Ed Slott’s Tax and IRA Tips, Top Overvalued Stocks, and Real Estate in 2023

We’ll review the top stocks, funds, and exchange-traded funds this week as well as updates you can make to your portfolio.

What You Missed

This week, we take a look at overvalued stocks, ESG portfolio performance in 2022, and the best companies to invest in right now. Christine Benz and Ed Slott share their tax and IRA tips, Sarah Newcomb talks budgeting, John Rekenthaler discusses all-weather stock funds, and Amy Arnott tells you what’s under the hood at Vanguard Charitable.

Chart of the Week

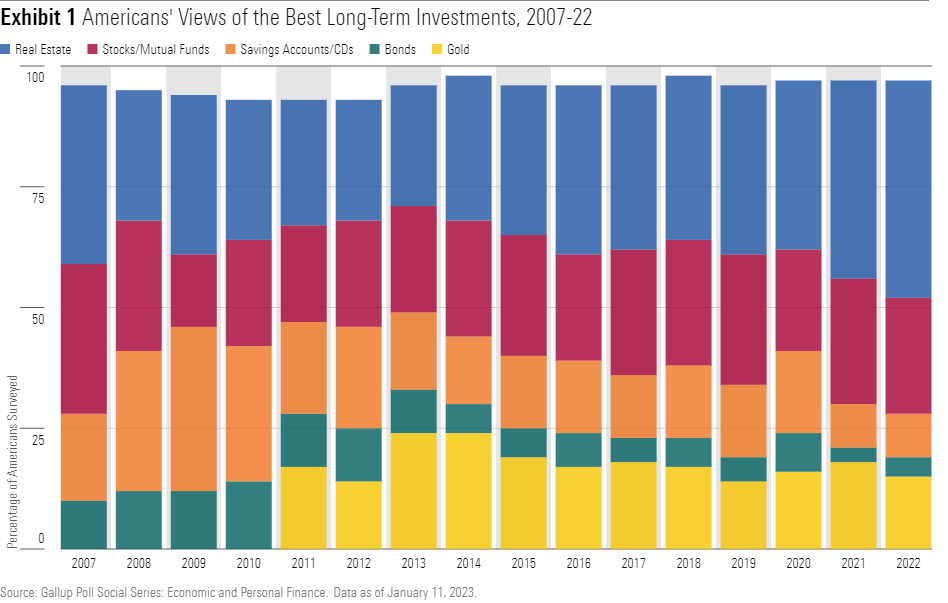

The Role of Real Estate Investments in a Portfolio

Investors can benefit from allocating as little as 5% to REITs.

Glossary Term of the Week

A budget is a tool investors can use to plan and track their spending and savings.

One of the first steps in creating budgets is to identify income sources and fixed expenses like rent or utilities. Then, investors can forecast variable expenses like food and transportation.

See Morningstar’s Investing Definitions and Financial Terms for the full definition.

Check out Sarah Newcomb’s article “This Budgeting Trick Can Help With Your Financial Goals.”

What to Watch

Tips for Last-Minute IRA Contributions

Rushing in a 2022 contribution before the April 18 deadline? Tax and IRA expert Ed Slott shares what you need to know.

Articles We Love

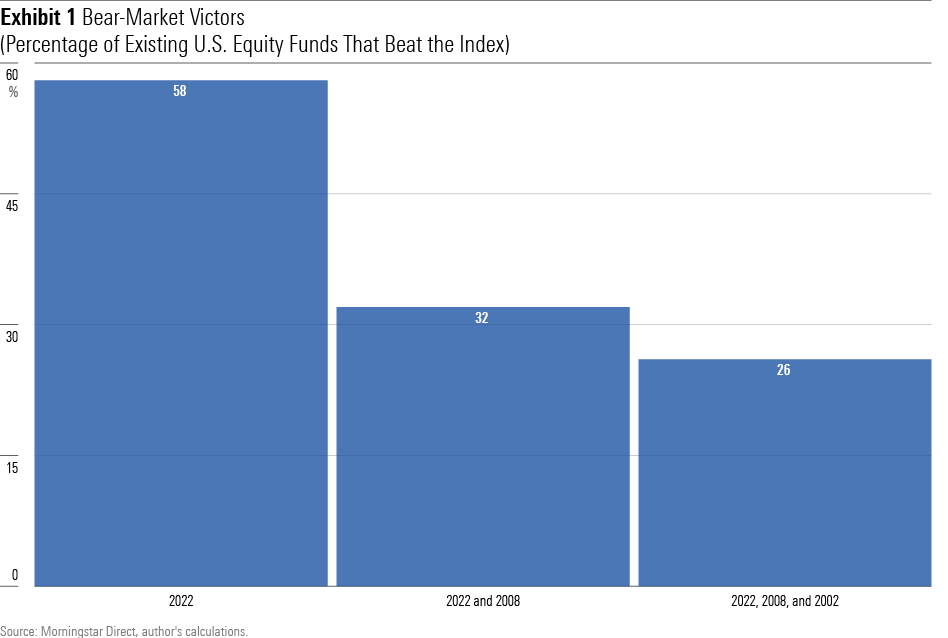

All-Weather Stock Funds Do Exist

Unfortunately, almost nobody owns them.

