Morningstar DirectTM

Elevate Your Investment Story

Turn your vision into reality with investment capabilities tailored to the way you work.

Already a client? Download now.

Morningstar Direct helps you redefine the way you work––and grow––with research you can trust, insights you can act on, and tools built to fit your day-to-day.

Contextualise the market

Data that makes a difference

Quality data doesn’t just ground effective analysis; it builds trust. Show your clients how your recommendations align with their goals with our global dataset that’s one of the broadest in the industry.

Powerful research and ratings

Evolve your expertise with insights from one of the largest teams of independent equity and managed-product analysts in the world and capitalise on the industry trends most relevant to your work. Our complex research methodologies surface as digestible ratings in our reporting capabilities.

Advanced analytics, simplified

Unlock the power of our data, research, and analytics with one click. We give you a multifaceted view of data powered by our notebooks, so you can make decisions with less friction and leave behind time-consuming processes.

Compare your products and portfolios

When your products beat benchmarks, you stand out from the crowd. Morningstar Direct gives you the tools to build strategies and products that put client goals––and your strengths––at center stage.

Deepen your analysis with asset flows

Our historical fund-flow data and forecasts bring investor preferences to light so you can build more competitive and relevant products.

Assess market position with performance reporting

Calculate outcomes across multiple variables at once by curating and grouping investments based on your needs.

