In Praise of Wall Street

Financial institutions might sometimes be wicked, but they deliver a genuine public good.

The Bad Old Days

Patrick O’Brian’s 20-novel seafaring series, set during the Napoleonic Wars, succeeds as an adventure, as a tale of a 6,000-page relationship (among the world’s great bromances, to use a deeply anachronistic term), and as a history. Naturally, the film inspired by the books, “Master and Commander,” emphasized the first two elements. Documentaries don’t recoup $150 million budgets. But O’Brian sought to immerse his readers, completely and utterly, in that past era.

Among his recurring themes was finance. Even casual O’Brian readers quickly realize how dangerous it once was to hold money. Bullion could be stolen, lost, or sunk. Letters of credit were both costly and inconvenient, as well as useless for many purposes. Banks that were badly managed lost their depositors’ assets. (King George III’s England lacked FDIC insurance, and so did every other country.)

Nor were there many other investment options. The Bank of England issued debt that was sound. However, the real return on its notes during the Napoleonic Wars was close to zero, on account of high inflation caused by spiking commodity prices. (Sound familiar?) And there were few opportunities to invest in companies, except privately. The London Stock Exchange had recently been formed, but at that stage it dealt mostly in government debt rather than in equity shares.

Consequently, the characters in O’Brian’s stories hold property, not financial assets. Captain Jack Aubrey spends a portion of his prize money on a country farmhouse. The rest of his newfound wealth goes toward breeding racehorses and mining for silver on his land. When Doctor Maturin inherits his godfather’s estate, he uses some of the proceeds to buy a ship, for privateering. Everyday sailors who come into money work for themselves, by becoming innkeepers.

Inside Jobs

The characters’ purchases are notable for what they omit. Unlike today’s 401(k) participants, who spread their assets across the global economy, O’Brian’s investors do not share their capital with others. They spend their monies entirely on their personal endeavors. That is fine, to an extent; there’s nothing wrong with self-funding. However, nations that rely exclusively on self-funding overfeed business ideas that come from the wealthy but inept—such as Captain Aubrey, who is as foolish on land as he is adroit at sea—while starving proposals from those who are blessed with energy and insight but lack money.

It’s hard to grow an economy while misallocating capital so frequently. Until recently, lifestyles changed at a glacial pace. One generation lived much the same as the next. Then, about two centuries ago, the pace quickened. For the first time in world history, children expected to live more comfortably than had their parents, and certainly more so than their grandparents. The Wealth Revolution was on.

This improvement customarily is credited to technological advances, and with good reason. There’s no question that economies that transmitted messages through sail and horseback can be nowhere near as powerful as those that transmit information at 300,000 kilometers per second. And it’s not just data. People move faster, products are created far more rapidly, and food is produced more efficiently. Science is not magic, but its economic effects are nonetheless miraculous.

