Global fund fees continue to trend downwards, as the majority of 26 markets we studied saw the asset-weighted median expense ratios for domestically domiciled and available-for-sale funds fall since 2017.

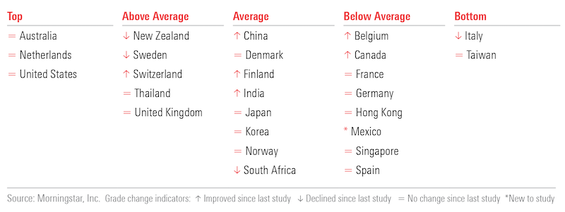

This trend was one of the top findings from the Fees and Expenses chapter of the latest Global Investor Experience Study, which evaluates the environment for mutual fund investors in markets around the world. As shown below, the highest overall scores went to Australia, the Netherlands, and the United States, while the lowest went to Italy and Taiwan.

In this report, we detail the market characteristics that drive higher transparency and lower global fund fees for retail investors. Below, explore some of our key conclusions.

5 takeaways from Morningstar’s 2019 Global Investor Experience Study: Fees and Expenses

1. Overall, investors are winning. The investor experience is improving across multiple markets, as a result of lower fund fees and ease of entry for investors to buy funds without loads or trail commissions. The trend toward lower global fund fees was most notable in locally domiciled equity funds, with 19 markets reporting reduced fees.

2. The investor experience isn’t improving in all markets. A few markets have seen demotions in their overall rankings. For instance, Italy fell from a Below Average to a Bottom grade in this study, as a result of individual investors routinely being subject to front loads and retrocessions, as well as high-asset-weighted median expenses across the board.

Global mutual funds without trail commissions are technically registered for sale in Italy, but they are not easily accessible for the average retail investor given that fund distribution is dominated by intermediaries (notably, banks).

3. Effective regulation can improve the investor experience. Take India, whose Fees and Expenses grade improved from Below Average to Average in this study. While still a small fund market relative to many others that we reviewed, India’s fund industry has seen rapid growth in assets under management in recent years.

This growth prompted the Securities Exchange Board of India, or SEBI, to require asset managers to pass economies of scale benefits back to investors through lower ongoing charges. To implement this change, SEBI capped the maximum expense ratios that can be charged to a fund based on its size. Since this regulation took effect in April 2019, distributor share-class expense ratios in India have declined 5 to 30 basis points.

4. Economies of scale benefits are not prevalent in cross-border markets. The large Undertakings for Collective Investments in Transferable Securities, or UCITS, marketplace (which spans Europe and Asia) does not seem to have led to reduced costs. Indeed, our research shows that small locally domiciled funds are often cheaper than giant Luxembourg- and Ireland-based funds.

In some cases, this occurs due to higher regulatory costs for cross-border funds: These funds tend to cater to the highest-cost markets because it is easier to rebate fees than to layer additional ones on. Another possible reason that fees across the UCITS marketplace remain relatively high is that these funds are often sold, not bought, particularly by distributors in Asian markets.

5. Economies of scale benefits translate into cost savings in large closed fund markets. 2019 marks the third consecutive study in which Australia and the U.S. have nabbed the highest grade in the Fees and Expenses sector. A key reason for this accomplishment is that ongoing fund fees in these markets are typically unbundled and regulations favour locally domiciled funds catering solely to local investors. Low asset-weighted fees in the U.S. and Australian marketplaces show the benefits of both economies of scale and fierce price competition among asset managers within these large global mutual fund markets.

Fees and Expenses is the first of four chapters in the 2019 Global Investor Experience Study. Regulation and Taxation will be produced in the final quarter of 2019.

More details about the Global Investor Experience Study’ s methodology are available on the Signature Research & Methodology page.