View our most recent Fund Family update here

The Morningstar Fund Family 150 is a semiannual publication that gives investors access to the same analytical rigor our own analysts use to keep tabs on the 150 largest fund families. At the end of 2018, the 150 largest fund families accounted for 99% of the $16.95 trillion invested in U.S. funds.

At Morningstar, our mission is to create the most effective investment data and research for investors. Consistent with Morningstar's guiding principles, the Fund Family 150 strives to put investors first. One page is dedicated to each fund family where we pair our qualitative and quantitative research with standard criteria for manager due diligence.

Helping investors select the best fund families

Based on the research performed by Bridget Hughes, Morningstar Research Services LLC’s director of parent research, fund families with Positive ratings have historically produced better results for investors as measured by the Morningstar Risk-Adjusted Success Ratio, which measures what percentage of a fund family's funds both survived the time period and delivered a Morningstar Risk-Adjusted Return better than the median fund's MRAR in their respective categories.

Hughes believes the fund families that earn Positive ratings can often go a long way toward building conviction and helping to provide a satisfactory long-term investor experience. A strong regulatory environment in the United States and the transparency it requires has helped to establish this. But following the rules isn't enough. Fund companies must provide other stewardship practices that reveal the extent to which a fund company puts investors' interests before those of portfolio managers and the broader asset-management company.

Our research goes well beyond an examination of a fund company's regulatory history. A key factor is corporate culture, which Morningstar's analysts assess primarily on a qualitative basis through regular on-site due diligence visits and other meetings with senior management and others in important functions. The strongest corporate cultures exhibit a clear mission to put investors first and are able to attract and retain professionals who can execute that goal. According to Laura Lutton, Morningstar Research Services’ director of manager research for North America, fund families with Positive ratings have experienced, stable investment staffs that are well-resourced in terms of personnel and tools, including risk-management analysis. They are more likely to avoid key-person risk through thoughtful succession planning.

Our research also looks at whether portfolio managers' financial interests are aligned with those of investors and at a fund company's approach toward the fees it charges investors, who have increasingly sought lower-cost options. In recent years, many broker/dealers and advisors have attempted to remove funds that carry high fees from their platforms. The trend toward offering low-cost funds with repeatable investment strategies has been a net positive for investors because performance improves as costs decline.

In summary, the comprehensive analysis that our analysts provide can give investors more conviction in their choice of investment partner, and, as Hughes’ research shows, it can also help improve investors' odds of a better financial experience.

Who are the top fund families?

Dodge & Cox tops the Fund Family 150 again and earns a Positive rating. Its team-based investment process is tested, consistent, and well-supported by a large and long-tenured research staff. Dodge & Cox also charges investors lower fees and earns the number-one ranking. The top three fund families are:

- Dodge & Cox

- Baird

- American Funds

Read more about these top fund families in our Fund Family 150 Highlights Report.

A visual way to show the top fund families

For investors who are deciding between fund families, the marketing pieces and sheer amount of investment data can be overwhelming, and the data can sometimes hold little value until it is contextualized and transformed into useful information. To help investors eliminate ambiguity, the Fund Family 150 provides context and shows each fund family’s relative position across a variety of measures. Each attribute provides some unique information.

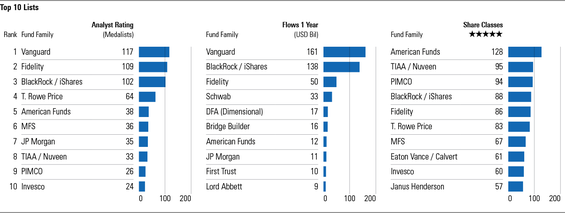

Below, we show the top 10 fund families with the most Gold, Silver, and Bronze Morningstar Analyst Ratings TM , the top 10 fund families with the most inflows during the last year, and the top 10 fund families with the most Morningstar Ratings TM of 5 stars.

Join Morningstar analysts for a webinar to learn about Morningstar's latest research on fund families. Watch Now.

The full Fund Family 150 publication is available in Morningstar Direct℠ Research Portal. If you’re a user, you have access. If not, take a free trial.

Please see below for important disclosure.