Central Banks Fight Inflation Amid Russia-Ukraine Conflict to Start 2022

We look at potential interest-rate hikes, soaring commodity prices, and investment opportunities.

The global economy has been on a recovery trajectory from the initial coronavirus decline for almost two years, but countries are still scrambling to find enough raw materials and labor to meet surging demands. High demand has driven up prices, which in turn has fueled inflation. As a result, wage growth in United States finally started to pick up at a faster pace than the past decade.

Last year, the Federal Reserve took the stance that inflation was transitory and didn't require intervention. The Fed has since changed its tone, however, and started 2022 with multiple federal-funds-rate hike projections. At the same time, other developed-markets central banks also kicked off rate hikes in the hope of taming inflation without severely suppressing the ongoing economic recovery.

Just as investors worried about surging commodities prices, the Russia-Ukraine conflict sent energy costs related to Russian supply skyrocketing, which may contribute to persistent inflation over the next few years. As long as the resolution of the Russia-Ukraine crisis is unclear, investors in Europe—which has historically relied on Russia for its natural gas—need to reevaluate the future of energy supplies as well as the implications for businesses and valuations.

Every quarter, Morningstar's quantitative research team reviews the most recent U.S. market trends and evaluates the performance of individual asset classes. We then share our findings in the Morningstar Markets Observer, a publication that draws on careful research and market insights. (Morningstar Direct and Office clients can download the report here.)

Here are some of the market insights from our latest quarterly review.