Improving Capital Allocation

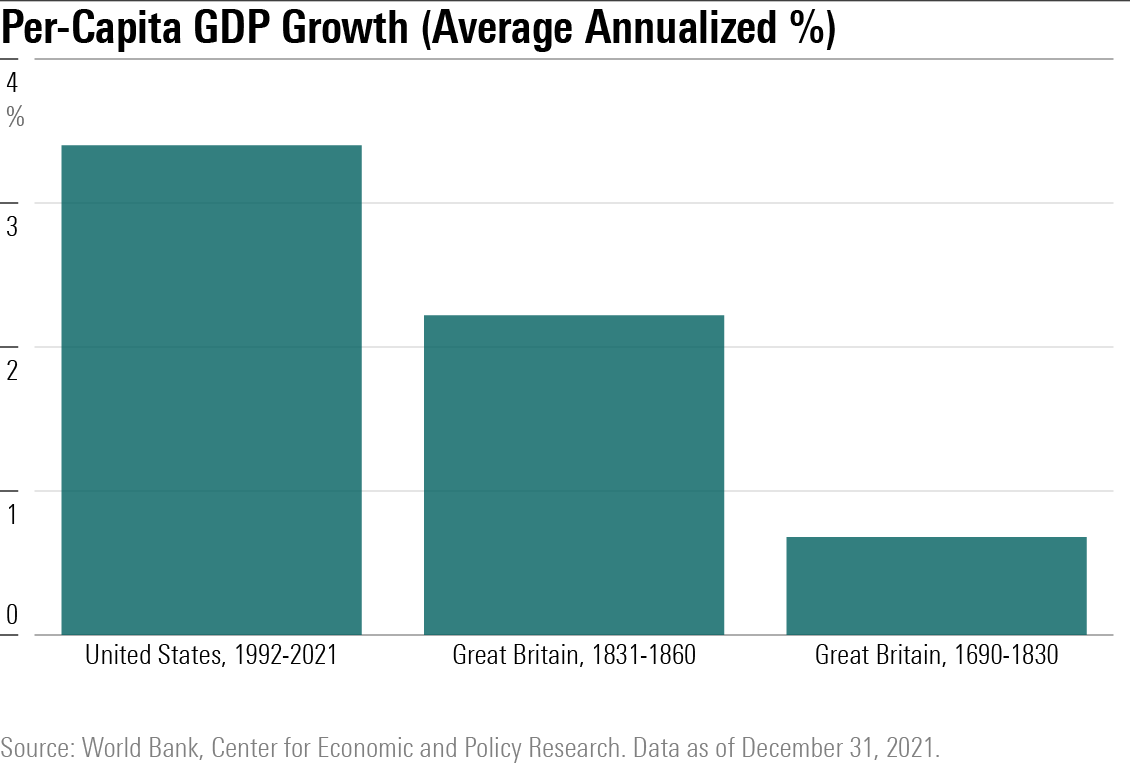

However, technology is not solely responsible for the economic explosion. Countries have also become better at harnessing what they have, through stronger governance, healthcare, education, and financial markets. We cannot isolate the effect of the latter, because it accompanies so many other social changes, but we can get an idea of the contribution from the various nontechnological factors by examining the per capita gross domestic product growth rates from 1) pre-to-early industrial Great Britain; 2) Great Britain, from 1831 through 1860; and 3) the United States, since 1992.

Recent economic growth easily outstrips that of the past. The earliest period is understandable, as technology was only beginning its advance. However, the Industrial Revolution was in full bloom during the middle period: The first steam railroad appeared in 1830, with the telegraph introduced shortly thereafter. Yet per capita GDP growth through that era was also well below current levels. The tools for growth existed, but too often they were wielded by the wrong hands.

That mismatch between capital and business ability is what Wall Street—I use the term advisedly, to mean any modern financial institution that aids and assists in the task of allocating investment capital—addresses. Not flawlessly, to be sure. Just as the invisible hand of the private markets is imperfect, often leading to under- or oversupply, so too are Wall Street’s more visible hands. The Street’s problems, of course, need no retelling. Its excesses have been amply publicized.

I agree with those objections, having published many of them myself. As with other occupations, financial institutions employ many people who either are not very good at their jobs or are regrettably capable, as their primary goal is to separate client from their money. Such business practices should be criticized. However, the corollary should also be stated: If Wall Street did not exist, the world unquestionably would be poorer, because capital would be both riskier to hold and less likely to reach those who could use it most adeptly.

I write these words not to apologize for Wall Street. My attempt instead is to put the Street’s failures into perspective. Financial institutions, in particularly those related to stocks and bonds (as opposed to retail banks) are commonly regarded as pointless middlemen: economic parasites that redirect productive assets into their own, highly profitable pockets. My parents believed that wholeheartedly, and they raised me to share that view. I no longer do.

Coda

As you may have guessed, this column was written while on vacation. That situation accounts for its source (two Patrick O’Brian novels, re-encountered after a 20-year hiatus), its spirit of rumination, and its shortage of data. As I am now back in Chicago, Friday’s installment will bring a return to normalcy.

Correction: An earlier version of this article incorrectly spelled the last name of author Patrick O’Brian as O’Brien (Aug. 2, 2022).

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/54RIEB5NTVG73FNGCTH6TGQMWU.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZYJVMA34ANHZZDT5KOPPUVFLPE.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/MNPB4CP64NCNLA3MTELE3ISLRY.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)