ETF Flows Keep Rolling in as Stocks Rebound in October

ETFs continued to drum up flows as investors kept an eye toward inflation last month.

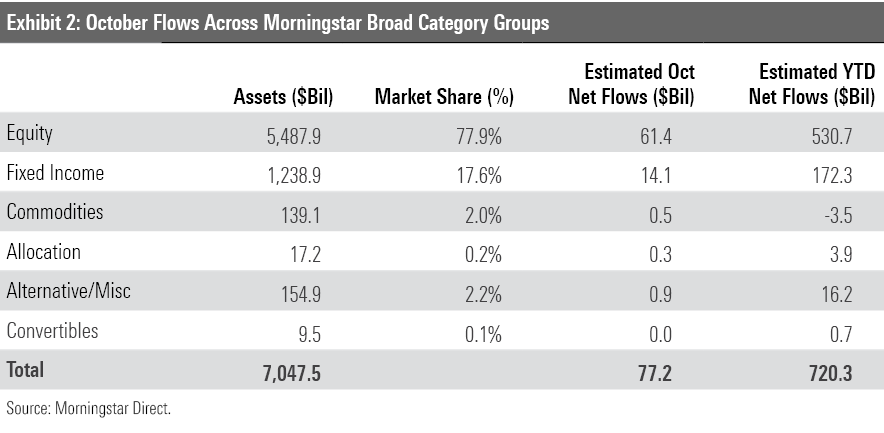

October marked another month of inflows for U.S. exchange-traded funds, as markets broadly course-corrected after a shaky September. ETFs pulled in an estimated $77.2 billion of new money last month. Their year-to-date haul rests at $720 billion with two months left in what has already been a record-setting year.

Stocks rebounded last month after slipping in September. The Morningstar Global Markets Index--a broad gauge of global equities--climbed 4.8%, its best month since December 2020. Bonds curbed their slide as well but couldn’t recoup their losses. The Morningstar U.S. Core Bond Index didn’t provide a return in October and has declined 1.63% for the year to date.

Here, we’ll take a closer look at how the major asset classes performed last month, where investors put their money, and which corners of the market look rich and undervalued at month’s end--all through the lens of ETFs.