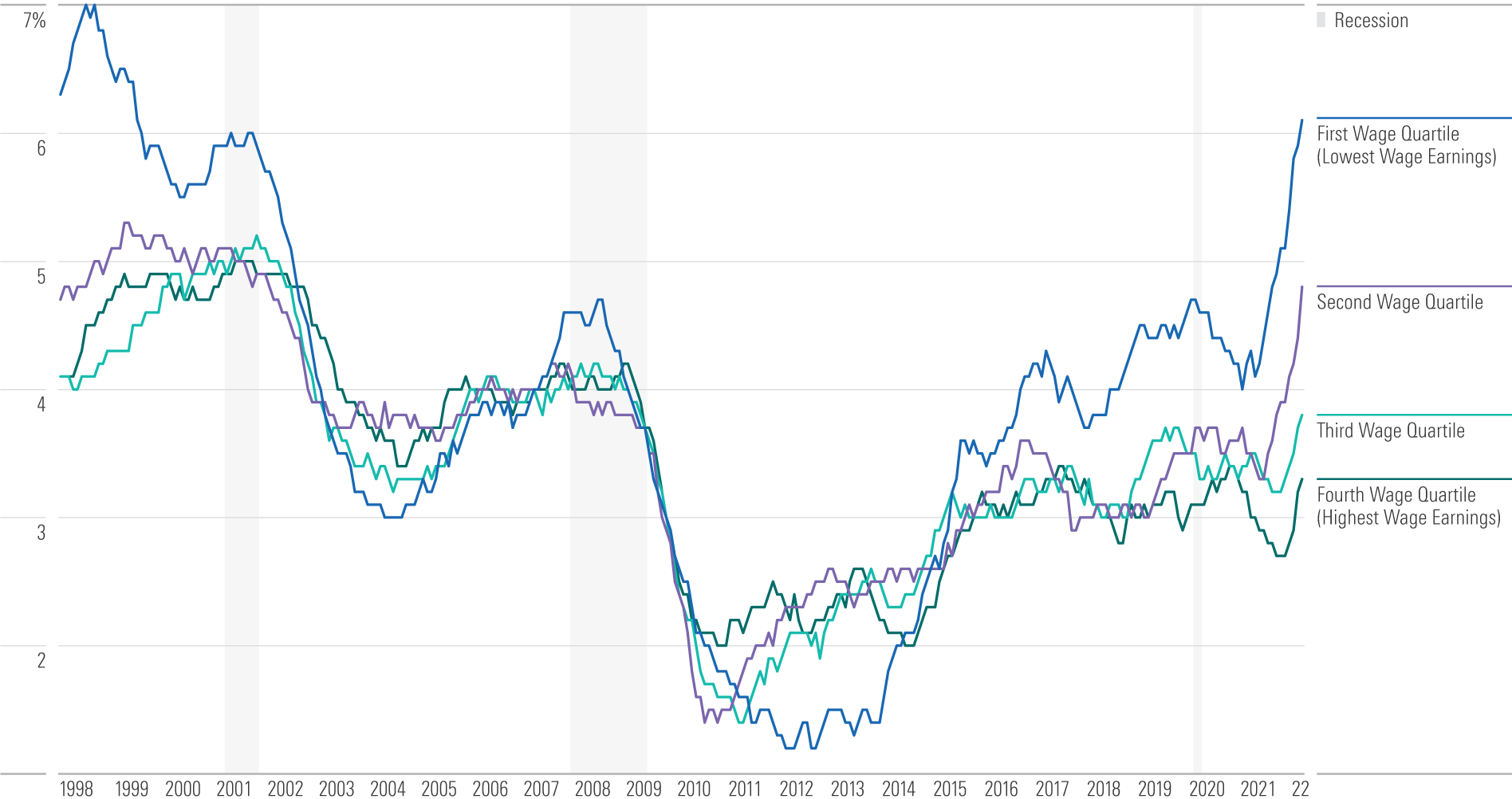

A Tight Labor Market Has Spurred High Wage Growth in the U.S.

Nowhere has the tight labor market been felt more acutely than in low-wage service industries. Businesses have rapidly raised wages to attract and keep workers, resulting in the most pronounced discrepancies in wage growth between low and high earners since the Federal Reserve Bank of Atlanta began tracking the data in 1998. While this wage pressure is likely adding a tailwind to already accelerating inflation, it is also potentially reducing (ever so slightly) the dramatic income inequality that has characterized the U.S. economy for decades.

Median Wage Growth by Quartile, 12-Month Moving Average

Source: Federal Reserve Bank of Atlanta. Data as of March 31, 2022.

