Oversee All of Your Retirement Plans

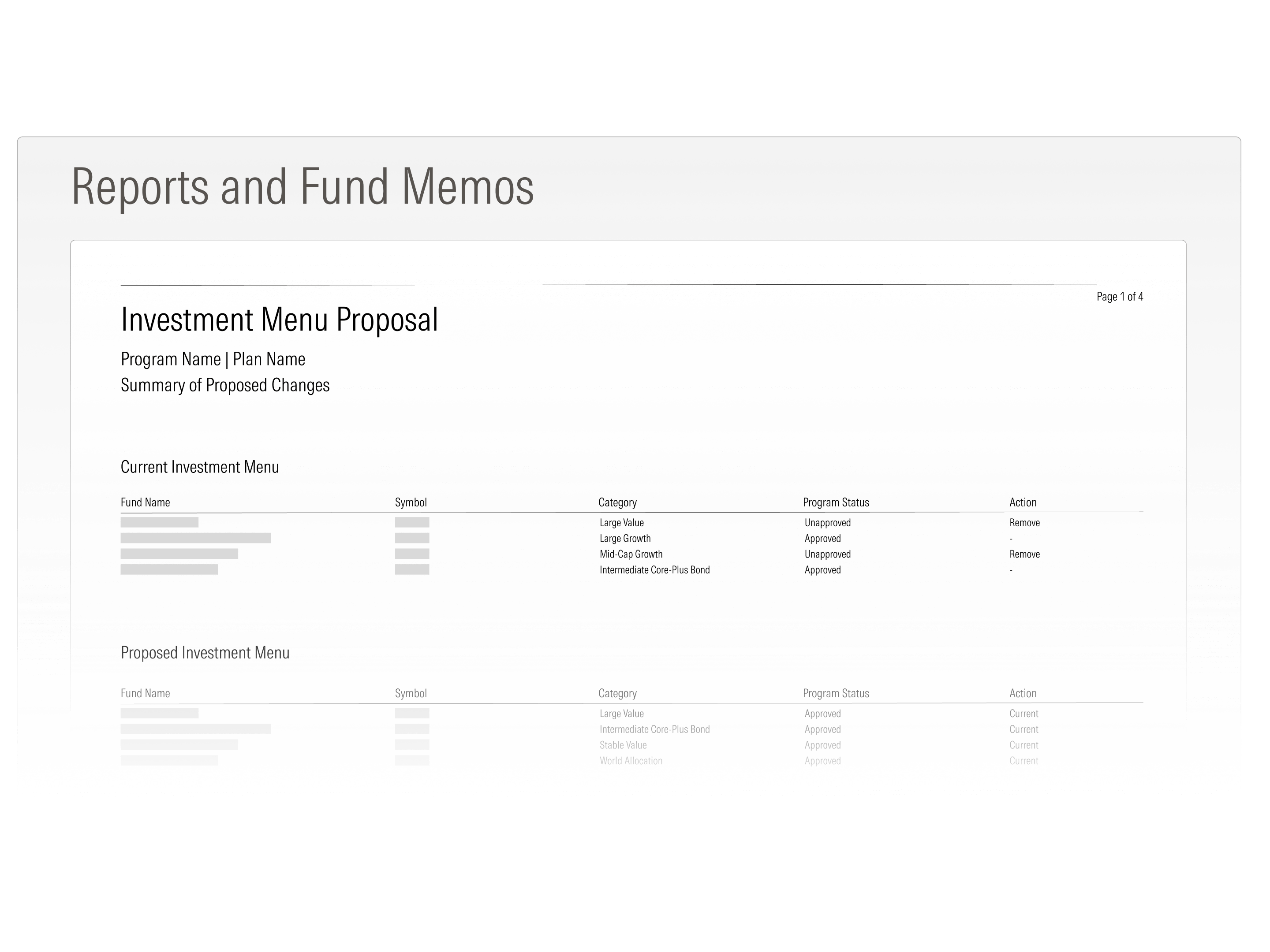

View live plan data and reports, propose changes to investment menus, and monitor the compliance-related health of your clients’ lineups.

Powered by a network of more than 25 plan providers, Plan Advantage helps advisors prospect and obtain pricing, manage plan lineups, and access detailed investment information—all from one place.

Provide a scalable service that allows advisors to easily create lineups for prospects, manage their existing plans, and grow their business.