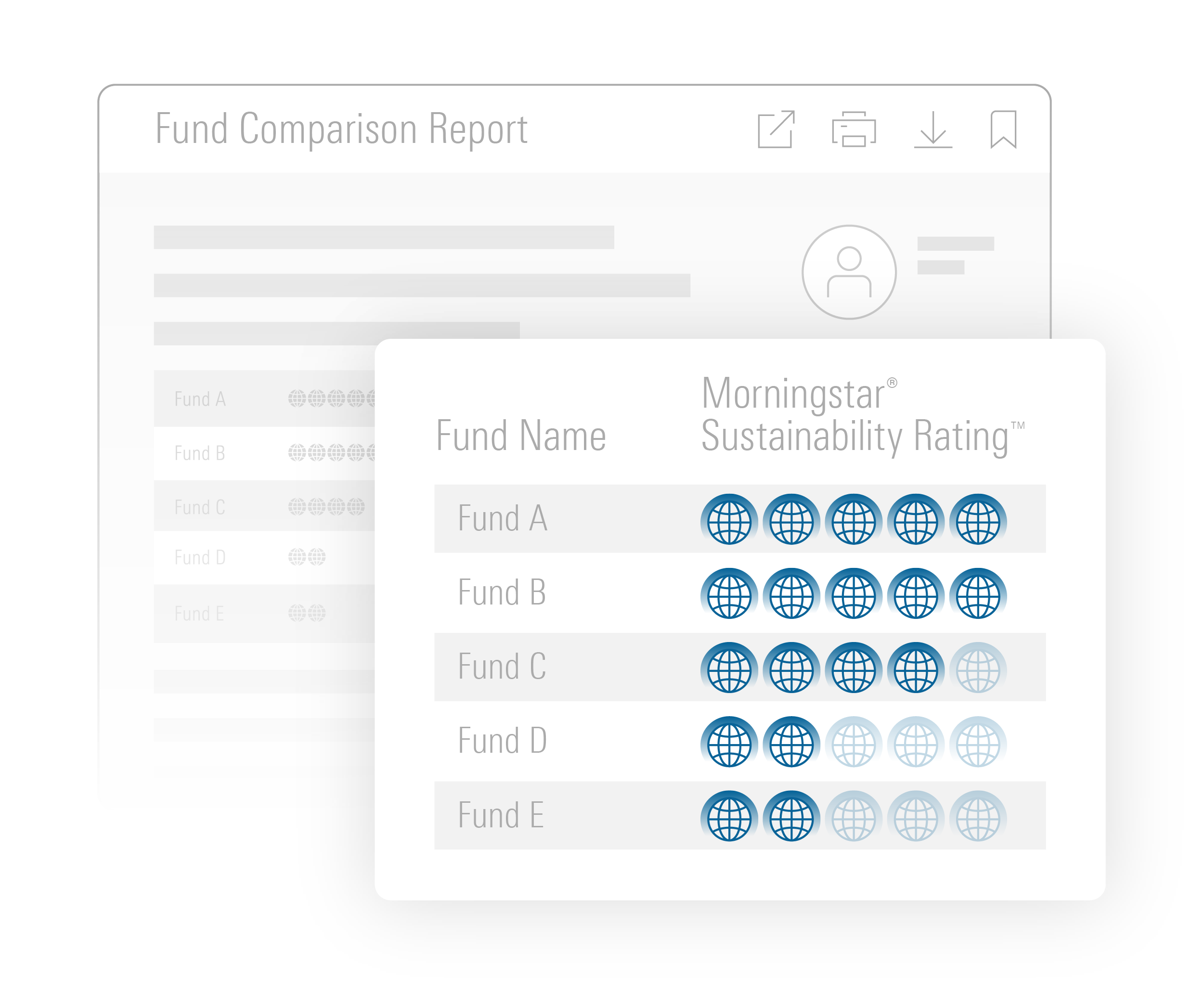

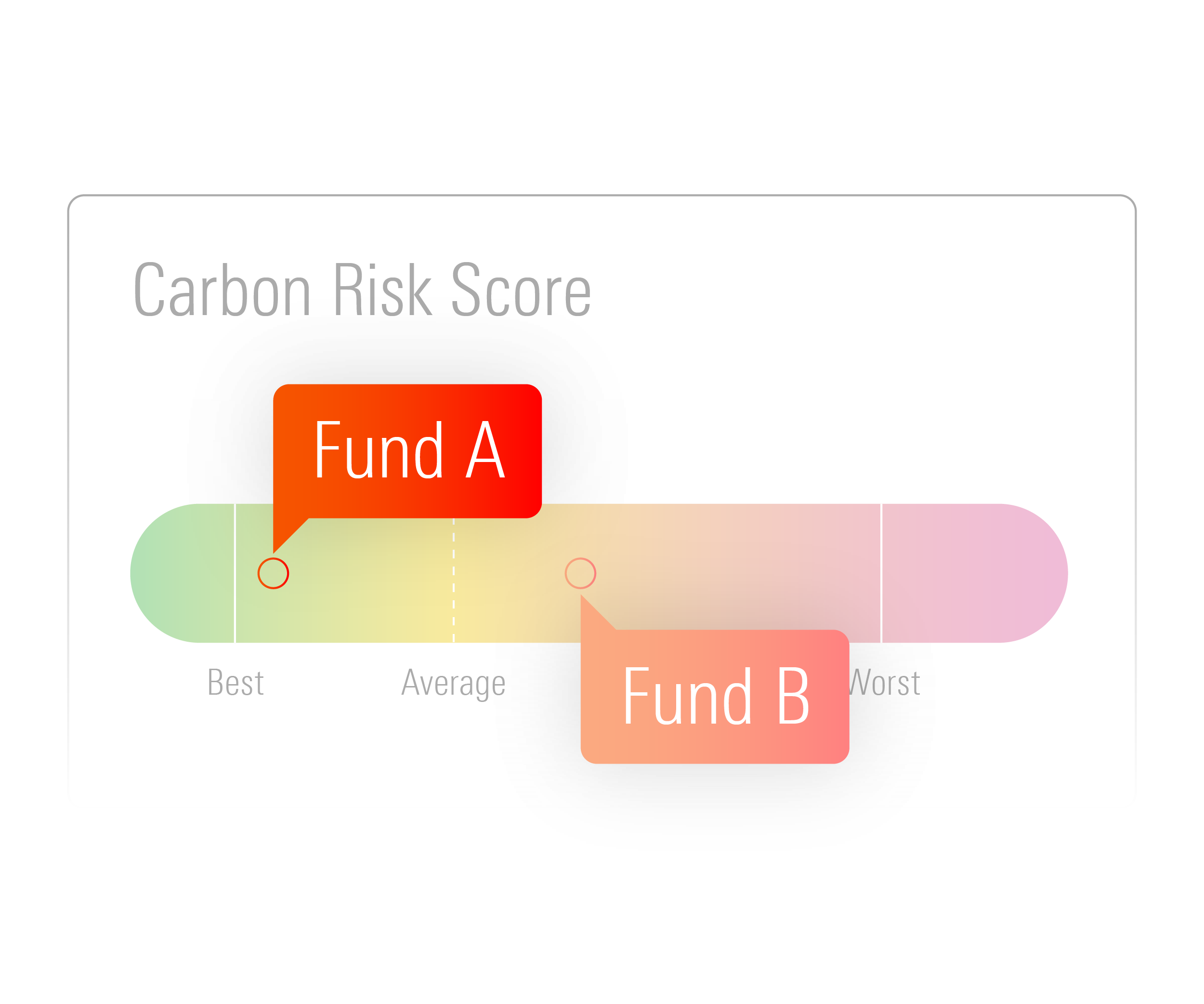

Lead with sustainability solutions

Our research, ratings, and data help you navigate the evolving definitions and regulations that surround sustainable investing, so you’re a reliable resource for your clients, no matter the topic.