Before attempting to identify all-weather stock funds, it’s worth testing to see whether such things exist. To assess that proposition, I evaluated the returns of mutual funds and exchange-traded funds during the three bear-market years of 2022, 2008, and 2002. Eligible candidates were diversified U.S. equity funds that existed through that 21-year period, investing an average of at least 85% of their assets in stocks.

Of the 953 funds that possessed the requisite history, 550 lost less than the Morningstar US Market Index during 2022, for a bear-market success rate of 58%. Of course, because I defined “success” as any return higher than negative 19.43%, the term is very much relative. Nevertheless, among the group that was evaluated, more equity funds than not outdid the costless index.

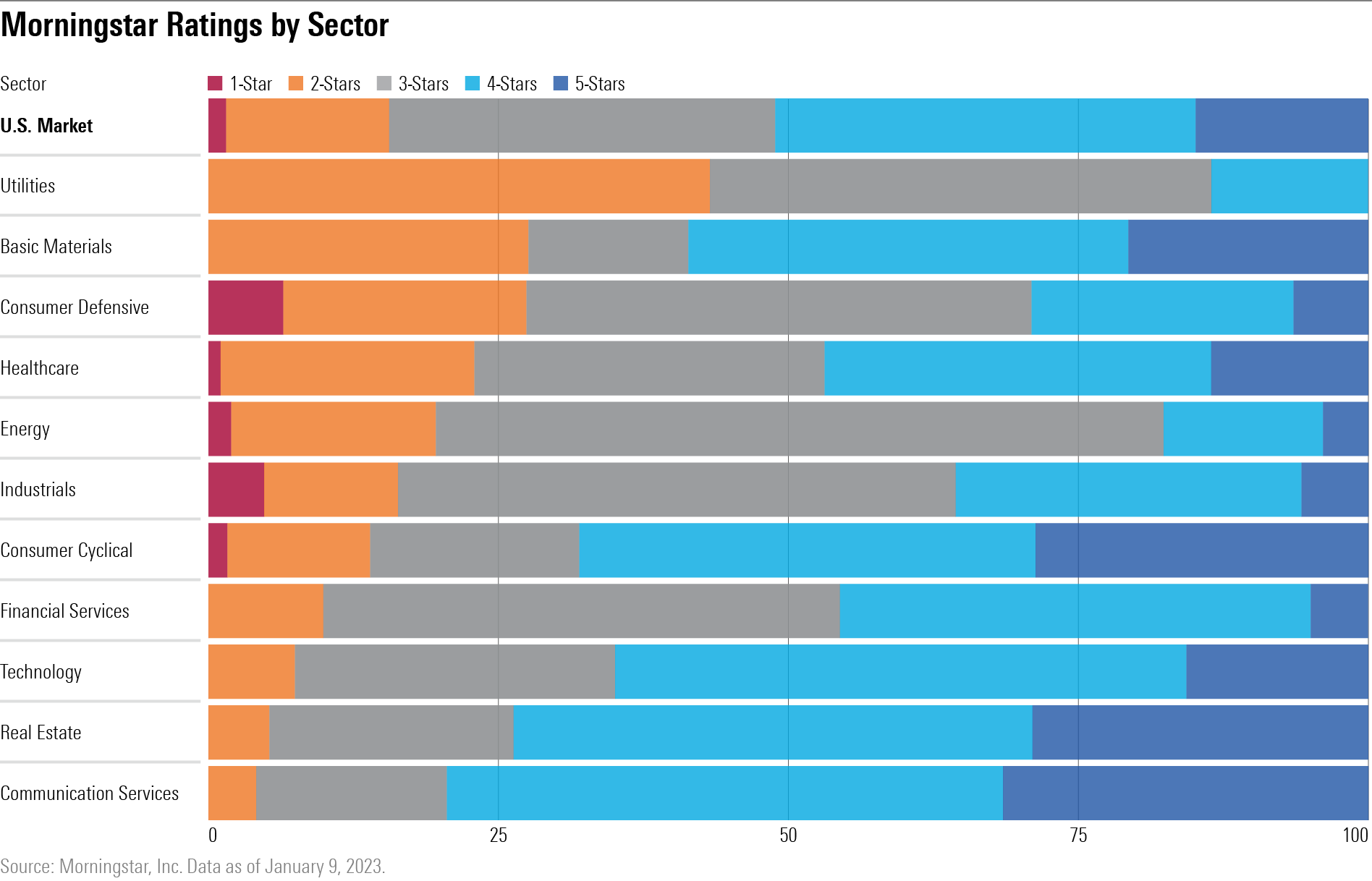

5 Most Overvalued Stocks Right Now

You may want to check your portfolio for these overpriced names.

