What a Strong Dollar Means for U.S. Stock ETFs

Trends for identifying and managing overlooked exchange-rate risk in domestic funds.

The value of the U.S. dollar has skyrocketed this year, gaining over 16% against a broad basket of foreign currencies through October. Foreign stock funds have felt the burn as returns are translated from local currencies back into U.S. dollars. The MSCI ACWI ex USA Index lost 11 percentage points to changes in foreign-exchange rates this year through Oct. 14. Currency-hedged exchange-traded funds may be a potential solution for some investors, but foreign-exchange risk can undermine performance of domestic stock funds as well.

Investors may be surprised to hear that a strong dollar can also drag down the performance of their U.S. stock funds. Alternatively, a weak dollar can boost returns. These funds are better shielded from dollar fluctuations than foreign investments because they derive most of their earnings from the U.S. market. But we live in a global economy, and U.S. stocks derive a portion of their earnings from foreign markets, which exposes them to a degree of foreign-exchange risk that’s easy to overlook.

Here, I’ll detail where the risk comes from, suggest some guidelines for estimating funds’ level of exposure to foreign revenue, and highlight U.S. stock funds with relatively high foreign-exchange risk.

Lost in Translation

Changes to exchange rates have an observable effect on foreign investments. But it’s harder to pinpoint their impact on U.S.-based companies with foreign revenue. My colleague, David Sekera, does a great job explaining how foreign revenue can undermine company earnings.

Foreign revenue drives exchange risk, but U.S. companies aren’t defenseless. They can target natural hedges by matching foreign revenue and costs in the same currency. Or they can use derivatives to hedge out currency risks.

There is no single approach to managing exchange risk for U.S. companies. But they are unlikely to hedge out all currency translation effects, regardless of the steps they take. As a result, foreign-currency translation can hit a company’s fundamentals, potentially driving short-term moves in its stock price.

While currency fluctuations tend to shake out over time, trends can persist for years. While most investors are best suited to focus on the long-term outlook of a company, bypassing short-term risks isn’t an option for everyone. Understanding foreign-exchange risk can help long-term investors diagnosis performance and stick to their plan when currency risk creates a drag on their investments.

Shortcuts for Determining Foreign Revenue Exposure

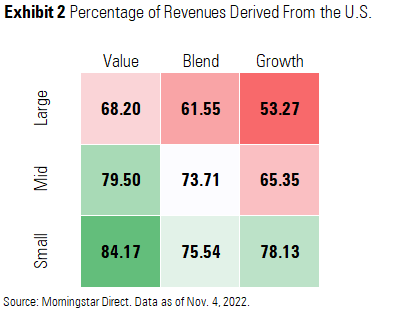

Investors may attempt to sidestep the impact of the rising dollar by investing in U.S. stocks. Others may look at diversifying their home-country bias with foreign stock exposure. Both types of investors should take a look under the hood of their U.S. stock funds to determine the extent to which the underlying revenue in their portfolio are biased to their home country. Exhibit 2 maps the growth, value, and core versions of the Morningstar US Large, Mid, and Small indexes.

Even for investors without access to Morningstar Revenue by Region data, these market-cap and style trends provide clear guidance for investors about how to add or remove foreign revenue exposure within U.S. stock funds. Mega-cap growth stocks are more globally diversified, so they tend to have a higher share of foreign revenue. All else equal, their global revenue base could boost relative performance when the dollar is weak. Likewise, small-cap value stocks tend to earn revenue close to home, making them a good bet to benefit from a strong dollar.

