ETFs Proved Their Tax Advantages Are Still Strong in 2021

A continued streak of low taxable capital gains distributions, along with a few important reminders.

A version of this article previously appeared in the December 2021 issue of Morningstar ETFInvestor. Click here to download a complimentary copy.

Exchange-traded funds’ tax efficiency was on display again in 2021. The number of ETFs that will pay out 2021 capital gains is much lower than the number of mutual funds that will make capital gains distributions. Also, the size of most ETFs’ capital gains distributions pales in comparison with some of the monsters being spun out of mutual funds this year.

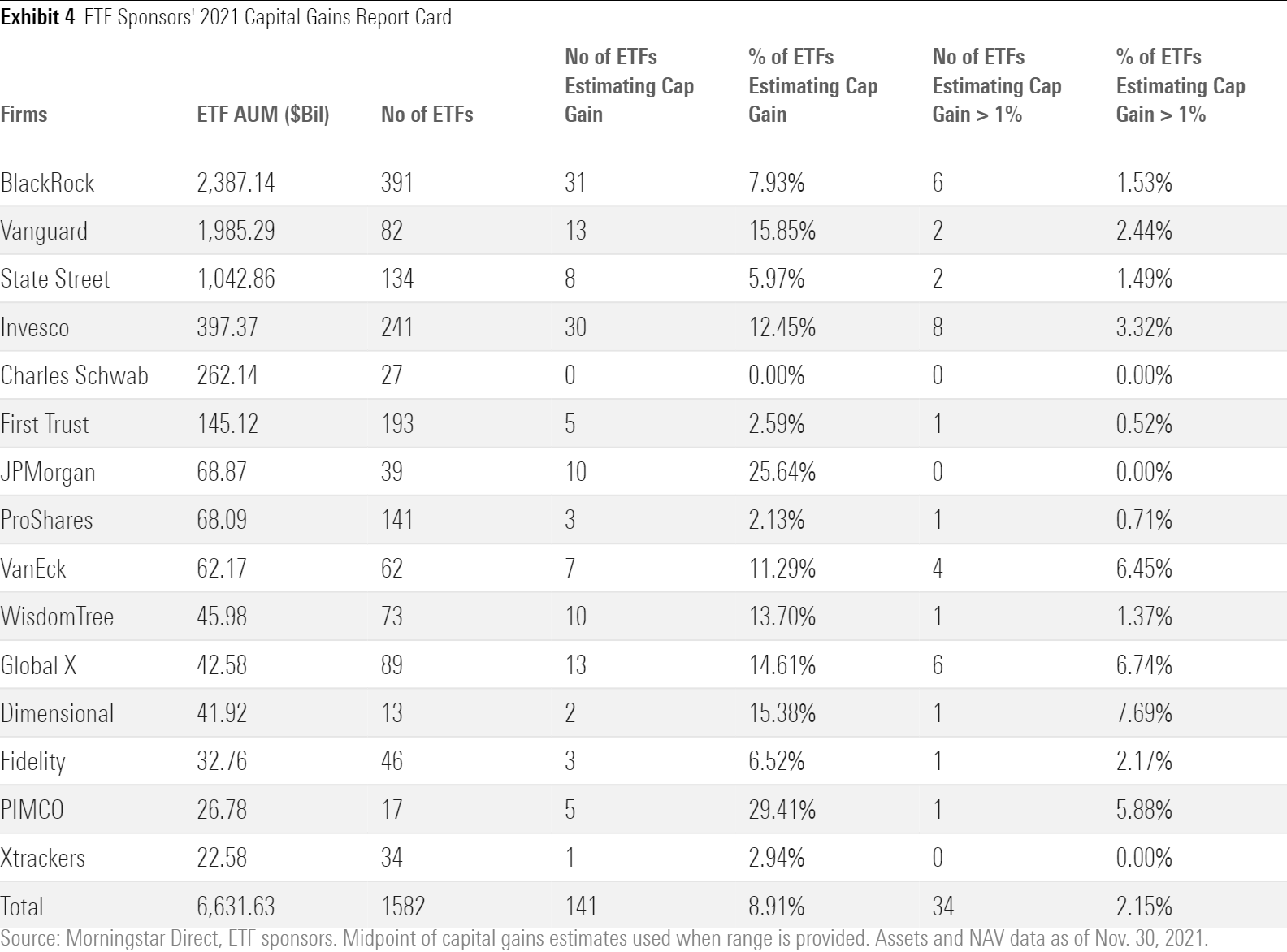

As of early December 2021, 15 of the biggest ETF sponsors had reported their estimated capital gains distributions for 2021. These firms back a combined 1,582 funds, which together held more than $6.6 trillion in assets as of the end of November. Among those funds, just 141 (8.9%) are expected to distribute capital gains to investors in 2021. While this is above the 5%-7% range we’ve seen over the past few years, most of these distributions’ impact on investors’ tax bills will be similarly small as in years past. Only 34 of them (2.2%) will distribute capital gains representing more than 1% of their end-November net asset value.

While the percentage of ETFs throwing off capital gains distributions ticked up a bit this year, there’s no need to fret. ETFs’ relative tax efficiency has never been an airtight proposition. A closer look at this year’s capital gains culprits highlights some of the factors that limit ETFs’ ability to shield their investors from capital gains distributions.