A Fall Rise

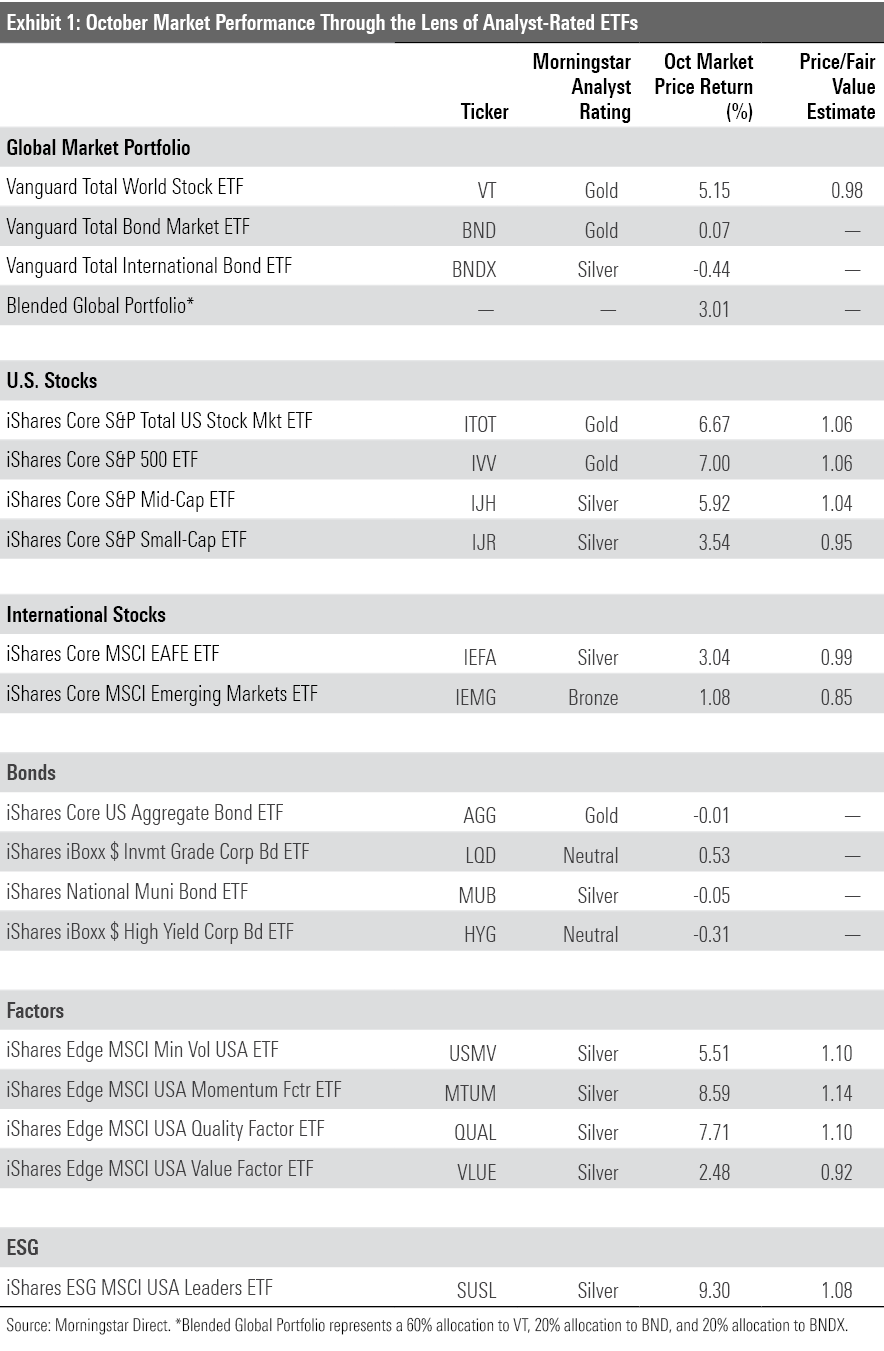

Exhibit 1 shows October returns for a sample of ETFs with Morningstar Analyst Ratings that serve as proxies for major asset classes. Investors in a blended global portfolio earned a handsome 3.01% return last month. Fixed-income components Vanguard Total Bond Market ETF BND and Vanguard Total International Bond ETF BNDX did little for the cause, but Vanguard Total World Stock ETF VT picked up the slack. The portfolio’s stock sleeve advanced 5.15% in its best month of the year.

International stocks pushed ahead last month. Vanguard International Stock ETF VXUS overcame lackluster performance from Japanese stocks (its largest country allocation) and climbed 2.88%. It got a boost from some of its northernmost constituents: Stocks from Canada, Sweden, Denmark, and Norway all added sound contributions in October. IShares MSCI EAFE ETF EFA outpaced iShares Core MSCI Emerging Markets ETF IEMG by about 2 percentage points as firms from overseas developed markets led their emerging-markets peers.

Most of the blended portfolio's stellar month comes from U.S. stocks. After uncertainty around interest rates and inflation sapped returns in September, iShares S&P Total U.S. Stock Market ETF ITOT rebounded with a 6.67% gain in October. A slew of better-than-expected earnings reports likely drove much of this growth. More than 80% of the S&P 500 firms to report third-quarter earnings through October beat their consensus estimates.

Whether investors’ confidence remains intact after this week’s Federal Reserve meeting remains to be seen. Markets pulled back after Fed Chair Jerome Powell indicated a faster timeline for tapering bond purchases and raising interest rates after the Fed’s September meeting. Stock investors may tap the brakes if Powell gives concrete details this week.

Fresh obstacles for some of the market’s top firms haven’t thrown large-cap indexes off course. Supply chain disruptions have hindered Apple’s AAPL and Amazon.com’s AMZN operations, and new-look Meta Platforms FB (2%) faces ridicule over problems embedded in Facebook and Instagram. Still, iShares Core S&P 500 ETF IVV jumped 7% in October, outstripping iShares Core S&P Small-Cap ETF IJR by about 4.5 percentage points. Excellent months from top holdings Microsoft MSFT and Tesla TSLA, which climbed 43% in October, fueled the growth. IVV and IJR have both risen 24% for the year to date.

So far, small-cap stocks have outperformed their larger peers during the pandemic recovery, as these companies tend to be more economically sensitive. However, their relatively weaker October showing came as COVID-19 cases continued to drop in the United States. According to data from the CDC, the seven-day rolling average of U.S. reported cases dropped by about 35% from the start of the month to end--the same rate of decline as September. About 80% of U.S. adults have received at least one vaccination dose. As improving numbers did not give small caps the boost that they have over the past few months, it’s fair to wonder whether the prospect of a fully opened economy has already been priced into stock valuations.

