ETF Investors Favor Bonds and the Basics in April

U.S. ETFs hauled in $31 billion as stocks and bonds ticked upward in April.

Key Takeaways

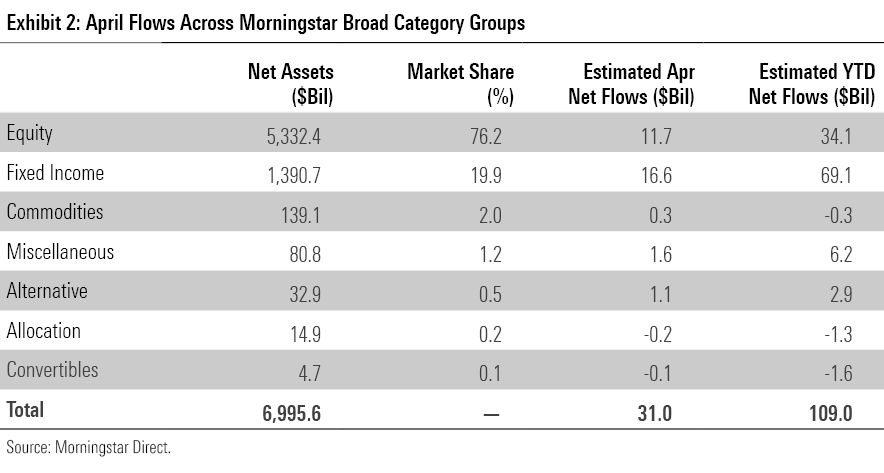

- U.S. exchange-traded funds collected about $31 billion in April, roughly the same amount they gathered in March.

- Investor appetite for riskier bond portfolios helped drive $16 billion into fixed-income ETFs.

- Healthy flows into the U.S. large-blend ETFs compensated for outflows from other U.S. equity Morningstar Categories.

- International-stock ETFs earned modest inflows behind another strong month for Europe-stock funds.

- Investors poured $2.2 billion into nontraditional equity ETFs, the cohort’s 37th consecutive month of inflows.

- The Morningstar US Market Index advanced 1.1% as large-cap stocks dominated their smaller peers.

- The Morningstar US Core Bond Index added 0.62%, bringing their year-to-date return to 3.56%.

