The Latest Attack on Target-Date Funds

Three professors claim that such funds dupe inattentive shareholders.

A Harsh Appraisal

Of all the academic investment papers that I have read, "The Unintended Consequences of Investing for the Long Run: Evidence from Target Date Funds," is the one with which I most firmly disagree.

The article, by Massimo Massa, Rabih Moussawi, and Andrei Simonov, fiercely criticizes its subject. The authors find that target-date funds underperform other funds to a "staggering" degree. This shortfall occurs because target-date funds "exploit" their relatively captive audiences, which are unlikely to punish subpar returns by redeeming their shares. For a similar reason, target-date funds also get away with "fee skimming."

I agree with the authors' initial assumptions. They are correct that target-date funds have unusually loyal shareholders who are relatively insensitive to both performance and costs. It is also true that those who promote target-date funds--by which I mean not only fund companies, but also 401(k) sponsors, consultants, and the media--have counseled target-date investors to "invest for the long run." They have been instructed not to sweat the details. Finally, it is true that most target-date fund lineups have closed structures, meaning that they invest only in funds from that organization.

The Price Is Right

So far, so good. From there, however, I must part ways. For one very big thing, target-date funds are relatively cheap. The median annual expense ratio for a 2035 target-date fund, including all underlying fees for funds of funds, is 0.65%. The corresponding figure for their closest investment rivals, allocation--50% to 70% equity funds, is 1.01%. The same holds true for other target-date categories. Across the board, they cost substantially less than does the typical allocation fund.

One could argue, perhaps, that target-date funds should be cheaper than other funds because target-date funds are so large. However, that is not so. The industry's target-date fund leaders are huge, but they control nearly all the group's assets. For example, the median 2035 target-date fund possesses a modest $500 million. Meanwhile, the median allocation--50% to 70% equity fund is slightly larger, at $600 million.

The truth is that fund companies frequently subsidize their target-date lineups, on three grounds. One is that target-date funds are a 401(k) plan's showpiece. Consequently, fund companies will often charge less for their target-date funds in the hope of securing the business. A second is that although target-date fund shareholders might not be cost-conscious, those who select 401(k) plans tend to be. Finally, as illustrated by the "Unintended Consequences" paper, target-date funds are heavily scrutinized. Overcharging for target-date funds is imprudent.

The authors identify some situations where target-date funds overpay when holding underlying funds from their own families, by not purchasing the cheapest available share class--a tactic that they call "fund profit pumping." Such behavior is indeed unseemly. On the other hand, when target-funds are substantially cheaper than all other allocation funds, which is in fact the case, one must conclude that the authors' critique of fund expenses misses the trees for the leaves.

The Performance Puzzle

The authors' analysis of target-date funds' returns is also perplexing. My approach for determining how target-date funds have performed is to compare their returns against: 1) custom indexes and 2) other funds that are similarly positioned. The authors take the academic approach of calculating "alphas," which measure how the funds have fared after they control for various investment factors, such as their asset allocations, preferences for growth or value stocks, tastes for long or short bonds, and so on.

Their approach has the advantage of being theoretically more accurate, but the disadvantage of being difficult to parse. If the correct investment factors aren't specified--which I suspect occurred here, as the paper doesn't include a factor for international investing, nor for Treasury Inflation-Protected Securities (common among nearer-dated target-date funds)--then the alpha calculation is quietly flawed. Complex methods don't always lead to better answers.

