The Catch to High Investment ‘Income’

More current cash usually means less future capital.

What Is Income?

Readers sometimes chide me for writing the term “annuity income.” Technically, they point out, annuities do not distribute pure income, meaning cash that has been generated from their portfolios’ investments. Instead, annuity payouts blend 1) genuine income with 2) realized capital gains and 3) return of capital.

Their admonishments are justified. Although annuity providers are legally permitted to call their payments “income,” permission granted by regulators does not make the usage correct. As with Required Minimum Distributions from retirement accounts, annuities distribute not only the profits earned by the investor’s principal, but also the principal itself.

Most people realize this, because investors forgo their principal when buying (nonvariable) annuities, and because RMD tables openly draw down portfolios. The intentions of either annuities or tax-sheltered accounts carry no secrets. However, many other investments that are generally regarded as producing “income” also return the buyer’s capital, albeit implicitly rather than explicitly.

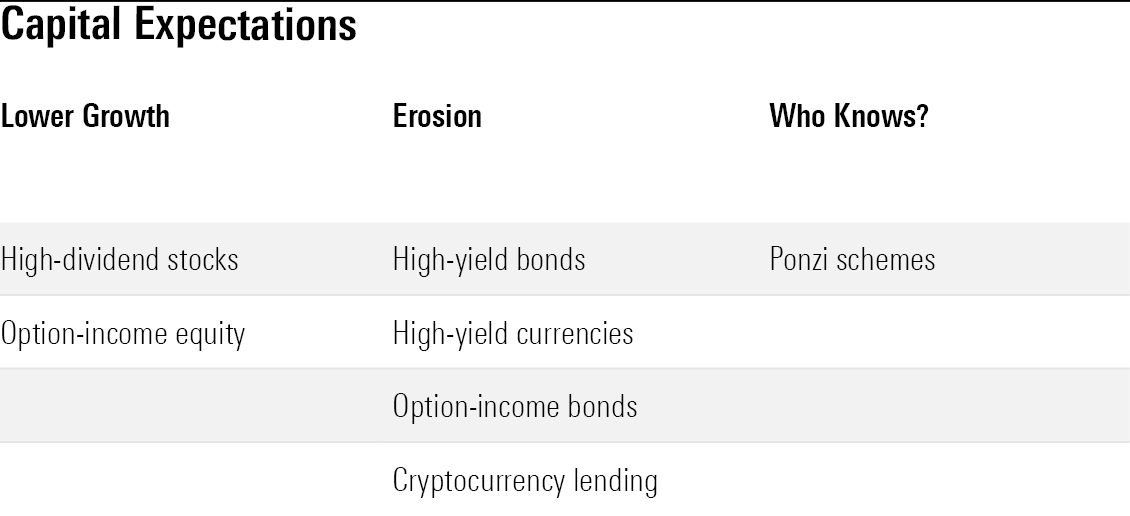

The table below provides several examples. It is illustrative rather than comprehensive. However, I trust that it will demonstrate the point. High-paying strategies that use equities typically grow their capital bases, but at a lesser rate than their rivals. Meanwhile, strategies that rely on bonds inevitably erode principal. They may hide that fact for a while, but eventually reality intrudes.

Equities: Lower Capital Growth

To be clear: Neither high-dividend stocks nor option-income equity strategies return investor capital. As with their low- or no-dividend siblings, high-dividend stocks pay their stated yields but make no distributions from principal. The same holds for option-income equity strategies, which disburse 1) the yield from their stocks and 2) short-term capital gains from selling call options. (Once again, the word “income” is incorrectly applied, but as the option-income equity strategy is never referred to as “option-short term capital gains,” I must comply.)