After value stocks outperformed their growth peers in September, the scales tipped back toward growth companies in October. Vanguard Growth ETF VUG notched an 8.26% return last month, while counterpart Vanguard Value ETF VTV advanced 5.44%. The two funds have traded blows all year. Each has led the other in five months this year. VUG has the narrow year-to-date advantage, however, leading VTV by about 2.5 percentage points since the start of 2021.

Consumer discretionary stocks, which tend to be faster-growing, led all sectors last month. Consumer Discretionary Select Sector SPDR ETF XLY rose 12.1%, in large part thanks to Tesla’s tremendous month. Energy stocks continued to climb, too. Energy Select Sector SPDR ETF XLE added 10.3% as a tight global oil supply drove up prices. After another strong month, XLE is now up 56.7% for the year to date--quite the turnaround for the fund that lost 32.6% in 2020.

Another Tesla beneficiary was iShares MSCI USA Momentum Factor ETF MTUM, which climbed 8.59% last month. IShares MSCI USA Quality Factor ETF QUAL and iShares MSCI USA Minimum Volatility ETF USMV also made out well, advancing 7.71% and 5.51%, respectively. Investors looking to buy these funds now must be willing to a pay up. According to Morningstar’s price/fair value ratio, each of these funds trades at least 10% above its fair value. The best bargain may in iShares MSCI USA Value Factor ETF VLUE; its 0.92 price/fair value ratio paints it a discount.

TIPS Continue to Cruise

Stock ETFs led the way in October with $61.4 billion of inflows, regaining momentum after their milder $34.9 billion intake in September. Bond ETFs collected $14.1 billion. While that marks their slowest month since February, it has been another strong year for bond ETFs. They have collected $172.3 billion for the year to date and could eclipse last year’s $212.1 billion annual flows record with a late surge.

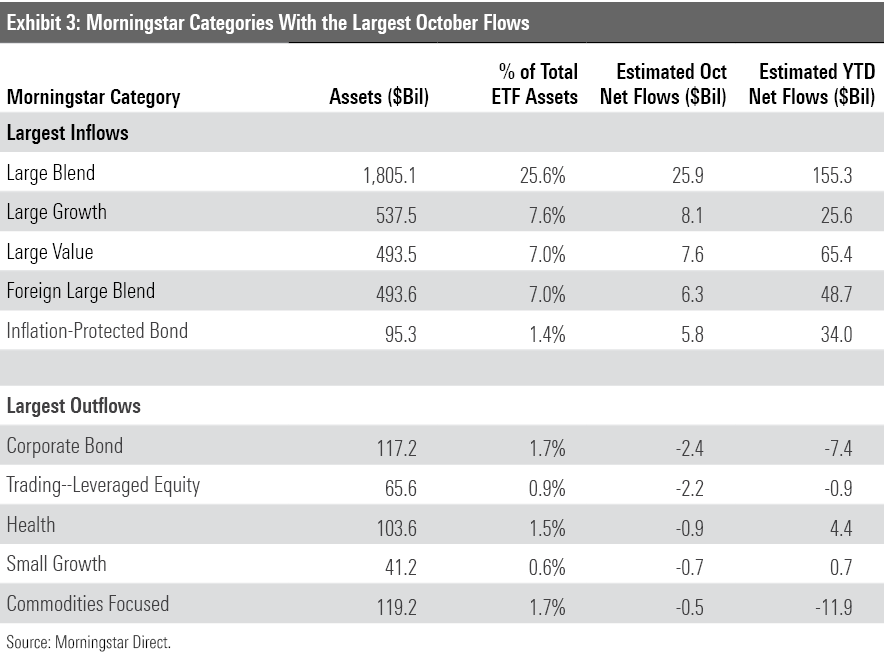

Inflation-protected bond ETFs continued their exceptional year. After adding $5.8 billion of new money last month, these funds have now collected $34 billion for the year to date. That represents more than double their previous annual flows record and an organic growth rate of 55.4%. IShares TIPS Bond ETF TIP and Vanguard Short-Term Inflation-Protected Securities ETF VTIP have led the charge. After each saw October flows in excess of $1 billion, the funds have pulled in $9.2 billion and $7.7 billion for the year to date, respectively. Inflation appears to be top of mind for many U.S. investors.