Bonds Hold Steady

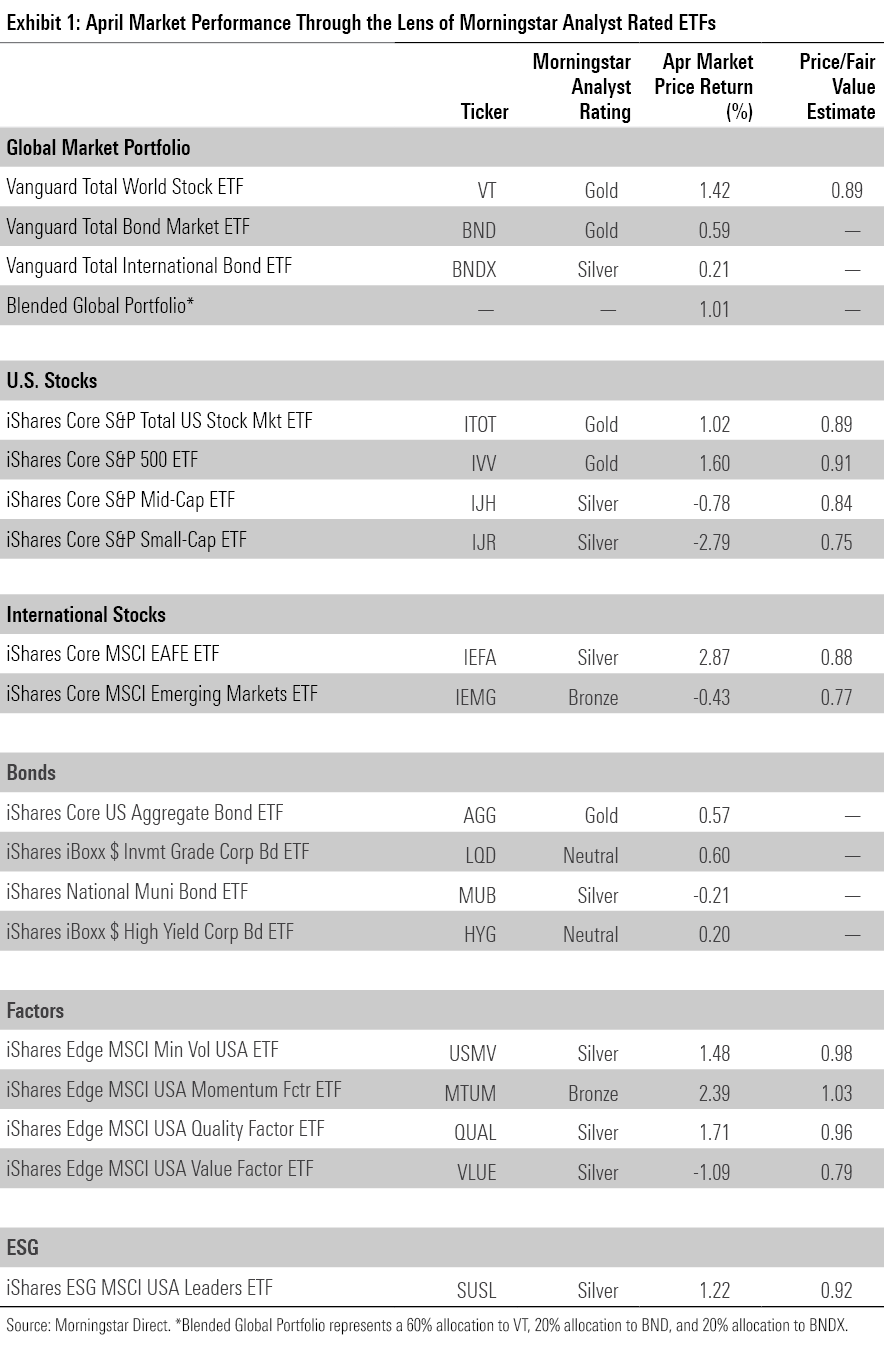

Exhibit 1 shows April returns for a sample of Morningstar analyst-rated ETFs that serve as proxies for major asset classes. Investors in a blended global portfolio earned a 1.01% return last month, as stocks and bonds both ticked upward in April.

The blended portfolio’s fixed-income sleeve offered a modest contribution in a quiet month for bonds. Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX rose 0.59% and 0.21%, respectively. Bond-fund performance has responded closely to the magnitude of interest-rate hikes since the start of 2022. At April’s conclusion, there was near-consensus expectation about what the Fed will do when it convenes on May 3: CME’s FedWatch Tool indicates that nearly 94% of traders expect a 0.25-percentage-point rate hike. Should that be the final rate hike of this cycle, as many investors expect, it should bode well for bonds. That said, some April economic data indicates there still may be work to do to rein in inflation.

Developed-Markets and Mega-Cap Stocks Pull Ahead

International stocks broadly advanced in April, as Vanguard Total International Stock ETF VXUS notched a 1.88% gain for the month. Developed-market stocks measured up well. IShares Core MSCI EAFE ETF IEFA advanced 2.87%, as the European stocks that constitute nearly two thirds of its portfolio continued their excellent start to the year. Morningstar indexes that track stock markets in Switzerland, the United Kingdom, and France each climbed north of 4.5% in April and between 11% and 20% for the year to date. Emerging-markets stocks didn’t share the spoils. Negative months for China and Taiwan stocks—which accounted for 43% of iShares Core MSCI Emerging Markets ETF IEMG—saddled that fund with a 0.43% pullback in April. IEMG has advanced 4.03% so far in 2023, about 7.5 percentage points behind IEFA.

Some positive earnings reports helped U.S. stocks rally in April’s final week to finish in the black. IShares Core S&P Total US Stock Market ETF ITOT closed the month 1.02% higher than where it started. A handful of companies drove much of the market’s performance. Microsoft MSFT and Meta Platforms META were two of the most potent, as both stocks jumped on the heels of stellar earnings announcements. Healthcare stocks Eli Lilly LLY, Merck MRK, and Johnson & Johnson JNJ all made sound contributions as well, helping iShares Core S&P 500 ETF IVV to a 1.6% April gain.

On the other hand, small-cap stocks continued to struggle in April: IShares Core S&P Small-Cap ETF IJR shed 2.79% on the month. That left it with a 0.32% loss for the year to date, about 10 percentage points behind IVV. After larger stakes in regional banks hamstrung IJR in March, unfavorable technology exposure set it back in April. As market mammoths like Apple AAPL, Microsoft, and Amazon.com AMZN powered IVV, weak performance from unproven software firms weighed on IJR. Small-cap ETFs look cheap through many price-multiple metrics, but they are likely at greater risk should higher rates or tighter lending standards tip the economy into recession.