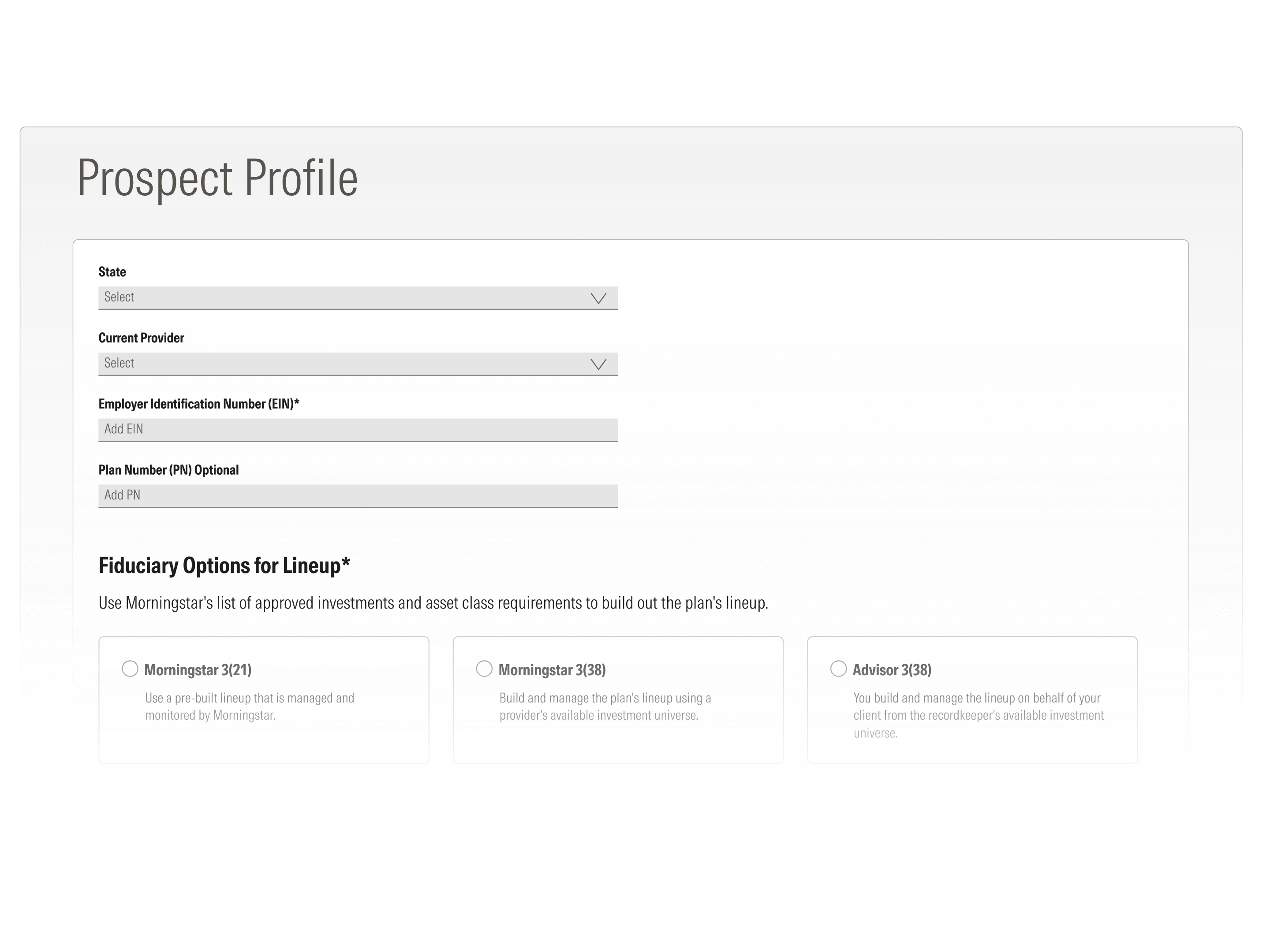

Select from a range of fiduciary options, including our 3(21) and 3(38) services, to maintain consistency across your business. Compliance alerts and plan reports can help you identify and mitigate potential compliance issues.

Stay up to date on your firm’s retirement plan business through readily available reports, metrics, and communications.

Manage, grow, and streamline your retirement plan business. Our centralized online dashboard gives you insight into your clients’ and prospects’ investment needs.

Capabilities that help you grow your retirement business, all in one centralized space.

Access high-quality, up-to-date data and reporting information to help you make informed decisions for your plans.

