By Jon Hale, Morningstar Research Services LLC

Funds

The Sustainable Funds Landscape in 6 Charts

Read Time: 4 Minutes

Sustainable investing is reaching new heights.

Names like BlackRock, State Street, Goldman Sachs, Microsoft, and Starbucks have articulated their commitment to sustainable investing and encouraged other companies to do the same. This push comes alongside the increasing focus on climate change and on corporations managing it for the benefit of all their stakeholders.

According to Morningstar’s 2019 Sustainability Landscape Report, there have been $21.4 billion of inflows to sustainable funds, and 30 new sustainable funds have been launched (all data from the report as of Dec. 31, 2019). Also, 35% of sustainable funds have finished in the top quartile of their respective Morningstar Category.

Here, we take a closer look at a few of the key takeaways from this report.

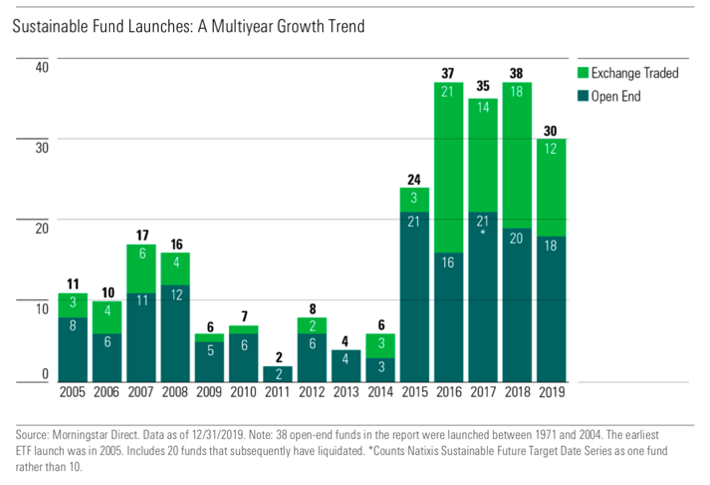

A Look at the Sustainable Fund Launches in 2019

Though the 30 new funds launched in 2019 marked a slight downtick from the previous year’s 38, they still rendered 2019 the fourth consecutive year with at least 30 new inceptions.

Here's the breakdown by fund type:

- 18 open-end funds.

- 12 ETFs.

- 22 equity funds.

- 7 bond funds.

- 1 money market fund.

This makes for a total of 303 funds in the sustainable universe. Launches over the past 15 years are shown in the chart below.

Why Sustainable Funds Now?

Beyond the new launches in 2019, 11 existing funds changed their investment strategies to focus on sustainable investing (making a total of 42 funds that have been repurposed over the past several years).

Asset managers may be attracted to this approach if they’re looking to:

- Build sustainable investing assets without the lengthy-time period required to start a fund from scratch.

- Breathe new life into an existing actively managed fund that is no longer attracting flows.

These funds’ original and updated names are listed in the table below.