Stocks may still be in the throes of a bear market, but there are still overpriced names for investors to be wary of.

As of Jan. 9, 2023, 15%, or 130, of the 847 U.S.-listed stocks covered by Morningstar analysts are considered overvalued, having a Morningstar Rating of either 1 or 2 stars. A year ago, about 30%, or 253 stocks, were overvalued compared with the fair value estimate set by Morningstar stock analysts.

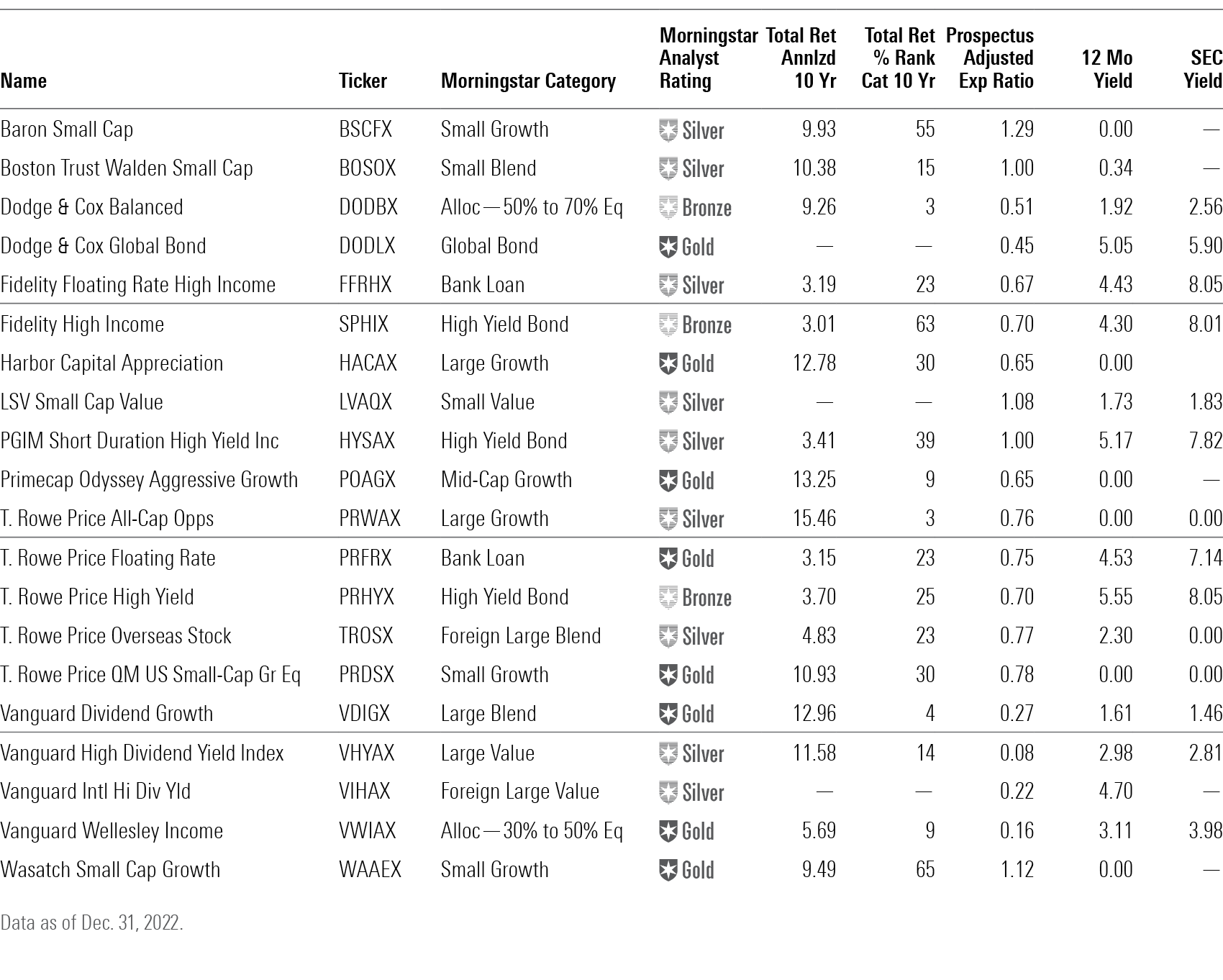

20 Funds for Investors to Consider in 2023

These funds have long-term appeal.

