We've published new research. Read highlights from our 2019 assessment of HSA providers.

Our 2018 Health Savings Account Landscape Report evaluates and ranks 10 of the largest health savings account, or HSA, plans available to individuals assuming two distinct use cases: HSAs as a spending vehicle to cover current medical costs, and HSAs as an investment vehicle to save for future medical expenses.

The HSA investment account appeals to individuals who will pay for medical costs out of pocket and intend to invest their HSA contributions to achieve long-term growth. Investing HSA dollars allows individuals to maximize the unrivaled tax benefits offered by HSAs. Often known as the triple tax advantage, contributions into HSAs are tax-deductible, investment growth and interest are tax-exempt, and withdrawals avoid taxes as long as they’re spent on qualified medical expenditures. The tax benefits outweigh what’s offered by a 401(k), a traditional IRA, a Roth IRA, or a 529 college savings plan.

How we assessed the best HSA investment accounts

We considered five components of HSA plans in assessing their merits as investment vehicles:

- Menu design: In our view, HSA plans’ investment menus should offer investment options in all core asset classes while limiting overlap among options.

- Quality of investments: Here, we measure the attractiveness of the underlying investments by leveraging our Morningstar Analyst Ratings for funds. The Analyst Rating indicates which strategies Morningstar analysts expect to outperform peers and benchmarks on a risk-adjusted basis over the long haul.

- Price: Our price calculations aggregate three common fees paid by HSA investors: maintenance fees, investment fees, and underlying fund fees. We assumed an investment account balance of $15,000, which is average for the industry,

- Performance: Performance measures how well a plan's current underlying fund lineup has fared on a risk-adjusted basis over the long haul.

- Investment thresholds: Many plans require participants to keep $1,000 or $2,000 in the checking account before they can invest. This can create an opportunity cost for HSA investors, so we favor plans without investment thresholds.

We consider price to be the most important component in evaluating the best HSA investment accounts, as it’s the most significant differentiator among plans.

The best HSA investment accounts

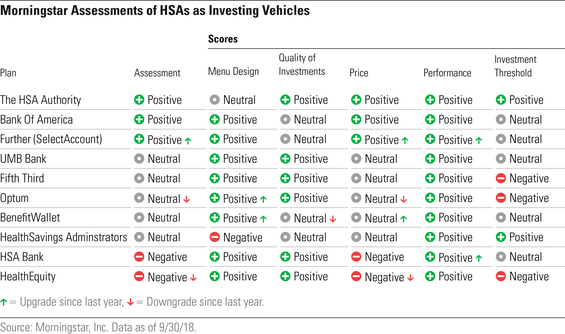

The HSA Authority, Bank of America, and Further received Positive assessments for use as an investing vehicle. The HSA Authority stands out as the most attractive, because it has strong investments that we expect will outperform over time, charges lower fees than all other plans that we evaluated, and doesn’t require investors to keep money in the checking account before investing. We believe Bank of America and Further also represent strong options, but neither plan stacks up to The HSA Authority in our opinion primarily because they aren’t quite as inexpensive.

UMB Bank, Fifth Third, Optum, BenefitWallet*, and HealthSavings Administrators earned Neutral assessments. Each plan offers some attractive features, such as attractive investment options, well designed investment menus, or first-dollar investing. However, they all levy fees that look about average versus the other plans we evaluated.

HSA Bank and HealthEquity** received Negative assessments owing to high fees and investment thresholds that require accountholders to keep either $1,000 or $2,000 in the checking account before investing.

Please see below for important disclosure.