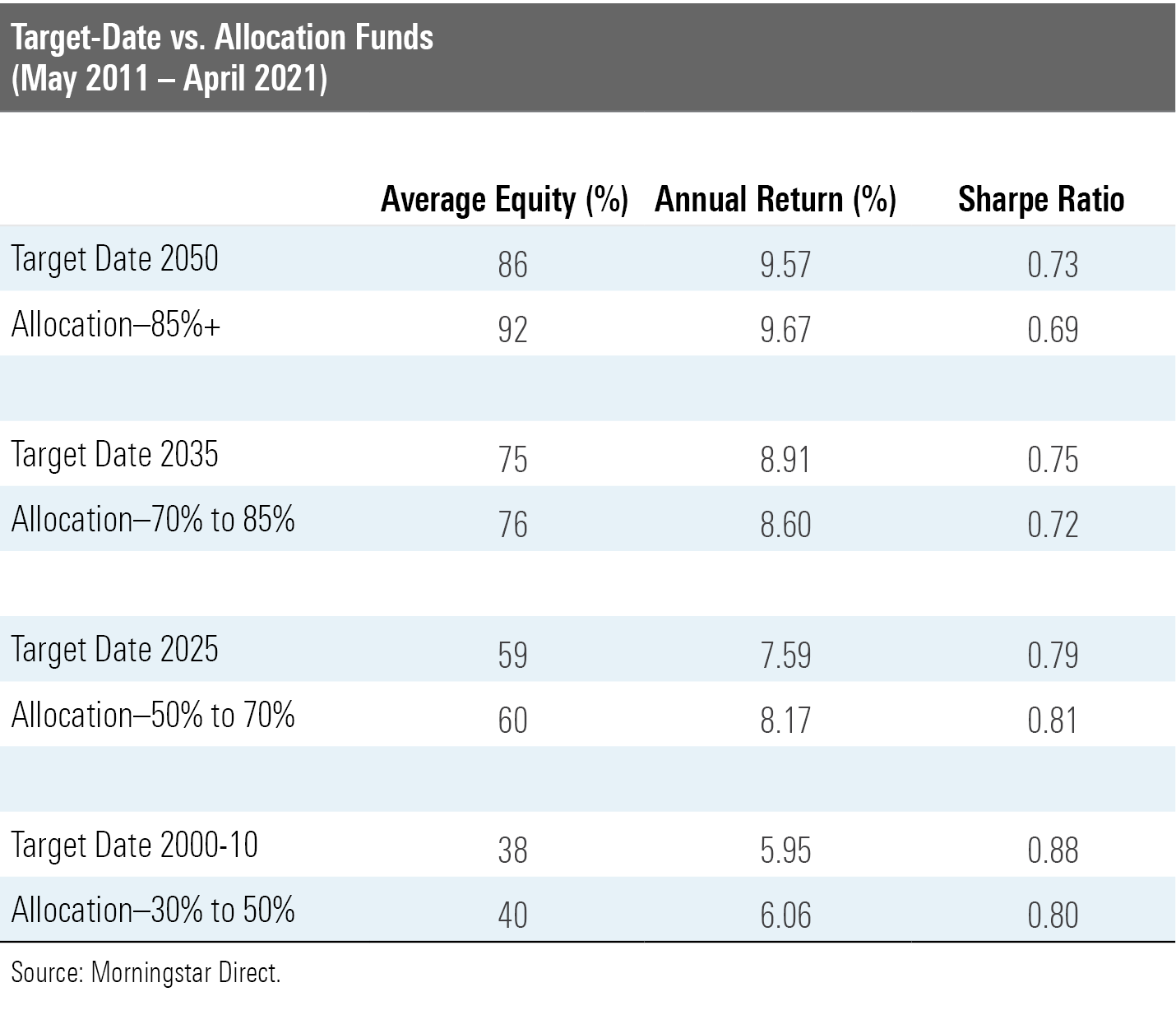

I cannot state that occurred here, as to duplicate the authors' research would be the subject of a white paper, not a column. But their output certainly does not match what my comparisons yield. To illustrate the point, let's compare the trailing 10-year results for four categories of target-date funds against four categories of allocation funds. The table below provides each category's: 1) average equity position during those 10 years, 2) total returns, and 3) risk-adjusted Sharpe ratio.

The comparison categories looked much like the target-date funds, and they behaved like them, too. That was what I had expected. After all, both sets of funds are managed by the same organizations, with much the same personnel. Why would they perform differently? The authors, of course, have an answer for my rhetorical question. Fund companies understand that shareholders will monitor their allocation funds more closely than they do their target-date funds. Therefore, providers do a better job of managing their allocation funds.

Plenty of Company

I remain unconvinced of that argument. For one, target-date funds are highly visible, because they anchor the second leg of America's retirement system. No other variety of mutual fund has ever been subjected to a Senate hearing. Nor has Morningstar's Christine Benz felt compelled to come to other funds' defense, as she did last month with target-date funds. Thus, the claim that target-date funds are a metaphoric dark alley, where crimes can be more easily committed without attracting attention, strikes me as untenable.

But even if I grant the thesis, I do not see the supporting evidence. Target-date funds are neither relatively expensive nor visibly poor performers. To be sure, most have trailed their expense-free benchmarks over the past decade, owing to their costs, the drag of cash, and the occasional investment glitch. But the same may be said for pretty much every other flavor of mutual fund. For those sins, target-date funds very much do not stand alone.

John Rekenthaler (john.rekenthaler@morningstar.com) has been researching the fund industry since 1988. He is now a columnist for Morningstar.com and a member of Morningstar's investment research department. John is quick to point out that while Morningstar typically agrees with the views of the Rekenthaler Report, his views are his own.

The opinions expressed here are the author’s. Morningstar values diversity of thought and publishes a broad range of viewpoints.

/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/ZKOY2ZAHLJVJJMCLXHIVFME56M.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/IGTBIPRO7NEEVJCDNBPNUYEKEY.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/HDPMMDGUA5CUHI254MRUHYEFWU.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/1aafbfcc-e9cb-40cc-afaa-43cada43a932.jpg)