Not all fixed-income categories have seen the same success. Corporate-bond ETFs leaked $2.4 billion in October, the most of any category. They have now bled $7.4 billion on the year, which tops only focused commodities ETFs’ $11.9 billion year-to-date exodus. Investors have flocked from gold ETFs in particular. That’s somewhat surprising because gold is conventionally viewed as a way to hedge against inflation. Investors may have lost patience with gold’s lackluster performance (SPDR Gold Shares GLD is down 6.76% this year), caught on to the idea that it is not as effective an inflation hedge as advertised, or some combination of both.

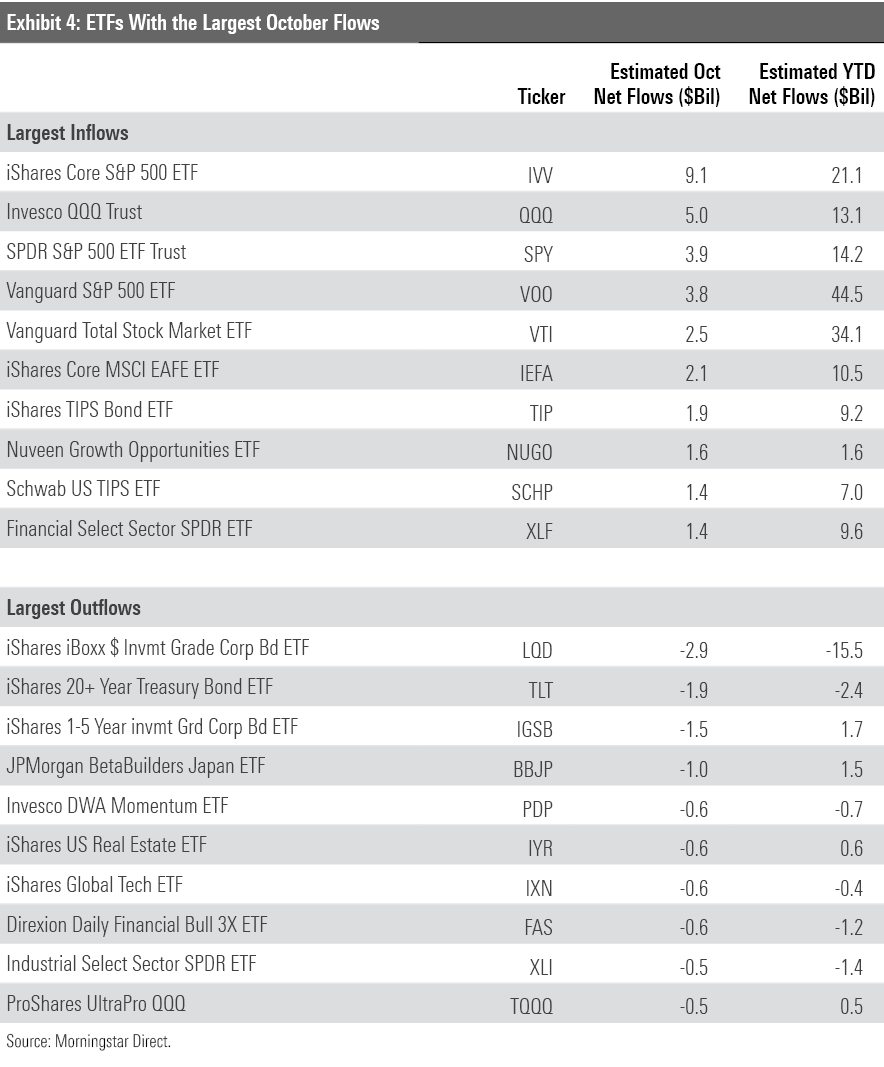

The U.S. large-cap blend, growth, and value categories won, placed, and showed in October's flows race. The usual suspects led the way. Three S&P 500 trackers--IVV, SPDR S&P 500 ETF Trust SPY, and Vanguard S&P 500 ETF VOO--claimed the top four spots on last month's individual ETF flows leaderboard. The only other fund to wiggle between them? Invesco QQQ Trust QQQ, the fifth-largest U.S. ETF on the market. While it hauled in $5 billion last month, ProShares UltraPro QQQ TQQQ, which tracks a triple-leveraged version of the same index, bled $506 million after a lucrative but unusual September.

