DIFFERENT RISKS

Investors have long championed board diversity. Boards with members from varied backgrounds can offer a breadth of experience and guard against the risk of groupthink. More recently, investors have put a heightened focus on diversity of gender, race, and sexual orientation. This sort of diversity is often thought to promote diversity of both opinion and experience. But that may not always be so.

BOARD EXPERIENCE

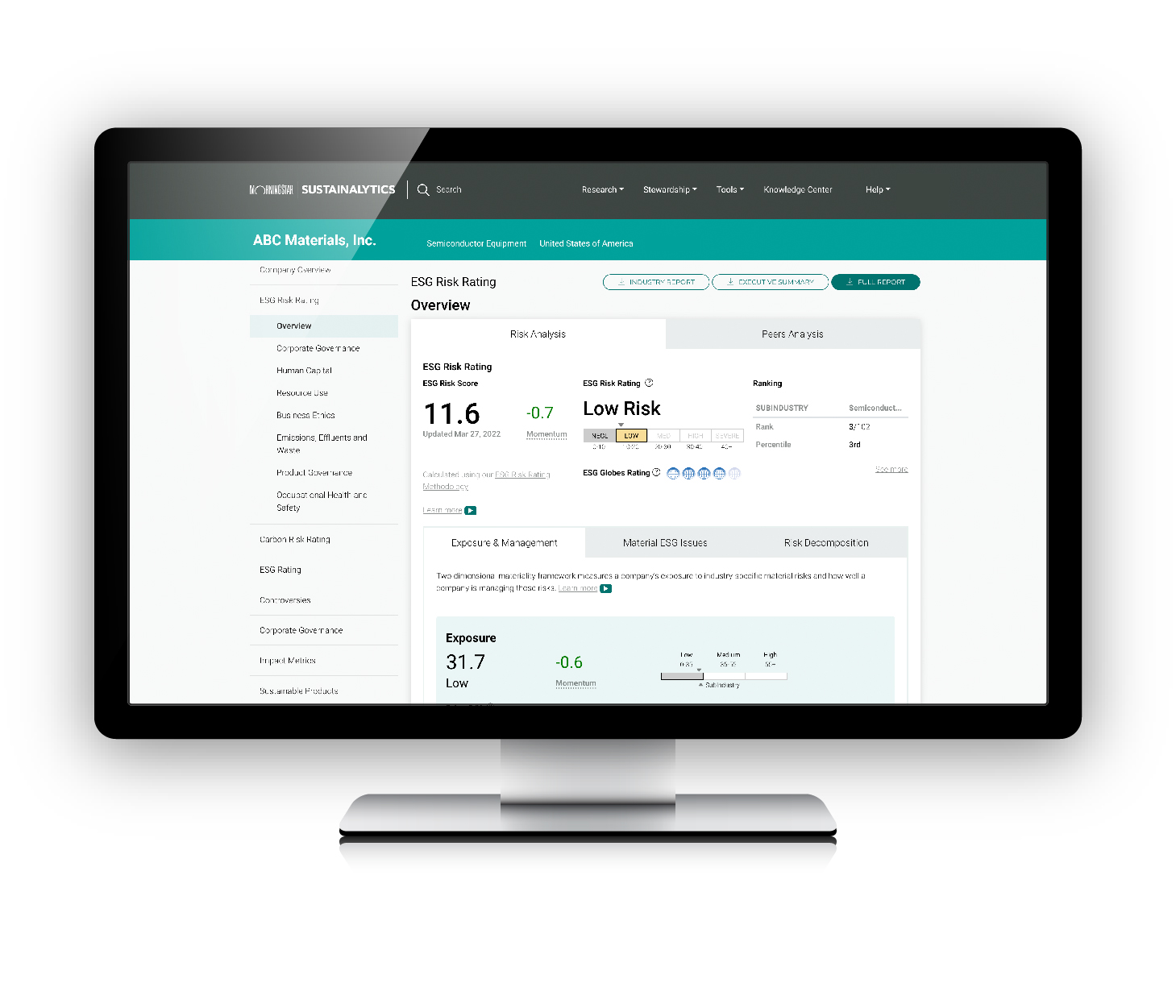

Investors who want to limit environmental, social, and governance risk related to board diversity can use ratings to manage them. Morningstar Sustainalytics’ “board experience” risk indicator measures whether a board has the industry experience to perform its oversight role, recognizing that a breadth of skills is required. Sustainalytics captures diversity of gender as a governance measure but does not capture diversity of race or sexual orientation. It also captures a companywide “diversity programs” management measure.

NOMINATING COMMITTEE

Sustainalytics also puts a focus on board-nominating committees, whose role is to evaluate new director nominations as well as renominations. Sustainalytics’ “nominating committee effectiveness” risk indicator measures the independence of a board’s nominating committee from company management and the transparency of its nominating process.

NASDAQ RULE

Last year, Nasdaq introduced a rule that requires listed companies to have at least two diverse directors or explain why they do not. Describing the rule’s purpose, Nasdaq noted “heightened attention to the commitment of public companies to diversity and inclusion.” Nasdaq also noted the need for “an increased variety of fresh perspectives, improved decision making and oversight, and strengthened internal controls.”

EXPERIENCE GAPS

Rivian, an electric truck company, highlights the need to consider these risks separately. Rivian aces Nasdaq’s diversity test: Half of its board members are women. But Sustainalytics gives Rivian the lowest board experience score, noting “gaps in board expertise or quality.” Rivian gets a stronger score for the effectiveness of its nominating committee, although Sustainalytics notes that its nominating process is poorly disclosed. Overall, Sustainalytics rates Rivian an underperformer for its corporate governance.

COMPANIES WITH RISK

Other American companies with underperforming governance that get poor board experience scores include ADT, AMC, Dun & Bradstreet, and Hyatt Hotels. ADT, AMC, and Dun & Bradstreet also get poor scores for nominating committee effectiveness. ADT, Dun & Bradstreet, and Hyatt Hotels pass Nasdaq’s diversity test. AMC fails.