2021 Capital Gains Culprits

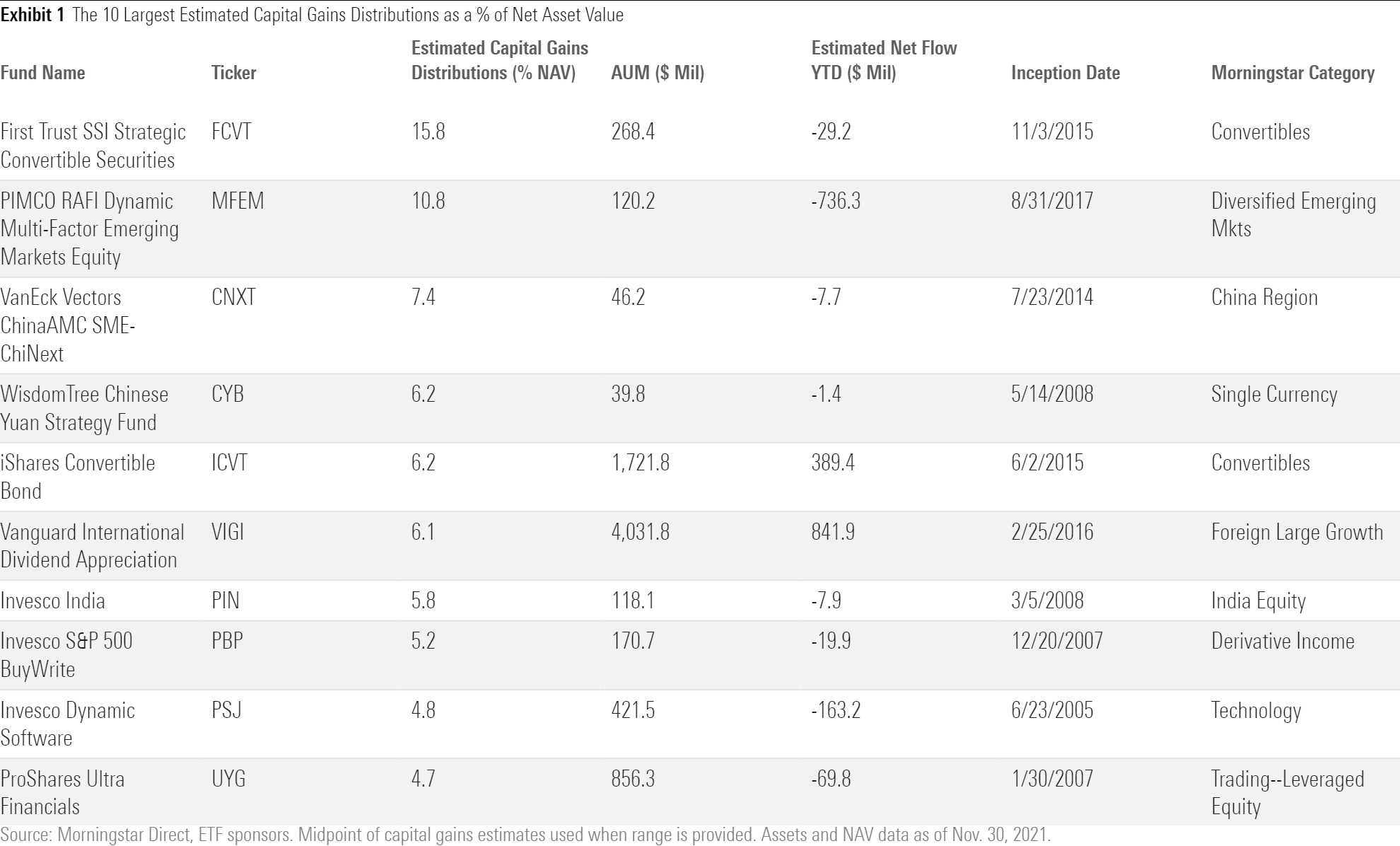

A combination of strong one-way flows, high turnover, and restrictions on in-kind redemptions explains much of the uptick in the percentage of ETFs distributing capital gains this year. Among the 35 ETFs anticipating capital gains distributions greater than 1% of NAV, almost two thirds will make distributions ranging from 2% to 8% of NAV. First Trust SSI Strategic Convertible Securities ETF FCVT and Pimco RAFI Dynamic Multi-Factor Emerging Markets Equity ETF MFEM are this year’s outliers, with estimated distributions representing 15.8% and 10.8% of their NAVs, respectively.

Vanguard International Dividend Appreciation ETF VIGI, which carries a Morningstar Analyst Rating of Silver, expects to pay out a capital gains distribution of more than 6% of its NAV this year. This marks the fund’s first-ever such distribution since its 2016 inception. VIGI’s distribution is the result of above-normal turnover (partly spurred by post-pandemic dividend cuts among some of its holdings), the inability to send some emerging-markets stocks out the door via in-kind redemptions, and strong one-directional flows. When ETFs experience strong inflows and few if any redemptions, they have fewer natural opportunities to rid low-cost-basis securities from their portfolios.

