10 Reasons the Surprise Rally In Japanese Stocks Could Continue

After a 2023 surge, dividends and buybacks could increase.

Editor’s note: This story was first published on January 16, 2024. On February 22, 2024, Japanese equities surged to a record high, with the benchmark Nikkei 225 index breaking through the previous high of 38,915 last achieved on Dec. 29, 1989.

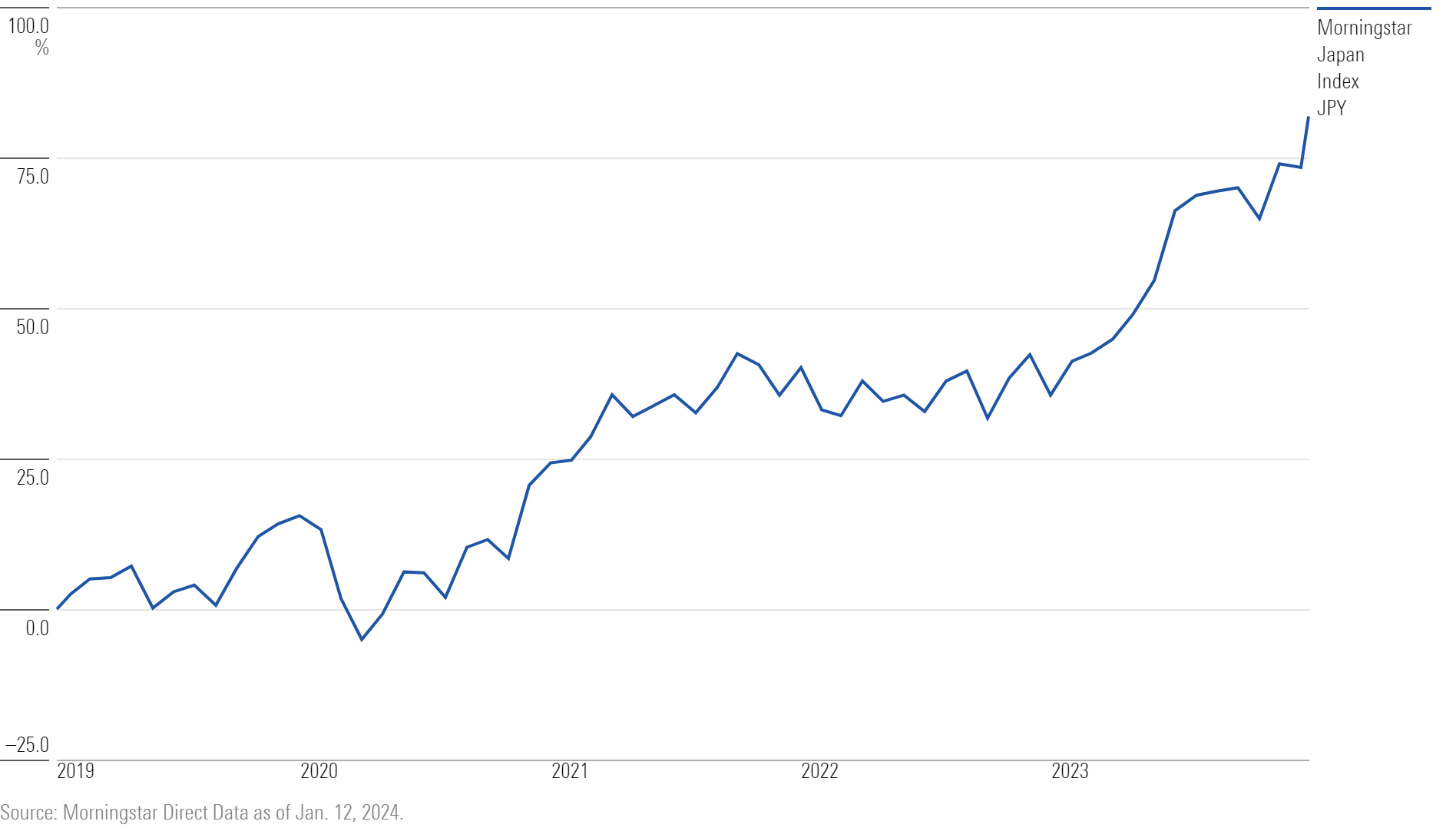

Investing in Japanese stocks has long been considered dead money—until the past year. The main Japanese benchmark index, the Nikkei 225, surged to fresh highs this past week, having rallied 28% in 2023. The question facing investors is whether this surprising rally still has room to run, or if it will turn out to be yet another false dawn for a market that has frustrated investors for decades.

