- Morningstar’s head economist predicts that mortgage rates will peak in 2023, making housing less affordable in the short term.

- Prospective buyers have begun to pull back from housing demand. Morningstar forecasts that home prices will fall by 5% in 2023.

- The Fed will need to lower U.S. interest rates to avoid a housing market crash. Our economists predict that the Federal Reserve will begin cutting interest rates in 2023 as inflation normalizes.

.png)

Economy

U.S. Housing Prediction: What Interest Rate Hikes Mean for Housing Demand, Starts, and Prices

Key Takeaways

Read Time: 4 Minutes

The housing market boomed in 2021. Spurred by record-low mortgage rates and limited supply, homes flew on and off the market in a week. Single-family home values raked in strong annual growth.

The year 2022 told a very different story.

Along with federal interest rates, 30-year mortgage rates hit a two-decade high in early November. As mortgage rates are rising, the housing market has cooled.

Morningstar researchers predict that mortgage rates will peak in 2023, making housing less affordable in the short term. What guidance can financial advisors give when the housing market looks shaky?

Here’s why the housing market looks out of control and how advisors can help clients stay on track to their financial goals.

What's Next for U.S. Interest Rates?

How Do U.S. Interest Rates Affect the Housing Market?

The federal funds rate doesn’t directly set mortgage rates, but the two often rise and fall in tandem. When the Fed slashed interest rates at the height of the pandemic, low mortgage rates drew hopeful homeowners into the market.

During the pandemic downturn, the housing boom helped prop up the economy. A couple of factors combined to send housing demand skyrocketing. Households had more to spend. And the growth in remote work led many to seek out more residential space.

