Why We Upgraded Funds From Vanguard and Fidelity

Plus a look at downgrades and a fund that is new to coverage.

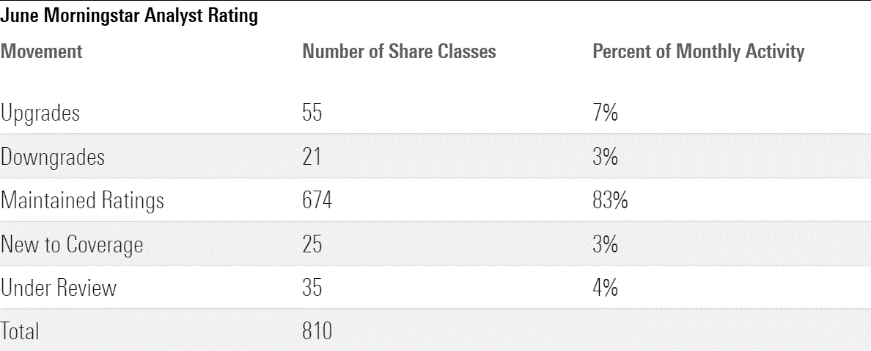

Morningstar updated the Analyst Ratings for 810 fund share classes, exchange-traded funds, separately managed accounts, collective investment trusts, and model portfolios in June 2022. Of these, 674 maintained their prior rating, 21 were downgraded, 55 were upgraded, 35 were placed under review because of material changes such as manager departures, and 25 were new to coverage.

Looking through share classes and vehicles to underlying strategies, Morningstar issued 182 Analyst Ratings during June. Of these, two were new to coverage and the remainder had at least one investment vehicle that had been previously covered by a Morningstar analyst.

Below are some of the highlights of the downgrades, upgrades, and strategies new to coverage.

Downgrades

The generational handoff underway at John Hancock U.S. Global Leaders Growth's USGLX dropped the strategy's Analyst Rating to Bronze from Silver for its cheapest share classes. Gordon Marchand and Rob Rohn are founding principals of subadvisor Sustainable Growth Advisers and have managed this fund since 1995 and 2003, respectively. Marchand dropped off this strategy in June and expects to retire from the firm next year, with Rohn's retirement expected shortly thereafter. Their successors have big shoes to fill. Marchand and Rohn's ability to find companies with steady growth and competitive advantages has produced solid results. The portfolio regularly provided considerable ballast in down markets, and the fund's rolling five-year returns since Marchand started in 1995 beat the large-growth Morningstar Category average nearly 70% of the time. Hrishkesh Gupta took Marchand's spot on the fund's management team on July 1, 2022, and Kishore Rao will remain as a comanager. Rao replaced George Fraise, another founding principal and member of the investment team who stepped away in January 2020. Gupta and Rao are well-credentialed, but we have yet to see how the team will work without the founders.

The SEC's charge requiring subadvisor Allianz Global Investors to stop providing advisory services to U.S.-registered funds by July 25, 2022, dropped Virtus Water's AWTPX Analyst Rating to Negative from Neutral for all share classes. Until that time, investors have no clarity about the strategy's future and forthcoming investment team. Voya reached an agreement with Allianz to take over most of its U.S. personnel; however, the team that manages this strategy is based in Europe and will remain at Allianz. Advisor Virtus Investment Partners has not yet named a successor and is exploring all options, which could include an in-house team taking over, finding another subadvisor to run it, merging this fund's assets into another strategy, or liquidation.

Upgrades

Increased confidence in Fidelity Puritan's FPURX veteran manager and surrounding resources boosted its Analyst Rating to Bronze from Neutral for all of its share classes. Lead manager Dan Kelley has ample, relevant industry experience. He engages with broad firm resources—security analysts, quant researchers, sector specialists, economists, and investment committee members—and, depending on where he perceives the most attractive relative value propositions, he allocates broadly between stocks and bonds (the neutral weight is 60% equity and 40% fixed income). Kelley targets growing companies with reasonable valuations in the equity sleeve. The bond portfolio is split between two Fidelity teams. Harley Lank and Alex Karam manage a sleeve that resembles Fidelity High Income SPHIX, while Mike Plage and Jeff Moore's slice is similar to Fidelity Investment Grade Bond FBNDX. In both instances, the fixed-income managers access robust groups of credit analysts, traders, risk specialists, and economists.

Vanguard Global Wellesley Income's VGYAX investor and advisor shares were both upgraded to Silver following a Process upgrade to Above Average. We have increased confidence in this strategy's multi-asset approach to income, which is similar to that of Gold-rated Vanguard Wellesley VWINX, but with a global mandate. Andre Desautels, who took over the strategy's equity sleeve in August 2019 focuses on valuations, limits turnover and holds a relatively compact portfolio of around 55 names. When conducting fundamental analysis, Desautels looks for firms well-positioned within their industries with high returns on invested capital, strong free cash flows, and good capital discipline. Many income-focused peers screen for yield, but here yield is the output of the process. On the bond side, investors are in capable hands with lead manager Loren Moran, who has 20 years of investment experience. While the bond sleeve here can take on more credit risk relative to Vanguard Wellesley, Moren made a well-timed move to a more-defensive positioning at the end of 2021 on concerns about tight yield spreads and the impact of the ongoing pandemic.

New to Coverage

American Funds Inflation Linked Bond BFIAX debuted with Neutral ratings for its cheapest share classes and Negative for its priciest shares as its more-flexible approach could lead to elevated volatility compared with other inflation-linked bond offerings. Ritchie Tuazon leads this offering along with generalist David Hoag and rates specialist Tim Ng. Rather than using Capital Group's typical multisleeved approach, Tuazon and Hoag comanage roughly four fifths of the strategy's assets in a traditional team-managed approach, while Ng contributes best ideas to the remainder of assets. The trio is supported by Capital Group's deep fixed-income resources, including additional rates contributors. The strategy's overall process leans heavily on macro/rates calls in order to gain an edge in the Treasury Inflation-Protected Bond arena. For instance, the managers expect duration and curve positioning to contribute 60% of excess returns. U.S. TIPS generally account for 85%-90% of the strategy's assets, with credit exposure through cash bonds typically kept in the mid-single digits. Since mid-2016, the team has used a short credit default swap index derivatives position to manage the strategy's risk profile. The short CDX position has often exceeded the strategy's long exposure to credit, which benefits the strategy if credit spreads widen.

/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/4295f84a-d866-4f43-8205-3fb777ae9f55.jpg)