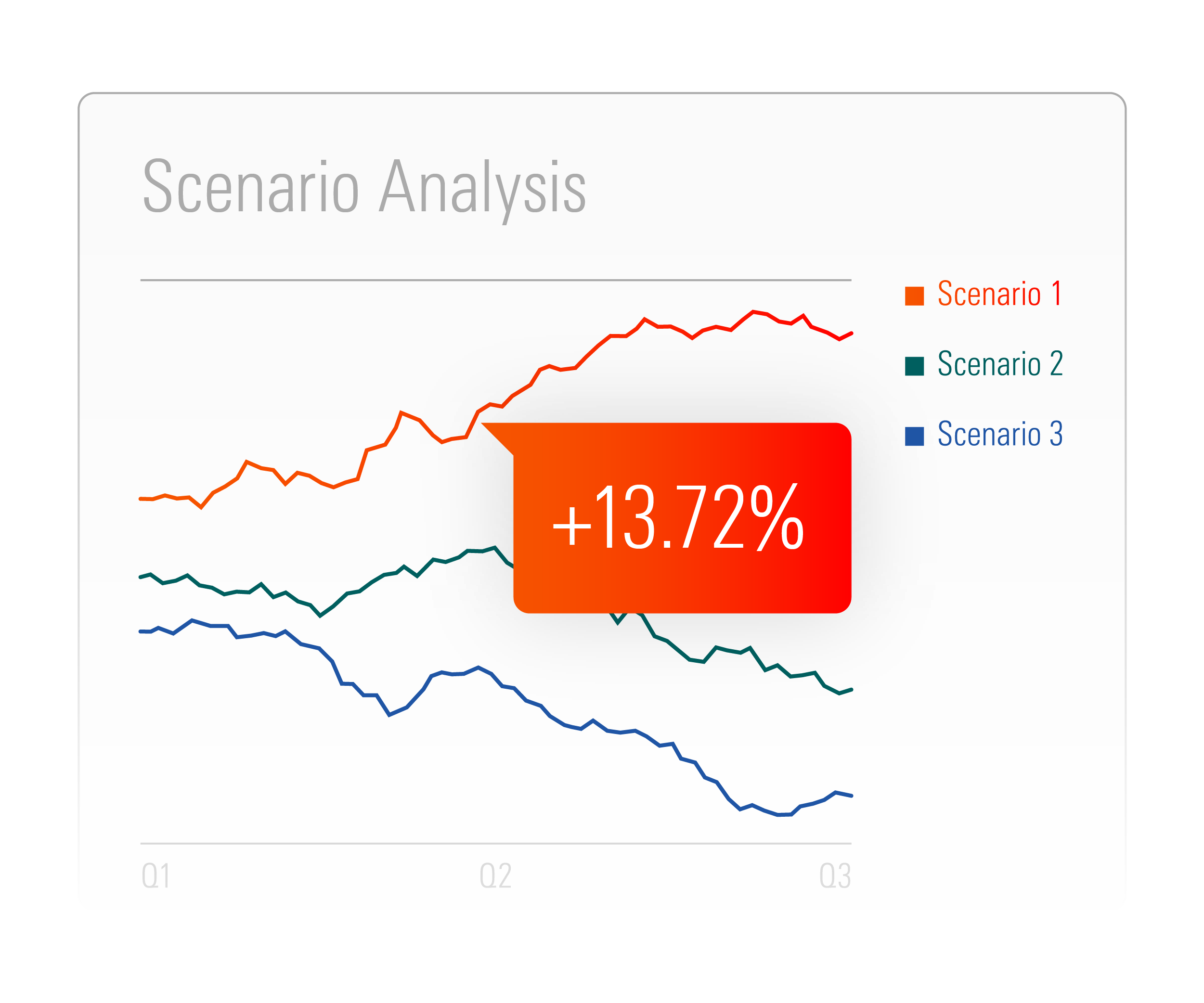

Transform threats into opportunities with risk analysis

Understand the potential impact different risk factors and scenarios can have on every portfolio to avoid threats and improve outcomes for your clients.