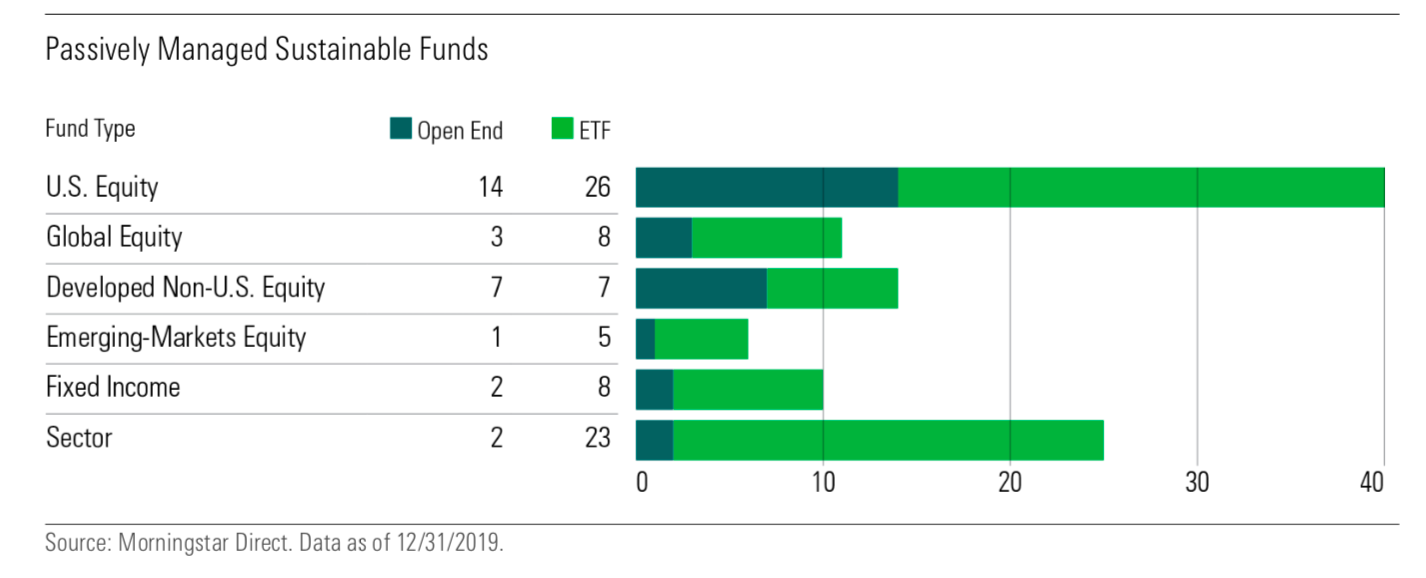

The Rise of Passively Managed Sustainable Funds

On the passive side, there are now 106 sustainable fund offerings, slightly more than a third of the larger sustainable funds’ universe. The lion’s share of passive sustainable funds is ETFs—77, compared with 29 open-end funds.

The chart below shows how these passive funds break down across fund types. U.S. equity funds account for about a third of the market’s offerings, and sector funds come in second with about a quarter.