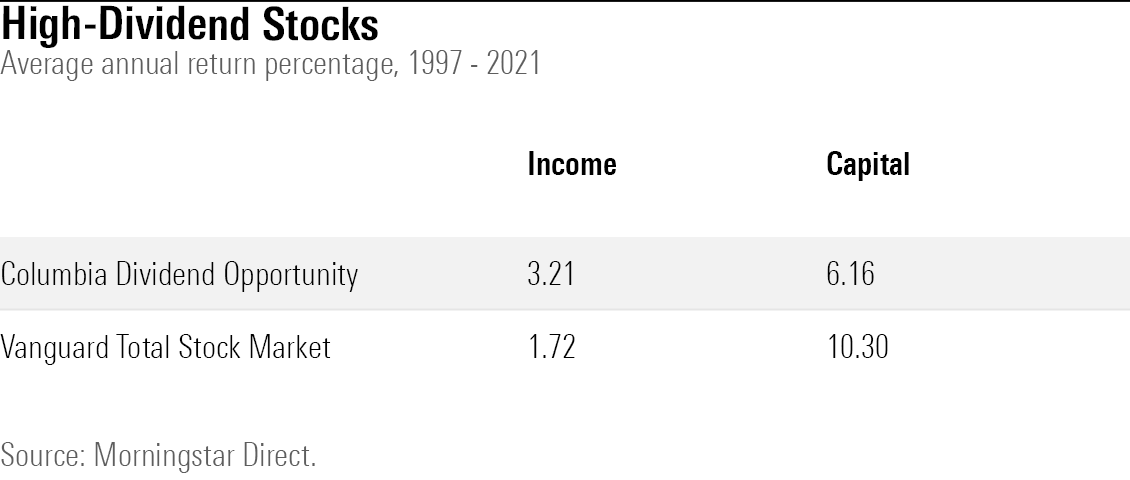

Unavoidably, though, the two tactics involve trade-offs. Investors in either strategy receive more today but less tomorrow. Companies that distribute high dividends cannot plow those monies back into their businesses, which therefore limits their future growth. For their part, option-income equity strategies must forfeit their portfolio’s biggest winners when the call options that sold are exercised. Over time, those opportunity losses eat into the strategy’s principal.

There is nothing wrong with arrangements like this. High-dividend firms usually lack strong growth prospects, so distributing profits to shareholders rather than reinvesting them into their operations makes good business sense. And if option-income equity strategies give up the right to own certain stocks, they are paid for making that concession. (They are, however, ill-suited for taxable accounts.)

But investors should understand the implications of high-paying equity strategies. Because they hold stocks, high-dividend and option-income equity strategies do grow their capital bases. But investors who spend the distributions they receive from those investments, rather than reinvesting the proceeds, will not be able to match the capital growth of the overall stock market.

Consider, for example, the capital performance of a prominent high-dividend fund from 25 years ago, Columbia Dividend Opportunity, versus that of Vanguard Total Stock Market Index.

Bonds: Capital Erosion

In a sense, the above argument is obvious. If high-dividend stocks matched the capital growth of lower-paying equities, they would deliver better total returns, and thus a free investment lunch. Similarly, if option-income equity strategies were able to make significantly higher distributions than standard equity funds while maintaining the same capital-growth rate, then smart investors would sell equity call options, and dumb ones would buy them. That is not the case.

Less overt, though, is the capital erosion caused by high-paying bond strategies. Most high-yield bond investors do not expect their securities to be a capital drain. Nor do those who own option-income bond strategies, which invest in the same fashion as their equity counterparts but with bonds rather than stocks. That junk bonds and option-income strategies are riskier than simply owning U.S. Treasuries is well understood. However, that risk is typically framed as producing more volatility, not as potentially harming principal.

But capital erosion with such strategies is inevitable. The underlying deal made by high-yielding debt is the same as that made by high-yielding equities: more money now, less principal later. The difference is that while the equity prices trend upward because companies reinvest profits into their businesses, bond prices do not. If all things remain equal, bonds prices stagnate.

Which means that a portfolio of high-yield bonds will tend to shed principal, on account of its securities’ occasional bankruptcies. So, too, will option-income bond strategies, which retain all their losing investments while being forced by exercises of call options to relinquish some of their winners. For their part, high-yielding currencies naturally tend to decline in value. If they did not, they would provide free investment lunch. Regrettably, investing is not so easy.

Also on my capital-erosion list is the small but entertaining field of cryptocurrency lending. Esoteric it may be, but the principle (not principal) of crypto lending is the same as with our other examples: accept a high payout, receive the possibility of a capital loss. Patrons of the lending firm Celsius recently suffered that experience, as the company stopped paying double-digit annual yields, froze its clients’ accounts, and is now attempting to stave off bankruptcy.

The threat to capital for high-paying bond strategies has been obscured by the long decline in fixed-income yields, which has propped up the prices of bonds that would otherwise have lost value. Even so, the largest high-yield bond fund from 25 years ago, PGIM High Yield, has shed 1% of principal per year, even as Treasury funds have increased their capital base.

Who Knows?

The final version of danger to investment capital, the time bomb represented by Ponzi schemes, is of course a jest. But the joke is not without relevance. As with high-paying strategies, Ponzi schemes attract investors who hope to enjoy strong current results without sacrificing their principal. Sometimes they can. Barring clawbacks, those who exit Ponzi schemes early will enjoy handsome profits. Unfortunately, those who remain do not. That’s a lesson that Celsius investors have now learned, very much the hard way.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IFAOVZCBUJCJHLXW37DPSNOCHM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/JNGGL2QVKFA43PRVR44O6RYGEM.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/GQNJPRNPINBIJGIQBSKECS3VNQ.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)