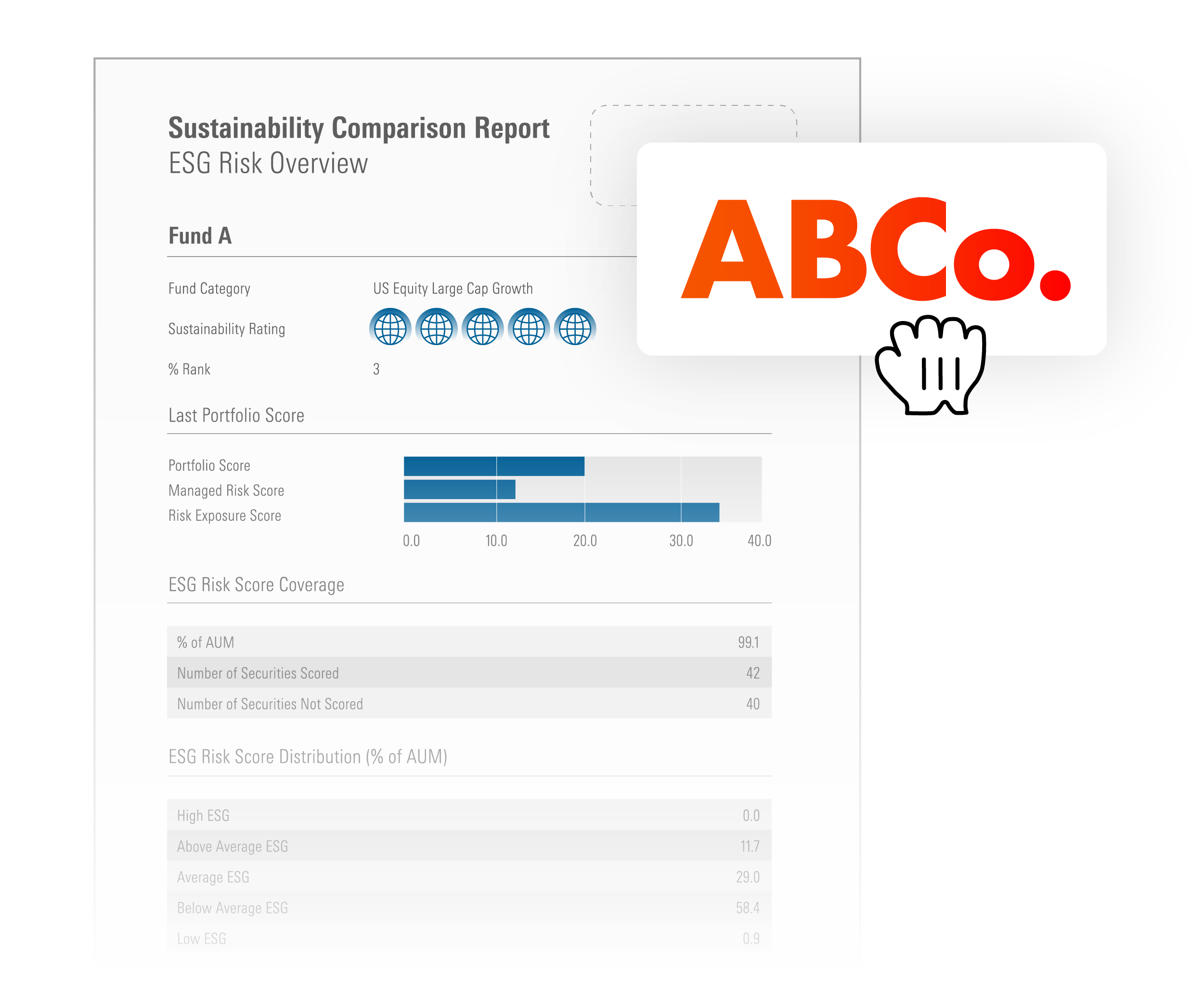

Communicate your value

Your story matters. The reporting solutions in Morningstar Direct amplify your message and brand presence with custom proposals and reports.