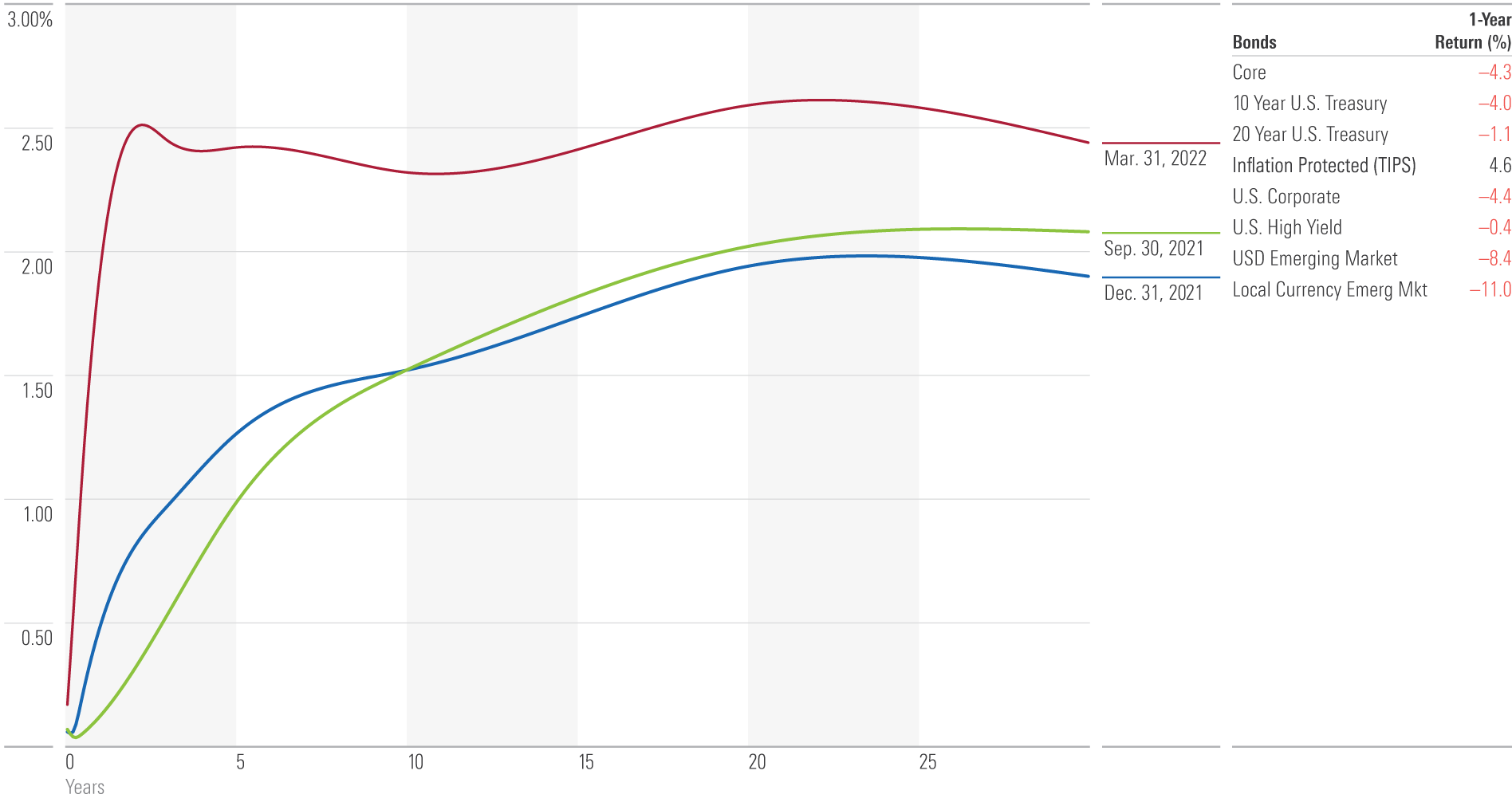

A Flattening Yield Curve May Signal Investor Caution in the U.S. Market

The Fed announced a 25-basis-point increase in the federal-funds rate in March and projected multiple additional rate hikes during the rest of the year. This began the process of raising interest rates in an effort to combat inflationary pressures, which pushed yields higher across the entire term structure. The yield curve experienced a substantial bear flattening as short-term rates rose at a much quicker pace than long-term rates. The curve has also begun to invert noticeably. This is an indicator that financing conditions are less favorable than they were just one quarter ago.

U.S. Treasury Yield Curve

Source: Morningstar Direct, Macrobond Financial. Yield curve data as of Mar 31, 2022.

The long end of the yield curve is still relatively low, but mortgage rates for U.S. homebuyers have increased significantly to a level unseen in the past decade as soaring housing prices finally started to slow.

