Top Stocks of 2022, ETFs for 2023, and Tax Season Tips

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, we take a look at 2022′s stock and bond market performance, ETFs to watch in 2023, and deep dive into Tesla’s stock. Christine Benz shares her tax fact sheet and calendar and Amy Arnott tells you what your net worth statement means.

Chart of the Week

15 Charts Explaining an Extreme Year for Investors

We look back at a brutal year in stocks, bonds, and cryptocurrency.

Glossary Term of the Week

Also known as: Tax Write-Off

A tax deduction is a provision in the tax code that reduces a person’s taxable income, or the amount of income used to calculate how much tax they owe. Taxpayers can choose to receive a standard tax deduction or take itemized deductions.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

What to Watch

3 Great ETFs for 2023 and Beyond

Investors don’t have to give up long-term performance to manage current risks.

Articles We Love

Your 2023 Tax Fact Sheet and Calendar

Bookmark this guide to stay abreast of the tax-related dates and data that should be on your radar this year.

As we enter 2023, there aren’t many seismic changes scheduled, taxwise. Instead, most of the tax changes going into effect as the new year dawns amount to adjustments to income or contribution limits, reflective of the effects of inflation in various provisions within the tax code. Because inflation has been high recently, those inflation adjustments are also higher than usual.

Here are key tax-related dates and data points to have on your radar for the year ahead.

Just How Bad Was 2022′s Stock and Bond Market Performance?

We’ve collected a list of “worst ever” and “worst since” records set across the markets on individual stocks and funds.

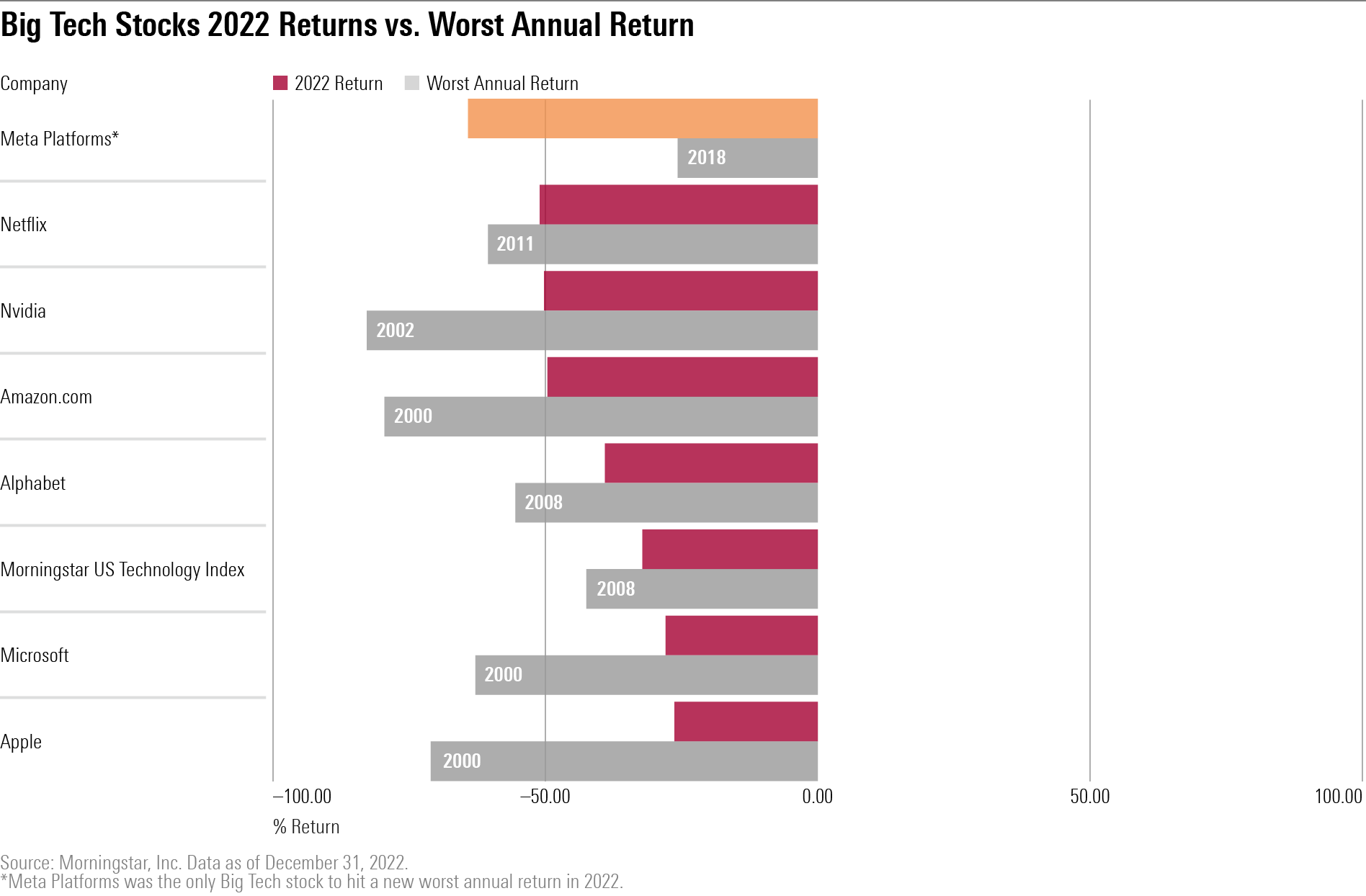

In Big Tech, 2022′s losses were significant. But aside from Meta Platforms META, this loosely defined group of stocks didn’t set new records for worst annual losses.