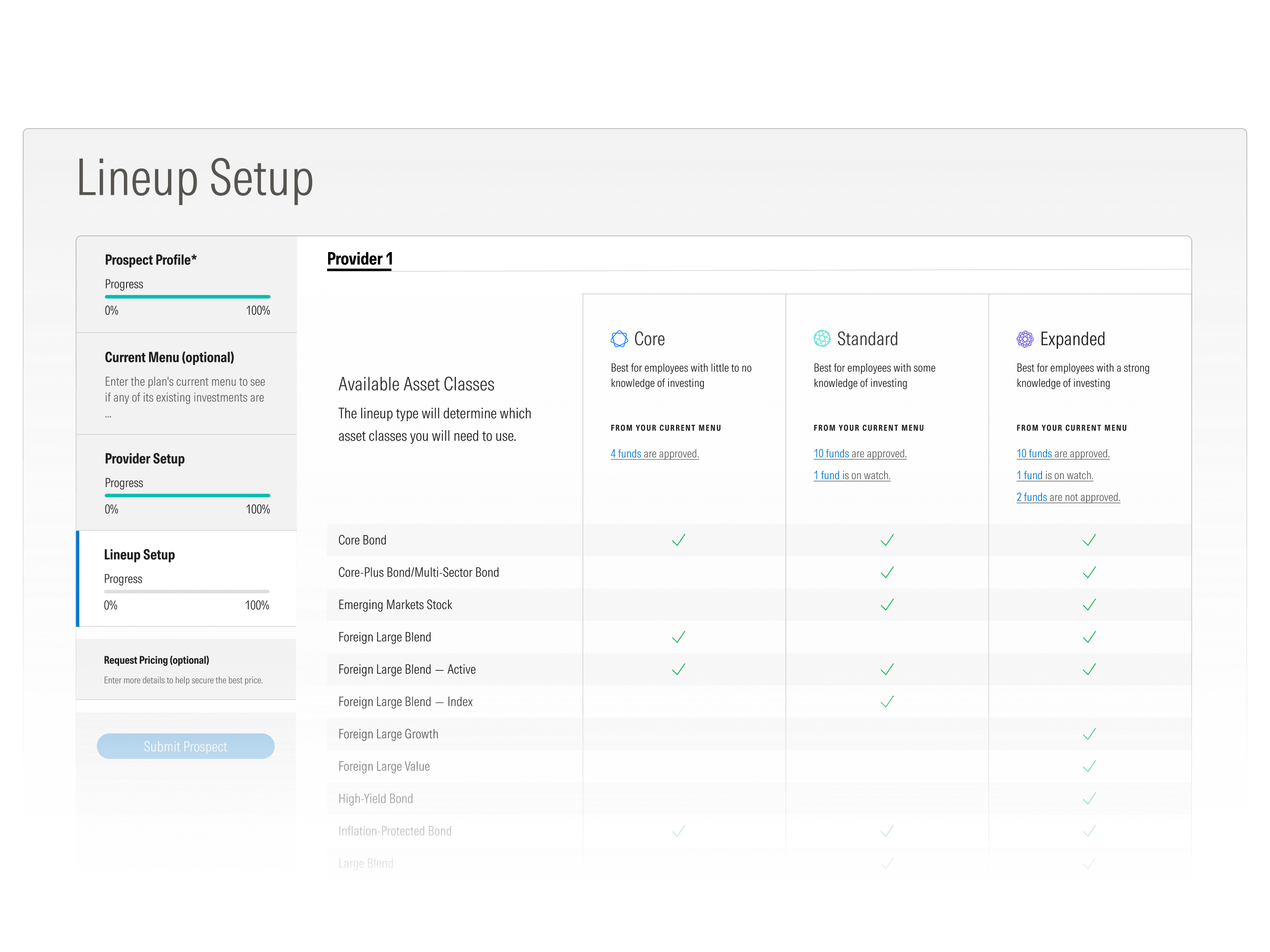

Check to see if a fund is approved, on-watch, or unapproved in an easy-to-scan dashboard.

Choose from different levels of customization to build plan lineups your way.

©2025 Morningstar Investment Management LLC. All rights reserved. The Morningstar name and logo are registered marks of Morningstar, Inc. Morningstar® Plan AdvantageSM is offered by Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., and is intended for financial professionals working with, or sponsors of, retirement plans subject to the provisions of the Employee Retirement Income Security Act of 1974, as amended (“ERISA”), unless exempt therefrom, or other state or federal laws governing retirement plans. The investment advice delivered through Morningstar Plan Advantage is provided by Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., or an affiliate, or a third-party who has licensed the Morningstar Plan Advantage software for their own use. The Morningstar name and logo are registered marks of Morningstar, Inc.

Advisor Managed Accounts is offered by Morningstar Investment Management LLC and is intended for citizens or legal residents of the United States or its territories. The portfolios available through Advisor Managed Accounts are created by an investment adviser (the “IA”) chosen by a plan sponsor. Morningstar Investment Management LLC, a registered investment adviser and subsidiary of Morningstar, Inc., is responsible for participant portfolio assignment from those portfolios created by the IA. The IA is not affiliated with Morningstar Investment Management and Morningstar Investment Management is not responsible for the portfolios the IA creates. The IA is not responsible for the portfolio selection made by Morningstar Investment Management, nor for other recommendations made by Morningstar Investment Management through Advisor Managed Accounts. Investment advice delivered by Morningstar Investment Management is based on information provided and limited to the investment options available in the retirement plan. Projections and other information regarding the likelihood of various retirement income and/or investment outcomes are hypothetical in nature, do not reflect actual results, and are not guarantees of future results. Results may vary with each use and over time.

All investments involve risk, including the loss of principal. There can be no assurance that any financial strategy will be successful. Morningstar Investment Management does not guarantee that the results of their advice, recommendations or objectives of a strategy will be achieved.