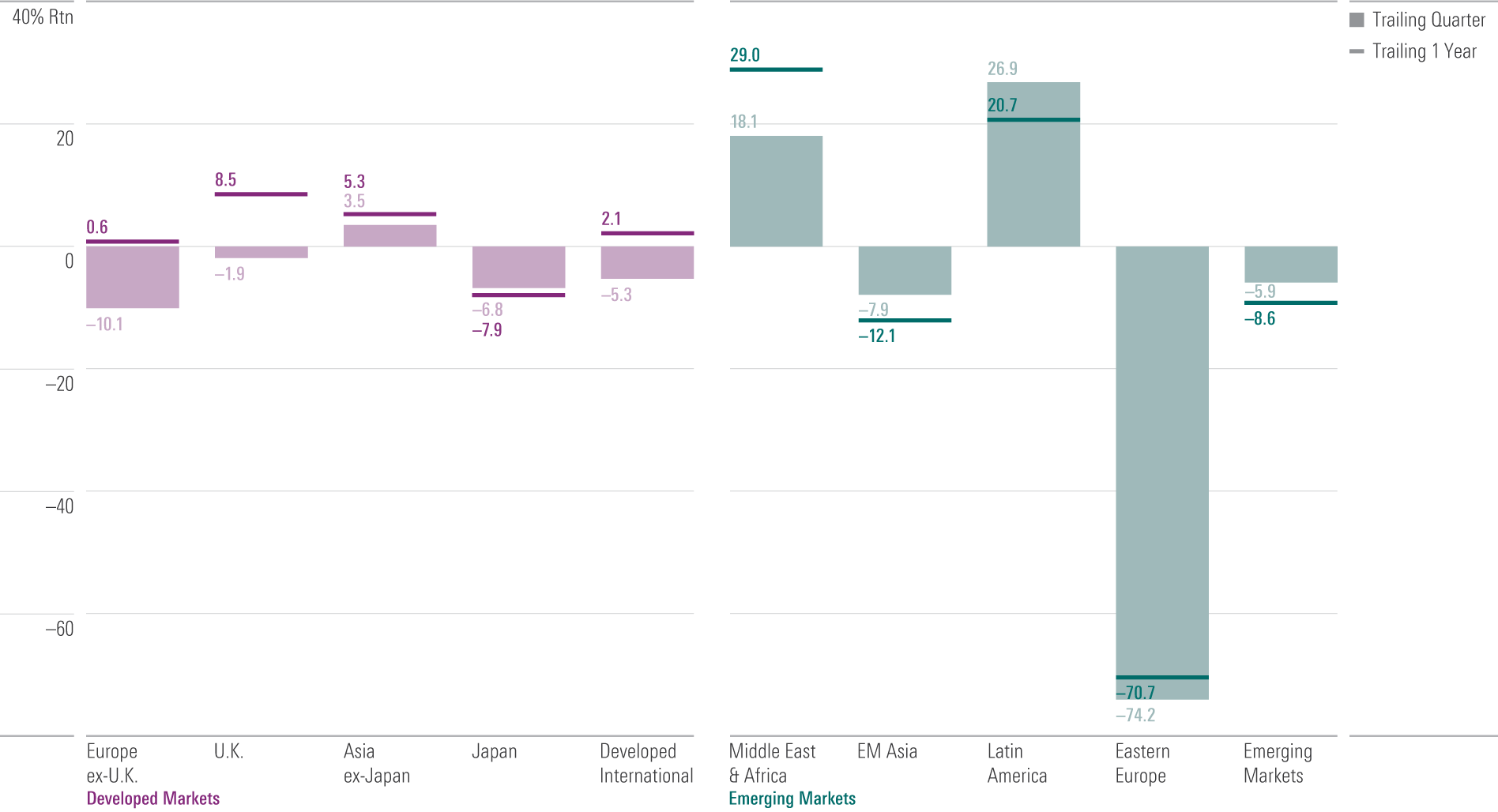

Global Markets Have Felt the Impact of the Russia-Ukraine Conflict

Eastern European stocks took a debilitating hit following the tragic turn of events in Ukraine. Trading partners and global markets overall also felt the impact, as global supply chain disruptions caused by the war amplified existing concerns over the impact of inflation, rising interest rates, and fragile economic growth prospects. The only countries and regions that benefited were oil exporters, such as the Middle East and Latin America.

International Stock Market Performance

Source: Morningstar Indexes. All returns are calculated in U.S. dollars. Data as of March 31, 2022.