Meta Platforms’ stock melted 64.2% in 2022, which eclipsed its prior worst annual loss of 25.7% back in 2018. The only other Big Tech stock that came close to hitting a new worst annual return record was Netflix NFLX, which declined 51.1% in 2022, about 9 percentage points shy of its worst-ever annual return of 60.6% in 2011.

The company’s shares illustrate the market’s past excesses—and, perhaps, its future promise

Each January, I write about a company that reflects the stock market’s zeitgeist. Two years ago, the firm was GameStop GME, meme stocks then being the rage. Last year’s topic was Digital World Acquisition Corp. DWAC, which was flying high thanks to its arranged marriage with Donald Trump’s new business venture, Trump Media. (As in a Julia Roberts film, that ceremony has since been twice postponed.)

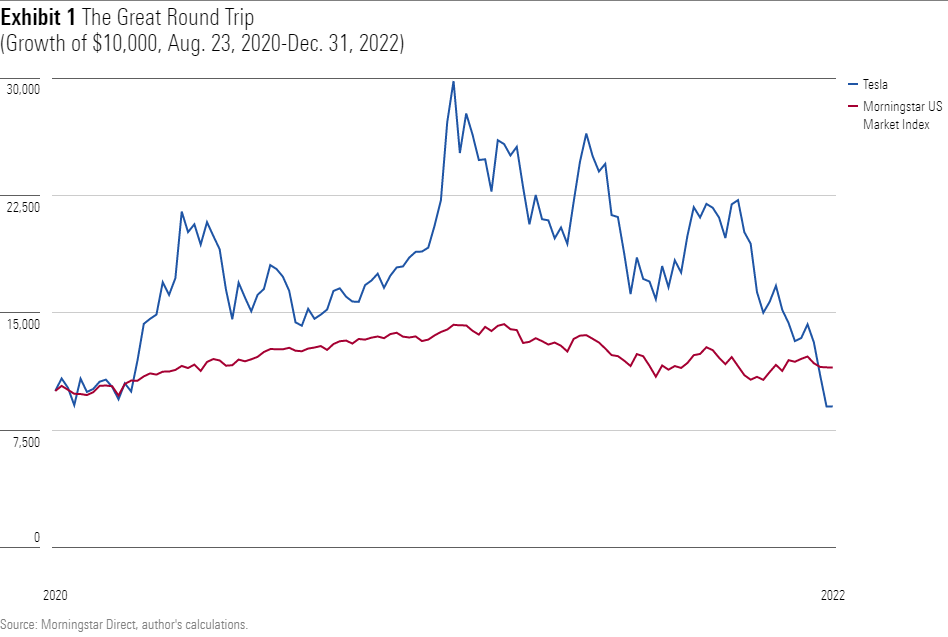

This year’s selection is, of course, Tesla TSLA. The company was not only among 2022′s two biggest stock market stories (along with Twitter, which is no longer publicly available), but it also neatly symbolizes the rise and fall of the previous bull market. In summer 2020 Tesla looked unbeatable—which, as shown by the following chart, it was over the next 12 months. During that time, Tesla’s stock price tripled.