Custom-fit collateral

Presentation Studio unites your firm under one cohesive, compelling story that highlights your strengths and brand.

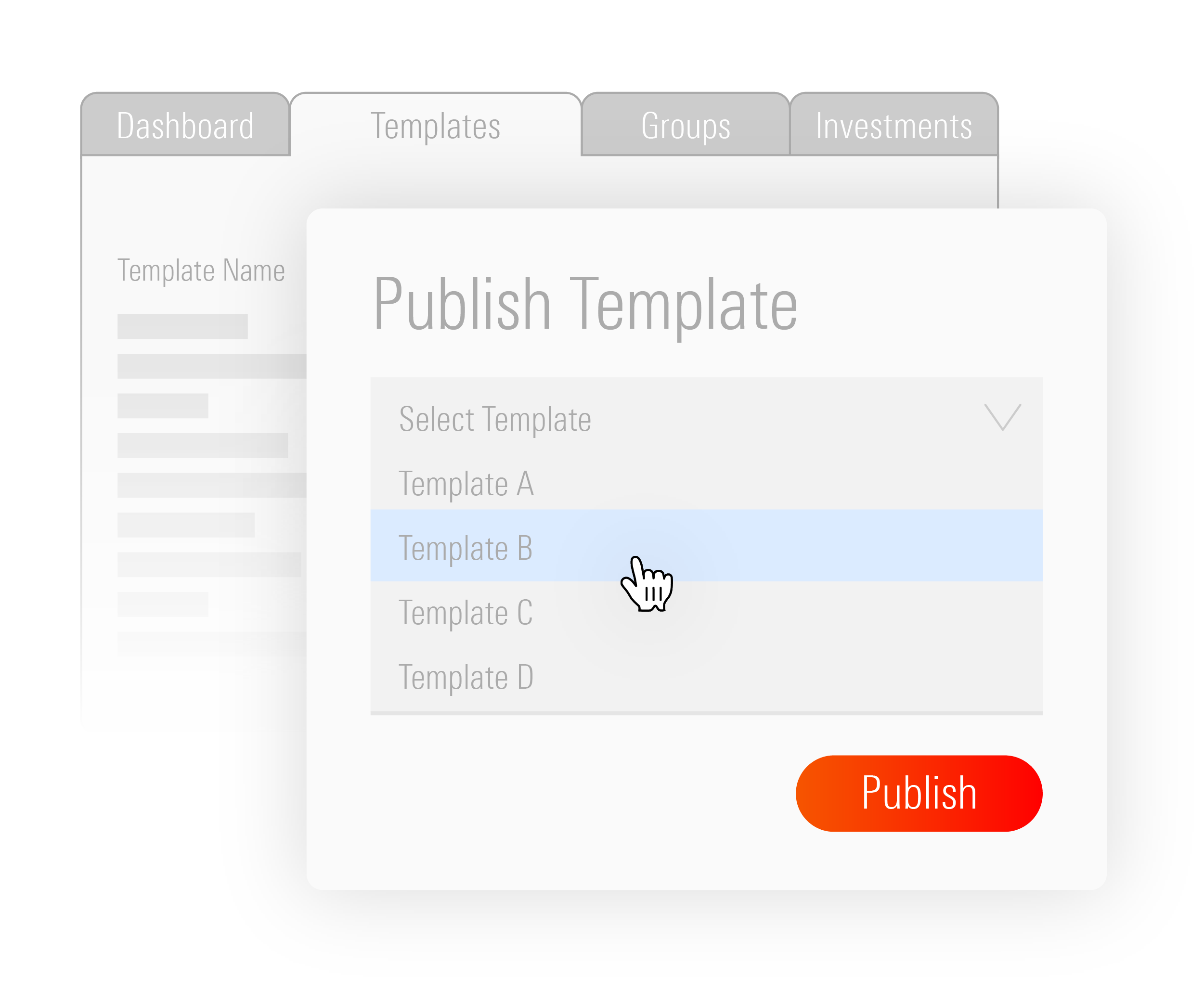

Seamless report distribution

Report Portal––an add-on that integrates with your existing Morningstar Direct and Presentation Studio tools––streamlines distributing collateral to client-facing groups and keeps the whole team connected with custom templates approved by your compliance team.