An Uptick in Distributions Among Stock ETFs

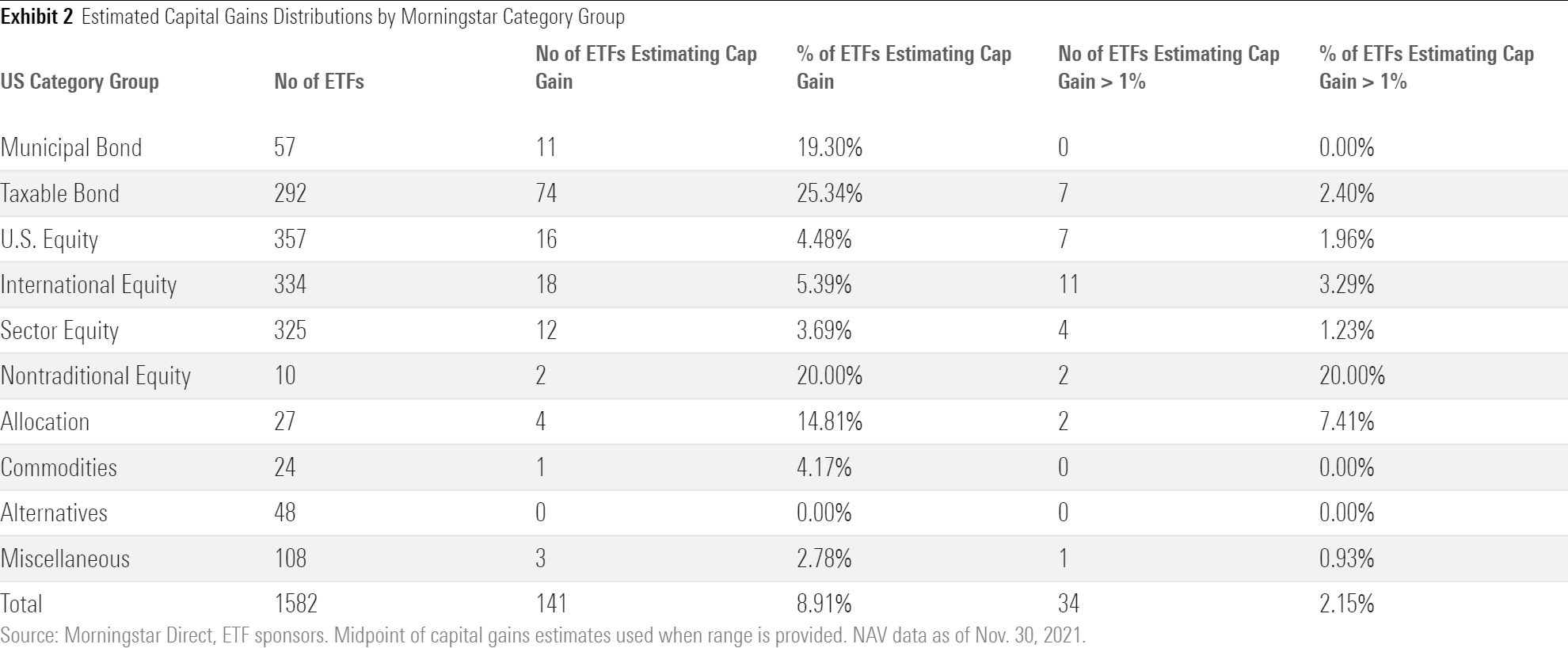

Exhibit 2 breaks down estimated capital gains distributions among the ETFs we’ve collected data for across their respective Morningstar Category groups. Relative to prior years, there are more equity funds distributing capital gains in 2021--particularly in the international equity category group. The number of stock ETFs pushing out gains rose to 48 in 2021 from 12 in 2020, or to 4.7% of all stock funds from approximately 1.3%. Distributions amounting to more than 1% of NAV were also most common among equity funds this year. Stock ETFs accounted for more than two thirds of all funds with large distributions.

But bond ETFs are still responsible for the bulk of capital gains distributions. A total of 85 bond ETFs in our sample will pay out capital gains in 2021, representing 59% of the total number of funds making distributions.

