When advisors meet with clients, they likely discuss the markets, but also retirement goals, plans for saving for college or charitable causes, and personal preferences. In conversation, they’ll likely learn about their clients’ risk tolerance and time horizon to help them develop an appropriate investing strategy.

This well-rounded approach to developing relationships means there’s an opportunity to help clients think beyond their portfolio and focus on their holistic financial goals. Sustainable investing is becoming an increasingly common way advisors can help align their clients’ values or interests with their investments.

Sustainable investing—investment approaches that consider environmental, social, and governance, or ESG, criteria and their impact throughout the investment process—can help clients relate to their investments and help give them an identity as an investor. However, many advisors may feel uncomfortable broaching this topic, either because they aren’t as familiar with sustainable investing solutions or believe investment performance may be sacrificed.

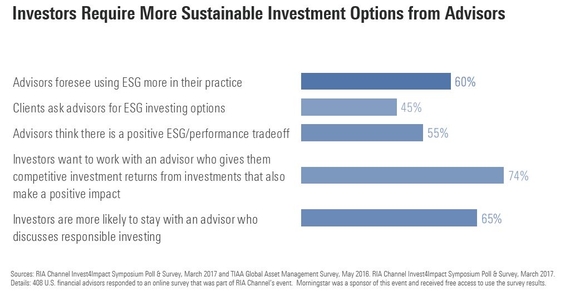

With sustainable investing becoming more mainstream, helping interested clients achieve their financial goals requires understanding the term as more than just a buzzword. Research from RIA Channel and TIAA, for instance, shows how investor interest in sustainable investing is continuing to grow, and the opportunity it may provide for advisors to strengthen their relationships with clients. According to the RIA Channel survey of 408 U.S.-based financial advisors, 45% of clients are asking for sustainable investing options. And according to the TIAA study of 2,200 investors who work with advisors, 65% of them would be more likely to stay with an advisor who discusses responsible investing.

During conversation, financial advisors like you can hone in on interests that clients may be passionate about, whether or not they realize at that moment that these preferences can be applied to their portfolios. This alignment of interests with their financial goals can help allow clients to look beyond market fluctuations. From there, they can develop an investment strategy that focuses on their values as well as their financial goals.

In addition to the potential value this approach may offer your clients, there are several ways sustainable investing may work for you. Below, we map out some considerations for incorporating sustainable investing options into your practice.

1. Connect with your clients on a deeper level

Incorporating sustainable strategies, such as ESG-focused portfolios, into your investment lineup can show that your practice is committed to helping clients connect their personal values to their investments.

By broaching the subject of sustainable investing with clients who have expressed interest in environmental and social issues—even if they aren’t necessarily viewing these topics through a financial lens—you can show that in addition to understanding their financial goals, you also want to understand who they are and what they value. This approach can help strengthen your relationship.

2. Position yourself to develop relationships with your clients’ family members

Successfully sustaining a relationship with your client sometimes means also developing a rapport with their family members or potential beneficiaries.

Discussing sustainable investing can be an effective way to connect with these beneficiaries. Numerous studies have shown that high-net-worth millennials and women have gravitated toward sustainable investing and have been the main drivers behind the spike in asset flows into this investment area. And now, new research is showing that other demographics possess this interest as well.

By using sustainable investing as a tool to bridge the gap, you may better position yourself to maintain, and even strengthen, client relationships from generation to generation.

3. Help differentiate your practice

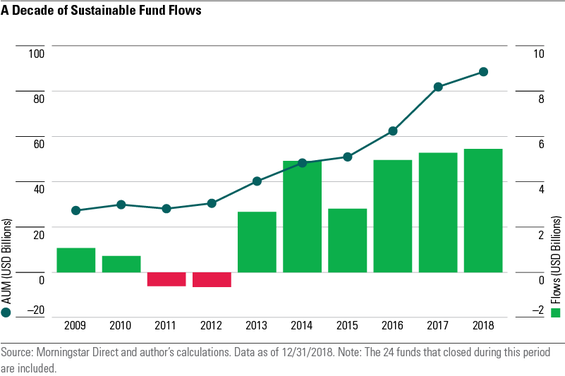

The simple fact is that sustainable investing is increasingly in demand. This is exhibited by the increase in assets flowing into this area (this Morningstar data from the 2018 Sustainable Funds U.S. Landscape Report is depicted on the chart below), in addition to the number of investment options now available. The chart also demonstrates that across the industry, sustainable assets have almost doubled over the past five years.

Historically, advisors have tended to be more reactive when it comes to offering these types of solutions to prospective or current clients. But this upward trend indicates that one way advisors could stand apart from the crowd is to consider the potential advantages of sustainable investing.

Adding sustainable investing options

As with any investment portfolio, you’ll want to work to ensure that any sustainable investments are professionally managed, well-diversified, and managed for risk accordingly. You may also want to consider intentional ESG funds—or funds that consider ESG criteria and their impact throughout all steps of the investment process—instead of funds that market ESG in their name only.

Morningstar Investment Management LLC’s ESG Asset Allocation portfolios, available through Morningstar® Managed Portfolios℠*, leverage Morningstar’s sustainability research to combine our valuation-driven asset allocation approach with ESG-focused mutual funds and ETFs. These core portfolios, which span the risk spectrum, are intended for investors who value sustainably minded options as part of a financial solution for their future.

The more you know, the more you can continue to uncover the opportunities that sustainable investing expertise can potentially create for you and your practice.

Carolyn Szaflik is a portfolio specialist and Sammie Spector is a marketer for the Morningstar Managed Portfolios product group.