A pair of brand-new ETFs burst onto the scene with stellar flows last month. Nuveen Growth Opportunities ETF NUGO, an active fund that came to market at the end of September, collected $1.6 billion in October. Active funds represent just 4% of the U.S. ETF market, but their footprint is expanding. Active ETFs have collected $74.9 billion for the year to date, which represents 10% of all ETF flows.

Investors’ wait for a bitcoin ETF ended when ProShares Bitcoin Strategy ETF BITO hit the market on Oct. 18. It has racked up $1.22 billion of inflows in just two weeks. Valkyrie Bitcoin Strategy ETF BTF was born three days later but felt the second-to-market sting, as it has accumulated only $54 million thus far. While flows reflect investors’ enthusiasm for a bitcoin ETF, these may not be the offerings that investors are looking for.

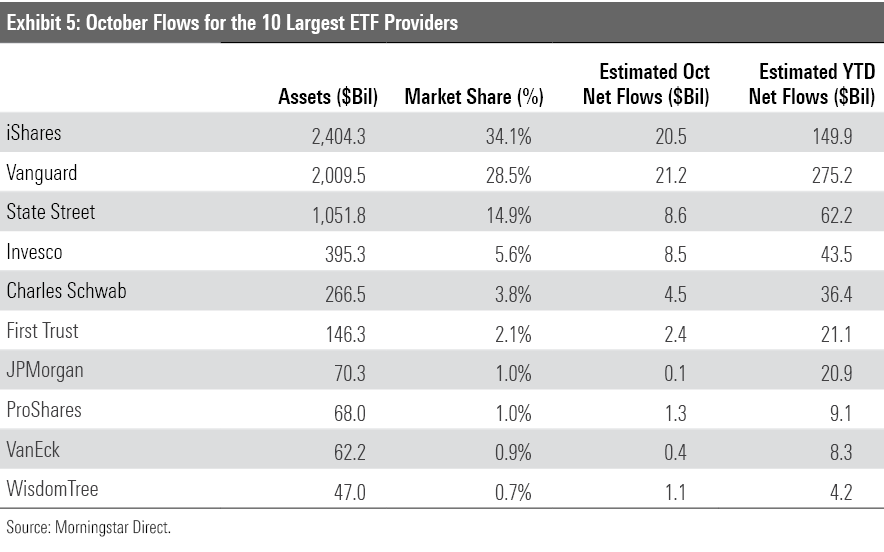

Vanguard Advances

Vanguard’s ETF lineup reeled in $21.2 billion last month, extending its streak atop the ETF provider flows leaderboard to 11 months. At the end of October, the firm’s $275.2 billion year-to-date haul exceeded that of its next-closest competitor, iShares, by about $125 billion.

Charles Schwab’s lineup of ETFs collected $4.5 billion in a solid month of inflows. Schwab now tallies nine ETFs whose 2021 inflows exceed $1 billion and none that have posted outflows. Investors’ appetites for low-cost, broadly diversified options seem to have benefited the firm. Its ETF roster mainly consists of cheap, market-cap weighted funds, like Schwab U.S. Dividend Equity ETF SCHD, whose $9.6 billion year-to-date inflow leads the firm. Schwab’s ETFs have pulled in $36.4 billion so far this year, but they still represent just 3.8% of the total U.S. ETF market.