The market gave us a lot of red numbers in 2022. It was one of the tougher years for stocks and bonds alike. But now I feel pretty good about investing for the long term.

To be sure, 2023 seems dicey, with more Federal Reserve rate hikes and a possible recession looming. But stocks appear cheap, and equity and bond yields are quite robust. A couple of years of sideways markets wouldn’t be so bad if fund investors can continue to bank yields of 2% to 8%, depending on the fund.

How Did the Bucket Portfolios Perform in 2022?

A tough market environment played to the strengths of these conservative-leaning portfolios, though they couldn’t escape losses.

This past year was likely an unnerving one for many retirees. Amid soaring inflation and rising interest rates, stocks and bonds both ended the year with double-digit losses, marking their worst simultaneous decline in more than 50 years.

Against this unforgiving backdrop, our Model Bucket Portfolios, including those composed of mutual funds as well as exchange-traded-fund-only portfolios, all saw losses of between 8% and 11%. The equity-heavy Aggressive Bucket portfolios exhibited the biggest declines in value, while the Conservative portfolios did a somewhat better job of preserving capital.

ESG Investing Keeps Pace With Conventional Investing in 2022

A look at Morningstar’s sustainability indexes and which funds outperformed.

Sustainable investing generated returns similar to those of the overall market in 2022. The broad Morningstar US Sustainability Index fell 18.9% in 2022, outperforming the 19.5% decline of its parent, the Morningstar US Large-Mid Cap Index. Over the same time, the S&P 500 fell 19.4%.

As with markets generally, value stocks outperformed growth by a large margin among environmental, social, and governance investments. “These market dynamics were unfavorable for sustainable investments,” says Dan Lefkovitz, strategist for Morningstar Indexes. Consider that the Morningstar US Sustainability Large Cap Broad Growth Index lost 30.1% over the year, nearly 3 times the 10.1% decline of its Morningstar US Sustainability Large Cap Broad Value counterpart. Energy, a traditional value sector, was by far the best-performing equity sector, while the growth-leaning technology sector was one of the worst.

Stocks, Funds, and Exchange-Traded Funds

The 10 Best Companies to Invest in Now

Investors have endured a lot of market uncertainty during the past year—and many market watchers expect volatility to persist for the foreseeable future. After all, the Federal Reserve has signaled that it will continue to raise rates to combat inflation in 2023, and the threat of an economic recession looms.

During uncertain times, investors may want to own companies that offer some sense of certainty in terms of cash flows and company fundamentals. That’s where Morningstar’s Best Companies to Own list comes in. The companies that make up this list—130 in total—have significant competitive advantages, and we think those advantages are stable or growing. We believe the best companies have predictable cash flows and are run by management teams that have a history of making smart capital-allocation decisions.

Looking Under the Hood at Vanguard Charitable

With $16.1 billion in assets as of June 30, 2021, the Vanguard Charitable Endowment Program ranks as the third-largest donor-advised fund affiliated with an asset-management firm in the United States, falling behind Fidelity Charitable Gift Fund and Schwab Charitable Fund. For investors who plan to maintain larger account balances, though, it’s arguably the best option. It offers the lowest administrative costs for higher account balances as well as a rock-solid investment lineup.

Evaluating Our Picks for Best and Worst New ETFs Over the Years

Each year, our ETF research team selects the best and worst new ETFs that launched during the past 12 months. We have chosen 15 “best” and 24 “worst” new ETFs out of a whopping 2,565 ETFs launched on or after Jan. 1, 2015. That means we cherry-picked the best and worst ETFs from 55% of all historical launches. Choosing our favorites and least favorites from the flurry of launches was not easy, but each year we have settled on a small cohort to represent each group.

There are no hard-and-fast criteria for picking the best and worst. But in our experience evaluating ETFs, we have some idea of what makes a good or bad one. Put simply, we judge each on the likelihood of a long-term positive investor outcome.

Missed Us?

BlackRock is launching an actively managed AAA CLO ETF $CLOA that will undercut incumbents ($AAA, $ICLO, and $JAAA) on the fee front by 5-6 bps—priced at 0.20%.—Ben Johnson, CFA @MstarBenJohnson

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6NPXWNF2RNA7ZGPY5VF7JT4YC4.png)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/RYIQ2SKRKNCENPDOV5MK5TH5NY.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/6ZMXY4RCRNEADPDWYQVTTWALWM.jpg)