Within State Street’s suite of sector ETFs, consumer staples stocks made out the best in April. Consumer Staples Select Sector SPDR ETF XLP climbed 3.65% courtesy of healthy profits from top holding Procter & Gamble PG and solid contributions from Coca-Cola KO and Pepsi PEP, a duo that represents one fifth of the portfolio. Financial Select Sector SPDR ETF XLF advanced 3.17% in spite of its small position in First Republic Bank. The bank will officially be marked to zero after regulators seized it and sold it to J.P. Morgan Chase JPM on May 1, 2023, one week after First Republic’s earnings unveiled the severity of its balance-sheet problems and sent its stock price into an irreversible spiral. SPDR S&P Regional Banking ETF KRE, which drew a batch of buy-the-dip investors earlier this year, shed 2.74% in April.

Bond ETFs Stay on Top

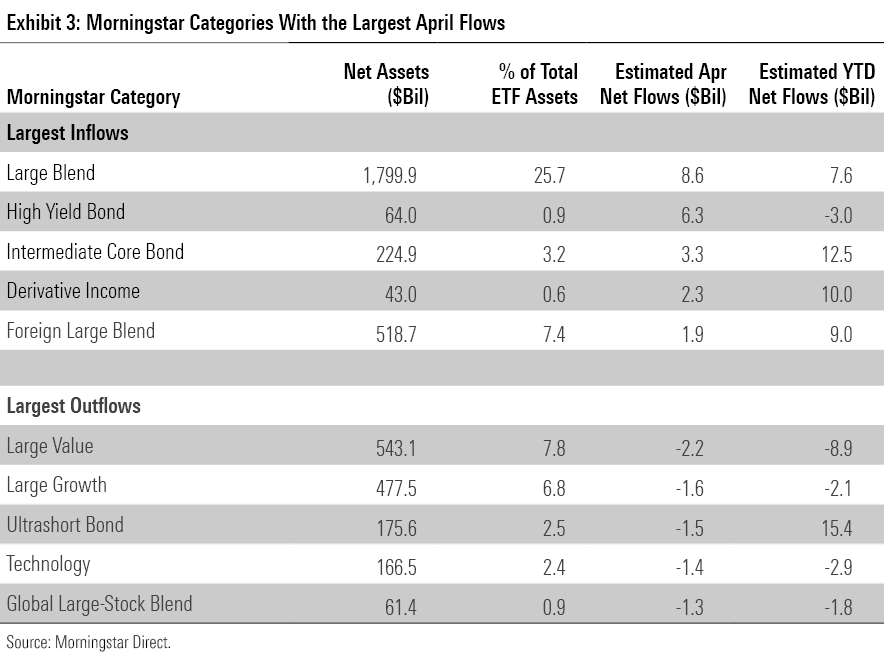

Investors continued to opt for bond ETFs over stock ETFs in April. They dumped in excess of $16 billion into bond ETFs, bringing the 2023 haul to more than $69 billion. That represented 63% of all ETF inflows for the fixed-income cohort, which represents about one fifth of the total market.

Investors’ icy attitude toward riskier bond portfolios started to thaw in April. High-yield bond funds broke out of their slump to the tune of a $6 billion April haul. That led all fixed-income categories and helped erase a dreadful first quarter in which its $9.1 billion of outflows ranked last among all categories. Corporate, intermediate core-plus, and emerging-markets bond funds—all of which come with more credit risk than the broad bond indexes—saw healthy inflows as well. More inflows into Treasury funds means that conservative bonds are still in demand, but investors were keener on credit risk in April than in the first quarter.

Shorter-term bond funds saw widespread outflows last month. The ultrashort bond category followed up a scorching first quarter with about $1.5 billion of outflows, and short-term bond funds suffered their third consecutive month of outflows. These shorter-dated bond funds seem mired in a sour spot, as investors are eager to capitalize on money-market funds’ attractive interest yields or lock in rates with longer-term bond offerings.