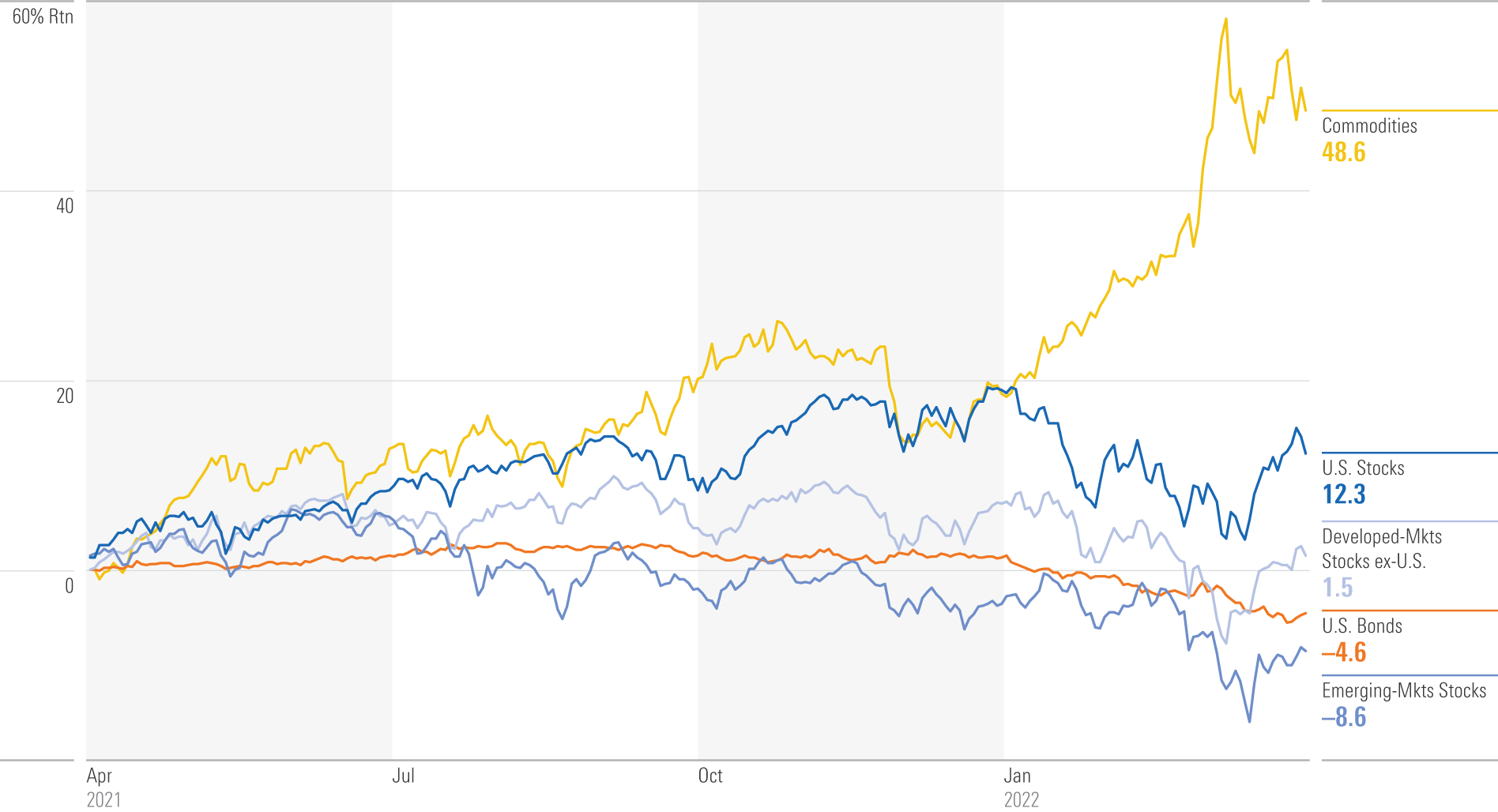

Commodities Prices Have Soared, Fueled by Sanctions on Russia

The United States and its allies imposed strict sanctions on Russia after the Ukraine invasion. Because Russia is a major oil, gas, and wheat exporter, the sanctions fueled shortage fears and caused prices to skyrocket. As a result, commodities posted their highest annual return since 2009, benefiting commodities investors but severely hurting consumers. Bonds, on the other hand, continued to suffer because of rapidly increasing inflation and the start of tighter monetary policy.

Trailing 12-Month Performance of Major Asset Classes

Source: U.S. stocks—Morningstar U.S. Market Index. Developed-markets stocks ex-U.S.—Morningstar Developed Markets ex-U.S. Index. Emerging-markets stocks—Morningstar Emerging Markets Index. U.S.bonds—Morningstar Core Bond Index. Commodities—Bloomberg Commodity Index. Data as of March 31, 2022.

While the broad equity markets around the world experienced a selloff, the energy sector in the U.S. as well as countries that export natural resources attracted investor interest. U.S. stock indexes bottomed out in the middle of March, but the U.S. equity market has since been on the rise, bouncing back faster than other developed markets during the past quarter. A strong U.S. dollar coupled with high gross domestic product growth helped fuel the recovery.