For now, analysts say the signs look good for Japanese stocks to continue to run. Among their reasons:

- The long-sluggish Japanese economy is looking healthier.

- Earnings growth is reasonable.

- Valuations on world-class companies are cheap.

- Dividends and stock buybacks could be on the rise.

“Japan is progressing,” says John Vail, chief global strategist at Nikko Asset Management. “The buybacks are coming in hot and heavy, companies have pricing power, profit margins are still hitting new highs, and valuations are reasonable.”

Alicia Ogawa, founder of Ogawa Japan Advisory, says: “The upshot is that Japanese companies are being held more accountable for financial performance. In a nutshell, there’s a sudden lurch to capitalism.”

Even if Japanese equities settle back to absorb the market’s advance last year, conditions are ripe for further gains for U.S. investors, according to analysts. In 2023, the Nikkei 225′s jump was eroded by the yen’s slide. The Morningstar Japan Index returned 27.9% in yen terms and 19.7% in U.S. dollar terms.

Japan Rising

Investors have been burned by false dawns in Japan before. Consider that the Nikkei 225 stands at 35,619, below the all-time high of 38,915.87 that it set in December 1989. Yet analysts say that this time is different. Credit goes to a market energized by reforms focused on building a more robust equity culture, a reversal out of deflation, a competitive currency, and a changing society. All this comes as valuations are among the cheapest in the developed world and corporate cash could be returned to shareholders.

A Return to Japan’s All-Time High?

Nikko Asset Management forecasts that the Tokyo Price Index, or Topix, will return 10.9% in yen terms and 16.7% in U.S. dollar terms this year. Vail attributes this to the firm’s forecast that the United States and Europe will be slower to cut interest rates than the market expects. By contrast, Nikko expects gains of 2.8% for U.S. equities and 2.3% for global stocks.

Meanwhile, James Rosenwald, founder of Dalton Investments and advisor to the London-listed Nippon Active Value Fund, predicts that in the next three to five years, the Nikkei will regain its all-time high and surge to 50,000.

10 Things Driving the Japanese Stock Market

- Decent growth - For all the challenges of its aging population, Japan’s economy continues to tick along. Nikko Asset Management believes Japan’s economy gained 2.2% in 2023, and that it will expand another 1.1% this year. That contrasts with its estimates of 2.3% growth last year and 1.5% this year for the U.S., 0.5% growth last year and 0.5% this year for the Eurozone, and 5.2% growth last year and 4.8% this year for China. Revenues are growing as well. According to Yardeni Research, analysts on average see revenue growth of 17% in 2023, 2.2% in 2024, and 2.1% in 2025. One reason is rising prices. Headline inflation hit 3.3% in Japan in October, a sea change. The hope is that deflation is in the rearview mirror.

- Earnings growth - Pretax profit margin surged to a record high of just under 7%, versus under 1% in December 1989, when the Nikkei topped at 38,916. Analysts on average see earnings growth of 3.7% for 2023, 11.5% for 2024, and 7.2% for 2025, according to Yardeni. For the five years, they see earnings growth clocking in at 10.3%.

- Cheap stocks - Japan currently trades at 14.4 times forward earnings, versus 19.9 times for the U.S. and 16.4 times for the MSCI All-Country World Index. “Japan has been stuck at 14 times for forever because people didn’t expect it to be a great market,” says Shuntaro Takeuchi, who manages the Japan strategy for Matthews Funds. It’s one reason Berkshire Hathaway BRK.A bolstered its stake in five Japanese trading firms in 2023, helping boost Japanese stocks.

- The tempting prospects of increased buybacks and dividends - Japanese companies have net cash. According to AllianceBernstein, companies representing 53.5% of Japan’s market capitalization had a net cash position on their balance sheets at the end of 2022, compared with 39.4% in the U.S. and 22.8% in the Eurozone. For Topix, net cash accounted for 19.2% of market value, compared with 6.8% in Europe and 3.6% for SPX.