Stock ETFs Get Back on Track

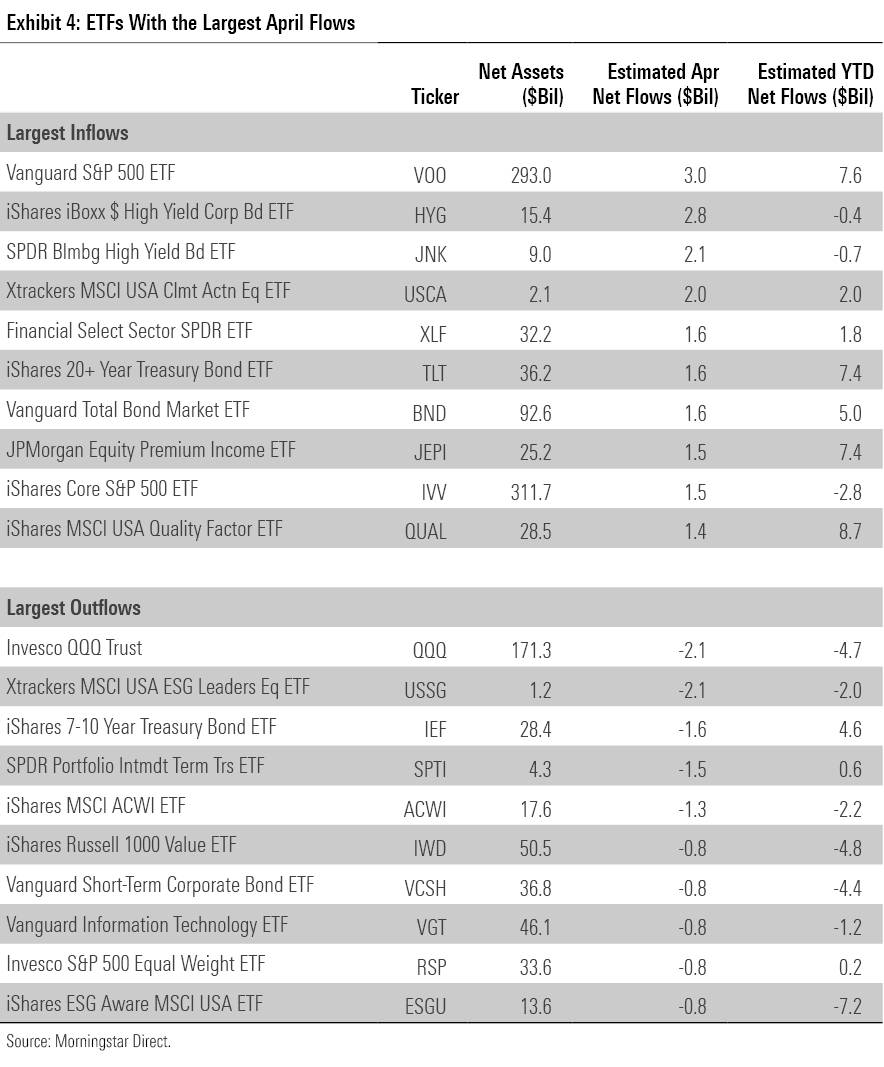

The lion’s share of inflows to stock ETFs went to international funds in the first quarter, but U.S. equity ETFs edged them out in April with a $5.3 billion haul. Large-blend funds led the way, collecting $8.6 billion; the rest of the domestic cohort shed a collective $3.3 billion. Many of the market’s most familiar funds powered the category: Vanguard S&P 500 ETF VOO pulled in $3 billion to lead all ETFs, and fellow S&P 500 trackers IVV and SPDR Portfolio S&P 500 ETF SPLG absorbed $1.5 billion and $907 million, respectively. U.S large-blend funds represent about one fourth of U.S. ETF assets. As their flows rise and fall, so do those of the overall market.

ETFs that line the sides of the Morningstar Style Box saw no such inflows in April. Large-growth funds lost about $1.6 billion, and their value counterparts shed $2.2 billion. That marks large-value funds’ fourth consecutive month of outflows and brings their year-to-date deficit to $8.9 billion, the worst among all categories. Dividend funds that reside there have lost some luster after flows, and performance shone in 2022. The main culprit is iShares Russell 1000 Value ETF IWD, but even its $4.8 billion year-to-date outflow hardly dents the large-value category’s $543 billion asset base.

International-stock ETFs gathered $4.2 billion in April, pushing their year-to-date haul over $34 billion, well ahead of their U.S. counterparts. Europe-stock funds have helped fuel the growth. This category entered 2023 with about $35 billion in total assets, but nearly $10 billion of inflows and tremendous performance—iShares Core MSCI Europe ETF IEUR climbed 14.86% for the year to date through April—has ballooned the category’s asset base to about $50 billion. The foreign large-blend and diversified emerging-markets categories have done their part as well, pulling in a combined $16 billion on the year.