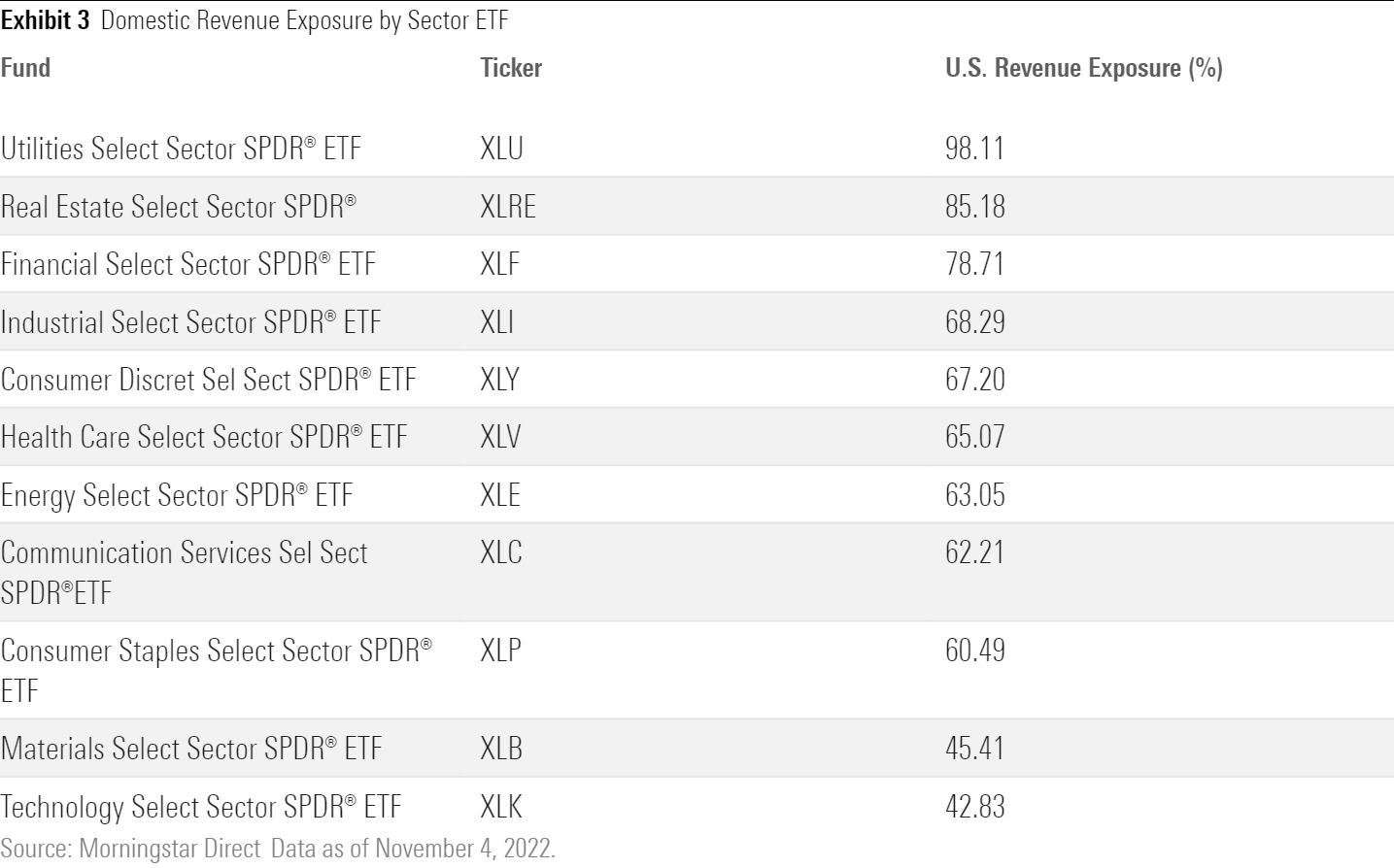

Revenue also tend to stay local for certain sectors, such as utilities and real estate. Basic materials and technology stocks are more likely to have higher amounts of foreign revenue. Exhibit 3 lists the proportion of U.S. revenue exposure by sector.

Market cap, style, and sector trends are easy guidelines for understanding funds’ global revenue diversification. They are best applied at the diversified fund level because trends may not hold for individual companies.

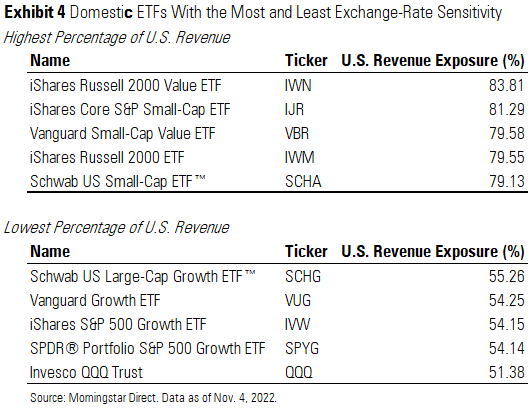

Exhibit 4 takes a closer look at popular (over $10 billion in assets under management) ETFs that fall at each end of the global revenue spectrum. IShares Russell 2000 Value ETF IWN confirms that small-value strategies come with the highest share of domestic revenue. On the other end, Invesco QQQ Trust QQQ led the way with the highest proportion of foreign revenue. In fact, QQQ only narrowly edged out iShares MSCI ACWI ETF ACWI—a global stock index—by 6 percentage points of U.S. revenue exposure. This underscores that exchange-rate risk can differ greatly between U.S. stock funds with globally diversified revenue.

Home-Country Unbiased

A stock’s home country, while important, fails to capture the diversity of a company’s revenue streams. QQQ is nearly on even footing with a globally diversified all-country world index in terms of foreign revenue. But small-cap and value-oriented U.S. companies tend to keep revenue close to home. Choosing one strategy versus another can have implications beyond just style and size—currency fluctuations can influence performance.

Investors betting for or against the dollar may be able to position their portfolio to benefit from their currency expectations. Others may want to manage the risk of short-term currency fluctuations. In either case, foreign stock exposure should not be considered alone. Domestic fund selection can have a big impact on a portfolio’s foreign revenue exposure.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/0fa19b38-60f6-4a0f-9e06-9869d9c57d52.jpg)