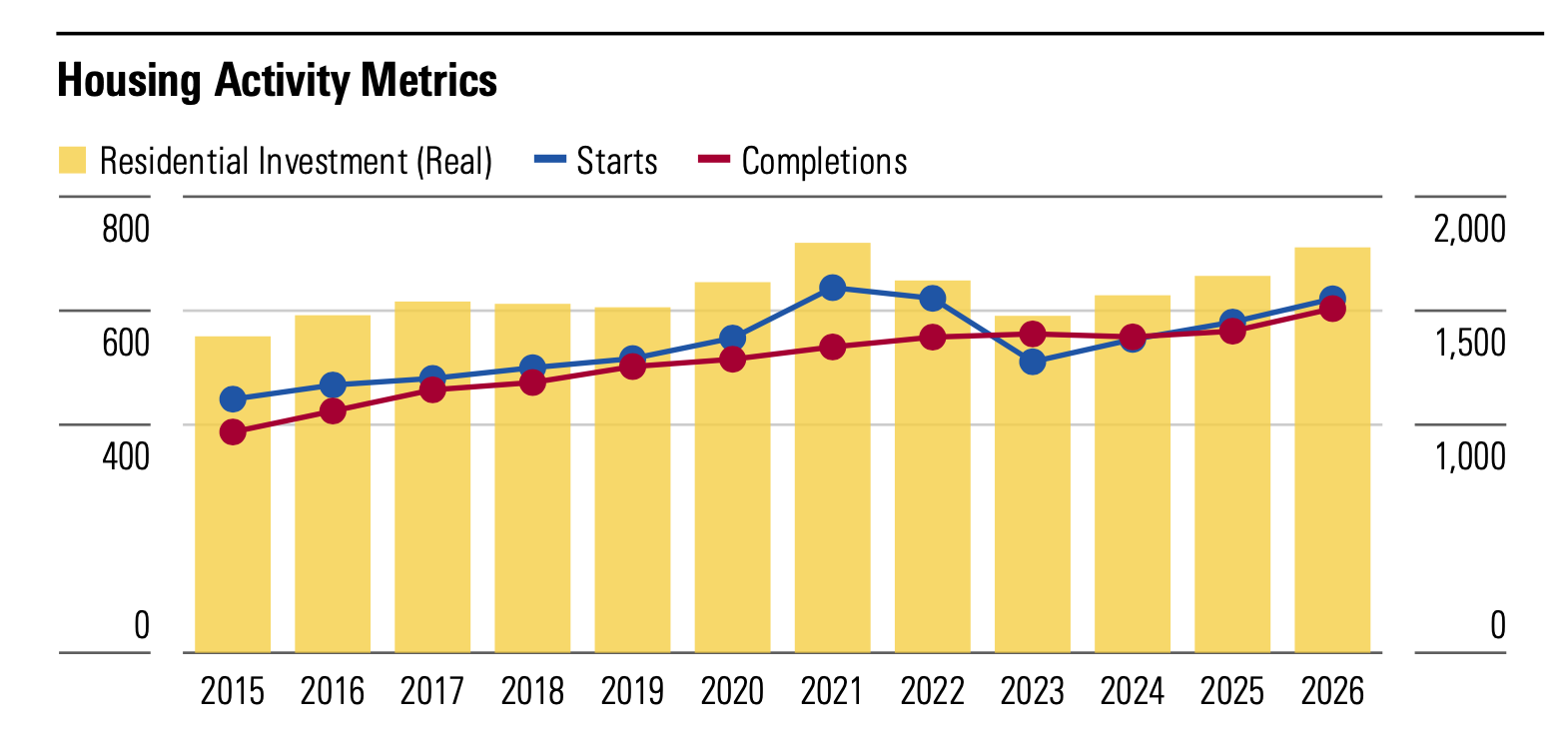

Residential investment jumped from 3.8% in the fourth quarter of 2019 to 4.8% of GDP in 2021, though it’s since fallen back.

By 2022, the housing market contributed to the overheating of the economy. The excess of housing starts—the total number of single-family houses that started construction—over completions in 2021 and 2022 created a huge stockpile of unfinished housing.

How Will the Fed's Rate Increase Affect the U.S. Housing Market?

Today the housing boom is correcting, which will cool the economy and may spark concerned calls from clients.

Housing affordability has deteriorated to its worst level since 2007. Soaring home prices were already weighing on affordability in 2021 as supply struggled to catch up with demand.

Mortgage rates also jumped in 2022—an understatement. Thirty-year mortgage rates reached a high of about 7% in early November, the highest in over 20 years.

High rates have begun to slow the demand for housing. Morningstar’s housing researchers project an 18% drop in starts in 2023, along with a 5% decline in housing prices. As this stockpile dwindles over the next two years, the housing supply will continue to expand, lowering housing prices.

But our research still shows some cause for optimism.

Morningstar analysts don’t expect a crash on par with the Great Recession housing bust, but the Fed will need to lower U.S. interest rates to stop the situation from worsening.

Preston Caldwell is the head of economics research at Morningstar. He predicts that the Federal Reserve will begin cutting interest rates in 2023 as inflation normalizes.

What Will the Housing Market Do in 2023?

Preston forecasts that rising mortgage rates should bring down housing activity, helping to accomplish the Fed’s goal of cooling off the economy.

The astronomical leap in mortgage rates has already begun to depress home values. Caldwell expects home prices to fall by 5% in 2023 and converge back to their pre-pandemic trend. Easing supply constraints should encourage builders and close the gap between starts and completions.

Caldwell projects that falling inflation will allow the Fed to start easing monetary policy by mid-2023. He estimates that the 10-year Treasury yield will need to fall to 2.25–2.5% over 2024–25 to boost housing affordability and demand, as well as economic growth.

The Pros and Cons of I Bonds and CDs

Shifts in the housing markets have alarmed would-be buyers who still remember the 2008 crash. What can aspiring homeowners do to maximize their savings?

Here’s how to talk clients through trending investment vehicles to find the right solution for their goals. With data-driven investment management software, you can discover opportunities for the long term.

Certificates of deposit offer more interest than savings accounts, with some caveats

Higher interest rates have increased the appeal of certificates of deposit, high-yield savings accounts, and money market accounts. As some CD returns rise above 3%, clients could choose to lock their money at today’s rate for a set period of time before buying a home.

Certificates of deposit offer a guaranteed return, with no risk of losing money, and can create enough psychological distance to encourage healthy saving habits.

However, if inflation remains high, it can eat into total returns. CDs also restrict client cash flow. Yields usually improve for longer-term CDs, up to five years, and if you withdraw it, you must withdraw the full total all at once.

I Bonds hedge against inflation with cash flow restrictions

Series I Saving Bonds, or I bonds, offer another option for investors setting aside savings.

Money in I bonds earns a set interest rate and an inflation rate that changes twice a year. If you buy an I bond between November 1, 2022, and April 30, 2023, you will be guaranteed a 6.89% annualized interest rate for six months.

There are a few downsides. Investors can only buy $10,000 in I bonds a year and must hold their bonds for at least 12 months. If investors cash out before five years have passed, they forfeit the last three months of interest.

Because the inflation rate changes twice a year, it’s more difficult for investors on their own to estimate how much they’ll earn. Advisors can help clients weigh their options and make informed choices about their financial future.

Bottom Line: Slowing Interest Rate Hikes Could Signal Good News for the U.S. Housing Market

Morningstar researchers think there’s less cause for concern about inflation in 2023 and beyond. Lower interest rates will be needed to avert an even more severe downturn in the housing markets than is already likely to occur.

Caldwell predicts that interest rates and mortgage rates will peak in 2023, allowing the housing market to revert to pre-pandemic trends.

For the full analysis, watch the webinar on demand.