Another month meant more flows into nontraditional-equity ETFs, one of the hottest corners of the market for months. Both of the categories that make up this cohort—long-short equity and derivative income—offer modified beta exposure. The funds took root in 2022 amid the market drawdown, but a more auspicious market backdrop hasn’t dulled investors’ enthusiasm for these products: The $2.2 billion they gathered in April marked their 37th consecutive month of inflows. Over that time, these funds swelled to over $44 billion in assets from $2.4 billion. JPMorgan Equity Premium Income ETF JEPI accounted for about half the size as of April 2023, but fellow covered-call strategies like JPMorgan Nasdaq Equity Premium Income JEPQ and Global X Nasdaq 100 Covered Call ETF QYLD have expanded their bases as well.

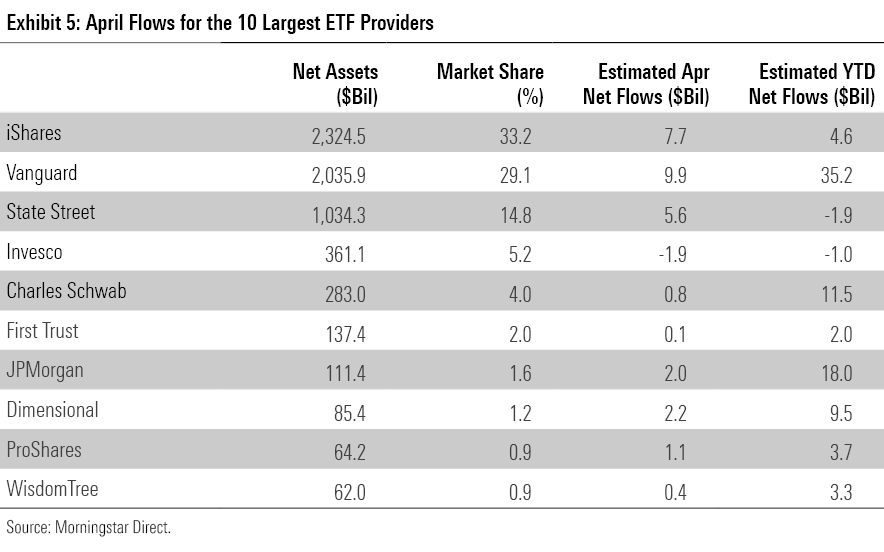

Vanguard Charts the Course

The ETF universe’s “Big Three″ lived up their billing in April. Vanguard, iShares, and State Street won, placed, and showed in the monthly flows race. Vanguard—whose $35 billion year-to-date haul leads all ETF providers—leaned on core offerings in April. VOO paced the market, and the $1.5 billion that BND collected gave the firm a lift in the bond arena. Bonds have been iShares’ strength this year, and last month was no different. Led by iShares iBoxx $ High Yield Corporate Bond ETF’s HYG $2.8 billion intake, investors piled about $8.3 billion into the firm’s bond ETF lineup. State Street bounced back from a wobbly first quarter thanks to renewed interest in its lineup of sector ETFs. These funds collectively absorbed $3.6 billion, with those that focus on financials, consumer staples, and communications stocks collecting more than $1 billion apiece.

Dimensional Fund Advisors corralled $2.2 billion of new money in April to continue its balanced 2023 effort. Each of the firm’s 30 ETFs finished the first four months in inflows, led by Dimensional US Core Equity 2 ETF DFAC and its $1.6 billion collection. Investors have plowed between $1.1 billion and $4.1 billion into Dimensional’s ETFs in each month dating back to November 2021. Some of those flows may come from Dimensional’s own open-end funds, but there’s no question the firm’s early-2020 introduction of ETFs has been a net positive for the firm. Including its open-end mutual funds, the firm flipped from outflows in 2020 and 2021 to modest inflows in 2022 and a hot start to 2023. Resurgent performance from cheaper stocks may drive that as well; most of its equity strategies have a value bent.

