ESG Bond Indexes Reveal How Country Risk Changed in 2020.

By Dan Lefkovitz

Sustainable Investing

By Dan Lefkovitz

Read Time: 2.5 Minutes

Sustainable investors don’t have many options when it comes to managed strategies focused on government bonds. Of the nearly 5,000 traditional mutual funds and ETFs domiciled across the globe classified by Morningstar as intentionally sustainable investments in January 2021, nearly 80% are focused on equities. Few of the fixed-income funds are in government-bond categories. Of those, only a handful track indexes.

That’s problematic because government bonds play a critical role in many portfolios. Their income streams, backed by government guarantees, are utilized by investors of all sizes—from retirees to asset owners looking to match future known liabilities. Government bonds counterbalance the risk of equities and serve as portfolio ballast, especially useful during times of market stress. When they lose money, their drawdowns tend to be far milder than those of stocks.

The Morningstar Global Treasury Bond Sustainability Indexes are tools for ESG-oriented bond investors. Launched in January 2021, the indexes represent the investable universe of developed market, investment-grade government debt tilted toward countries with lower ESG risk as defined by the Sustainalytics Country Risk Rating.

Country Risk Ratings are, of course, dynamic, and the coronavirus pandemic drove significant changes in 2020. Index composition tells the story of evolving country risk.

The Morningstar Global Treasury Bond Sustainability Indexes focus on domestic debt publicly issued by sovereign governments in their home currency. The 23 currently index-eligible developed-market countries span North America, Europe, and the Asia Pacific region.

The indexes are derived from parent indexes that are not screened on sustainability criteria. For example, the Morningstar Global Treasury Bond Sustainability Index is derived from the Morningstar Global Treasury Bond Index. Constituent weighting is driven by both market value and country risk.

The Sustainalytics Country Risk Rating drives index weighting. Sustainalytics, the Morningstar division focusing on environmental, social, and governance research, assigns risk ratings to 172 countries around the world. The rating gauges a country’s long-term prosperity and economic development prospects by assessing how sustainably it is managing its natural, human, and institutional capital.

Sustainalytics assesses more than 30 indicators to score three areas, which correspond to the E, S, and G pillars. Meanwhile, an event rating assesses incidents that might have negative impact, such as state corruption or violent conflict. Lower ratings represent less risk. Country risk ratings are refreshed quarterly.

The debt securities in each sustainability index are identical to the constituents of its parent index. But weights are determined by a combination of market value and country risk.

Countries with lower (better) country risk ratings receive more weight in the index and countries with higher country risk ratings receive less weight. Indexes are rebalanced monthly, and weights are capped to ensure diversification.

The coronavirus pandemic of 2020 exemplifies how events can significantly impact sovereign ESG risk.

Sustainalytics made several ratings revisions in September 2020 to reflect pandemic-related risks. ESG risk in many key markets increased, with the U.K. and U.S. experiencing the largest increases due to their pandemic struggles, while Japan’s ESG risk level rose by far less.

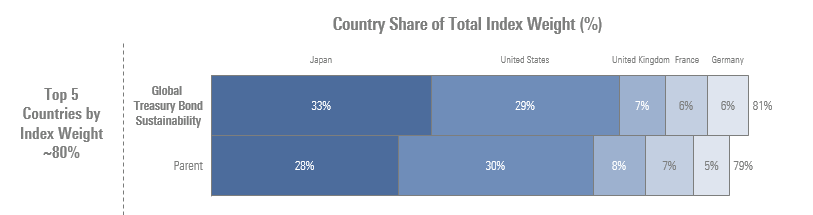

Comparing the Morningstar Global Treasury Bond Sustainability Index’s country weights with its parent index at the end of 2020 demonstrates how country risk ratings drive exposure.

Among the largest countries, the sustainability index maintains above-market weight to Japan and Germany and below-market weight to the U.S., U.K., and France. Among smaller countries, the sustainability index is heavier on Australia and Canada and lighter on Italy and Spain.

While the indexes launched in early 2021, their back-tested track record is similar to their parents. Future performance can be monitored to observe how country risk drives performance. Over the long term, lower ESG risk should make a country’s debt a better investment.

Dan Lefkovitz is a strategist on Morningstar's Indexes team.