Here’s the latest addition to the Morningstar Direct user experience:

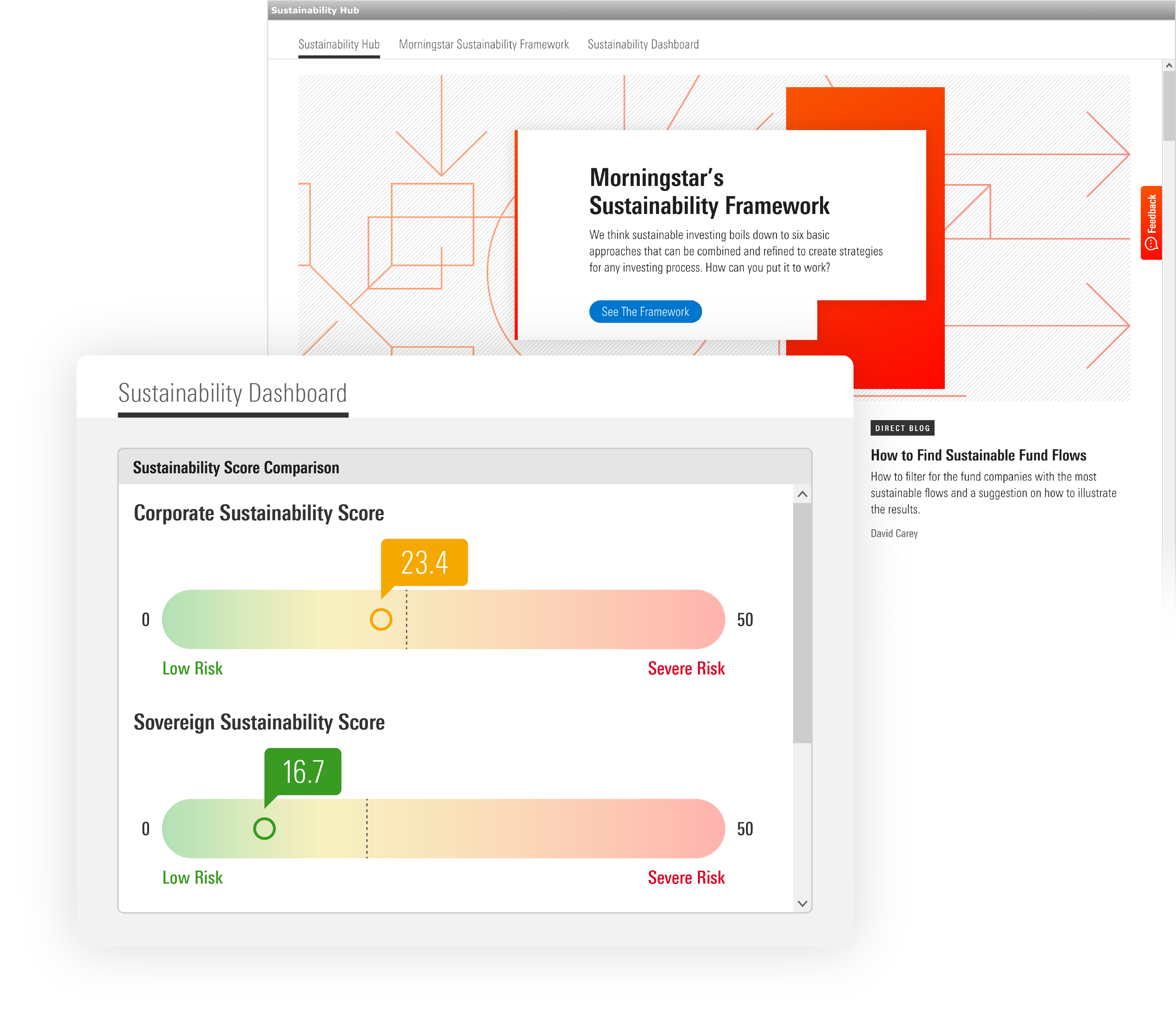

Streamline your workflows with world-class ESG research, data, and ratings

Morningstar Direct’s sustainability hub connects you with the latest ESG research and uses our sustainable investing framework to simplify and guide ESG research, analysis, product creation, and reporting.

Stay ahead of the market, no matter where you are

See how Morningstar Direct elevates the investment process across the globe.

Resources for current clients

Download Morningstar Direct to your desktop or learn how to make the most of your current seat with our on-demand training resources.

Get started with Morningstar Direct

Sign up for a free trial and bring your investment vision to life.