More Bang for Your Bud

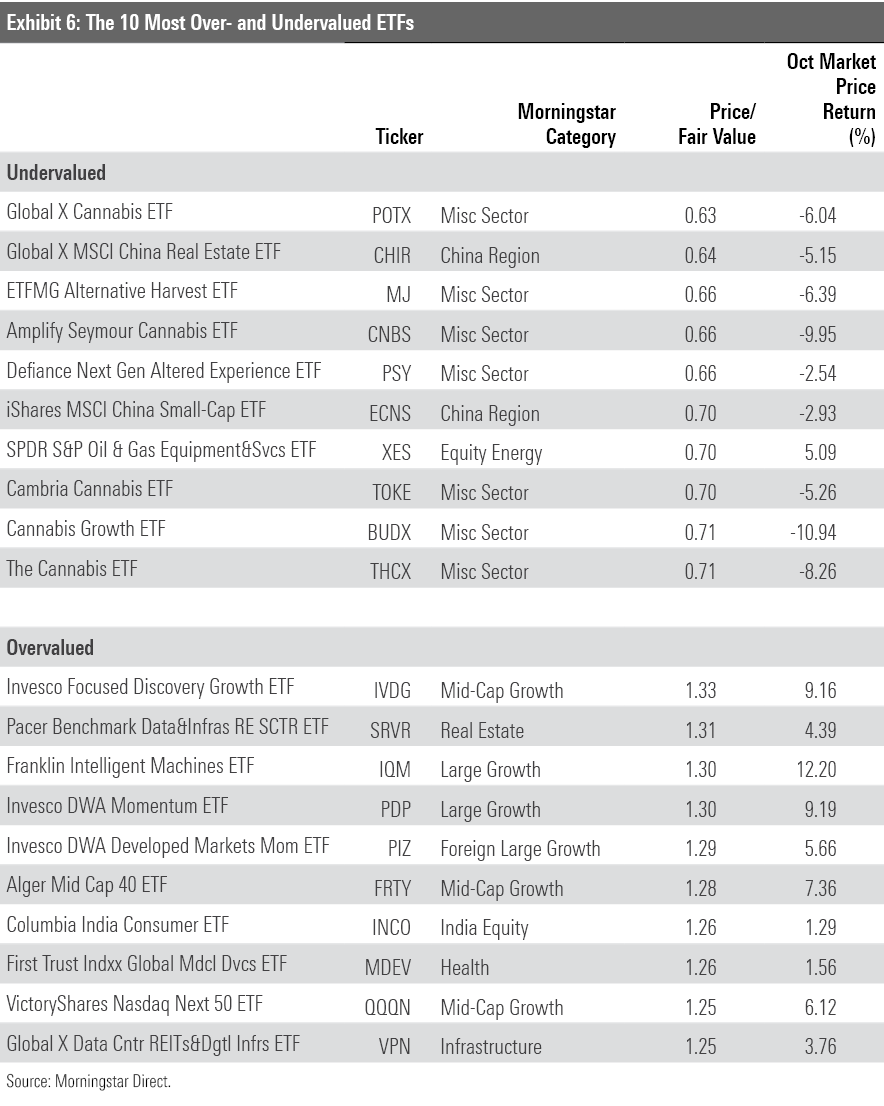

The fair value estimate for ETFs rolls up our equity analysts' fair value estimates for individual stocks and our quantitative fair value estimates for stocks not covered by Morningstar analysts into an aggregate fair value estimate for stock ETF portfolios. Dividing an ETF’s market price by this value yields its price/fair value ratio. This ratio can point to potential bargains and areas of the market where valuations are stretched.

The “undervalued” half of Exhibit 6 shows funds that traded at the lowest price relative to their fair value at the end of September. ETFs that seek to capitalize on the legalization of cannabis or other drugs dominate this month’s list. Seven of the 10 funds on the list fit that mold. Each of these funds slid in October, but their performance has not always marched in lockstep.

Consider two funds from Exhibit 6: Global X Cannabis ETF POTX and Amplify Seymour Cannabis ETF CNBS. They have little in common other than their targeted cannabis theme. POTX tracks a rules-based index that features companies deriving at least 50% of their revenue from the broadly defined cannabis industry. Canadian firms constitute about two thirds of its portfolio. CNBS is an active offering that focuses on U.S. stocks and carries a sharper growth orientation. Only about one third of these portfolios overlap with one another. POTX has dropped 14% for the year to date, while CNBS narrowly lands in the red with a 0.25% decline. This illustrates a broader point on thematic funds: Two strategies that purport to chase a common theme can do so in different ways, leading to different outcomes for investors.