Some Familiar Faces

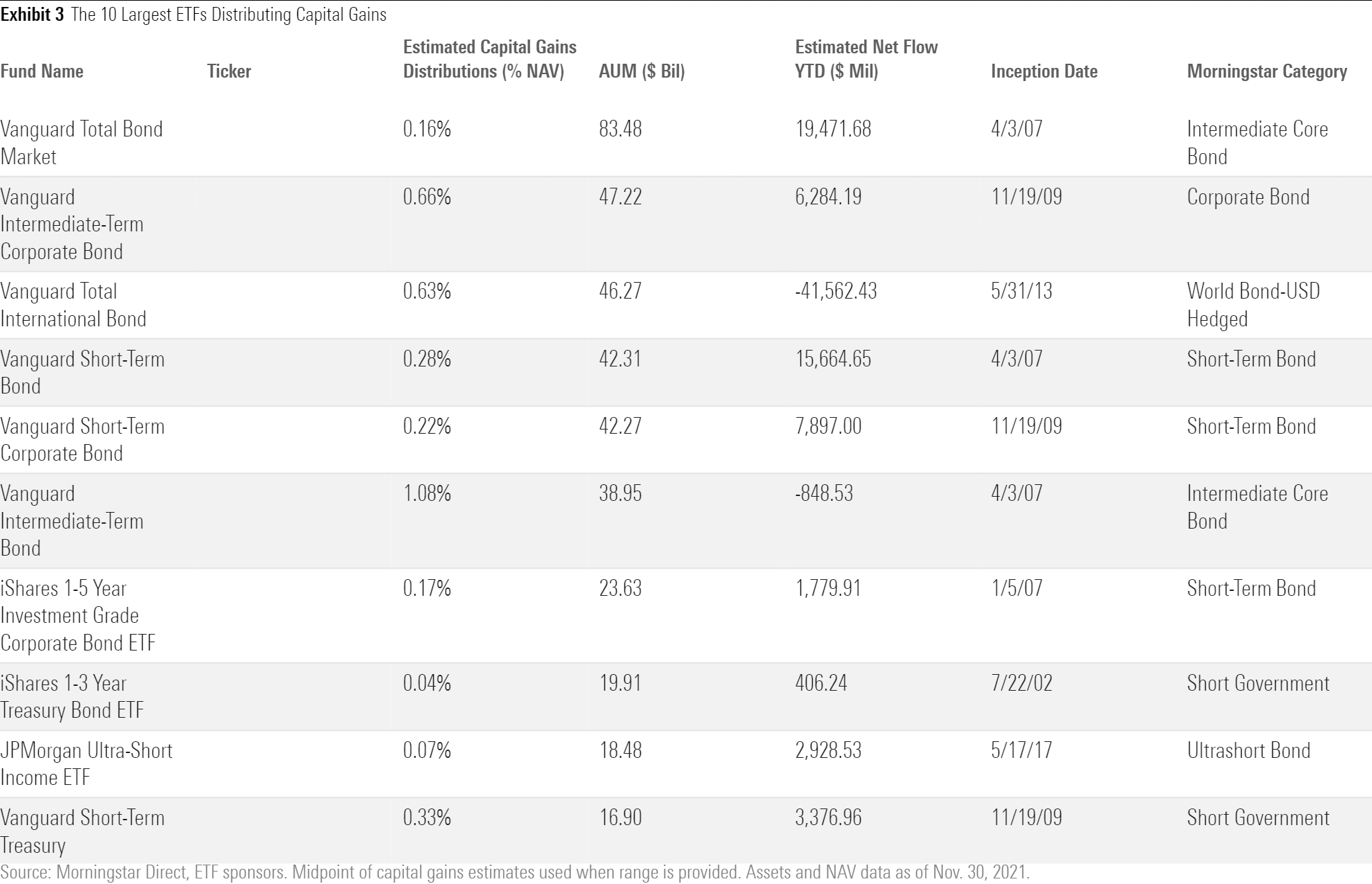

The roster of the 10 largest ETFs distributing capital gains this year features some familiar bond funds. Many of these funds are affected by strong flows and/or focus on a particular segment of the yield curve.

Who Let the Gains Out?

Exhibit 4 tallies capital gains distributions among the ETF sponsors from which we collected distribution data. These figures illuminate the difference in the makeup of these firms’ ETF lineups. As a general rule of thumb, the more bond funds a firm offers, the more of its ETFs will pay out capital gains in a given year. Also, this year, firms with ETF lineups that have significant exposure to China and other emerging markets saw the number of ETFs anticipating gains in their range increase, such as Global X and VanEck.

The big four--BlackRock, Vanguard, State Street, and Invesco--landed in the middle of the pack this year as measured by the percentage of their ETFs distributing capital gains. But these firms' lineups are generally more expansive than their peers. With the industry’s most expansive menu of ETFs, BlackRock has the highest number of ETFs expected to pay out capital gains this year, with 22 out of those 31 funds being bond funds. Similarly, of the 30 Invesco ETFs expecting to pay out gains this year, 18 are bond funds. Vanguard has just one non-bond fund paying out gains, while State Street has two.