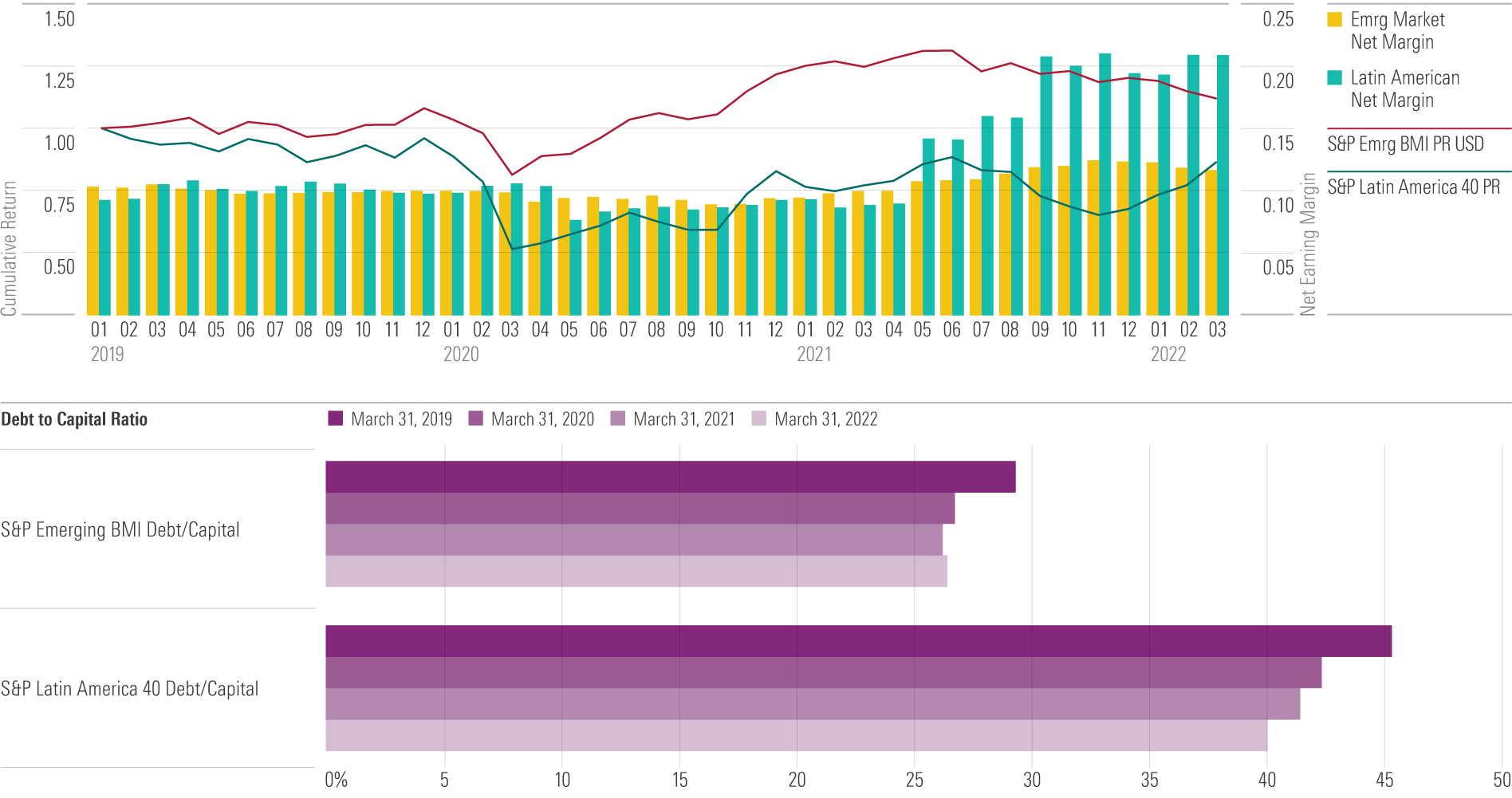

U.S. Inflation May Create Opportunities in Latin America

Among emerging markets, Latin America is often considered to be more in debt and inflationary compared with its Asian fellows. These perceptions make Latin America less attractive for equity investors. The situation might be changing, however, as the region's debt/capital ratio has dropped significantly and the earning margin has improved. A strong and inflationary U.S. dollar helps alleviate the foreign debt pressure in Latin American export-oriented economies. If this situation continues, it might be Latin America's time to shine.

Latin America vs. Emerging Markets

Source: Morningstar. Data as of March 31, 2021.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T5MECJUE65CADONYJ7GARN2A3E.jpeg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/VUWQI723Q5E43P5QRTRHGLJ7TI.png)

/d10o6nnig0wrdw.cloudfront.net/04-22-2024/t_ffc6e675543a4913a5312be02f5c571a_name_file_960x540_1600_v4_.jpg)