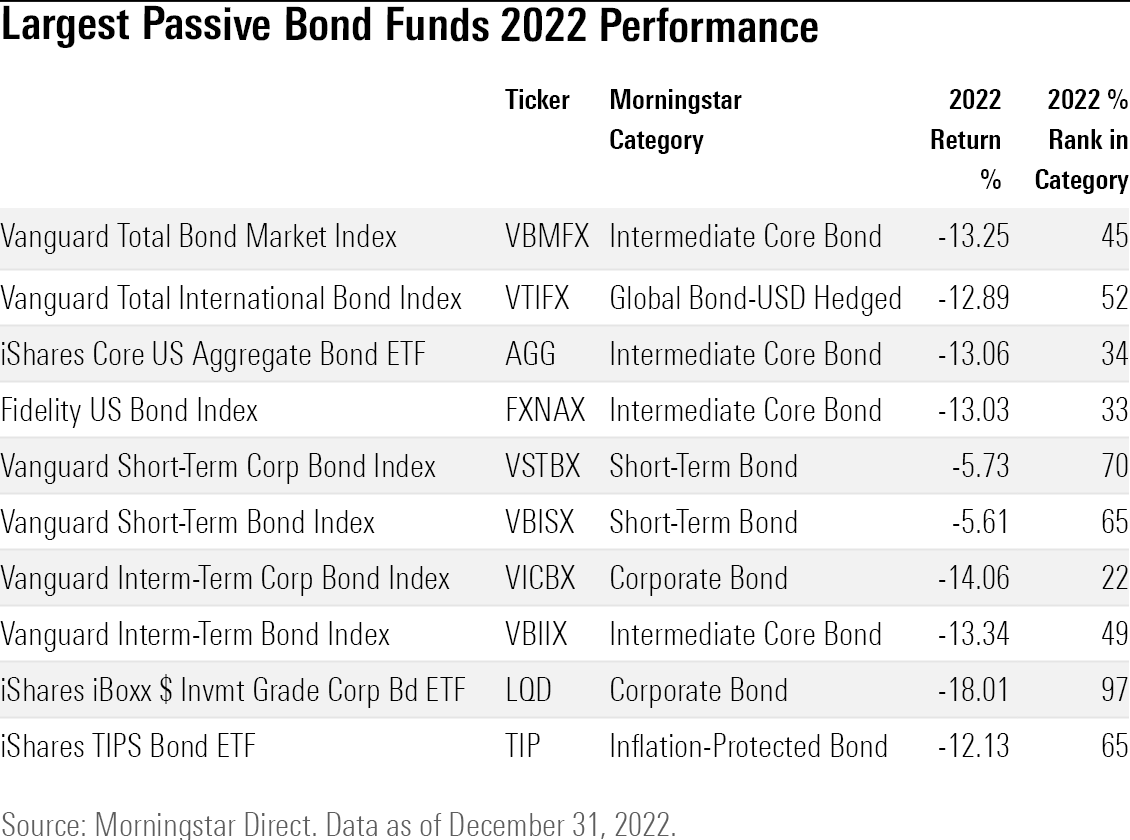

How the Largest Bond Funds Did in 2022

Rising rates inflicted record losses on the most widely owned bond funds, but some actively managed bond funds fared somewhat better.

Investors generally don’t expect double-digit returns from their bond funds, especially not those in negative territory.

Bond funds usually are meant to play a stable part in portfolios, providing diversification from more volatile stocks. But 2022 wreaked havoc on bonds and the funds that hold them as the Federal Reserve raised short-term interest rates at an unprecedented pace to combat 40-year highs in inflation. Because bond prices move in the opposite direction of yields, the Fed’s rate hikes inflicted record losses on many bond funds. That included the bond funds that are the most widely held by investors.

What Your Net Worth Statement Is Telling You

A summary of all your assets and liabilities is a crucial first step toward getting a better handle on your finances.

Compiling a net worth statement might seem like a tedious task. You’ll need to gather as much information as you can about all of your assets (including taxable accounts, tax-deferred accounts, real estate, and personal property) and liabilities (including mortgages and car loans). But it’s also one of the best ways to get a clear snapshot of your financial health.

In this article, I’ll walk through a hypothetical net worth statement and discuss how to interpret what it’s telling you.

Stocks, Funds, and Exchange-Traded Funds

Stocks finished 2022 down more than 19%, as measured by the Morningstar US Market Index. Stubbornly high inflation, rising interest rates, and talk of a possible economic recession rattled markets for much of the year.

Heading into 2023, stocks look downright cheap according to our metrics. The median stock in Morningstar’s North American coverage finished the year trading at a 16% discount to our fair value estimate.

“As much as we thought stocks were overvalued coming into 2022, we now see the markets as trading at a deep discount to our fair value estimate,” writes Morningstar chief U.S. market strategist David Sekera in his latest stock market outlook.

A Brutal Year in the Markets Doesn’t Rattle ETF Investors

After years of torrid growth that featured only brief interruptions, markets crashed back down to Earth in 2022. The Morningstar Global Markets Index, a broad gauge of global equities, declined 18.31% on the year after it slid 3.71% in December. That marked its worst calendar year since 2008. Meanwhile, the Morningstar US Core Bond Index closed the year 12.96% lower than where it started—the worst year in a track record that dates back to 2000. The index fell in nine of the 12 months on the year after declining 0.42% in December.

Contrarian Picks for 2023 and Beyond

Last year was the worst for bonds in decades and the worst for global stocks since 2008. There are sure to be opportunities amid the wreckage, though. One approach that has proved effective is Morningstar’s Buy the Unloved study. Each year since 1994, we’ve looked for contrarian mutual fund investment ideas among the Morningstar Categories that suffered the most outflows in the previous year, or the unloved, while avoiding the groups that received the highest inflows, or the loved.

Missed Us?

Check out our investing specialists on Twitter:

~49% of all active funds topped their benchmark index in 2022. Among the larger asset classes, active US stock funds fared well (~62% beat rate), taxable bond funds less so (~48%), and int’l stock funds even worse (~40%). — Jeff Ptak @syouth1

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/5N6PBZJLMJEIXBH6EHTKPDK6NE.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/FIN36RNGOFABFDS2NCP2RCCG3I.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/UWZH3VLHBVCIDP2ANJ73YKE4QA.png)