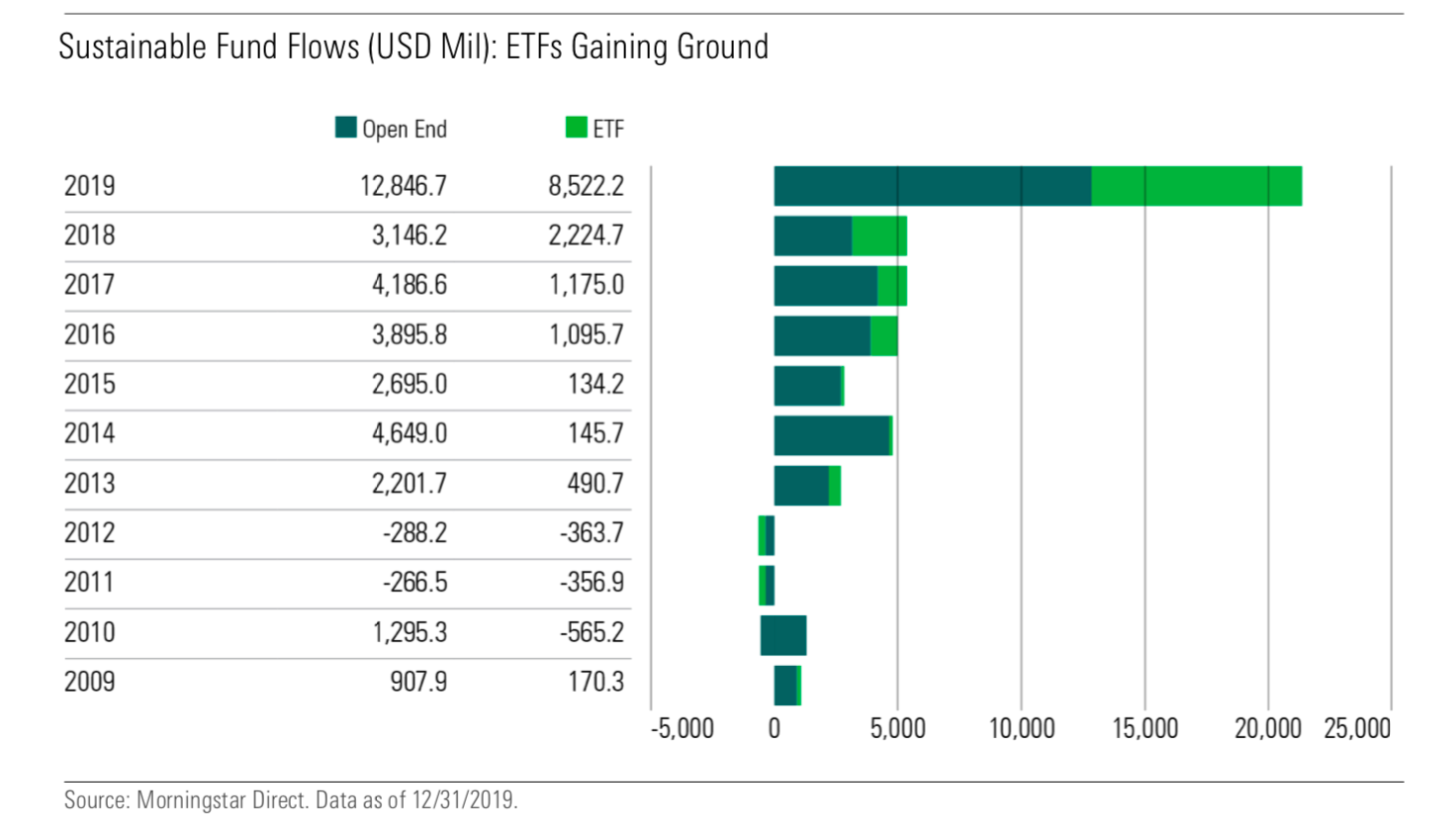

Sustainable Fund Flows Into Open-End Funds and ETFs

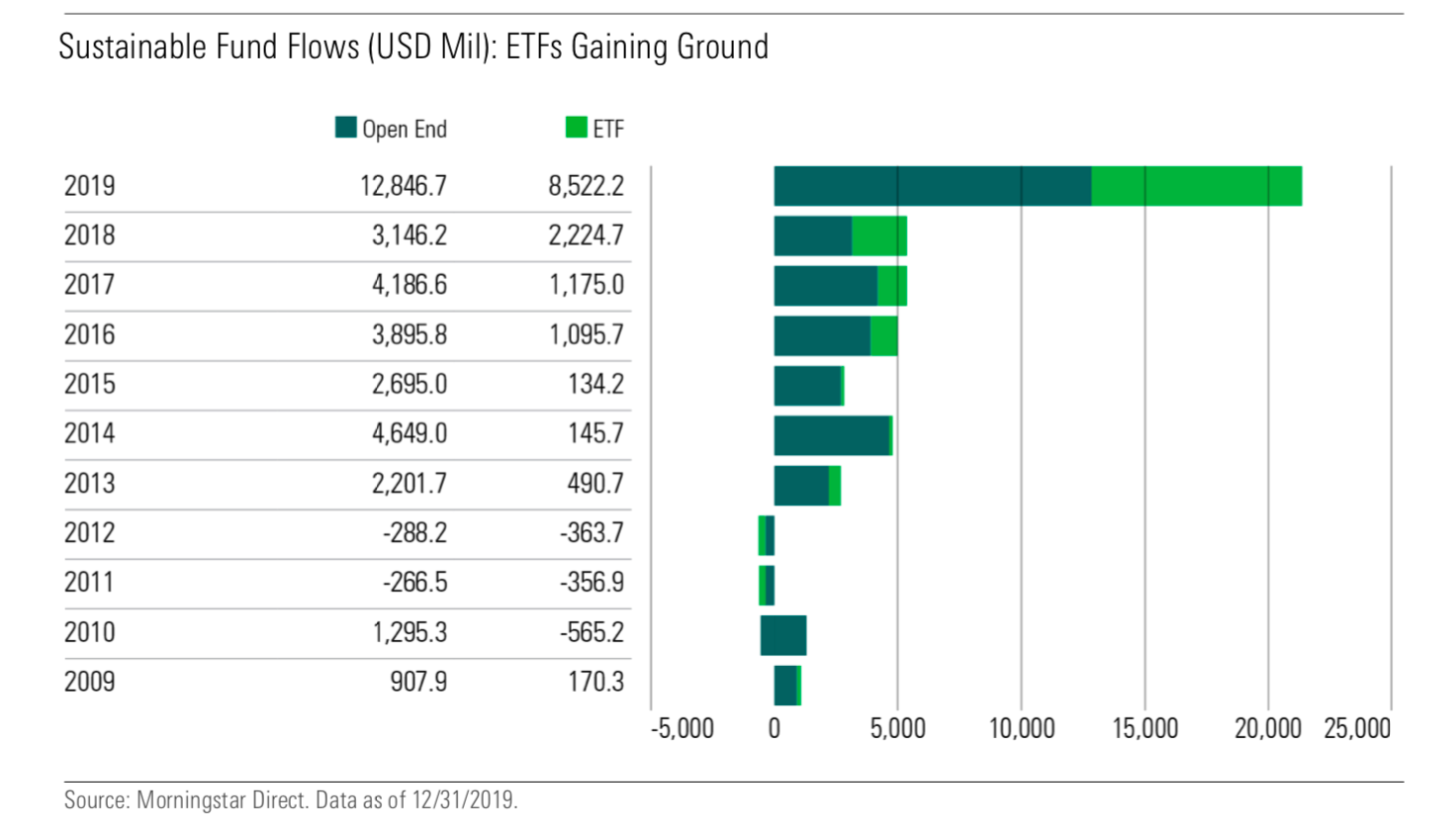

ETFs experienced a substantial increase in flows in 2019—about $8.5 billion, up from about $2.2 billion the year prior. This fourfold year-over-year increase is in line with the increase seen in open-end flows (which rose to $12.8 billion from $3.1 billion), but represents a substantial lift in the longer term: At 40% of overall sustainable fund flows, ETFs are collecting twice the percentage of flows that they did in 2016 and 2017.

These trends are shown in the chart below.

Which Asset Managers’ Sustainable Funds Had the Biggest Inflows and Outflows?

A few asset managers accounted for the majority of inflows to sustainable funds:

- BlackRock led the pack on the inflows front, attracting $5 billion to its 15 funds (13 iShares ESG ETFs and two actively managed funds). These funds now have a total of $10.4 billion in assets under management. Three of the funds were placed in the top 15 of individual fund flows.

- Calvert, now owned by Eaton Vance, collected $3.7 billion for its 28 funds, making for a total of $18.9 billion AUM. Two of these funds were placed in the top 15 of individual fund flows.

- TIAA and its subsidiary Nuveen had net flows of $2.8 billion, for a total of $9.1 billion AUM. This large amount is primarily due to the strength of the TIAA-CREF Social Choice Bond, which had the greatest inflows of any individual fund in 2019 ($1.8 billion).

- Vanguard gained $2.7 billion, with three of its four offerings placing in the top 15 of individual fund flows.

The 10 asset managers with the greatest inflows in this area are shown in the chart below.

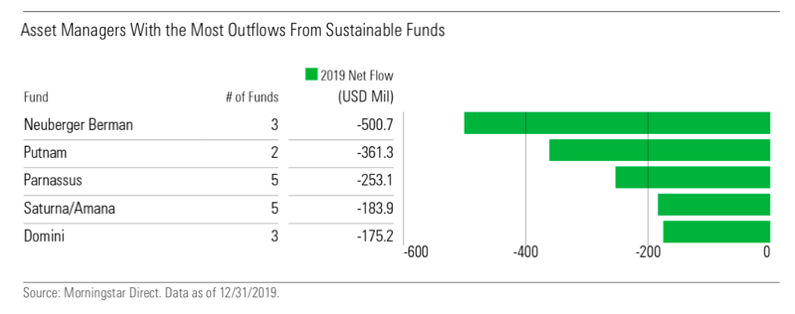

At the same time, a few asset managers had outflows from their sustainable funds. These asset managers, shown on the chart below, all run older, actively managed funds with large but dwindling asset bases.

