It was a tough year for investors in 2018, with broad declines in stock and bond prices affecting their returns. The S&P 500 slipped by 4.4%, the MSCI Europe dropped by 10.6%, and the Bloomberg Barclays Agg Corp fell by 2.2%.

Against this backdrop, funds that incorporate environmental, social, and governance factors demonstrated resilience. Sustainable funds today pursue a large range of investment strategies. But what they share is the consideration of ESG factors, which leads most of them to companies that are managing environmental and social issues effectively and have strong corporate governance practices. These tend to be lower-volatility and higher-quality companies that hold up better during downturns, as was the case last year.

3 takeaways about European ESG funds in 2018

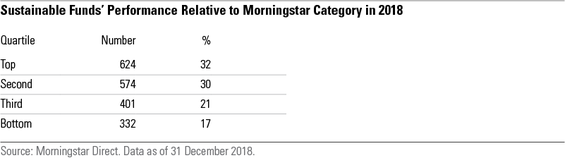

- Sustainable funds performed well in 2018. European-domiciled sustainable funds as a group performed better than the overall fund universe in 2018. The returns of 32% of sustainable funds landed in the top quartile of their respective Morningstar Categories, and 62% finished in the top half. By contrast, the returns of only 17% placed in the bottom quartile.

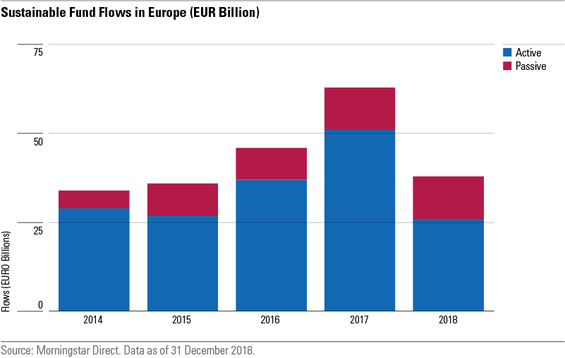

- Inflows fell but less than for the overall market. European sustainable funds collected

EUR 34.4 billion in new money. This is 40% less than the EUR 57.9 billion the year before. However, this decline in inflows was smaller than the 80% slump suffered by the overall European fund universe. Meanwhile, passive sustainable funds continued their long-term asset-gathering trend, attracting 3.4% more money last year than they did in 2017.

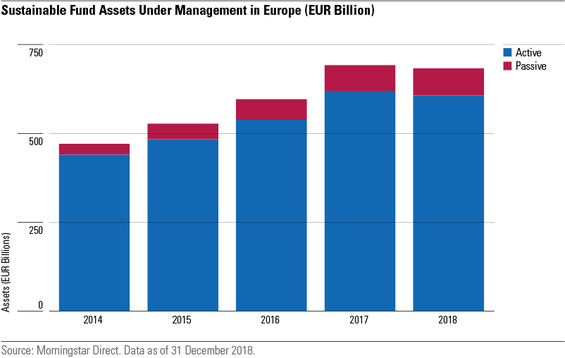

- Assets fell but less than for the overall market. Despite positive flows, European sustainable funds registered a decline in assets under management of 1.3% to EUR 684 billion at the end of 2018. This compares with a stronger drop in overall European fund assets of 3.9%.