Small-Cap ETFs Look Cheap

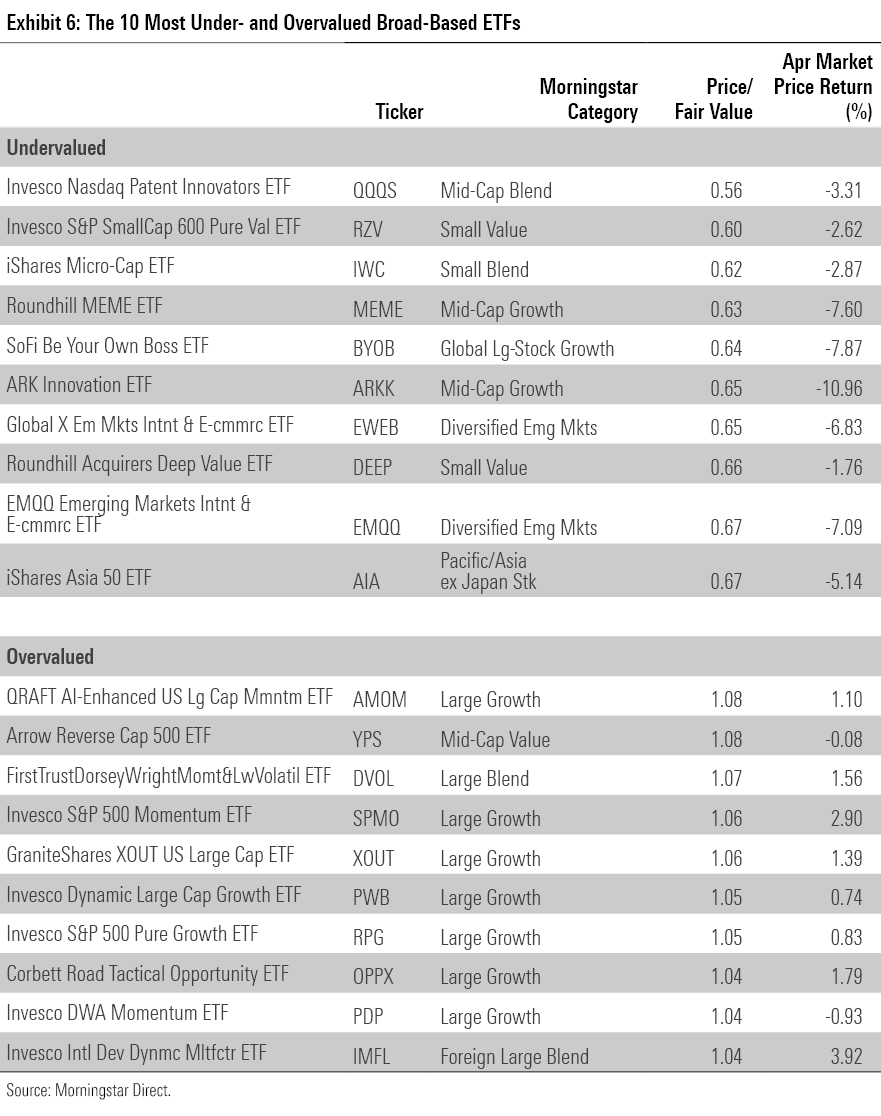

The fair value estimate for ETFs rolls up our equity analysts’ fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

Small-cap stock ETFs continue to look undervalued after another subpar month of returns. Small-value funds offer the deepest discount; the six analyst-rated funds traded at 26% below their fair value on average. For those with broader inclinations, even iShares Core S&P Small-Cap ETF IJR offered a 25% discount at April’s end. Weak performance has shrunk the numerator in small-cap funds’ price/fair value ratios; IJR trailed IVV by about 9.5 percentage points since the start of 2023.

That said, investors should note that small-cap funds sit in a delicate position. Should the aftermath of the Silicon Valley Bank crisis result in stricter lending standards for banks, small-cap companies would likely be affected more acutely than their better-established peers. Small-cap funds that favor profitable, financially sound stocks may better navigate a tighter environment. Avantis U.S. Small Cap Value ETF AVUV and Dimensional U.S. Small Cap Value ETF DFSV both fit that description and sport Silver ratings.

IShares MSCI USA Momentum Factor ETF MTUM was one of only a few analyst-rated ETFs that traded above its fair value as of April 30, 2023. That it comes at a 4% premium should not be a surprise; it chases richly valued stocks by design. But the fund hasn’t rewarded investors who paid up for it. The fund trailed the Morningstar US Market Index by more than 10 percentage points for the year to date through April, ranking in the bottom 1% of the large-growth peer group. When the fund rebalanced in November 2022, it stashed more than 60% of the portfolio into healthcare and energy stocks—two of the market’s three worst-performing sectors in 2023. Its allocation to tech and communications stocks—2023′s standouts—sat at a meager 6%. MTUM will rebalance at the end of May, so investors should expect this fund to look much different this time next month.

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)