Eliminating Barriers to Investing in Sustainable Funds

Despite ample interest from investors in sustainable investing, flows into sustainable funds have been limited for three main reasons:

- the lack of sustainable fund options.

- the perception that sustainable investing results in underperformance.

- overall investor inertia.

As more sustainable funds build attractive track records, however, these barriers are falling. Increasing research showing the competitive performance of sustainable investments and advisor education on the most effective ways to introduce the topic to clients are helping, and regulators are increasingly requiring ESG disclosures from companies.

Learn how you might build a sustainable fund for investors. Schedule a demo with the Morningstar Direct team.

The information, data, analyses, and opinions presented herein do not constitute investment advice; are provided solely for informational purposes and therefore are not an offer to buy or sell a security; and are not warranted to be correct, complete, or accurate. The opinions expressed are as of the date written and are subject to change without notice. Except as otherwise required by law, Morningstar shall not be responsible for any trading decisions, damages, or other losses resulting from, or related to, the information, data, analyses, or opinions or their use. The information contained herein is the proprietary property of Morningstar and may not be reproduced, in whole or in part, or used in any manner, without the prior written consent of Morningstar. Investment research is produced and issued by subsidiaries of Morningstar, Inc. including, but not limited to, Morningstar Research Services LLC, registered with and governed by the U.S. Securities and Exchange Commission.