New ETF entrant Dimensional had two funds distributing capital gains this year. The larger distribution of the two, totaling 2.28% of NAV, is from DFAS. According to Dimensional, the mutual fund accumulated the majority of these gains prior to its conversion to an ETF in early June of this year.

More Gain, Less Pain

While it’s still generally true that ETFs tend to be more tax-efficient than mutual funds, it’s important to remember where these advantages come from. ETFs’ tax benefits aren’t airtight, and taxable investors will still get a bill for regular distributions of income. But most do a very good job of helping investors defer capital gains taxes, allowing them to pay the taxes they owe when they owe them, and not when others’ might stick them with the bill--as has been the case for years for many mutual fund investors.

A previous version of this article stated an incorrect number of Dimensional ETFs distributing capital gains in 2021. The article and exhibits have been updated to reflect the accurate data.

Disclosure: Morningstar, Inc. licenses indexes to financial institutions as the tracking indexes for investable products, such as exchange-traded funds, sponsored by the financial institution. The license fee for such use is paid by the sponsoring financial institution based mainly on the total assets of the investable product. Please click here for a list of investable products that track or have tracked a Morningstar index. Morningstar, Inc. does not market, sell, or make any representations regarding the advisability of investing in any investable product that tracks a Morningstar index.

/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/c00554e5-8c4c-4ca5-afc8-d2630eab0b0a.jpg)