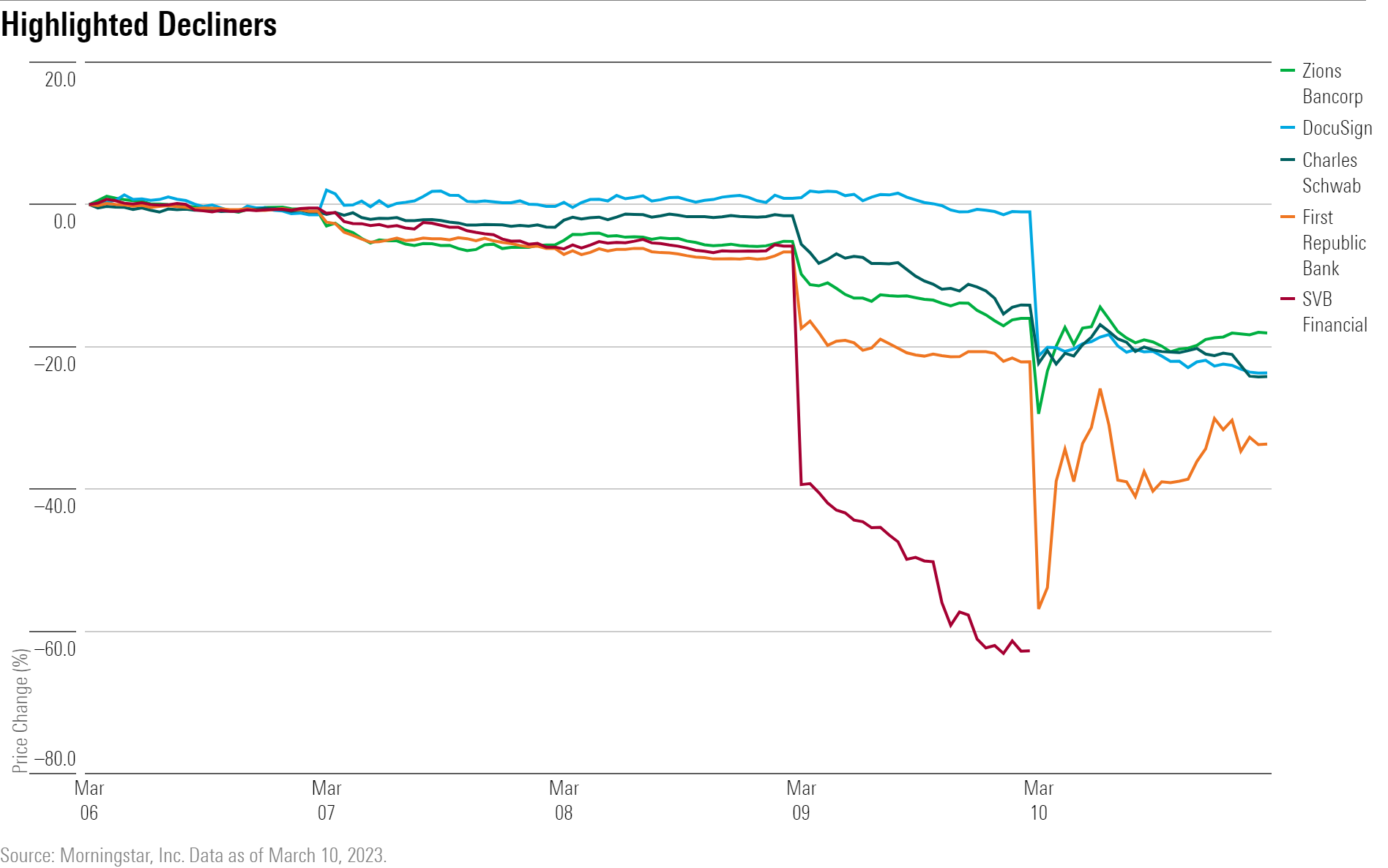

An unveiled liquidity crisis at Silicon Valley Bank SIVB sent shock waves across the market. Worries that a similar liquidity issue could occur at other banks led to losses for the entire industry. First Republic Bank FRC and Zions Bancorp ZION were among the worst hit.

Charles Schwab SCHW stock also fell over liquidity concerns, as the firm, like many banks, has a “material amount of fixed-income securities on its balance sheet with unrealized losses, as recently rising interest rates have decreased the value of fixed-income securities,” says Michael Wong, Morningstar’s financial-services sector director. Wong does not currently have any concerns over the firm’s liquidity or capital levels and maintains his fair value estimate at $87 per share.

DocuSign DOCU stock plunged despite reporting fourth-quarter revenue that exceeded the company’s revenue guidance. “DocuSign continues to see macroeconomic pressures resulting in deal compression and elongated sales cycles. In fact, management noted a slight deterioration in the demand environment,” says Morningstar senior analyst Dan Romanoff. Romanoff maintained his fair value estimate of $72 per share for the firm.

DocuSign also announced that Cynthia Gaylor would be leaving her position as CFO, but she will remain at the firm until the next quarterly earnings announcement.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7WLK3HWLZBFR7NKI45PXWUD6OI.jpg)

/d10o6nnig0wrdw.cloudfront.net/06-10-2024/t_dec034bc4f7c4ce79d00708d5033ef18_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/ba63f047-a5cf-49a2-aa38-61ba5ba0cc9e.jpg)