- Investor activism - The number of shareholder proposals is on the rise. In November, shareholders voted overwhelmingly for a buyout of storied conglomerate Toshiba. Last year, Dai Nippon Printing launched a large shareholder buyback program, and Seven & i Holdings (the parent company of 7-Eleven) announced a restructuring after being prodded by activists. Rosenwald says: “Instead of being your enemy, the government wants to see activism, to see global leaders survive and thrive. It feels almost uncomfortable with the government being my friend for the first time.”

- Japanese regulators and investors are pushing for shareholder value - This is making companies more accountable. The Japan Exchange introduced hardcore requirements to remain a listed company, including minimum levels of free float, and shamed companies trading below book value. It also insisted that companies trading below book announce how they plan to do better. Last March, the Tokyo Exchange said just half of its so-called prime listings of liquid stocks trade above book value, “which represents expectations of future value creation.”

- Individual investors are getting lots of encouragement - Japan is boosting how much people can save annually through individual savings accounts, with some tax advantages. Bruce Kirk of Goldman Sachs writes that only 13% of Japan’s 2 quadrillion yen of household assets are in equities, compared with almost 40% of U.S. households.

- The yen is still cheap - This is good for exporters and global investors. Exporters are a large chunk of Japan’s listed companies, and global investors benefit when the yen rises against the currency in which they keep score. At the end of 2023, the yen slid to a multidecade low of around 151 to the dollar from 103 to the dollar in 2020. That’s eased a tad amid expectations that the Bank of Japan could tighten credit this year.

- Foreigners are turning bullish - In September, BlackRock Investment Institute said: “We … now turn more positive, going overweight due to strong earnings, share buybacks, and other shareholder-friendly corporate reforms. Japan is not immune to a global slowdown. Yet we see pieces falling in place ... that underpin our relative preference for Japanese equities on a tactical horizon of 6-12 months.” While that’s creating a bubbly mood, the longer-term prospects remain solid.

- The old order is changing - After grappling with the COVID-19 pandemic, Japan witnessed the U.S. say it wouldn’t send troops to battle Russian forces in Ukraine in 2022. With this came calls for Japan to dramatically increase its defense spending. A year later, former prime minister Shinzo Abe was assassinated. Says Ogawa: “It was a rude awakening. It made Japan suddenly realize they had to stop pretending everything was going to be okay.” Kirk writes that some of today’s reforms look similar to previous proposals, but he adds that Japan “is also responding to two new developments: more challenging geopolitics and the sudden appearance of significant Japanese inflation.”