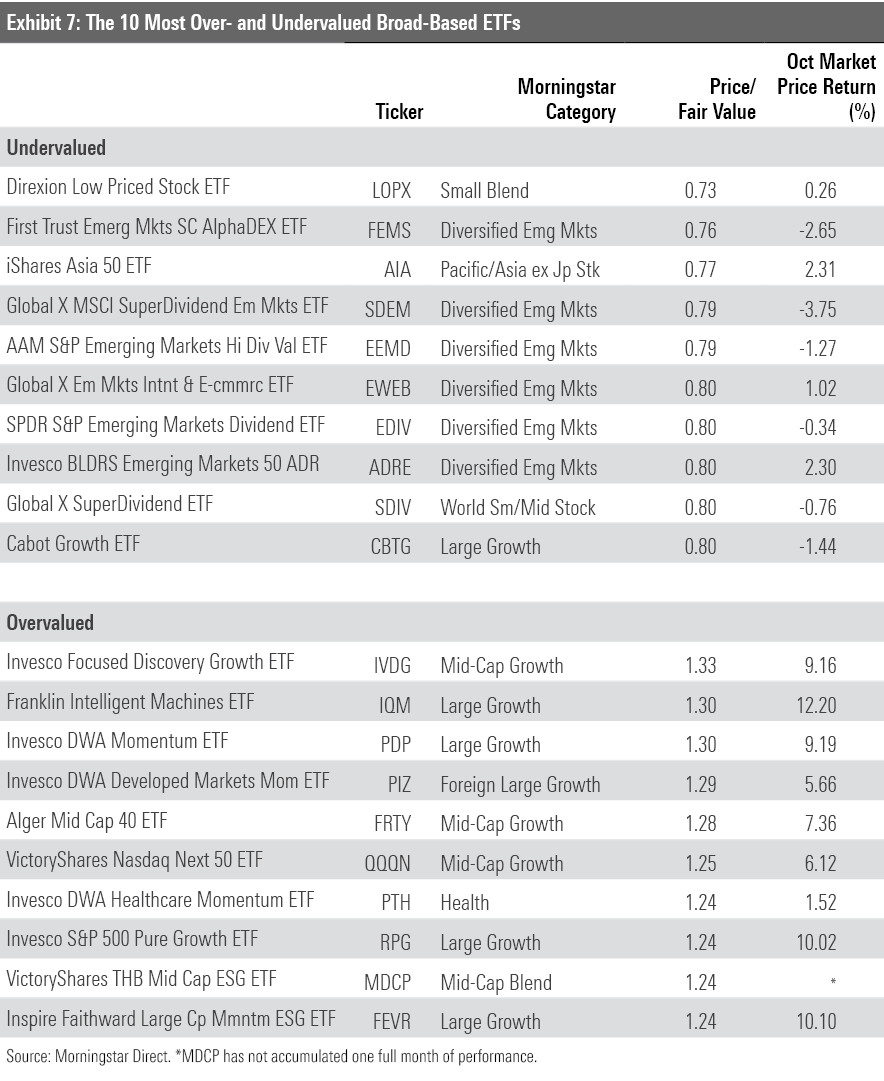

International funds continue to beckon toward value investors, as they offer many of the cheapest valuations among more diversified portfolios. As Exhibit 7 shows, many of the cheapest broad-based options reside in emerging markets. Several of these funds zero in on companies that distribute healthy dividends. Investors may find these funds attractive in an environment where yield is difficult to find. But buyer beware: Emerging-markets stocks present a unique set of risks to consider, and income isn’t always what it seems on the surface.

Yield-focused investors may see appeal in Global X SuperDividend Emerging Markets ETF SDEM, for example. The fund yielded 6% over the 12 months through September 2021, a much loftier payout than iShares MSCI Emerging Markets ETF’s EEM 1.51% or IVV’s 1.36% over the same span. But this fund is risky, and it has not compensated investors for that risk. It captured all of the MSCI Emerging Markets Index’s downside but only 76% of its upside over the three years through October.

VictoryShares THB Mid Cap ESG ETF MDCP is newly featured on the pricier side of Exhibit 7. This active fund, born at the start of October, features about 30 stocks with sound profitability and environmental, social, and governance characteristics. Investors should not be surprised to see ESG portfolios trade at lofty valuations. Funds that score well in ESG metrics also tend to be high-quality businesses--and those rarely come cheap. ESG strategies also tend to favor technology stocks, whose valuations usually exceed the energy and utilities firms these funds often avoid. To be sure, tech stocks represented about 30% of MDCP as of end-September compared with 20% of the Russell Midcap Index, its category benchmark.

/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-18-2024/t_34ccafe52c7c46979f1073e515ef92d4_name_file_960x540_1600_v4_.jpg)

/d10o6nnig0wrdw.cloudfront.net/04-09-2024/t_e87d9a06e6904d6f97765a0784117913_name_file_960x540_1600_v4_.jpg)

/cloudfront-us-east-1.images.arcpublishing.com/morningstar/T2LGZCEHBZBJJPPKHO7Y4EEKSM.png)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/30e2fda6-bf21-4e54-9e50-831a2bcccd80.jpg)

:quality(80)/s3.amazonaws.com/arc-authors/morningstar/a90ba90e-1da2-48a4-98bf-a476620dbff0.jpg)