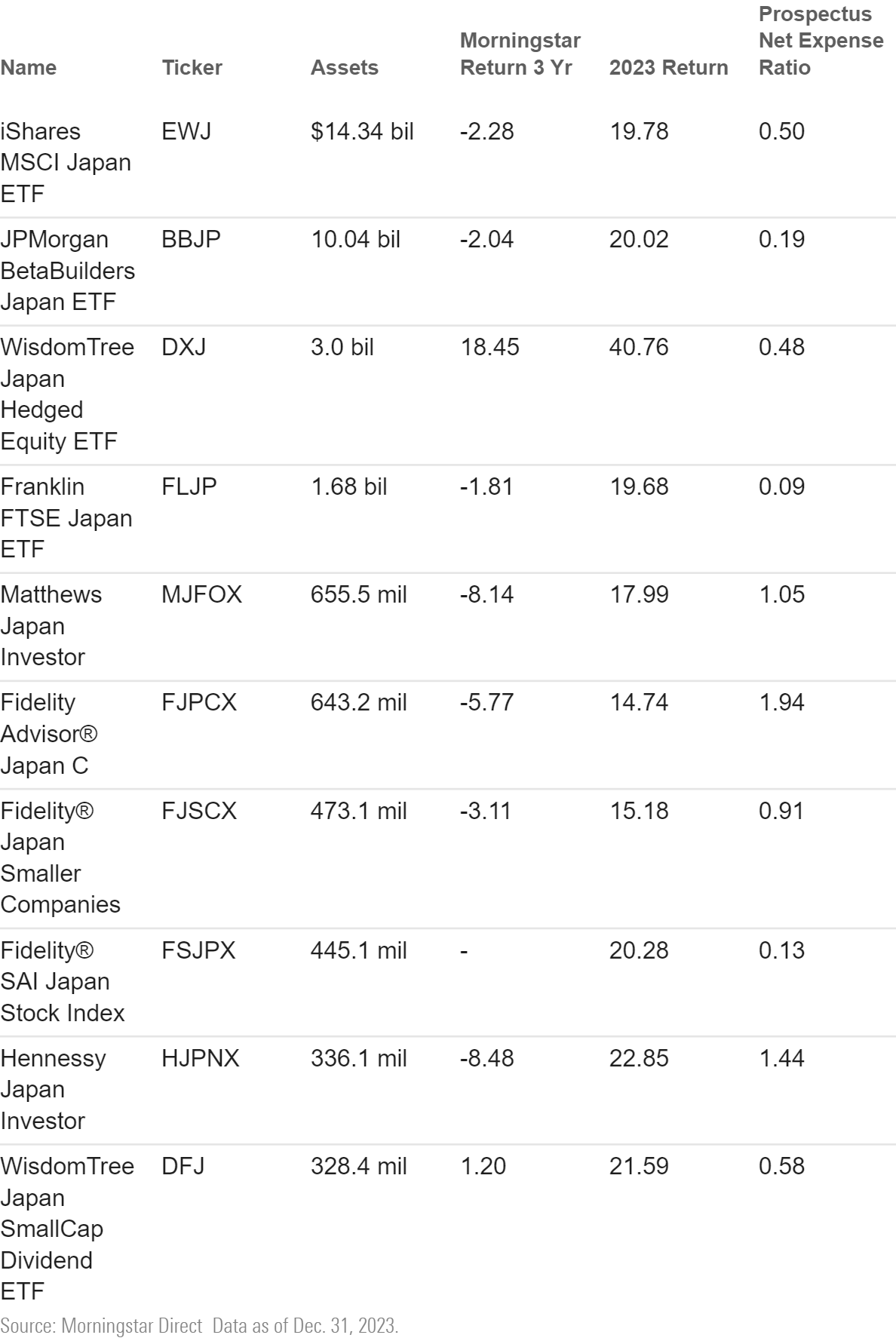

Shopping In Japan

There are of course Japanese mutual funds, both active and passive. You can find a list of the largest in the table below, ranked by size and including their returns for 2023. The average return of the 49 U.S.-registered Japan funds in Morningstar Direct was 17.84% last year. Keep in mind that costs are enemies of returns. The average expense ratio for the group was 0.72%.

The Largest Japan Funds

Want to pick stocks? The great investor Peter Lynch advises that you research companies you’re familiar with, like Sony SONY, Toyota TM, or Nintendo NTDOF. Look at their growth prospects and see if they’re cheap. Check Morningstar.com to see where prices stand vis-a-vis their fair values. For a list of large Japanese companies that Japan’s exchange operator sees as creating value, you can look at the new JPX Prime 150 Index.

Rosenwald has one caveat: Avoid companies that solely rely on the domestic market. “The demographics are terrible,” he says. Instead, Lorraine Tan, director of Asia equities at Morningstar, is fond of export-oriented stocks, such as Fanuc FANUF and Harmonic Drive Systems HSYDF.

Takeuchi owns shares in factory automation company Keyence KYCCF, which is number two on the JPX Prime 150. He’s also a fan of Shin-Etsu Chemical SHECF, a global leader in chemicals for semiconductor and PVC manufacturing, as well as insurer Tokio Marine TKOMY, which is growing fast since its portfolio outside Japan is growing robustly.

If you want to do even more research, check out small caps. Investment firm GMO sees great opportunity among Japanese small-value companies. The firm believes broad equities are fairly valued but says active managers who buy cheap small-value stocks stand to capture an additional 4% of returns and that any gain in the yen could add another 4%.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/PKH6NPHLCRBR5DT2RWCY2VOCEQ.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/KD4XZLC72BDERAS3VXD6QM5MUY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/d53e0e66-732b-4d50-b97a-d324cfa9d1f8.jpg)